The Economic Impact of Indiana’s Turfgrass Industry

June 18, 2007

PAER-2007-6

Quintrell Hollis, Graduate Student and Jennifer H. Dennis*, Assistant Professor.

*Jennifer H. Dennis is also in the Horticulture & Landscape Architecture Department, Purdue University.

Turfgrass is an agronomic crop that provides functional, recreational and ornamental benefits to human activities (Beard 1973). Functional uses of turfgrass include wind and water erosion control thereby minimizing dust and mud surrounding homes and businesses. Other functional attributes of turfgrass include healthier, fresh and improved environments in urban and suburban areas. Turf is also recognized for reducing glare, noise, air pollution and heat buildup and is used widely along roadsides for erosion control. Turf is used recreationally for sports activities including golf, lawn tennis, soccer, rugby, polo, and football to help reduce injuries which are utilized by most professional sports as it provides a strong groundcover. Aesthetics is another benefit as turf is used in landscapes. Past research has shown that landscaped homes and businesses can benefit financially from higher resale values (Behe et al., 2005; Des Rosiers et al., 2002; Henry 1999; Orland et al., 1992). The turfgrass industry is a subsector of the green industry (i.e., floriculture, nursery, woody ornamentals) which is characterized as a set of fragmented businesses. Despite the benefits gained from turfgrass sales, little has been done to examine the economic impact. This article attempts to fill this void.

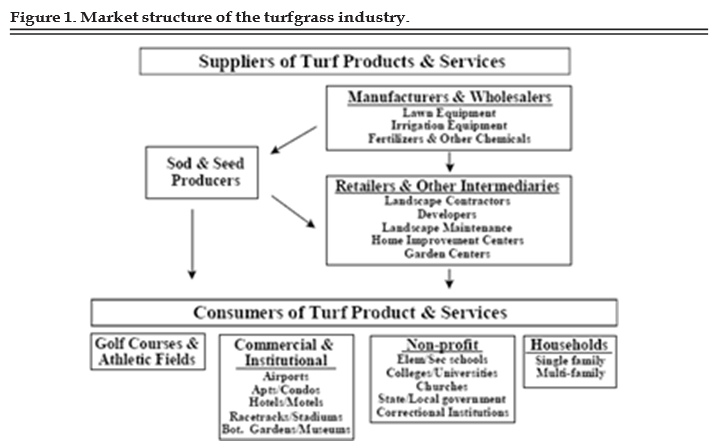

The economic sectors of the turfgrass industry include sod farms, lawncare services, lawn and garden retail stores, and lawn equipment manufacturing. Golf courses are also included in this sector as a major industry that depends upon highly managed turfgrass for golf play (Haydu Hodges and Hall 2006). Within this industry, five sectors were studied to determine the economic impact including sod production, lawncare services, lawncare goods retailing, lawn equipment manufacturing and wholesaling, and golf courses. The market structure and several linkages for this industry are shown in Figure 1.

Figure 1. Market Structure of the Turfgrass Industry.

Information reported in this article is derived from a national study conducted by the University of Florida and University of Tennessee that examined the broad regional economic impacts of differences within the United States Turfgrass and Lawncare industry. All fifty states were included and divided into seven geographical regions. Economic impacts of the U.S. turfgrass and lawncare industry in 2002 were estimated based upon survey data in conjunction with various published sources of secondary data, and economic multipliers derived from regional input-output models for each state using the Implan software system and associated datasets. All numbers reported are expressed in 2005 dollar terms. This article will focus on Indiana’s Turfgrass and Lawncare industry and its relation to select Midwestern states (Illinois, Iowa, Michigan, Minnesota, Missouri, Ohio and Wisconsin) as well as one surrounding state that is not included in the Midwest region (Kentucky).

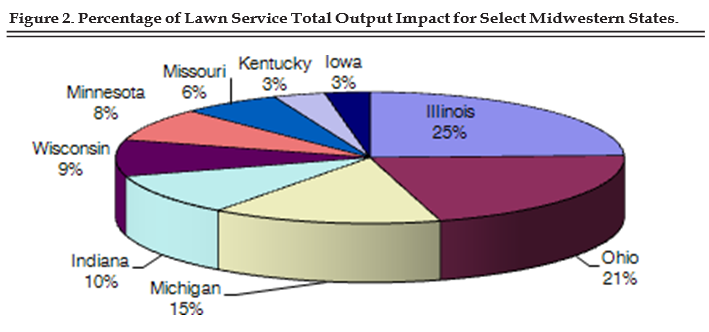

Figure 2. Percentage of Lawn Service Total Output Impact for Select Midwestern States.

