Interesting Times for U.S. Trade Policy

January 31, 2025

PAER-2025-02

Author: Russell Hillberry, Professor of Agricultural Economics

As urban legend has it, an ancient Chinese curse says, “May you live in interesting times.” Apparently, the curse is neither ancient nor Chinese. Whatever its origin, it seems that the curse has fallen on export-oriented agriculture (and on the writer of this annual outlook). The re-election of Donald Trump as U.S. President promises a return to the chaotic and unwise trade policies of his first term—policies that damaged the aggregate U.S. economy, with export-oriented agriculture bearing a disproportionate share of the costs. (Oh well, at least it was interesting.) One aspect of the chaos surrounding the President-elect’s trade policy is the arbitrary and frequently changing level of threatened tariffs, as well as the identity of the changing countries whose exports he says he wishes to target. This inconstancy is itself a cost to businesses that wish to trade and invest in the U.S.; it also complicates any effort to predict the trade policy landscape in 2025.

This review considers two of the President-elect’s most recent proposals. In both cases, retaliation by threatened partners would substantially reduce incomes in export-oriented agriculture. The sectors that would be most affected are, most likely, soybeans should China be the targeted partner, and corn, pork, dairy, and poultry if Mexico is the primary target. If the proposal the President-elect campaigned upon is enacted – and if U.S. trade partners retaliate in kind – recent research suggests that significant income losses will be felt across the breadth of agricultural sectors that participate in large-scale export activity. Model estimates suggest that U.S. landowners’ incomes would fall by 6%. On the other hand, U.S. food manufacturing sectors might benefit from a trade war because reduced agricultural commodity prices would give them access to cheaper inputs.

The consequences of trade policy actions are often difficult to summarize succinctly because nearly every trade policy action generates winners and losers, both at home and abroad. While the effect of tariff increases on the economy is almost always negative, some industries benefit, and others are hurt, making it difficult to observe aggregate consequences. But consequences for individual sectors are sometimes quite visible, as they were in 2018.

