Ag Economy Barometer Declines Again, Producers Express Concern About Interest Rate Policy

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer October results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

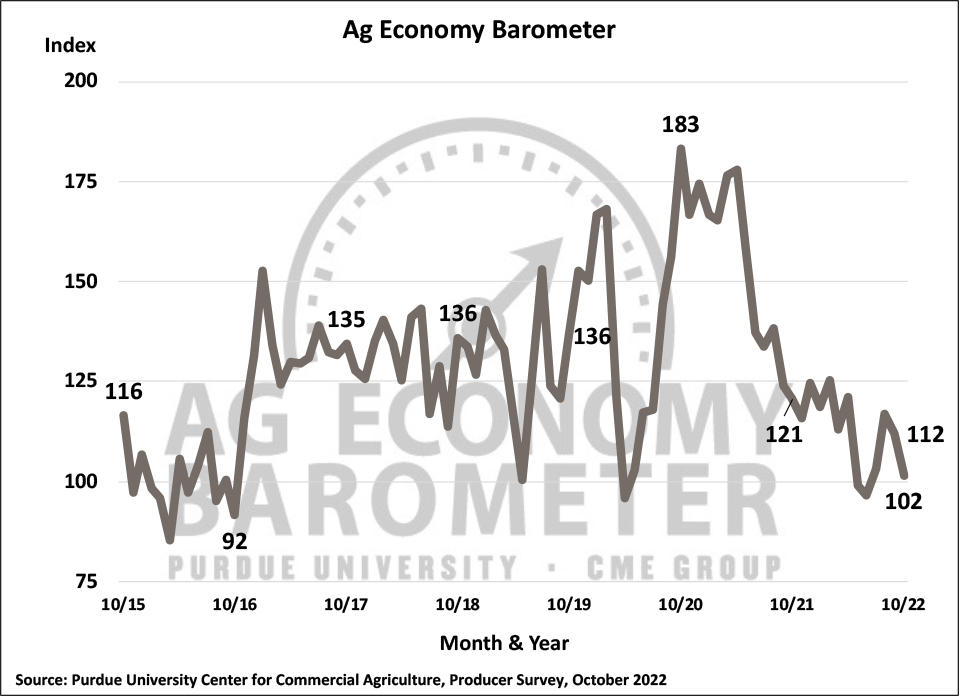

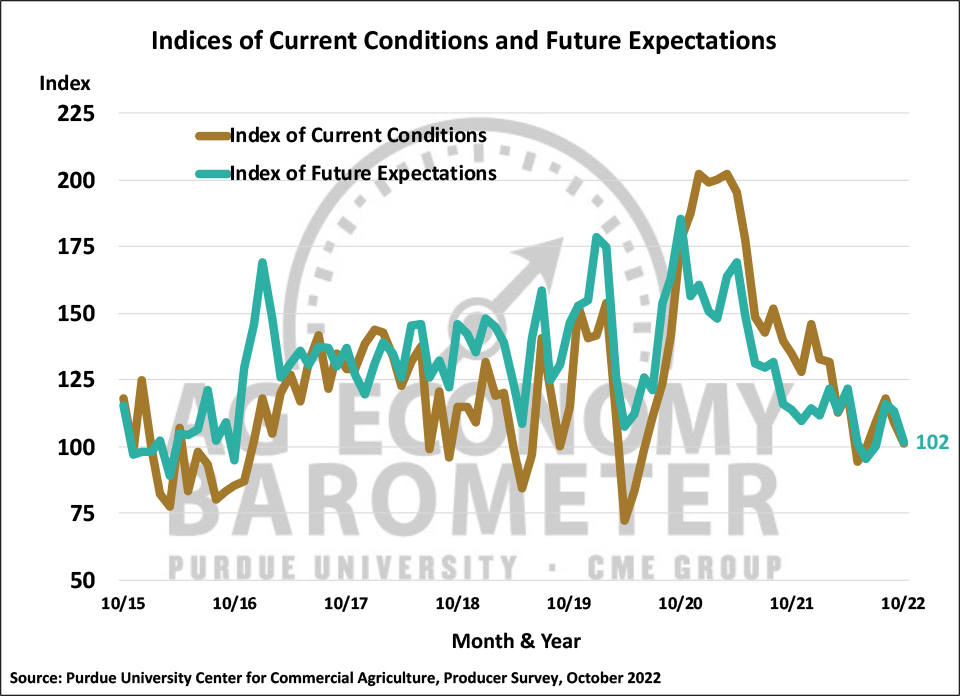

Farmer sentiment weakened again in October as the Purdue University-CME Group Ag Economy Barometer fell to a reading of 102, down 10 points compared to a month earlier. Both of the barometer’s sub-indices, the Index of Current Conditions and the Index of Future Expectations, declined this month. The Current Conditions Index dipped 8 points to a reading of 101 while the Future Expectations Index dropped 11 points to a reading of 102. When the barometer survey was launched in October 2015 estimates from the fourth quarter of 2015 and first quarter of 2016 served as the barometer’s base period and the average Ag Economy Barometer index value over those two quarters was 100. This month’s survey results suggest that farmer sentiment is on par with that of late 2015 and early 2016. The comparison is interesting because this year’s weakness in farmer sentiment is taking place despite very strong net farm income compared to the earlier period. USDA estimates indicate that U.S. inflation adjusted net farm income averaged across 2021 and 2022 is more than 40% above the 2015-2016 average. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from October 10-14, 2022.

