Corn Prices Have Bullish Potential

December 5, 2018

PAER-2018-20

Author: Chris Hurt, Professor of Agricultural Economics

Surprise! Corn prices are expected to be at their highest level in three years. The potential strength in prices is being led by record usage and declining inventories.

Supplies are high, but usage is higher. U.S. yields reached record levels at 178.9 bushels per acre. The 2018 crop at 14.6 billion bushels was the second largest ever. The good news for growers is that us- age is expected to exceed 15 billion bushels. As a result of usage exceeding production, ending stocks of corn will decrease by over 300 million bushels.

The major categories of usage will be at-or-above records. That starts with exports where USDA expects a 1% increase over last year’s crop to 2.45 bil- lion bushels. So far this marketing year, which be- gan in September, export commitments (loadings plus unshipped sales) are off to an outstanding start which is up 16% from last year at this time. Weekly export sales are reported by USDA, so the market will watch the trend on exports closely this winter.

Corn use for feed is expected to reach 5.5 billion bushels the largest since the 2007 crop. This will be the largest feed use in the ethanol era. As the use of corn for ethanol grew over the past decade, the feeding of ddgs increased and tended to reduce the volume of corn fed directly to animals.

Finally, corn use for ethanol is expected to be nearly the same as last year’s record near 5.6 billion bushels. So far this marketing year, corn use for ethanol is up by 1%. However, ethanol plant margins have been running in the negative with low energy prices (oil and gasoline). These weak margins likely mean there will be some plant slowdowns or closings in coming months and that corn use for ethanol may be somewhat lower for the 2018 crop.

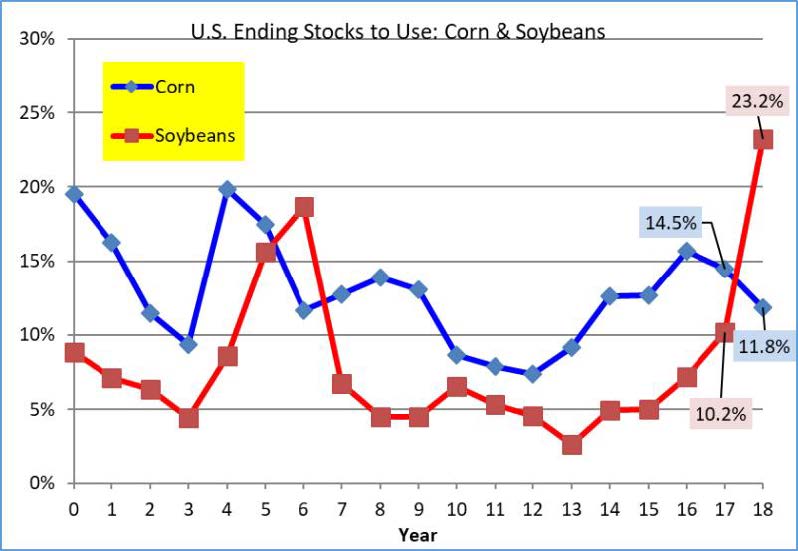

Corn ending stocks are lower for both the 2017 crop and now the 2018 crop. The stocks-to-use ratio has dropped from 15.7% for the 2016 crop to 11.8% cur- rently anticipated for this year (chart). This is a meaningful tightening of inventory and provides bullish price opportunities if usage is stronger than currently anticipated, or if weather in South America or the U.S. turns adverse in 2019.

Higher prices are expected! U.S. marketing year aver- age (MYA) prices were $3.36 per bushel for both the 2016 and 2017 crops. Current estimates are for the 2018 crop to be $3.60, a 7% increase. Indiana corn prices have averaged about 15 cents higher than the U.S. so an expected Indiana price for the 2018 crop would be $3.75.

In Indiana, record yields and stronger prices will con- tribute to an important income boost relative to the 2017 crop. Yields in the state at 194 were 14 bushels higher than 2017 and corn prices are expected to be about 20 cents higher. Revenue per acre will rise by $88 per acre over 2017. Assuming costs were $10 per acre higher, this leaves an estimated net return that is $78 per acre higher than 2017. Over the states 5.2 mil- lion harvested acres, corn returns potentially add an estimated $400 million to farm income compared to 2017. These higher corn returns will be split between 2018 and 2019 as Indiana farmers will sell about 40% of the 2018 crop in calendar year 2018 and the remaining 60% in 2019.

Storage continues to be an important strategy. Cur- rent cash bids tend to have good premiums for later delivery. Bids for June/July 2019 delivery tend to be 15 to 25 cent premium to nearby bids (depends on location). Those with on-farm storage consider for- gone interest returns as their primary storage costs. Depending on each individual’s interest rate, this amounts to 1.0 to 1.5 cents per bushel per month, or 5 to 8 cents for storage into the early summer. If one can gain 20 cent higher prices for 5 to 8 cents of cost, that is a handsome additional return to storage. The point is that pricing and delivery can occur at two different times. When you get ready to price, also consider the returns for pricing for later delivery.

Those using commercial storage will probably find that the monthly storage charge along with forgone interest costs is higher than the premium bids for later delivery. For example assume the 5 to 8 cents of forgone interest costs to store into the early summer, and also add 3 cents per month of storage costs for commercial storage. Five months of storage adds an additional 15 cents added to 5 to 8 cents for total costs of 20 to 23 cents. These costs often exceed the premium bids for later delivery.

Short term upside targets are $3.90 to $4.00 on the March futures and $4.10 on July futures. The next objectives above these would be $4.20 to $4.30. These are levels that will provide around $4.00 or higher cash bids at processors and ethanol plants.

Corn acreage will increase in 2019, but maybe not by as much as the early estimates. Price relationships for new-crop 2019 can still change based on what hap- pens to the U.S./China trade dispute and to the final corn and soybean yields in South America. In addition Purdue budgets for 2019 using current new-crop prices are still suggesting that soybeans are favored over corn in the Eastern Corn Belt. Market developments (China/South America, etc.) will cause new crop prices to “bid” for the acres that are needed. The trade conflicts with China and the current easing of those tensions makes it difficult to predict how new- crop price relationships will unfold this winter. For this reason, it is suggested that farmers try to maintain some flexibility on some of their 2019 acres. This may also imply not forward buying all inputs such as seed.

Keep an eye on new crop pricing opportunities with the potential for December 2019 futures to reach $4.25.