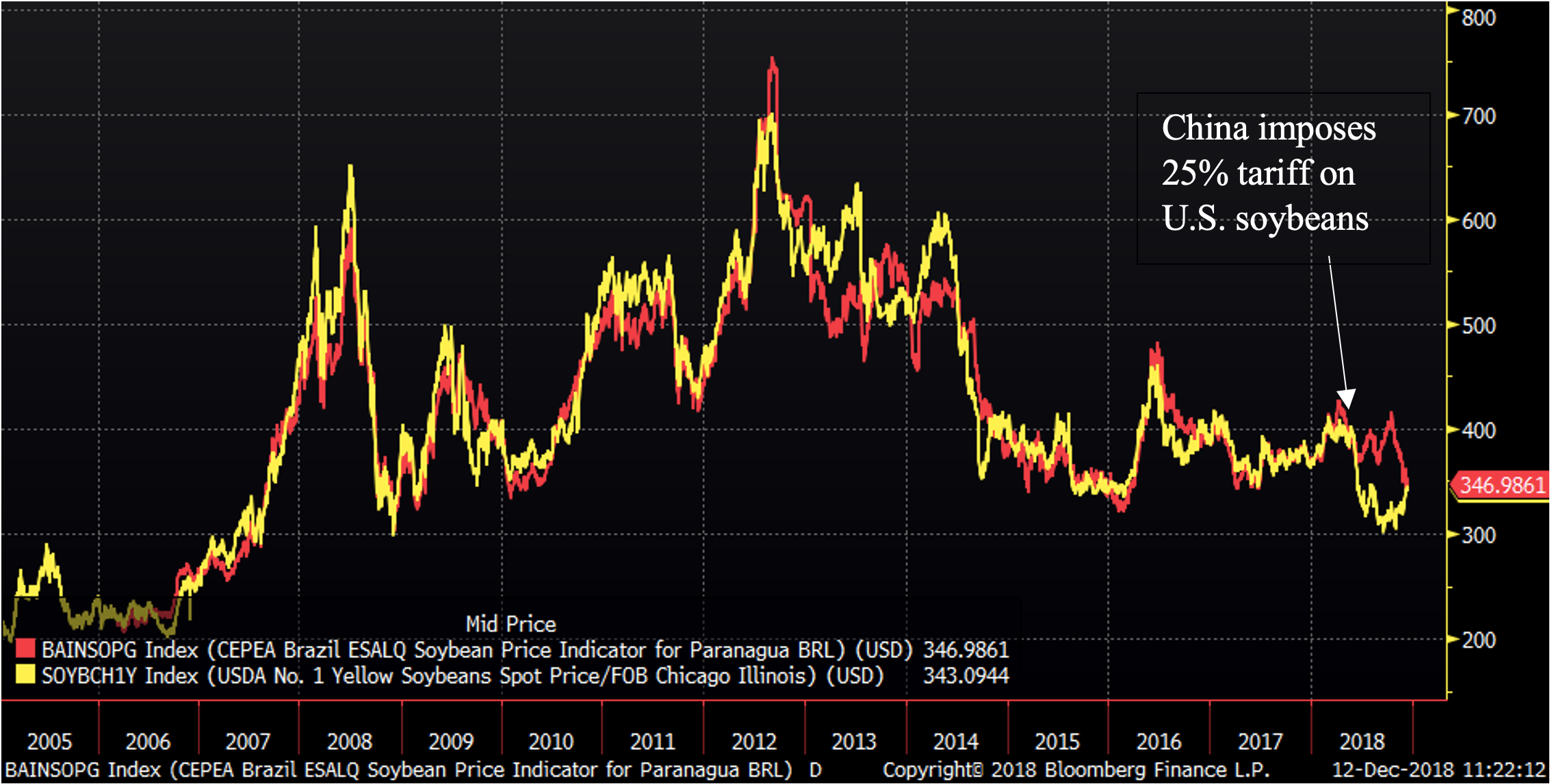

Export-oriented agriculture was among the most visible losers from the 2018 trade war. In retaliation for U.S. tariffs on Chinese manufactured goods in 2018, China imposed a 25% tariff on imports of U.S. soybeans, largely switching their purchases from U.S. to Brazilian sources. Since China was by far the largest importer of soybeans, the result of its tariff on U.S. soybeans was a sharp drop in the price of U.S. soybeans, both in absolute terms and relative to the price in Brazil. Figure 1 reproduces and annotates a figure from an earlier version of this review, Hillberry (2018). The figure shows the prices of soybeans in Chicago and Paranagua, a major port for soybean exports from Brazil. International market forces tend to keep these prices together over time, but the trade war in 2018 saw a sharp drop in the U.S. export price relative to the Brazilian price. Rarely is a country such a large buyer of a product that its own tariff differential on the same product from two different export sources passes through entirely to prices, but in this case, China was large enough to make that happen. The price gap between Paranagua and Chicago soybeans in October of 2018 was $89 per metric ton (or $2.42 per bushel) against a U.S. price of just over $300 per metric ton.

Figure 1. Soybean prices in Paranagua, Brazil (red line) and Chicago (yellow line) in USD/metric ton

Image notes: Copyright by Bloomberg Finance LP. Adapted from Hillberry (2018)

The political consequences of this negative shock to farm incomes were largely offset when then-President Trump arranged a bailout of domestic farmers (Belmonte, 2021). The bailout used 92% of the revenues earned by assessing tariffs in the first place, negating one of the only positive effects of the tariffs on the U.S. economy (Bernstein, 2024). Since the 22nd Amendment to the Constitution precludes another term for President Trump, it may be that such largesse should not be expected in his forthcoming term, even if the negative consequences of the trade war hit U.S. agricultural exports similarly. Since tariff revenues have become a key justification for imposing the tariffs in the first place, there will be less flexibility to use those revenues to bail out farmers hurt by the President’s trade war.