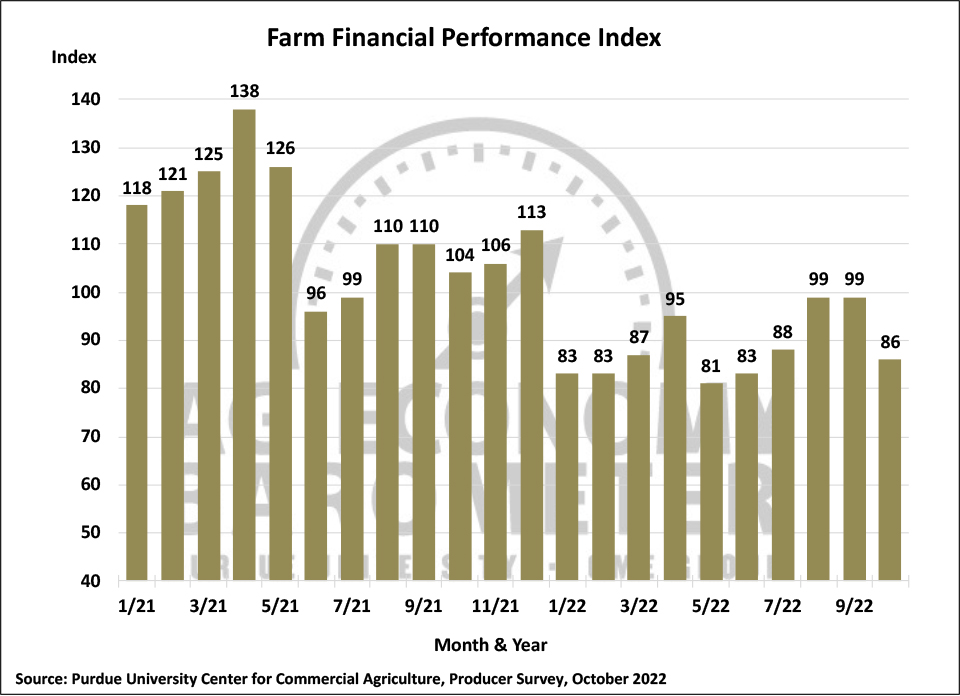

Concerns about their farm’s financial performance was one of the drivers of weakening sentiment among producers. The Farm Financial Performance Index fell 13 points this month to 86. This month’s weaker financial performance reading is a distillation of producers’ concerns about high input costs combined with weaker commodity prices. Challenging shipping conditions throughout the Mississippi river valley have hampered exports recently and the corresponding widespread weakening of corn and soybean basis levels might be contributing to heightened concerns about financial performance. Looking ahead to next year, over 40% of producers in the October survey view high input costs as their top concern followed by rising interest rates which was chosen by 21% of respondents. This month the percentage of producers choosing lower output prices as a top concern rose to 13%, matching the percentage of producers who chose input availability as a major concern.

