Improved Producer Optimism in October

James Mintert, David Widmar and Michael Langemeier

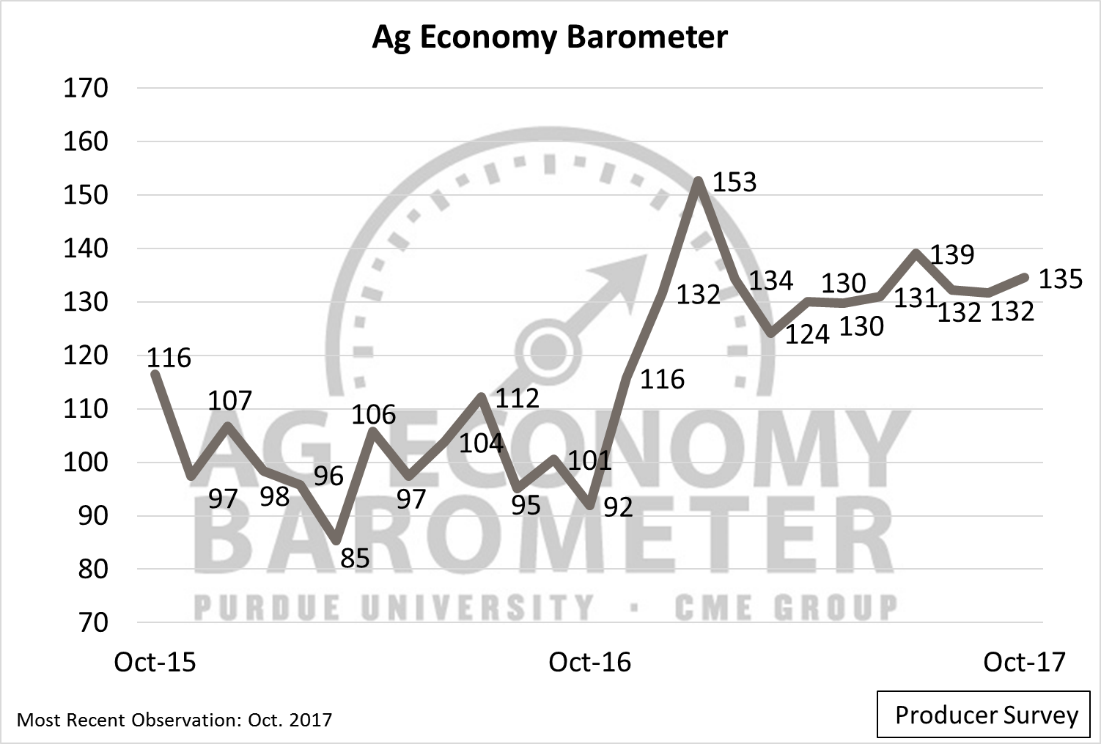

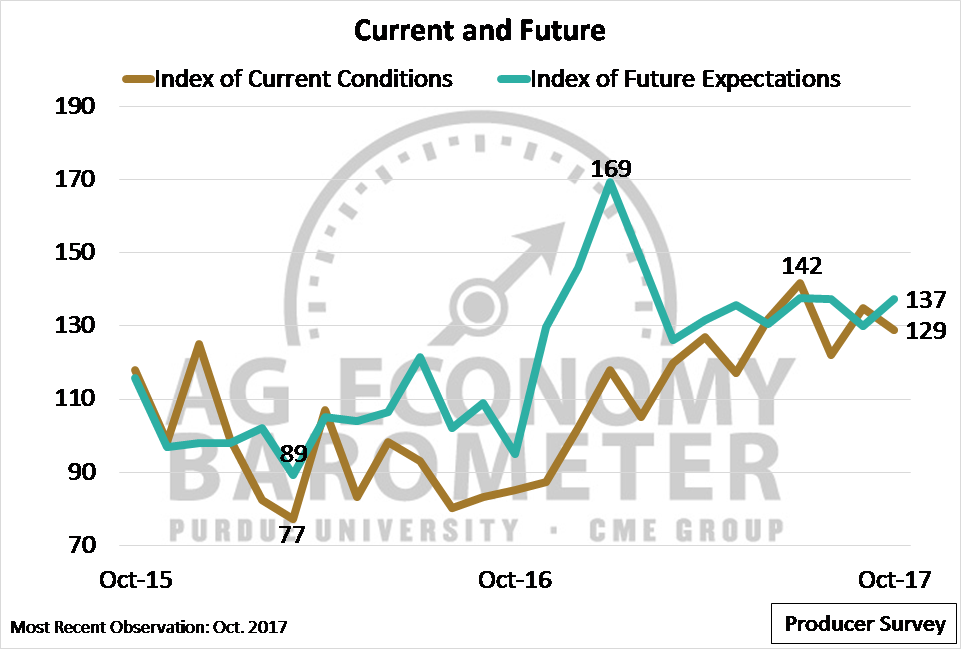

The latest measure of agricultural producer sentiment improved slightly during October to 135, its third-highest level since data collection began two years ago (Figure 1). Although stronger than a month earlier, the Purdue/CME Group Ag Economy Barometer remained within the trading range it has been in since last February, fluctuating between a low of 124 and a peak of 139. The modest improvement in the barometer during October was the result of producers’ improved expectations regarding the future as the Index of Future Expectations increased to 137 from a reading of 130 in September, whereas the Index of Current Conditions actually weakened slightly (Figure 2).

Figure 1. The Purdue/CME Groups Ag Economy Barometer, October 2015 to October 2017.

Figure 2. The Index of Current Conditions and Index of Future Expectations, October 2015 to October 2017.