Likely impacts of the Trump campaign’s tariff proposals (and retaliation by other countries)

The trade policy proposal that Donald Trump campaigned on prior to the 2024 election was a broad 60% increase in tariffs on imports from China and a 10 or 20 percent broad tariff on imports from all other countries. While Congress has given the president relatively wide authority to impose tariffs on individual products or individual countries, it seems that a proposal to enact broad-based tariffs (across both countries and products) would require Congressional action. Members of Congress from districts where export-oriented agriculture is important should take this proposal seriously, as the proposal, along with likely retaliation from U.S. trading partners, is expected to generate considerable harm to several agricultural exporting sectors (and to the economy as a whole).

Balistreri et al. (2024) use a calibrated global trade model to assess the effects of the President-elect’s proposals, together with proportional responses by U.S. trading partners. In a model of global trade, the authors consider the economic effects of a 60% U.S. tariff on Chinese goods and a 10% tariff on goods from other countries, together with each country imposing retaliatory tariffs on U.S. exports in line with what the U.S. imposed upon their exports. The model offers considerable sector-level detail and so allows the distributional effects of the tariff war to be discussed in some detail.

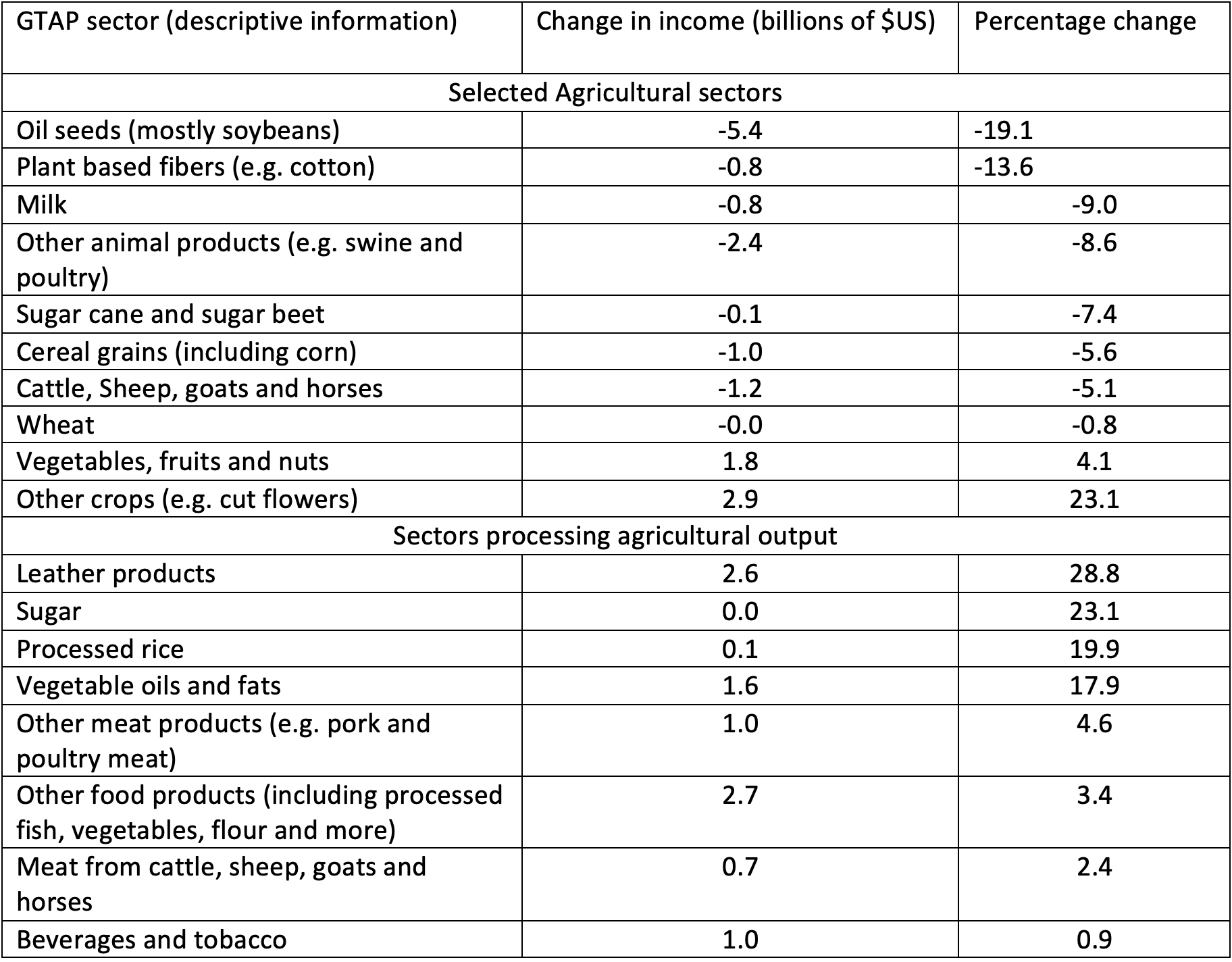

According to the model estimates, the net annual cost of the trade war for U.S. households would amount to approximately $7000 per year (6.8% of consumption). Because agriculture is a major export sector, retaliation by U.S. trade partners would mean that many agricultural sectors would generally see losses that are even larger than that of the typical U.S. household. Sector-level results for the modeled trade war scenario are reported in Table 1. The hardest hit sectors are oilseeds and cotton, though producers of milk, swine and poultry, sugar cane and beets, corn, and livestock also suffer substantial losses of income in the simulated trade war. The very large tariffs on China (matched by equivalent Chinese tariffs on U.S. goods) are likely the main reason that the oilseed sector is hurt so badly. Import competing sectors – primarily horticulture – see increases in income due to the trade war. Another way to look at the effect of the modeled tariff war on agriculture is to consider the calculated effect on the incomes of landowners, which fall by 6.4% in the modeled scenario.