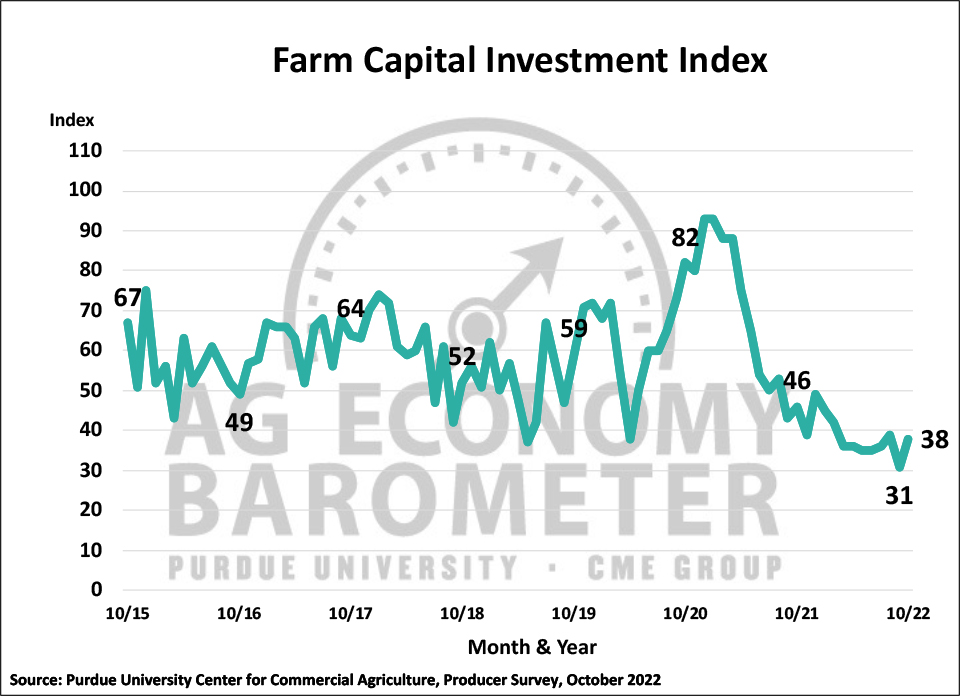

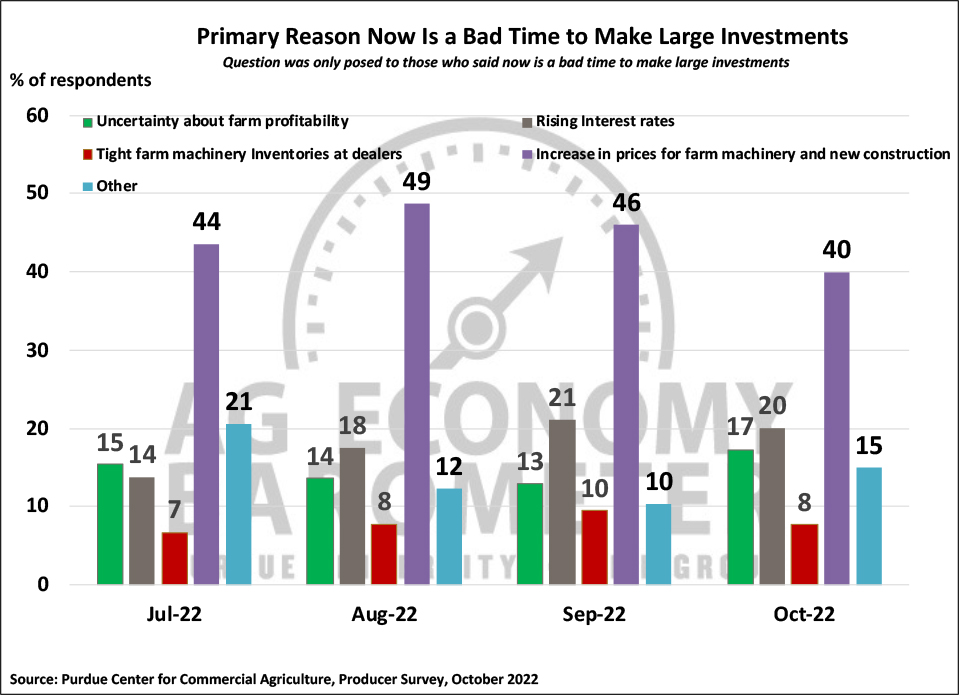

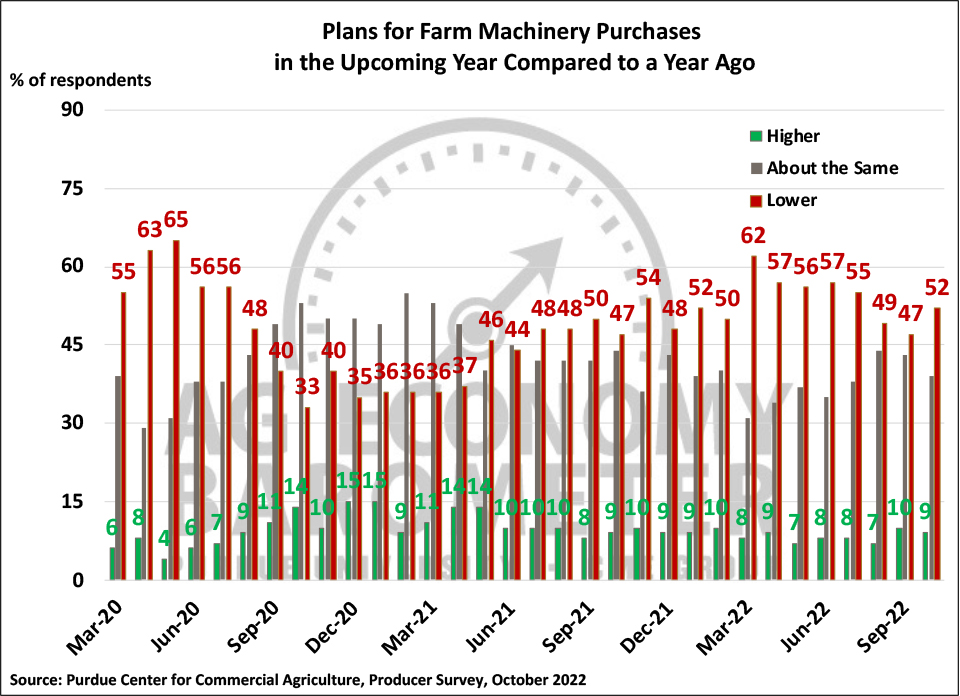

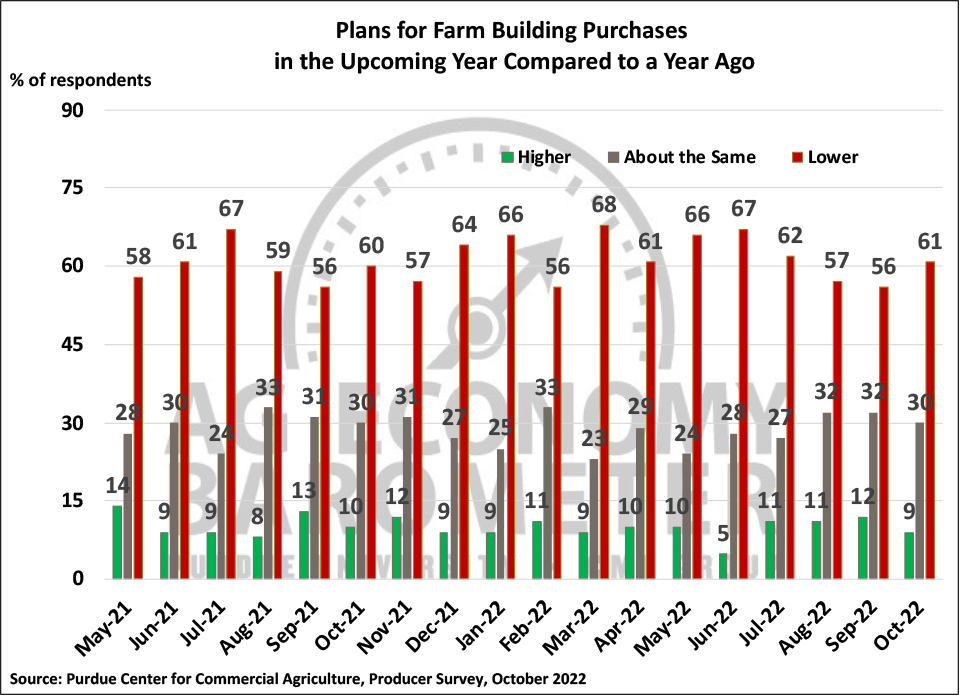

After dipping to a new record low last month, the Farm Capital Investment Index improved this month to a reading of 38. The rise in the investment index was driven by a reduction in the percentage of producers who said now is a bad time to make large investments. Despite the index’s modest rise in October, the investment index remains mired near its all-time low. Once again, a follow-up question posed to producers who view this as a bad time for large investments revealed that increasing prices for farm machinery and new construction (40% of respondents) was the primary reason for the negative outlook. However, that was down from 49% who chose high prices two months ago as their top concern with rising interest rates (20%) and uncertainty about farm profitability (17%) coming in second and third, respectively.

