Purdue Crop Budget Update

November 18, 2009

PAER-2009-12

Alan Miller, Farm Business Management Specialist

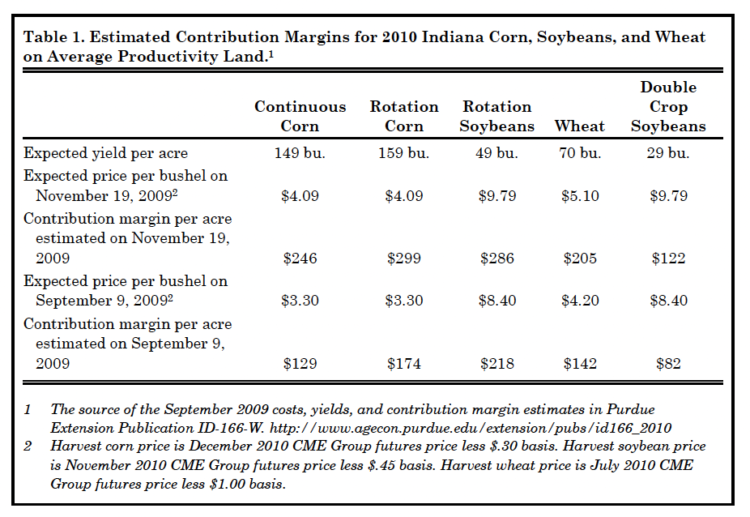

A rollercoaster ride for corn and bean prices is making estimating 2010 crop profit potential in Indiana challenging. When Purdue Ag Economists published an initial forecast for the 2010 crop year, corn and bean prices were down and profitability had gone the way of crop prices. As of the close of trading at the CME Group on November 19, 2009, fall 2010 prices for corn, and soybeans were up $.79 and $1.39 per bushel, respectively, from the crop prices used in our forecast back on September 9. Wheat prices for next summer are up too. Fortunately, input prices have been far less volatile this fall, so the cost estimates in the September 2009 forecast for the 2010 crop year are still reasonable. Table 1 summarizes the revised estimates of contribution margins for crops produced on average quality land.

Table 1. Estimated Contribution Margins for 2010 Indiana Corn, Soybeans, and Wheat on Average Productivity Land.

Even though soybean prices are up more, the contribution margin (crop returns in excess of variable crop production costs) is up the most for corn. In early September the fore‑ cast contribution margin for rotation soybeans on average productivity farmland was $44 per acre higher than for rotation corn. The market‑ place was probably trying to send a strong signal to South American soy‑ bean growers. Now the forecast indicates the contribution margin from rotation corn is $13 per acre higher than soybeans. For highly productive farm ground the contribution margin for corn now looks to be $42 per acre higher for rotation corn than rotation soybeans. For low productive ground the contribution margin only favors corn by $2 per acre.

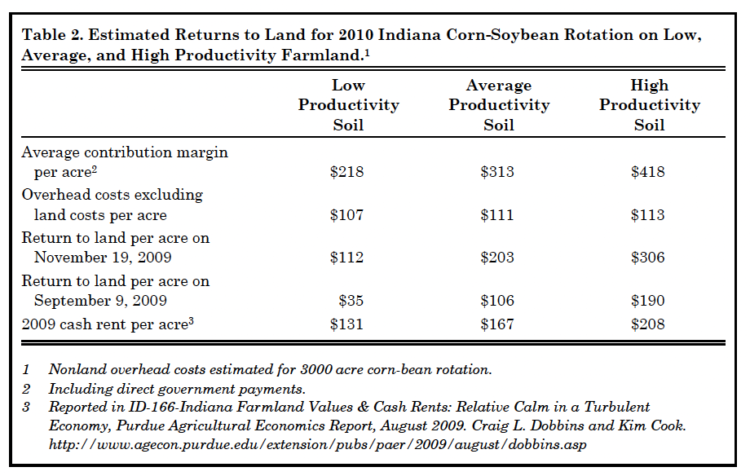

Farmers and landowners are also reviewing rental arrangements at this time of year. Purdue’s September forecast of cost and returns suggested cash rents in Indiana might be under pressure to fall in 2010 in response to very tight profit margins. The current estimates suggest that profit margins have improved enough that cash rents may no longer be under pressure to decline.

The return to land from crop farming, which is left after deducting variable crop production expenses and nonland overhead costs from crop revenues, is one indicator of what cash rent a farm tenant might be able to afford to pay for cropland in 2010. On September 9, 2009, the return to land from growing corn and soybeans in rotation was forecast at $35, $106, and $190 per acre for low, average, and high productivity farmland, respectively. As of November 19, 2009, the forecast returns to land had increased to $112, $203, and $306 per acre, respectively for low, average, and high productivity land. Table 2 compares the returns to land forecast on September 9, 2009 and November 19, 2009. The $203 per acre return to land on average ground is $36 per acre higher than the average statewide cash rent in 2009 reported in the Purdue Ag Economics report in August 2009.

Table 2. Estimated Returns to Land for 2010 Indiana Corn-Soybean Rotation on Low, Average, and High Productivity Farmland.

Ups and downs in crop prices go right to contribution margins, tenant’s profit margins, and return to land. The rollercoaster ride for prices and for profitability measures is unlikely to continue. Updating your estimates of profitability for 2010 will continue to be a necessity at least until you lock in your prices for the 2010 crop year.