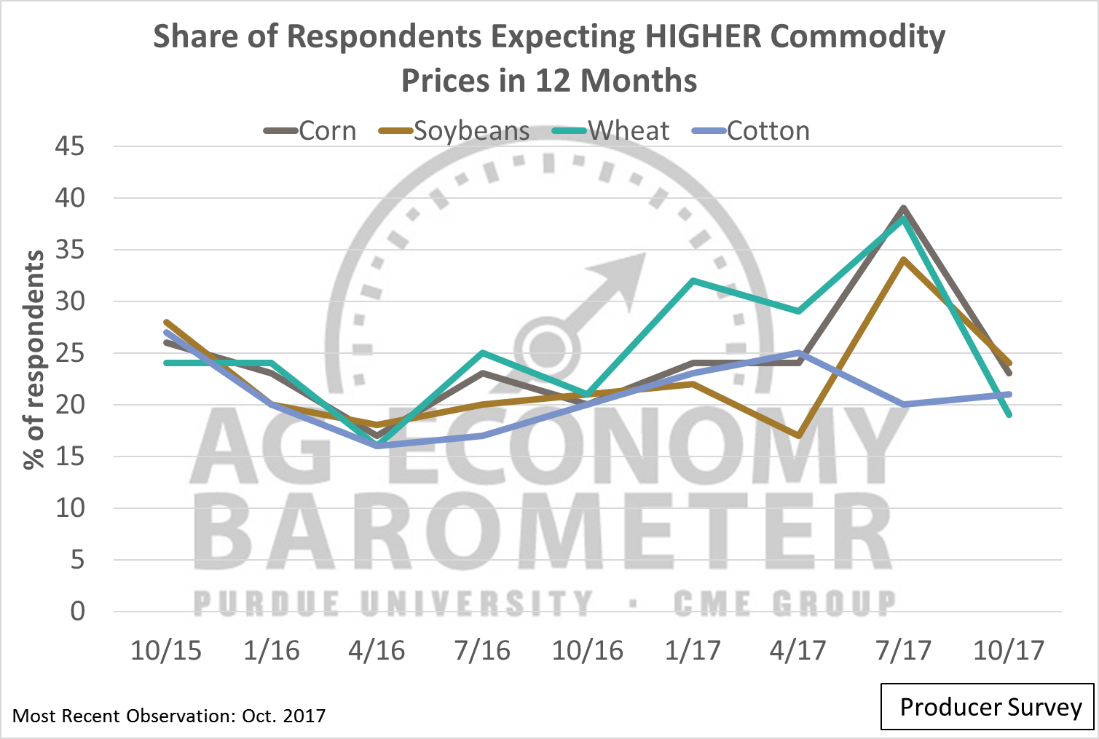

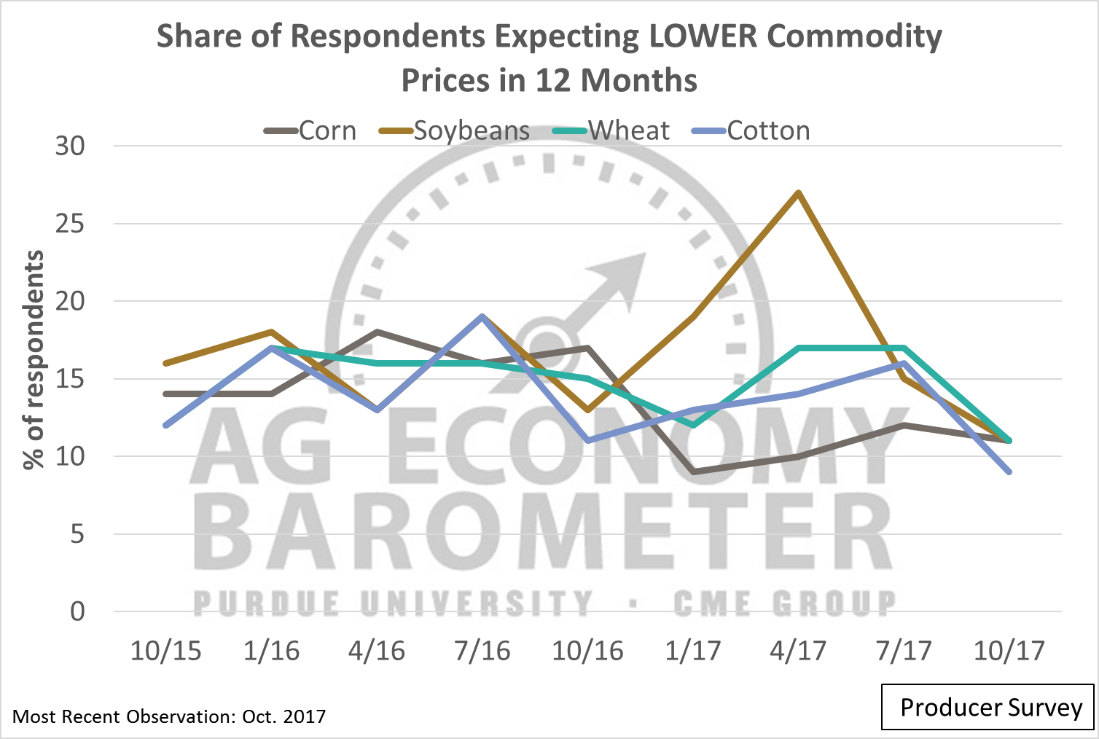

Less Optimism, But Also Less Pessimism about Crop Prices

On a quarterly basis, producers provide some insight into their crop price expectations 12 months out. Specifically, producers are asked whether they expect prices for corn, soybeans, wheat, and cotton to be higher, lower, or about the same as current levels. Compared to July, fewer producers expect higher corn, soybean and wheat prices in the upcoming 12 months (Figure 3). However, at the same time, fewer producers also expect crop prices to decline over the next year, indicating that an increasing percentage of producers actually expect little change in crop prices during the upcoming year (Figure 4). October marked the smallest share of producers expecting lower prices for soybeans, wheat and cotton in the year ahead since data collection began in October 2015.