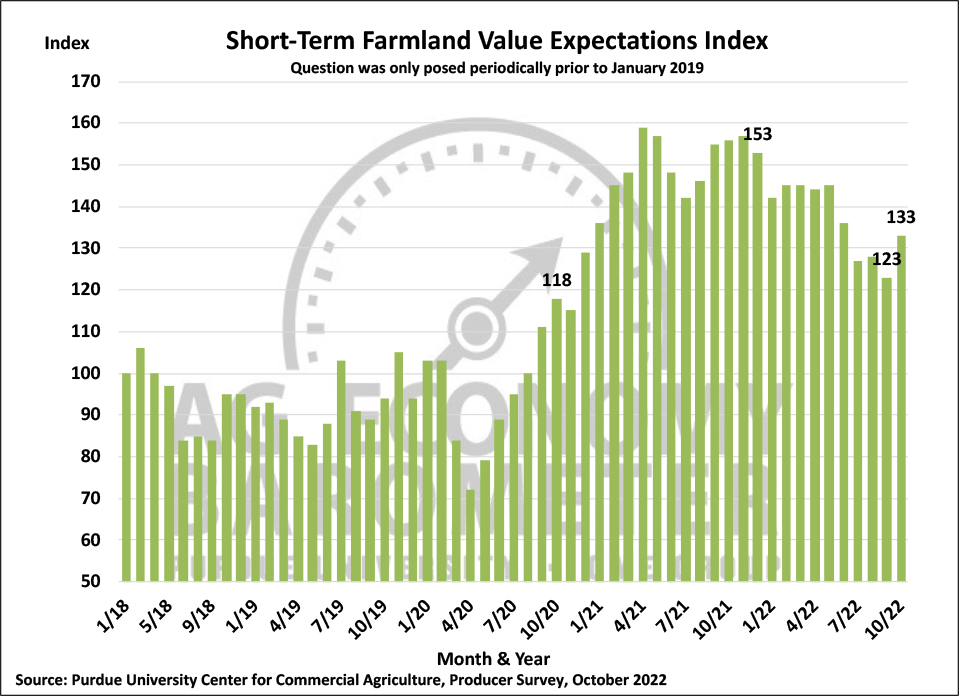

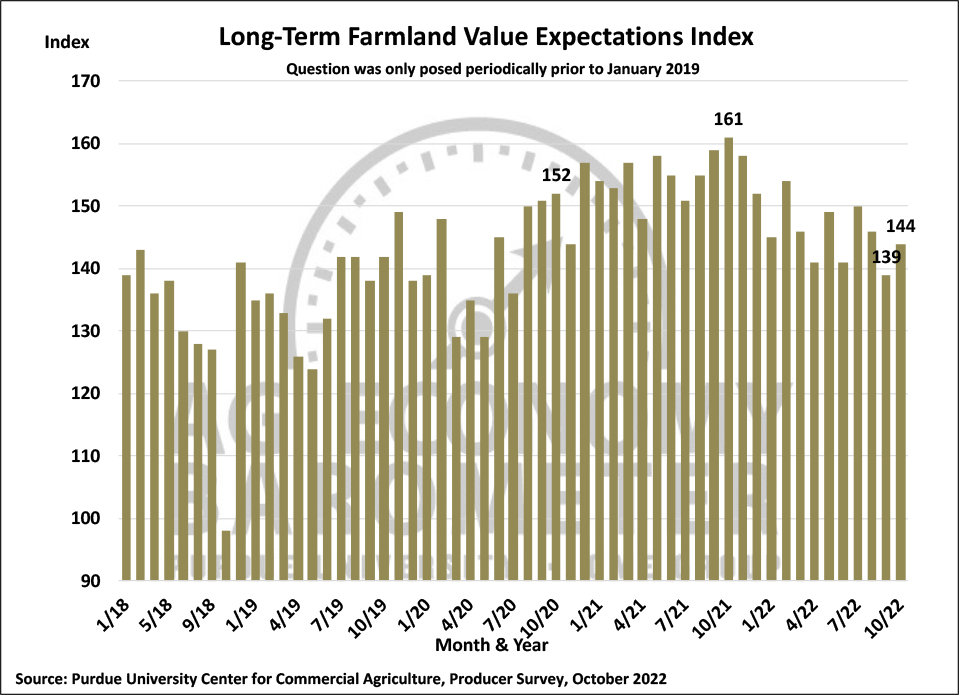

Both the short and long-term farmland value indices rose this month. The Short-Term Farmland Value Expectation Index rose 10 points to a reading of 133 while the Long-Term Farmland Value Index rose 5 points to 144. Strength in both indices comes on the heels of reports from farmland auctions around the Corn Belt that land values are setting new record highs again this fall. The short-term index rose in October primarily because more respondents said they expect values to rise over the next year whereas the shift in the long-term index was primarily the result of fewer producers saying they expect values to decline over the next year. A shift in perspective regarding the drivers of farmland values occurred this month among respondents who said they expect values to rise over the next five years. Notably, fewer farmers chose non-farm investor demand as the primary reason they expect values to rise while more farmers chose inflation as a reason that they expect to see values rise. Even with this month’s rise both indices remain weaker than a year earlier. The short-term index this month was 15% lower than in October 2021 while the long-term index was 11% below a year ago.