Table 1. Simulated effects of Trump campaign tariff proposal and retaliation on Ag and Food Sectors

Note: Calculations by Balistreri, Binte Ali, and McDaniel (2025). Estimates taken from Table 3 of that study. Simulated effects of 60 percent increase in tariffs on imports from China and a 10 percent increase in tariffs on imports from all other countries, along with symmetric retaliation by foreign trading partners.

The second part of Table 1 shows that processors of agricultural inputs benefit from a trade war scenario. Since foreign tariffs limit the options for U.S. exporters, U.S. exports are sold instead in the U.S. market, so commodity prices fall in the U.S. Processors in the U.S. benefit from these lower input prices. Since most processing sectors’ sales are relatively concentrated in U.S. domestic markets, their output prices do not fall as much as their input prices, leading to increased net incomes in those sectors.

Since this discussion focuses on the effects of the tariffs and likely retaliation on agriculture and food sectors, we refer the reader to the original study to see the likely effects on the sectors outside of food and agriculture. Briefly, incomes in manufacturing sectors rise substantially, but these gains are more than offset by losses in the service sectors of the economy. Within mining, petroleum extraction and refining benefit, while incomes in the coal, natural gas, and mineral sectors fall. Incomes in the economy as a whole fall by $702 billion, or 3.6%. The 6.8% reduction in U.S. consumption arises through a combination of lower incomes and higher prices.

Another interesting result coming from the paper is that in the scenario in which the President-elect’s proposal is met with proportional retaliation by all U.S. trading partners, China emerges as a net winner from the tariff conflict. Since China imports less from the U.S. than the U.S. does from China, the distortionary effects of China’s tariffs are smaller there than U.S. tariffs are in the U.S. Since China is only raising tariffs on the U.S. in this scenario, importers there are able to switch to other sources more easily than U.S. importers since U.S. importers also see tariffs rise on imports from countries other than China. China’s export interests are hurt by reduced access to the U.S. market, but the retaliatory tariffs that other countries put on U.S. exports give Chinese exporters a new advantage over U.S. exporters in those markets. This advantage in foreign markets is more than enough to offset the losses to China of its own bilateral trade war with the U.S.