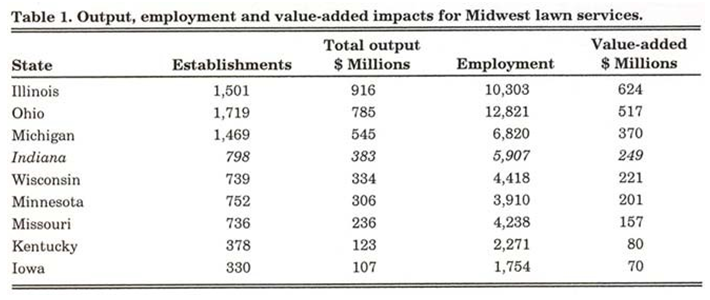

Table 1. Output, employment and value-added impacts for Midwest lawn services.

National Results

Three indicators were used to determine economic impact which include: total output impact, and valued added impact. Total output impact is the total economic activity generated in each state by sales (or output) to final demand or exports. This includes the effects of intermediate purchases by industry firms from other economic sectors (indirect effects) and the effects of industry employee household consumer spending (induced effects), in addition to direct sales by industry firms. Direct output impacts, representing sales by the turfgrass industry sectors totaled $41.4 Bn. Indirect output impacts were $3.52 Bn, representing the value of pur- chased goods and services, and induced impacts were $13.00 Bn, arising from consumer spending by industry employees. Total output impact generated from this industry was $62.2 Bn. Employment impact is the number of jobs generated by a firm which is a measure of economic contribution to a regional economy. The U.S. Turfgrass and lawncare industry supplied over 822,849 jobs.

Value-added impact is the net economic contribution to business and personal income in a regional economy or the difference between sales revenues and cost of purchased inputs and includes the value of employee wages and benefits, owner’s compensation, dividends, capital outlays and business taxes paid. The value-added impact for turfgrass and lawncare was $37 Bn and generated $23 Bn in labor income and is responsible for $2.4 Bn in indirect business taxes to local and state governments.

Each sector provides a different economic impact on the turfgrass industry. Golf Courses provide the highest percentage of economic impact at 36% while the lawn services sector has the second largest impact at 33%. Lawncare goods retailing is third at 15% while lawn equipment is fourth (13%) and sod production is fifth at 3%.

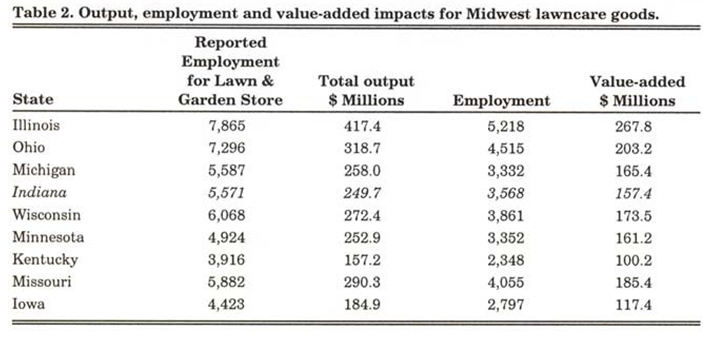

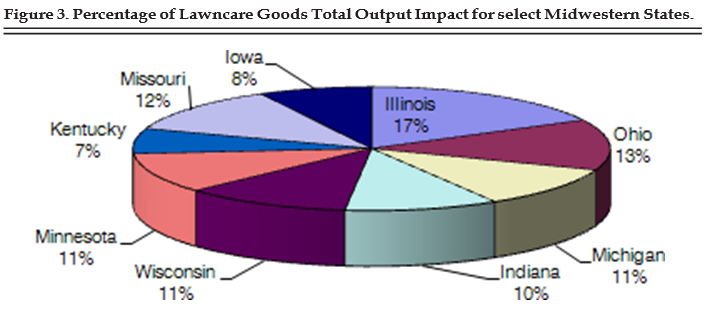

Table 2. Output, employment and value-added impacts for Midwest lawncare goods

Figure 3. Percentage of Lawncare Goods Total Output Impact for select Midwestern States

Indiana Results

Indiana’s turfgrass industry generates $1.4 Mn in output or revenue impacts from all sectors accounting for 2% of the nations total output impact. Indiana generates 18,830 jobs which is approximately 2% of the national output. The value-added impact generated by Indiana’s turfgrass industry totaled $805.5 Mn that constitutes approximately 2% of the national output. Each sector is evaluated individually and is compared by rank to surrounding Midwestern states.