Figure 3. Share of respondents expecting higher commodity prices in 12 months: corn, soybeans, wheat, and cotton.

Figure 4. Share of respondents expecting lower commodity prices in 12 months: corn, soybeans, wheat, and cotton.

Are Used Farm Machinery Prices Strengthening?

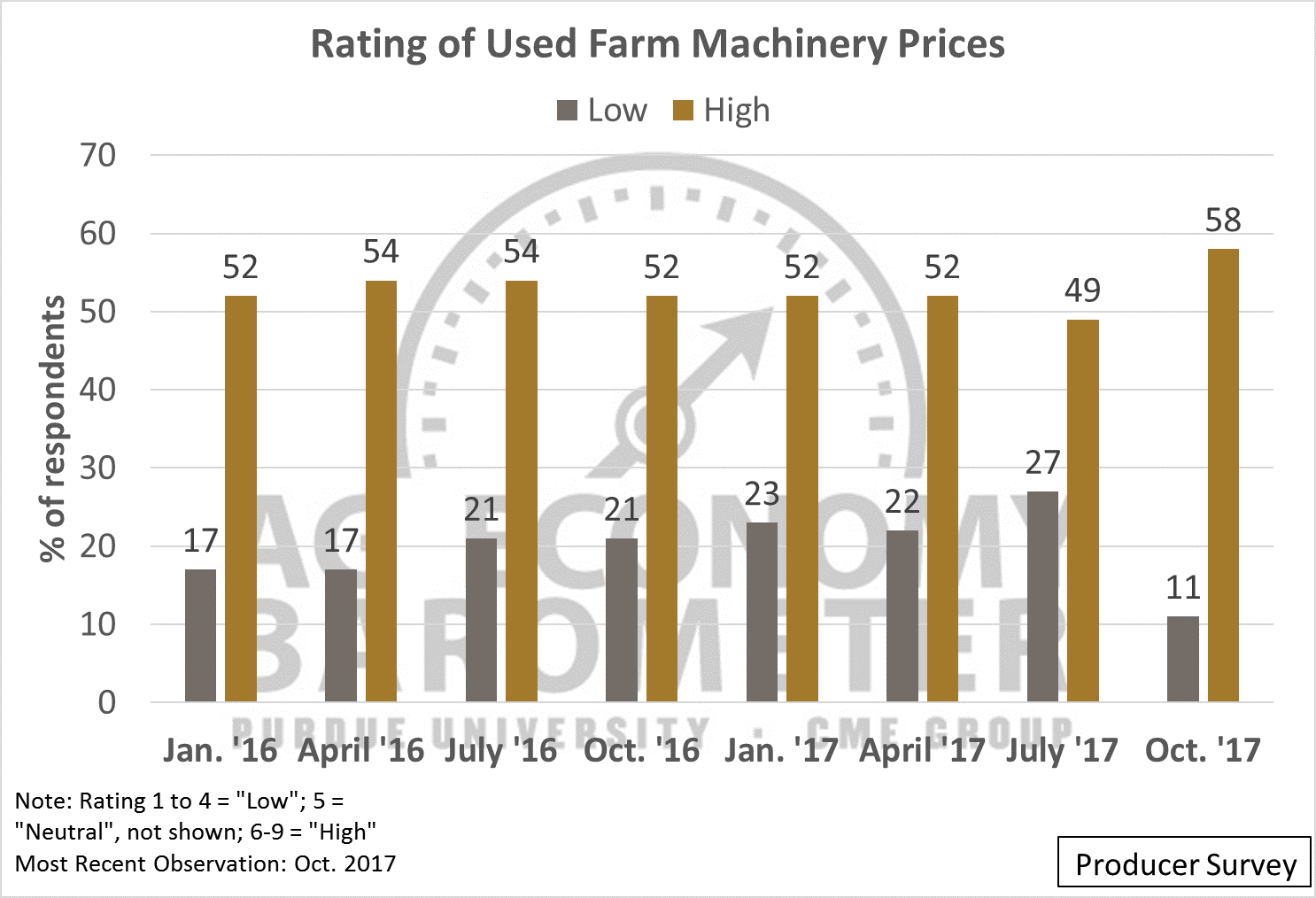

Once each quarter, producers are asked to rate used farm machinery prices on a scale from one (very low) to nine (very high). During October, the share of producers rating machinery prices as high—a rating of six to nine—increased, while the share of producers rating prices as low—a rating of one to four—declined. In October, 58 percent of respondents rated used farm machinery prices as high, the highest percentage since we began collecting data in early 2016 (Figure 5). On the other hand, the share of producers rating prices as low fell from a life-of-survey high 27 percent in July 2017 to a life-of-survey low 11 percent in October. The shift in perceptions regarding used farm machinery values could be an indicator that used machinery values are strengthening. Anecdotal evidence from some Corn Belt farm equipment dealers suggests that sales volume during 2017 improved, which is consistent with producer responses on the survey.

Figure 5. Producer rating of used farm machinery prices.