Implications of the new proposal to target Canada and Mexico

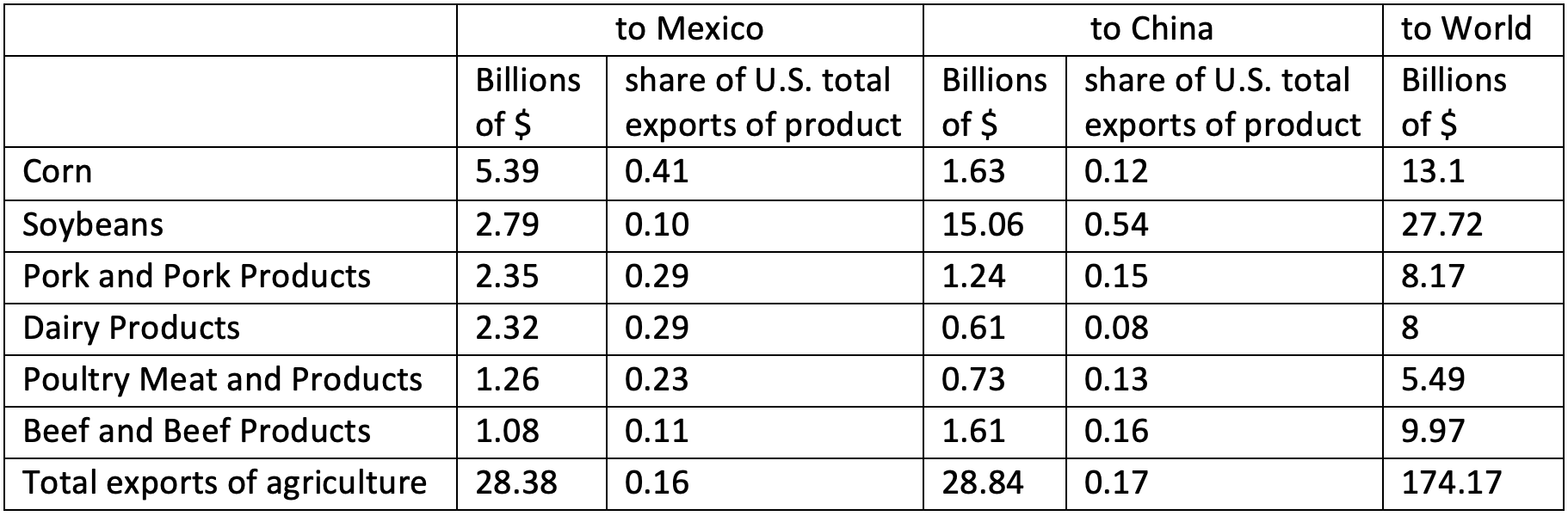

Soon after his 2024 election, President-elect Trump proposed a different set of tariffs than those he had campaigned on. He proposed new 25% tariffs on goods coming from Canada and Mexico, as well as 10% additional tariffs on China. The proposal is new, and the writer is not aware of a model-based analysis of the effects of a trade war among North American countries. What we can do is look at the size of the two North American markets and the composition of the imports they buy from the U.S. Data from the U.S. Department of Agriculture show that each of the North American markets are roughly similar in size to the Chinese market in terms of food and agriculture exports. China is still the largest market, with $28.84 billion of U.S. export sales there in 2023. Canada and Mexico each imported $23.38 billion of U.S. agricultural exports. Even though each market is smaller than China, together they are quite a bit larger.

Exports to Canada are concentrated in processed foods and fresh fruits and vegetables. These sectors may be less susceptible to a U.S.-Canada trade war than would agricultural commodities because the substitution of U.S. commodity exports with exports from other countries is easier than with fruits, vegetables, and processed foods. In Mexico, as in China, imports from the U.S. are often agricultural commodities, so it is worth comparing the two markets to see how different commodities are exposed to a trade war with North America instead of China.

Table 2 shows U.S. exports to Mexico, China, and the World, respectively, as well as Mexican and Chinese market shares for a set of large U.S. agricultural export commodities. The table reiterates the point that U.S. soybean farmers are heavily exposed to China, which accounts for half of U.S. soybean exports. But the table also shows that there are several sectors quite exposed to Mexico, especially corn at 41%. However, the pork-related products sector and the dairy sector see almost 30% of the U.S. export sales go to Mexico, while in the poultry sector, the figure is 23%. What this data suggests is that the impact of retaliatory tariffs by Mexico will hit quite differently than retaliatory tariffs by China. They are likely to be painful for U.S. export-oriented agriculture just the same. A multi-front trade war would have even larger negative consequences.

