A good time to understand the agricultural supply chain

April 26, 2022

PAER-2022-13

Dr. Francisco Scott, Economist, Federal Reserve Bank of Kansas City

The effects of the COVID-19 pandemic on the economy show that there has never been a better time to research the agricultural and food supply chain. The interaction between the new ways in which consumers consume food and the consolidation of firms in the ag supply chain has led to many new questions that are in search of an answer. In a market where few firms sell, consumers with shifting tastes provide opportunities for firms to select themselves into market niches where they can charge higher prices. At the same time, the relationship between firms — farmers included — has changed with the widespread adoption of contracts, bargaining, and vertical integration in the supply chain. Issues related to the consolidation of firms, market power, and its relationship with changes in prices also have made the rounds in policymaking, particularly in an environment of increasing demand and constraint supply.

Fortunately, there has never been a time with a better theoretical and empirical arsenal to answer these questions. The tools that I find most useful to answer questions related to food supply chains are under the framework of what became known as industrial organization, or I.O., for short. I.O. studies markets where there exists a combination of few sellers, sellers that sell products that are not homogenous, and consumers that do not fully understand the price and characteristics of the products they are buying (Sexton, 2013). These are called imperfect markets, and most agricultural markets can be described as such.

Fortunately, it is a field where the Ph.D. program in agricultural economics at Purdue University has much expertise. I discuss next where the core of my research focus is one year after I graduated from the program.

Interaction between consumer behavior and imperfect competition

My initial research interest was to know how consumers’ misperception about the quality that food labels communicate impact the decision of firms to alter the quality and prices of their products. This is important because the modern consumer increasingly cares about food attributes that cannot be verified by any other means than by food labels.[1] For example, if consumers start to believe that the quality of an organic, non-GMO ready-to-eat cereal is much higher than a traditional ready-to-eat cereal, what are the incentives for a firm to start producing an organic, non-GMO, and environment-friendly version of that organic, non-GMO ready-to-eat cereal and charge an even higher price? While some consumers may be worse off because of higher prices, other consumers who value environment-friendly products may be happier with the availability of this new and fancier version of the ready-to-eat cereal.

In a recent paper, my co-author Juan Sesmero and I tried to study this phenomenon (Scott and Sesmero, 2021). We developed a theoretical model to show that when competition is imperfect (only a few firms in the market sell products and there is no prospect of other firms entering), there exists an incentive for firms to offer lower levels of quality than what the society would desire. This is because imperfect competition allows firms to save on costly investments by providing lower quality products, while also charging relatively high prices for the level of quality they offer. But we also show that as consumers start to overvalue a product, and as this overvaluation leads to a higher willingness to pay for that product, firms may start to provide more quality to the market. This is because the cost associated with higher quality provision is outpaced by the benefits that overvaluation of quality provides. In other words, misperception can increase the average quality of products in the market and benefit society.

We also show that consumers who strongly overvalue quality based on label information end up paying much more for the product than consumers who do not overvalue. The consumers who do not overvalue benefit from the overall increasing food quality in the market. The benefit for society, then, is not equally distributed; in fact, consumers who overvalue quality tend to be worse off because of their misperception. Firms tend to benefit from overvaluation, and we show that misperception of quality tends to benefit firms more than consumers Finally, we show that when consumers start to undervalue quality, firms may decrease their quality offering, which in most cases, is bad for society.

To test the validity of the theoretical predictions, I developed an incentivized laboratory experiment to test the behavioral deviations from the theory we developed. The goal of the experiment, which was conducted at Purdue University and had subjects act like sellers, was to understand how decision-makers provide quality and decide prices in a simulated market of imperfect competition. Would the theoretical derivations hold when human beings were making decisions?

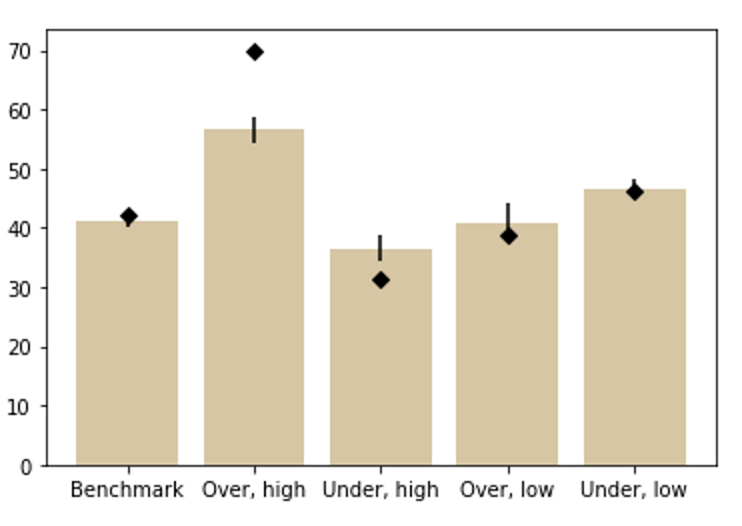

Figure 1 shows that on average, sellers’ choice of quality-adjusted prices (columns) are close to what the theory predicts (diamonds): sellers whose products are high-quality tend to charge more when buyers overvalue their product, charge less when buyers undervalue their product, charge less when buyers overvalue the competitor’s product, and charge more when buyers undervalue their product.