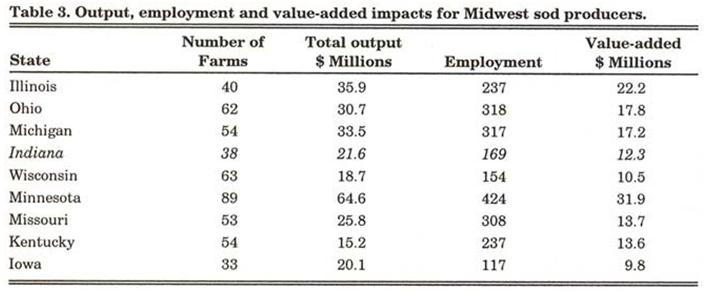

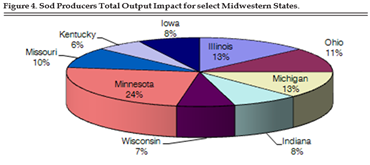

Table 3. Output, employment and value-added impacts for Midwest sod producers.

Figure 4. Sod Producers Total Output Impact for select Midwestern States.

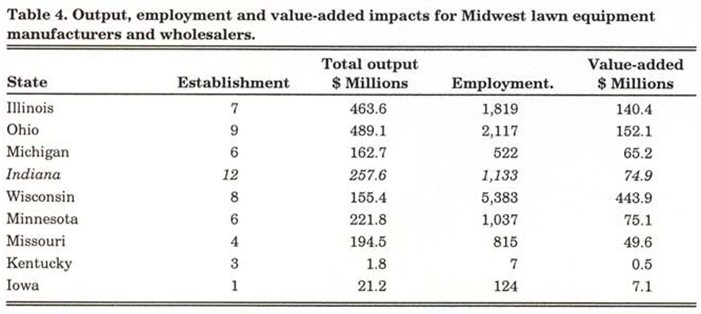

Table 4. Output, employment and value-added impacts for Midwest lawn equipment manufacturers and wholesalers.

Lawncare Goods

The lawncare goods sector encompasses retail lawn and garden supply stores such as Tru-Green that may be franchised or identified as a chain, as well as independent mom- and-pop stores that sell pesticides, fertilizers, seeds, and other turf items to end consumers. Indiana’s lawncare goods sector supplies 3,568 jobs which is fifth amongst surrounding states (Table 2). Indiana has an output impact of $249.7 Mn (10%) which is 4% of the national output and ranks 7th compared to other sur- rounding states (Figure 3). Illinois, Ohio, and Missouri are the top three in output impact accounting for $417.4 Mn (17%), $318.7 Mn (13%), and $290.3 Mn (12%) respectively (Figure 3). Indiana had a value added impact of $157 Mn.

Sod Producers

Indiana sod producers generated 169 jobs with 38 operations (Table 3). This sector accounts for $21.6 Mn of output impacts which ranks 8th amongst Midwestern states (Figure 4). Minnesota is the leader in output impacts amongst surrounding states with an output impact of $64.6 Mn (8%) and 89 operations. Indiana’s sod production sector is responsible for a value added impact of $12.3 Mn, 11% of the national total value added output.

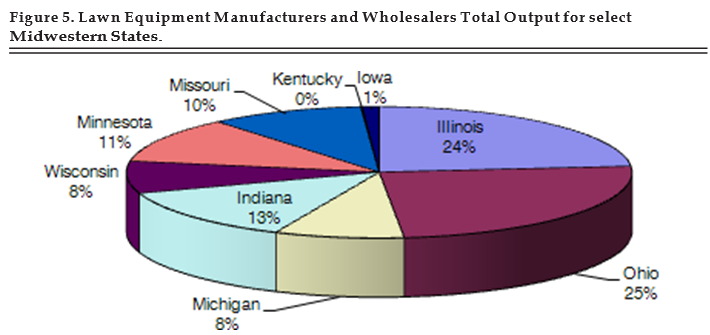

Lawn Equipment Manufacturing and Wholesaling

The lawn equipment manufacturing and wholesaling sector includes firms that manufacture commercial turf and grounds care equipment, push-type lawnmowers, powered lawn edgers/trimmers, yard vacuums and blowers, lawn tractors and riding mowers, and parts and attachments for consumer lawn and garden equipment. Indiana has an output impact of $257.6 Mn, which is 3% of the national output (Table 4). Ohio and Illinois were leaders amongst surrounding states in output impact with $489.1 Mn (13%) and $463.6 Mn respectively (Figure 5). Indiana has 12 establishments that supplied 1,333 jobs. Indiana has a value added impact of $74.9 Mn in the lawn equipment manufacturing sector.