Table 2. U.S. Exports of Agricultural and Food Products to Mexico, China and the World 2023

Source: USDA Foreign Agriculture Service, Global Agricultural Trade System, Drawn December 17, 2024.

Are the tariff threats real, or just a negotiating tactic

Some commentators have argued that, as President, Trump is unlikely to impose large tariffs but rather plans to use the threat of tariffs merely as a “negotiating tool.” Bade (2024) offers a useful discussion along these lines. Given the economic disruption outlined in the trade war simulation discussed above, it is to be hoped that the President-elect can be persuaded not to start another tariff war. This writer’s opinion is that the emerging view on Wall Street and among trade-supporting Republican politicians is overly optimistic. It is likely that President Trump will increase tariffs, harming the U.S. economy and export-oriented agriculture in particular. Without going into the topic in great detail, here are some key points to keep in mind when hearing the argument that tariffs are “only a negotiating tool.”

-

In his first term, the president-elect built an infrastructure to exchange tariff exclusions for political favors; this infrastructure is not useful to him without large tariffs in place.

In many countries, high tariffs facilitate corruption by government officials, who use their authority over tariff collection to exchange tariff reductions/exemptions for bribes that are paid by importing firms (see, for example, Sequiera, 2016 for evidence from Mozambique, and Rijkers et al., 2017 for Tunisia). Due to its overall low tariff structure, outright bribery has not been a problem in the U.S. in living memory. There has been a tariff suspension process that allows firms to petition Congress to reduce statutory tariffs for a period of two to three years. Ludema et al. (2018) describe the process. Perhaps not surprisingly, Ludema et al. find that lobbying expenditures by both proponents and opponents affect the likelihood that Congress approves a requested suspension. While certainly exuding a whiff of corruption, this run-of-the-mill transactional politics was, at least, openly scrutinized through reports by a bipartisan federal commission and open debate in Congress.

In his first term as president, Donald Trump introduced a process that brought the decision to grant tariff exemptions inside the executive branch. Fotak et al. (forthcoming) explain that the exemption process for imports coming from China was not subject to legislative or regulatory oversight. There is also no infrastructure for appealing the decisions made in the Executive Branch. Statistical analysis of the tariff exemption decisions made under then-President Trump shows that, all else equal, firms donating to Republicans in the 2016 election cycle were more likely to be granted exemptions from paying tariffs, and firms donating to Democrats were more likely to have tariff exemption requests denied when compared to a firm that made no donations at all (Fotak et al., forthcoming). The authors also find that firms hiring lobbyists who had played a role in the Trump administration were more likely to be successful in their requests for tariff approvals. DePillis (2020) offers a journalistic account of the process and the ways in which the system worked against small businesses that lacked the clout to be successful in their application for an exemption.

In the unlikely event that the President-elect’s negotiations were to successfully use the threat of tariffs to achieve something that is useful to the people of the United States, he would forego the opportunity to use the tariff exemption process to reward friends and punish enemies. In this author’s view, the motive to use the tariff exclusion process for political and/or corrupt purposes is a key reason to believe that large tariffs will, in fact, be put in place during the next administration. Krugman (2025) agrees and explains that induced investments in the President-elect’s cryptocurrency might be a likely vehicle through which he could personally profit from the corrupt use of the tariff exemption process.

-

Expected revenue from tariffs could partially offset revenues from other tax cuts.