Fewer Producers Expect to Reduce Fertilizer Rates in 2018 than in 2017

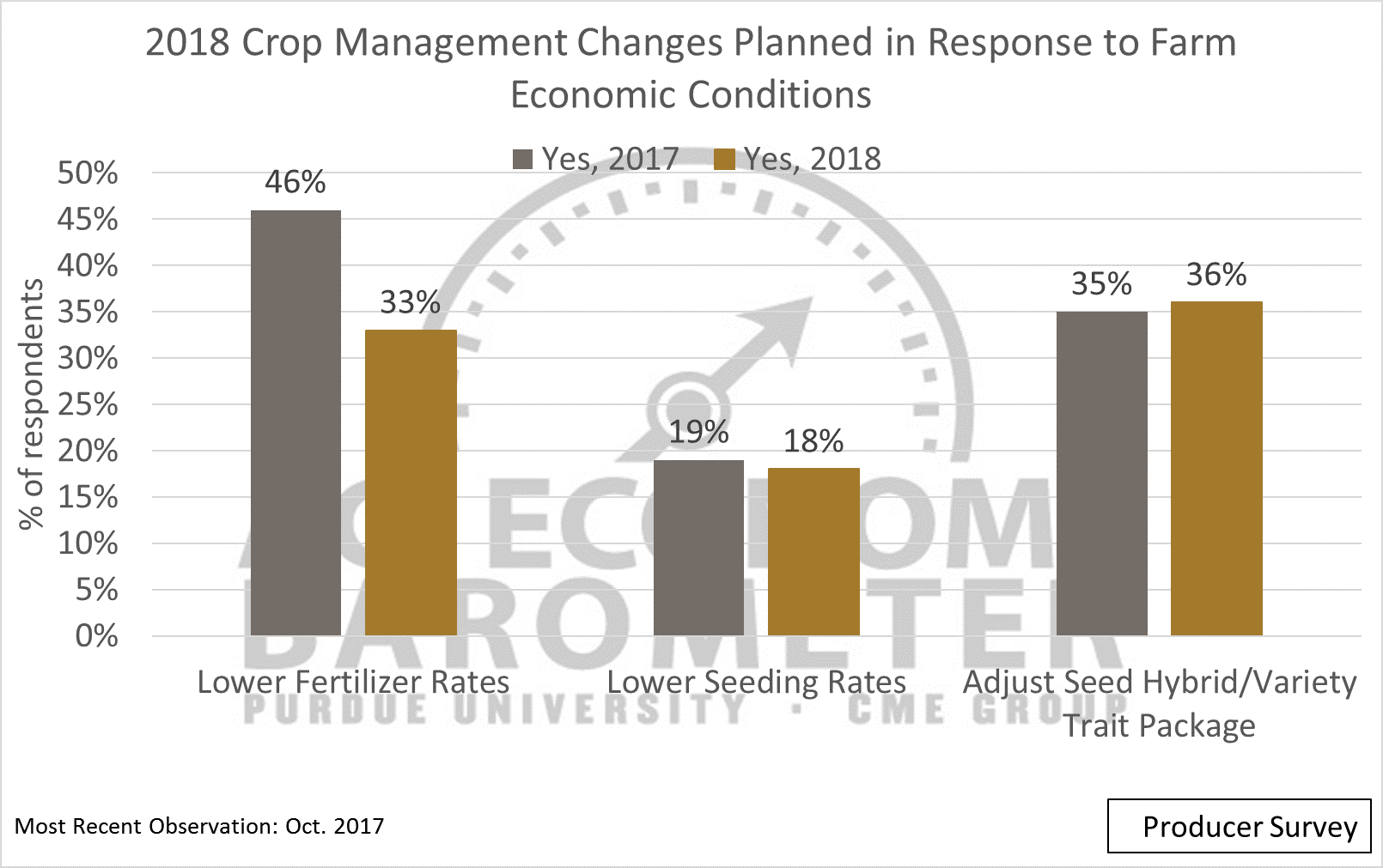

For the second year in a row, producers were asked whether they expect to make management changes in response to challenging economic conditions. Specifically, producers were asked if they planned to lower fertilizer rates, lower crop seeding rates, or adjust their hybrid or variety trait packages for the upcoming season. The share of producers planning reductions in seeding rates and changes in their hybrid/variety choices in 2018 changed little from those reported last year, but the percentage of producers planning to reduce fertilizer usage in 2018 was noticeably smaller than last year. Similar to last year, 19 percent of producers expect to lower seeding rates and 35 percent of producers will adjust their seed variety or hybrid package in 2018. However, just one-third of producers indicated they plan to reduce fertilizer rates in 2018 compared to 2017, down from 46 percent when the survey was conducted a year ago (Figure 6). One possible reason for the smaller share of producers planning to reduce fertilizer rates is that fertilizer prices, particularly for anhydrous ammonia, are lower than a year ago. For example, recent price quotes for anhydrous ammonia were 20 percent lower than a year ago with other crop nutrient prices exhibiting smaller price declines.

Figure 6. 2018 and 2017 crop management changes planned in response to farm economic conditions.

Producers See 2018 Expenses Holding Steady

