Specialty Farm Households’ Consumption and Risk Behavior After Natural Disasters

April 13, 2020

PAER-2020-08

Authors: Ahmad Zia Wahdat, Ph.D. Candidate in Agricultural Economics, Michael Gunderson, Professor of Agricultural Economics, and Jayson Lusk, Distinguished Professor of Agricultural Economics

Midwestern farm producers are facing two major concerns this spring: the COVID-19 epidemic and potential flooding. As COVID-19 has pushed people into ‘social-distancing,’ followed by a decline in restaurants sales, the epidemic will more likely affect the labor-intense specialty crops than staple crops. Meanwhile, the National Weather Service (NWS) and National Centers for Environmental Prediction (NCEP) forecasts above normal precipitation for the Midwest for spring and early summer. The wet spring and summer of 2019 and 2020, along with COVID-19, could have a compounding negative effect on farm income in the Midwest. A natural question that arises is whether farm income losses have implications for farm household consumption and well-being.

Recent research by the authors was designed to study precisely these questions. A survey of Indiana specialty crop producers was conducted in the summer of 2019. The study had two main objectives. The first was to determine how a farm household changes consumption after a hypothetical income loss from a natural disaster. Secondly, the study sought to understand producers’ risk preferences and risk-taking behavior after hypothetical natural disasters.

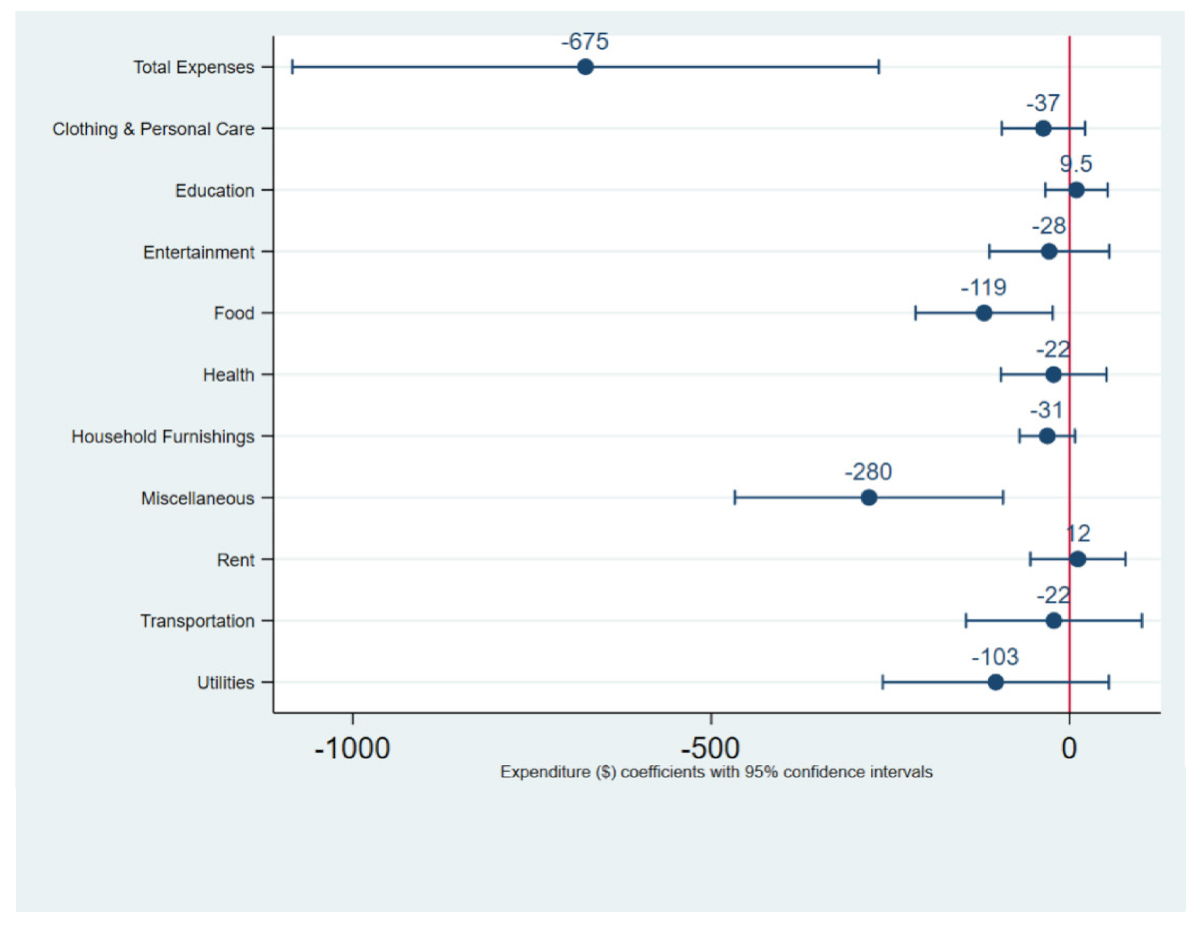

Average monthly income and expenditures for farm households was calculated for 12 months prior to the date of survey. On average, producers had a monthly income of about $5,500. Household expenditures were the highest for miscellaneous category (mortgage and retirement), followed by health, food, transportation, and utilities. Once producers were exposed to the hypothetical income shock, we found that producers facing disaster-related income losses significantly reduced their total consumption expenditures by about $675 as seen in figure 1. Particularly, producers significantly reduced their expenditures of food ($119) and miscellaneous ($280) categories. This implies that farm households who faced a significant income loss (20% to 32%) are willing to sacrifice part of their food, mortgage, and retirement expenses. Expenses as health and education were not significantly affected by the income losses. Meanwhile, producers were less willing to take financial risk after the income-loss experience.

It is unclear if the reduction in food expense occurs from lower quantity, lower quality, or a change in healthfulness of items purchased. To the extent that reduced food expenditures imply lower consumption of healthy foods, there are longer run implications for family health. Meanwhile, spending less on mortgage and retirement has implications for longer-run debt and working life. Food, mortgage, and retirement expenses can be easily adjusted when times are hard, but their impact can be real over producers’ life.

Understanding the consumption response of farm households to income loss is important for understanding farm household well-being. After a disaster, households adjust different categories of consumption because it is a way of coping with income loss. Marginally, post-disaster recovery and rehabilitation efforts can generate a higher value by targeting those consumption categories that are adjusted downwards by farm households. Meanwhile, credit institutions may need to design better credit terms for disaster-affected producers, so there is an incentive for producers to invest in their farms.