One of the most consequential decisions that Congress will face in the upcoming year is whether (and if so, how) to renew the temporary tax cuts that were implemented in 2017, along with the difficult tax of finding the funds necessary to pay for the additional tax cuts and expenditures the President-elect promised during the campaign. Bogage (2025) explains that merely extending the existing tax rates into the future – an extension of the planned temporary tax cuts – is projected to increase the government debt by $5 trillion over the next decade, while the President-elect’s entire set of promises made during the campaign would increase the debt by $15 trillion. The non-partisan Committee for a Responsible Budget (2024) estimates that the tariffs in the President-elect’s campaign proposal tariffs would raise approximately $2.7 trillion, though the negative effects of retaliation and/or exclusions on the estimated tariff revenue to be collected were not considered. If scored this way, the tariff revenues could be used in Congress’ budget reconciliation process to offset more than half of the cost of renewing the existing tax rules. Thus, including tariff increases in the tax cut legislation offers the President-elect another motive for increasing tariffs during his term. This is another reason to believe that the tariffs are not simply a negotiating tool; the President-elect expects to put them in place. It is worth noting, however, that many Republican senators are skeptical of relying on tariffs as a source of revenues (see Everett and Goba, 2024), and renewing the tax plan would likely rely on many of these Senators’ votes.

-

Uncertainty about the future of tariffs is itself costly for firms making trade and investment decisions

Whether or not the tariffs go into place, the uncertainty generated by the President-elect’s ever-evolving threats means that it is extremely difficult for firms to make trade and investment decisions. Without a firm policy proposal, firms have difficulty understanding their input prices. Firms wishing to export do not know if their exports will face retaliatory tariffs. All else equal, firms in supply chains would prefer to be located in a market with less trade policy uncertainty than the U.S. currently. Even if the President-elect never imposes the tariffs he threatens, the uncertainty he creates while “negotiating” poses real costs to businesses involved in international trade and reduces the incentive to invest in the U.S.

-

The U.S. Constitution grants Congress, not the President, the authority to set the tariff.

Article 1, section 8 of the U.S. Constitution grants Congress the right to set tariffs (or duties, as it says there). Starting in the 1930s, Congress began granting the president limited power to set the tariff in international negotiations. Later grants of power defined sets of circumstances when the President could act on their authority. It is unlikely that the Congresses that granted such powers had in mind that the President alone would set tariff rates that were capable of collecting trillions of dollars of revenue without even consulting the Congress, whose responsibility in our system is to authorize tax and spending decisions. The arbitrary ways in which the President and the U.S. Trade Representative’s office have decided to impose large tariffs on broad swathes of U.S. international trade (and give exemptions to the tariffs at their own discretion) runs counter to the spirit of the Constitution, which set the power to tax and set tariff rates firmly in the hands of Congress. Congress should take all necessary steps to reclaim this power from a President who is clearly abusing the powers that Congress long ago delegated, under the assumption that the delegated power would be used responsibly and to the benefit of the American people.

Conclusion

Much of the media discussion about tariffs focuses on the question of whether they are a net positive or net negative for the economy, in aggregate. Standard models of international trade typically show that the net effects of tariffs on the aggregate economy are likely to be negative. But the most important implication of the models for politics is that tariff policy has sizable distributional consequences—large tariffs produce both large winners and large losers among different segments of the U.S. economy. Moreover, it is likely that U.S. trading partners would retaliate against U.S. tariffs with tariffs of their own and that retaliations magnify greatly the losses borne by export-oriented sectors like agriculture. Detailed analysis of the tariff plan that President-elect Trump proposed during the campaign – along with a likely scenario for retaliation by foreign governments – shows that, broadly, those involved with manufacturing sectors would benefit from a tariff war, while those involved with services and agriculture would lose. Higher prices for imported goods would hurt consumers, leaving the U.S. worse off as a whole. The specific sectors that are most harmed by a tariff war depend upon the countries initially targeted by U.S. tariffs. Chinese retaliation against U.S. tariffs would likely hurt growers of soybeans most, while retaliation by Mexico would likely hurt corn, pork, dairy, and poultry sectors. One interesting result from a formal analysis of the President-elect’s campaign proposals is that the food processing sectors can benefit from a tariff war because fewer export opportunities for agriculture give U.S. food processors cheaper inputs.

