Trends in Farmland Price to Rent Ratios in Indiana

July 23, 2020

PAER-2020-10

Author: Michael Langemeier, Professor and Associate Director, Center for Commercial Agriculture

Farmland prices have declined approximately 15 percent since 2014. However, farmland prices remain substantially above historical prices. For example, farmland prices in 2020 in West Central Indiana are 63% higher than they were in 2010 and 255% higher than they were in 2000 (for current land values see Kuethe and Dobbins, in this edition of PAER). Concerns are periodically expressed by many investment analysts that farmland prices are higher than justified by the fundamentals. One justification for this concern is that previous research has established the tendency of the farmland market to over-shoot its fundamental value.

A standard measure of financial performance most commonly used for stocks is the price to earnings ratio (P/E). A high P/E ratio sometimes indicates that investors think the investment has good growth opportunities, relatively safe earnings, a low capitalization rate, or a combination of these factors. However, a high P/E ratio may also indicate that an investment is less attractive because the price has already been bid up to reflect these positive attributes.

This paper computes a ratio equivalent to P/E ratio for farmland, the farmland price to cash rent ratio (P/rent), and discusses trends in the P/rent ratio. We use land value and cash rent data for the 1960 to 2020 period for West Central Indiana to illustrate the P/ rent ratio. Data from 1975 to 2020 were obtained from the annual Purdue Land Value and Cash Rent Survey. For 1960 to 1974, the 1975 Purdue survey numbers were indexed backwards using the percentage change in USDA farmland value and cash rent data for the state of Indiana.

Price to Rent Ratio

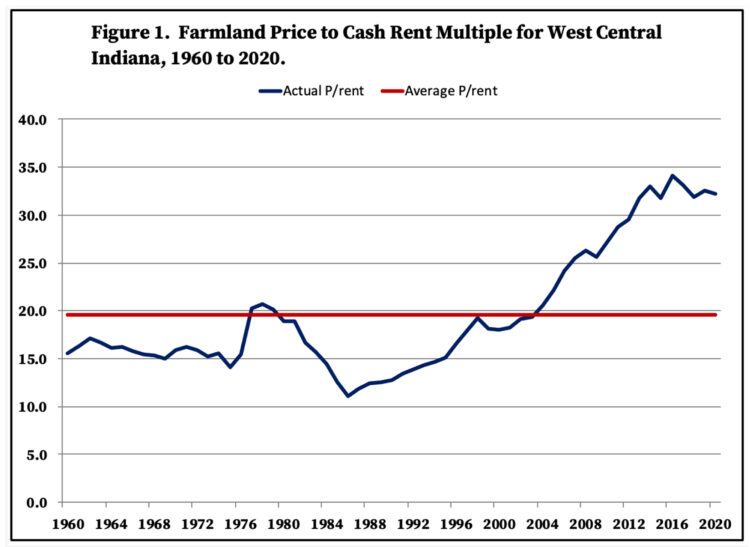

The P/rent ratio for West Central Indiana has an average value of 19.6 over the 60-year period from 1960 to 2020, with a high of 34.1 reached 2016 and a low of 11.1 in 1986, which was perhaps the bottom of the valley after the price bubble of the 1970s and very early 1980s (Figure 1). At the peak of this bubble, the P/rent ratio reached a high of just over 20 from 1977 through 1979. The P/rent ratio subsequently dropped to the teens in the early 1980s, and reached its low in 1986. The rise from around 15 in 1976 into the 20s and down to 11.1 in 1986 corresponds exactly to what is viewed as the bubble in farmland prices that was followed by one of the more difficult periods for agriculture in the early-to-mid 1980s. The current value of 32.2 relative to the historic average of 19.6 and previous high around 20 at least raises concerns that current farmland prices could be overvalued in relationship to returns.

Over the 60-year period from 1960 to 2020, the P/E ratio for stocks is 19.1, which is similar to the average P/rent ratio. The P/E and P/rent ratios do not necessarily track one another. The average correlation coefficient between these two measures is only 0.25. Though not the topic of this paper, diversification potential between the stock market and farmland is relatively high.

Cyclically Adjusted P/Rent

Shiller (2005; 2014) uses a 10-year moving average for earnings in the P/E ratio, often labeled either P/E10 or cyclically adjusted P/E (CAPE), to remove the effect of the economic cycle on the P/E ratio. When earnings collapse in recessions, stock prices often do not fall as much as earnings, and the P/E ratios based on the low current earnings sometimes become very large (e.g., in 2009). Similarly, in good economic times P/E ratios can fall and stocks look cheap, simply because the very high current earnings are not expected to last, so stock prices do not increase as much as earnings. By using a 10-year moving average of earnings in the denominator of the P/E ratio, Shiller has smoothed out the business cycle by deflating both earnings and prices to remove the effects of inflation. Shiller also uses the P/E10 to gain insight into future rates of return. That is, if an investor buys an asset when its P/E10 is high, do subsequent returns from that investment turn out to be low, and vice versa?