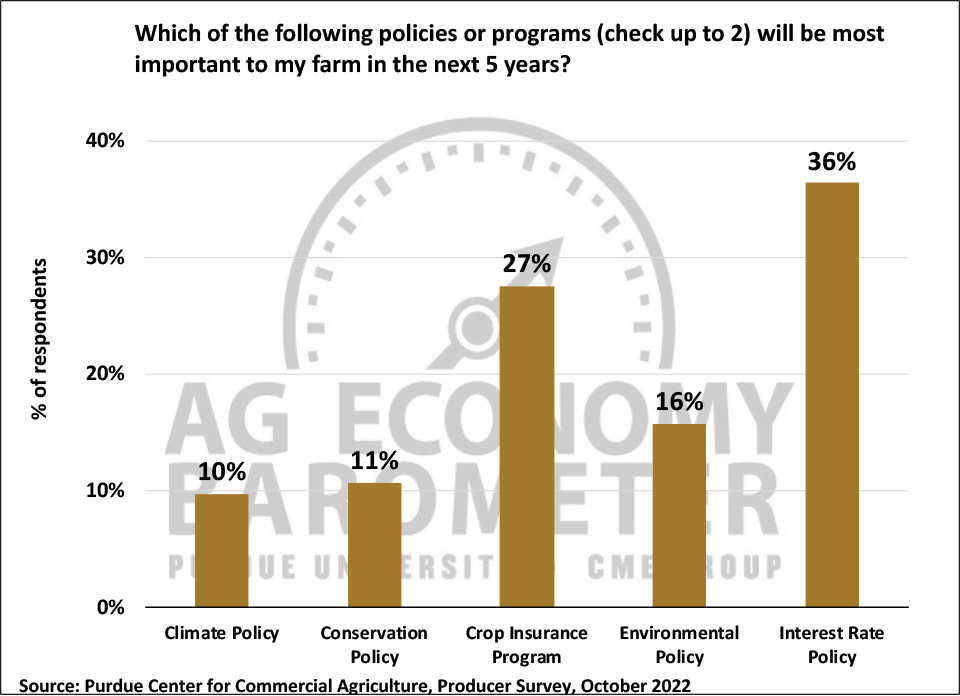

Farm policy discussions are underway around the nation as Congress prepares for debate on a new Farm Bill in 2023. As a result, several farm policy related questions were included in this month’s barometer survey and posed to crop producers. Crop producers were asked which two policies or programs would be most important to their farm in the upcoming five years. The top choice was interest rate policy (36% of respondents) followed by crop insurance program (27% of respondents). Environmental policy was chosen by 16% of crop producers with conservation policy (11%) and climate policy (10%) in a near dead heat. When asked how effective the current ARC-County and Price Loss Coverage (PLC) programs are at providing a financial safety net, 72% of respondents rated the two programs as either “somewhat” (61%) or “very effective” (11%). When the same question was posed relative to crop insurance, 84% of respondents rated it as either “somewhat” (56%) or “very effective” (28%).

Wrapping Up

Farmer sentiment declined again in October with the Ag Economy Barometer falling 10 points to a reading of 102. Producers were less optimistic about both current conditions on their farms as well their expectations for the future. This month’s weakness in farmer sentiment pushes the index back near levels observed in late 2015 and early 2016 when farm income was sharply lower than it has been the last two years. Producers are concerned about their farms’ financial performance, highlighted by issues surrounding both the cost and availability of key inputs. Although fewer producers this month said they view now as a bad time to make large investments, which helped push the Farm Capital Investment Index higher, the index remains at a weak level with the cost of new machinery a major concern. Despite the weakness exhibited in farmer sentiment, both the short and long-term farmland value indices rose this month. Among farmers who expect farmland values to rise, more of them cited inflation as a reason for values to rise than in prior months. Finally, producers are concerned about the impact U.S. interest rate policy will have on their farms and the ag economy with over one-third of crop producers choosing it as the most important policy issue for their farming operation.