The inconstancy of the President-elect’s tariff plans is a burden on business in the United States. Even after the election, it is difficult to form expectations about the coming trade policy environment. This analyst thinks that it is most likely that the post-election plans are implemented rather than those he proposed in the campaign, as the President retains authority to impose tariffs on individual countries, while his election campaign plan requires a vote in Congress. As of now, this suggests tariffs on Mexico, Canada, and China, the U.S.’s three largest trading partners. Imposing tariffs on the largest trade flows gives him the most opportunity to use the tariff exclusion process for his personal and political benefit. It is time for Congress to reclaim the tariff-setting authority it was granted in the Constitution; the President-elect has clearly been misusing the authority Congress transferred to the Presidency under the assumption that it would be used responsibly and for the benefit of the American people.

References

Bade, G. (2024, December 6). Decoding Trump’s tariff threats. Politico. https://www.politico.com/newsletters/politico-nightly/2024/12/06/decoding-trumps-tariff-threats-00193118

Balistreri, E. J., Ali, S. B., & McDaniel, C. (2025). Tariff: the most beautiful word in the dictionary? [Unpublished Manuscript]. Yeutter Institute, University of Nebraska—Lincoln, Lincoln, Nebraska. https://balistreri.createunl.com/Papers/Beautiful_Tariffs.pdf

Belmonte, A. (2021, January 18). Trump’s massive farmer bailout failed to make up for the “self-inflicted” trade damage. Yahoo Finance. https://finance.yahoo.com/news/trump-farmer-bailout-legacy-trade-135241986.html

Bernstein, J. (2024, July 12). Tariffs as a major revenue source: Implications for distribution and growth. The White House. https://bidenwhitehouse.archives.gov/cea/written-materials/2024/07/12/tariffs-as-a-major-revenue-source-implications-for-distribution-and-growth/

Bogage, J. (2025, January 2). 10 policies Republicans could use to pay for new tax cuts. Washington Post. https://www.washingtonpost.com/business/2025/01/02/trump-budget-cuts-national-debt/

Committee for a Responsible Federal Budget. (2024, October 28). The fiscal impact of the Harris and Trump campaign plans-2024-10-28. U.S. Budget Watch 2024. https://www.crfb.org/papers/fiscal-impact-harris-and-trump-campaign-plans

DePillis, L. (2020, March 1). How Trump’s trade war is making lobbyists rich and slamming small businesses. ProPublica. https://www.propublica.org/article/how-trump-trade-war-is-making-lobbyists-rich-and-slamming-small-businesses

Everett, B., & Goba, K. (2024, November 19). Republicans leery of trying to pay for tax cuts with Trump’s tariffs | Semafor. Semafor. https://www.semafor.com/article/11/19/2024/republicans-leery-of-trying-to-pay-for-tax-cuts-with-trumps-tariffs

Fotak, V., Lee, H. S., Megginson, W. L., & Salas, J. M. (2024). The Political Economy of Tariff Exemption Grants [Unpublished manuscript]. https://jfqa.org/wp-content/uploads/2024/08/23440-Tariff-Exemptions.pdf

Hillberry, R. (2018), “The Administrations’ Trade Policy: What It May Mean for the Future!” Purdue Agricultural Economics Report. https://ag.purdue.edu/commercialag/home/paer-article/the-administrations-trade-policy-what-it-may-mean-for-the-future/

Krugman, P. (2025, January 3). Never underestimate the ignorance of the powerful. Krugman Wonks Out Substack. https://paulkrugman.substack.com/p/never-underestimate-the-ignorance

Ludema, R. D., Mayda, A. M., & Mishra, P. (2017). Information and Legislative bargaining: The political economy of U.S. tariff suspensions. The Review of Economics and Statistics, 100(2), 303–318. https://doi.org/10.1162/rest_a_00705

Rijkers, B., Baghdadi, L., & Raballand, G. (2015). Political Connections and Tariff Evasion Evidence from Tunisia. The World Bank Economic Review, 31(2), 459–482. https://doi.org/10.1093/wber/lhv061

Sequeira, S. (2016). Corruption, Trade Costs, and Gains from Tariff Liberalization: Evidence from Southern Africa. American Economic Review, 106(10), 3029–3063. https://doi.org/10.1257/aer.20150313