The P/rent ratios reported thus far are the current year’s farmland price divided by current year cash rent. Here we model our P/rent10 after Shiller’s cyclically adjusted P/E ratio. Cash rent and farmland prices are deflated, and then 10-year moving averages of real cash rent are calculated. The P/rent10 ratio is computed by dividing the real farmland price by the 10-year moving average real cash rent. A similar computation is done for 10-year owner-operator returns (P/OO-10).

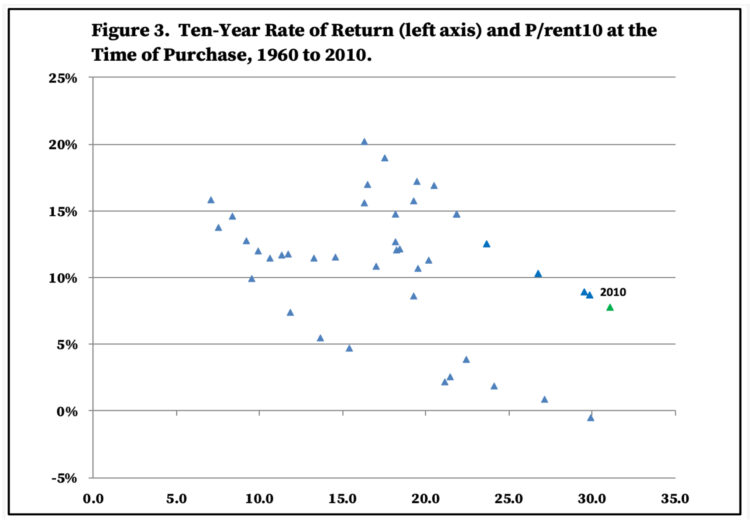

Figure 2 shows all three of these ratios: P/rent10; P/ OO-10, and Schiller’s P/E10. The P/OO-10 fell through the first half of the 1970s when real returns grew faster than land values, increased from around 20 in the mid 1970’s to 28.2 in 1977, and then fell to 6.8 in 1987. The P/OO-10 then increased steadily until it reached a peak of 75.2 in 2015. The P/OO-10 ratio has ranged from 35.4 to 69.5 since 2015. Since 2014, the P/00-10 ratio has remained above the P/rent10 ratio, indicating that cash rents have been higher than owner-operator returns. In the long-run, you would expect the two ratios to be similar. In fact, the average P/rent10 and P/OO-10 ratios for the 1960 to 2020 were 21.8 and 21.7, respectively. For the ratios to equilibrate, either cash rents will need to decrease, owner-operator returns will need to increase, or a combination of the two will need to occur. Typically, cash rents adjust slowly to changes in owner-operator returns.

Figure 2. Ten-Year Moving Average of Cyclically Adjusted P/rent, P/OO, and P/E Ratios, 1960 to 2020.

The P/rent10 ratio reached a peak in 2013 at 47.5. Since then, the ratio has steadily declined reaching levels of 30.2 and 30.6 in 2019 and 2020, respectively. However, the P/rent10 ratio in 2020 is still relatively high compared to the long-run average (using 1960 to 2020 data) of 21.8. Does the current P/rent10 ratio signify a bubble or is something else going on? We contend that one of the primary reasons for the relatively higher P/rent10 ratio experienced in recent years are the relatively low interest ratios. The long- run average interest rate on 10-year treasuries is approximately 6.0 percent. In contrast, the rate since 2010 has averaged only 2.3 percent.

Buy at a High Ratio: Get a Low Future Return?

Shiller also discusses the relationship between the P/E10 ratio and the annualized rate of return from holding S&P 500 stocks for long periods. In general, his results show that the higher the P/E10 ratio at the time of purchase, the lower the resulting multiple year returns, like for the next 10 or 20 years. The West Central Indiana farmland and cash rent data from 1960 to 2020 are used to compute 10 and 20 year annualized rates of return. Returns are the sum of the average of cash rent as a fraction of the farmland price each year, plus the annualized price appreciation over the holding period.