Figure 1 Average quality-adjusted prices from experiments (columns) and expected quality-adjusted prices (diamonds). The benchmark bar shows the treatment in which consumers played by a computer do not over- or undervalue quality. The subsequent bars represent quality-adjust prices when consumers overvalue a high-quality product, undervalue a high-quality product, overvalue a low-quality product, and undervalue a low-quality product. Black bars are the 95% confidence interval.

As governments implement regulations about the information that can and cannot be included in food labels (think, for example, California’s Proposition 37, or the National Bioengineered Food Disclosures Standard), they must be thoughtful about the intended and unintended consequences of such regulations. What we show is that misperception can benefit some consumers when misperceptions about the information contained in labels lead firms to increase the actual quality they provide for their products. Also, from a scientific point of view, we provide a theoretical and behavioral framework under which researchers can collect retail data to check for the effects of misperception of information on quality provision.

Supply, demand, and competition upstream the supply chain

Recently, my research evolved to matters impacting the upstream of the agricultural supply chain. These matters include the understanding of the interaction between demand, supply, and farm income on credit availability, the impact of competition on agricultural lending, and the interaction between food retailers and food processors after a major negative supply shock. I will briefly discuss ongoing efforts to understand the agricultural credit market.

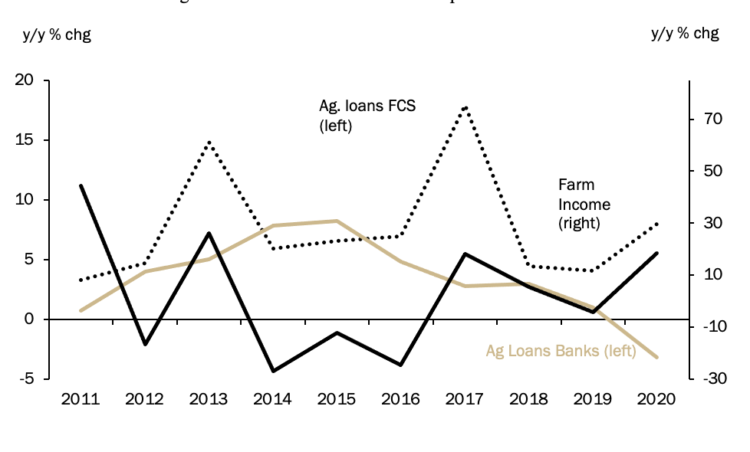

The growth rate of loans in ag banks depends on the supply of loans by banks, which varies depending on the phase of the business cycle, and the demand for loans, which varies depending on the growth rate of farm income, as shown in Figure 2. To better understand the changes in the growth rate of non-real estate loans to farmers, Todd Kuethe, Ty Kreitman, David Oppenhal, and I constructed a novel database that allows us to disentangle the effects of supply and demand on the growth rate of non-real estate loans in banks.

We find that changes in demand have a larger impact than changes in the supply of loans. In other words, changes in bank loans are more related to the dynamics of the ag market in general (commodity prices and shocks in costs) than any type of tightening or loosening of lending standards promoted by banks. This finding corroborates with the idea that large swings in farm income have a strong impact on the growth rate of loans. Changes in the supply of credit tend to have a much smaller or muted impact on non-real estate loans. The study also provides evidence against the idea that farmers are severely credit constraint and in favor of the idea that farmers use loans to smooth negative shocks in income and consumption.

Figure 2 Growth rate of farm income, agricultural loans (operating and real estate) from ag banks and associations at the Farm Credit System.

Sources: FFIEC, FCA, USDA, and author’s calculations

Another important aspect of credit availability relates to competition for clients between the most important lender institutions. Figure 2 shows that associations at the Farm Credit System (FCS) have had more success in avoiding negative impacts from swings in farm income than ag banks. Preliminary analysis shows that the difference between the cost structure of Banks and the FCS is less of a concern in terms of competitive pressure; the FCS most likely has been able to attract farmers using a mix of better terms and structure of loans. This, of course, has important implications for markups in the industry and important implications on how competition in the ag credit market work.

Summary

The agriculture supply chain is dynamic. Investigating matters that affect the functioning of supply chains, particularly how demand, supply, and market structure interact is essential to understanding market efficiency and distribution of surplus. My education at Purdue gave me the tool kit to pursue answers to the most pressing matters that impact the supply chain of agriculture. By studying the supply chain, researchers, stakeholders, and policymakers can better promote efficiency and well-being in society.

References

Scott, Francisco, and Juan P. Sesmero. “Market and welfare effects of quality misperception in food labels.” American Journal of Agricultural Economics (2022).

Sexton, Richard J. “Market power, misconceptions, and modern agricultural markets.” American journal of agricultural economics 95, no. 2 (2013): 209-219

[1] Attributes that cannot be verified by consumption are called credence attributes. Examples of credence attributes are non-GMO ingredients, where the food is grown, and how animals are raised. These characteristics cannot be verified by consumers as they are consuming the product and must be communicated with some informational mechanism. The most popular mechanism available to food products is called a food label. Food labels are a disclaimer placed in the package by a trustworthy third-party.