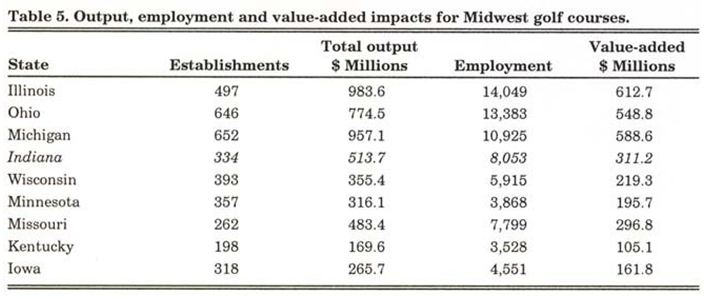

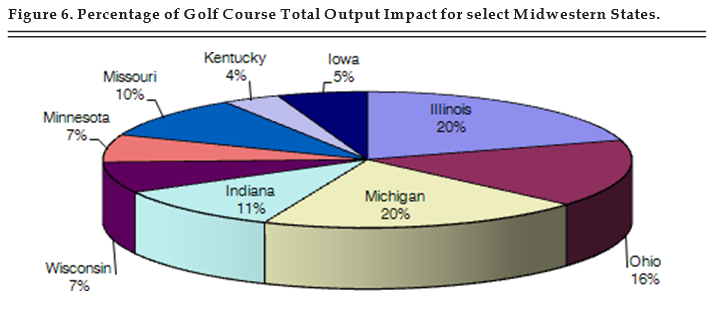

Golf Courses

Indiana’s golf course sector generated $513.7 Mn (11%) (Table 5) in output, which is 5% of the national output and ranks fourth amongst surrounding states (Figure 6). Indiana has 334 golf course establishments, which were responsible for 8,053 jobs. Indiana’s value-added impact contributed $311.8 Mn of total value added impact. Illinois and Michigan were the leaders amongst the surrounding states in value-added impact with $612.7 Mn and $588.6 Mn respectively.

Figure 5. Lawn Equipment Manufacturers and Wholesale Total Output for select Midwestern States.

Table 5. Output, employment and value-added impacts for Midwest golf courses.

Summary

Figure 6. Percentage of Golf Courses Total Output Impact for select Midwestern States.

Nationally, sod producers had the largest economic impact in the South. States that produced

the most output for the lawncare sector were California and Florida. Two Midwest states were among the top ten for output impacts in this category: Illinois and Ohio. Wisconsin was the only Midwestern state to emerge as a leader in output impacts for a sector (lawn equipment manufacturing and wholesaling). Tennessee and South Carolina provided the next biggest output impacts for the lawn equipment manufacturing and wholesaling sector. Lawncare goods and retailers top states for economic impact were California and Texas.

The golf course sector had the most economic impact in California, New York, Texas, Illinois, and Michigan. Indiana’s turfgrass industry accounts for $1.4 Mn in economic impact or roughly 2% of the national output and provides 18,830 jobs (2% of national total). The value-added impact of Indiana’s Turfgrass and Lawncare industry for all five sectors totaled $805.5 Mn dollars which represent 2% of the national output in value-added.

References

Beard, J.B. 1973. Turfgrass: Science and Culture. Imprint Englewood Cliffs, NJ: Prentice-Hall.

Behe, B., J. Hardy, S. Barton, J. Brooker, T. Fernandez, C. Hall, J. Hicks, R. Hinson, P. Knight, R. McNiel, T. Page, B. Rowe, C. Safley, and R. Schutzki. 2005. Landscape Plant Material, Size, and Design Sophistication Increase Perceived Home Value. Journal of Environmental Horticulture (accepted).

Des Rosiers, F., M. Theriault, Y. Kestens, and P. Vleeeneuve. 2002. Landscaping and House Values: An Empirical Investigation. Journal of Real Estate Research 23(1-2):139-161.

Henry, M.S. 1999. Landscaping Quality and the Price of Single Family Houses: Further Evidence from Home Sales in Greenville, South Carolina. Journal of Environmental Horticulture 17(1):25-30.

Haydu, J.J., A.W. Hodges, and C.R. Hall. (2006). Economic Impacts of the Turfgrass and Lawncare Industry in the United States (FE632). April 2006, Food and Resource Economics Department, Institute of Food and Agricultural Sciences, University of Florida Cooperative Extension Bulletin.

Orland, B., J. Vining and A. Ebreo. 1992. The Effect of Street Trees on Perceived Values of Residential Property. Environment and Behavior 24(3):298-325.