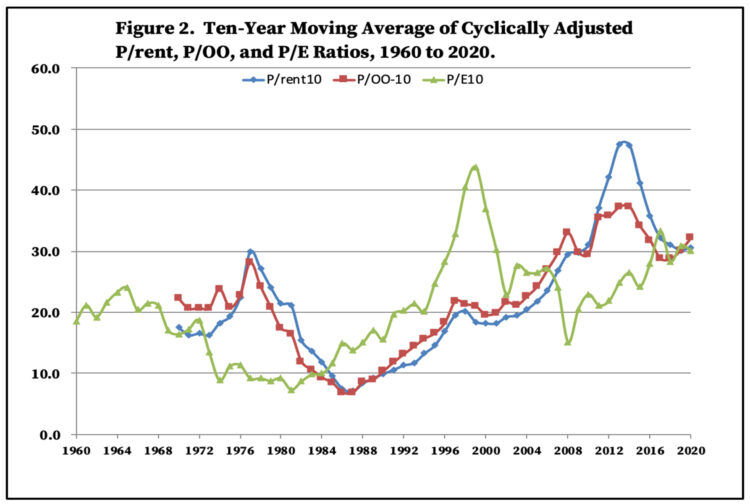

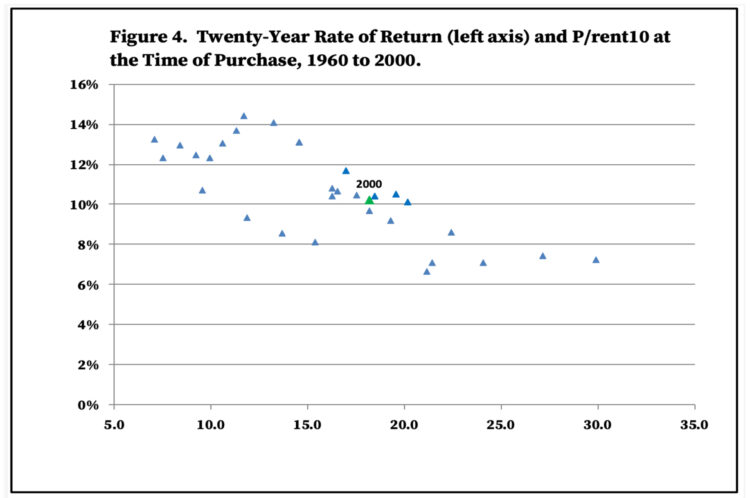

The results for farmland show a negative relationship similar to that exhibited in Shiller’s stock data. The 10-year holding period returns for farmland show a strong negative relationship (Figure 3). That is, if one purchased farmland when the P/rent10 ratio was very high, like now, they tended to have a low 10- year rate of return. Alternatively, if one purchased farmland when the P/rent10 was intermediate or low, they tended to have moderate to high 10-year returns. The 10-year returns ranged from a small negative to 20%. The 20-year holding period returns also exhibit a strong negative relationship with the P/rent10 ratio (Figure 4). The 20-year holding returns range from 6 to 14%.

Figure 4. Twenty-Year Rate of Return (left axis) and P/rent10 at the Time of Purchase, 1960 to 2000.

The P/rent10 levels in 2011 through 2016 were above 35, which is literally off the chart (horizontal axis of Figure 3). The high P/rent10 ratio in 2011-2016 could be partially explained if market participants are expecting owner-operator returns to increase and the cost of capital to remain relatively low for the foreseeable future. It is important to note that the 10-year rate of return for land purchased in 2010 is much higher than the ten-year rate of return for land purchased in 1977, despite the fact that the two P/rent10 ratios for these two periods are similar.

The 20-year rate of return for land purchased in 2000 is 10.2 percent, which is in the middle of the range of 20-year rates of return illustrated in figure 4. It will be interesting to see if the 20-year rate of return declines as the P/rent10 ratio increases in the next few years. For land purchased in 2000 the P/rent10 is 18.2. In the next five years, this rate will increase to approximately 22, and then increase dramatically for land purchased in 2006 on.

Final Comments

Our analysis indicates that the P/rent ratio (price per acre divided by cash rent per acre) is substantially higher than historical values, and that this ratio is also high relative to the comparable P/E ratio on stocks as measured by the S&P 500. In order to maintain the current high farmland values, cash rents would have to remain relatively high, and interest rates would also have to remain very low. Most agricultural economists expect crop returns to remain at current levels, putting downward pressure on cash rents, and for interest rates to remain similar to current levels in coming years.

Furthermore, we demonstrated that farmland values have tended to have a cyclical component in which farmland values move too high relative to the underlying fundamentals and then over time move too low relative to fundamentals. We use a cyclically adjusted P/rent ratio to show that a very high P/rent ratio, as we have now, tends to be associated with low subsequent returns. Simply stated this means that the historical relationships show that those who bought farmland when the P/rent ratio was high tended to have low subsequent returns. On the other hand, those who bought farmland when the P/rent ratio was intermediate or low, tended to have intermediate or high subsequent returns. The current record high P/rent ratio could be a warning to current farmland buyers that their odds of favorable returns on these purchases may be low.

Our reading from examining 60 years of history is that current farmland values are elevated in relationship to the underlying economic fundamentals. If we are correct, this means that those purchasing farmland at current prices may experience “buyer’s remorse” in coming years. But having said this, there remain some possible situations in which farmland values could be maintained or even increase. Positive influences on land include low interest rates, the relatively small percent of land currently on the market, the attractiveness of farmland to pension fund managers, and the fact that land is a good hedge against inflation.

References

Kuethe, T. H. and C.L. Dobbins. 2020. “Indiana Farmland Values Increase but Signal Concern of Potential COVID-19 Slump.” Purdue Agricultural Economics Report, Purdue University, August 2020, pages 1-8.

Shiller, R.J. 2005. Irrational Exuberance, Second Edition. New York: Crown Business.

Shiller, R.J. 2014. S&P 500 P/E Ratio. www.multpl. com, accessed July 29, 2015.