Indiana Farm Incomes Drop from Record Highs

December 23, 2013

PAER-2013-16

Chris Hurt, Extension Economist

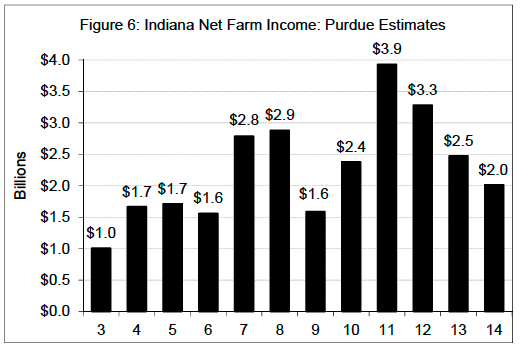

After record high incomes in 2011 and 2012, Indiana farm incomes are expected to come under downward pressure into 2014 and perhaps beyond (Figure 6).

Figure 6. Indiana Net Farm Income: Purdue Estimates

The driver of lower incomes is sharply lower crop prices and of course much fewer crop insurance payments compared to the 2012 drought year.

The impact on incomes will be different by farm type. Farm families that produce crops are expected to suffer disproportionate large drops while livestock farms will rejoice in sharply higher incomes as feed prices fall. But, for the state in total, crop receipts are more than 70% of total farm receipts, so total state farm income tends to be driven by the fortunes of crop producers.

While farm incomes are expected to come off the record highs, they are not expected to collapse back to pre-2006 levels when $2 corn provided about $1 to $1.7 billion dollars of annual income. Still $2.5 to $2.0 billion of income for 2013 and 2014 means a considerable tightening.

Crop income prospects for 2015 and 2016 may improve somewhat with some recovery in corn prices, but not to the lofty heights of recent years. For the crop sector the outlook is for market prices to be below costs of production for cash rent tenants. This signals a period of belt tightening for crop producers and thus driving costs lower is likely to become an important strategy.