For the first time, producers were asked on the October survey about their expectations for farmland rental expenses in 2018. Producers overwhelmingly (80 percent of respondents) indicated that they expected farmland rental rates to be unchanged in 2018 compared to 2017. Responses from the remaining 20 percent of respondents were split equally between those who expected rental expenses to be higher (10 percent) and lower (10 percent).

Interestingly, producer responses to this question differed markedly from the quarterly Agricultural Thought Leaders survey responses. A majority of the ag thought leaders (52 percent) expect farmland rental expenses expense to decline in 2018 with just 40 percent of the thought leaders reporting that they expect farmland rental expenses to be unchanged in the year ahead.

Producers were also asked to project their farms’ expenses in 2018 compared to 2017. A majority of producers (62 percent) reported that they expect no change in their expenses in the upcoming year. However, somewhat surprisingly in light of the tight operating margins crop farms are facing, 31 percent of respondents expect their expenses to increase in 2018 compared to a year earlier.

Conclusions

Producer sentiment strengthened modestly in October compared to a month earlier. Improving expectations about the future drove the increase in sentiment. Looking ahead, there is less pessimism among producers regarding crop prices, especially for wheat, soybeans and cotton, in the year ahead than reported in previous surveys. Compared to prior surveys, a larger portion of producers reported on the October survey that used farm machinery prices were high. Finally, 80 percent of producers expect farmland rental rates in 2018 to remain unchanged from 2017’s rates, with a smaller majority (62 percent) expecting all farm expenses in 2018 to remain about the same as in 2017.