Indiana Manufacturers Employment and Trading: Insights from a Survey

March 13, 2002

PAER-2002-1

Michael Wilcox, Graduate Assistant and Kevin McNamara, Professor

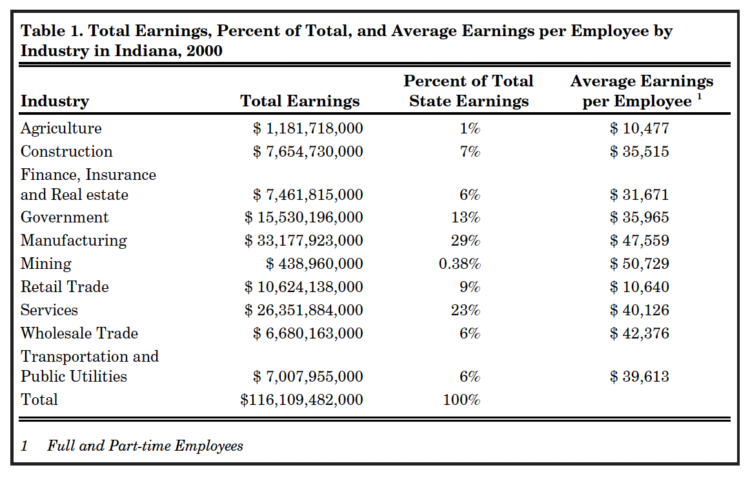

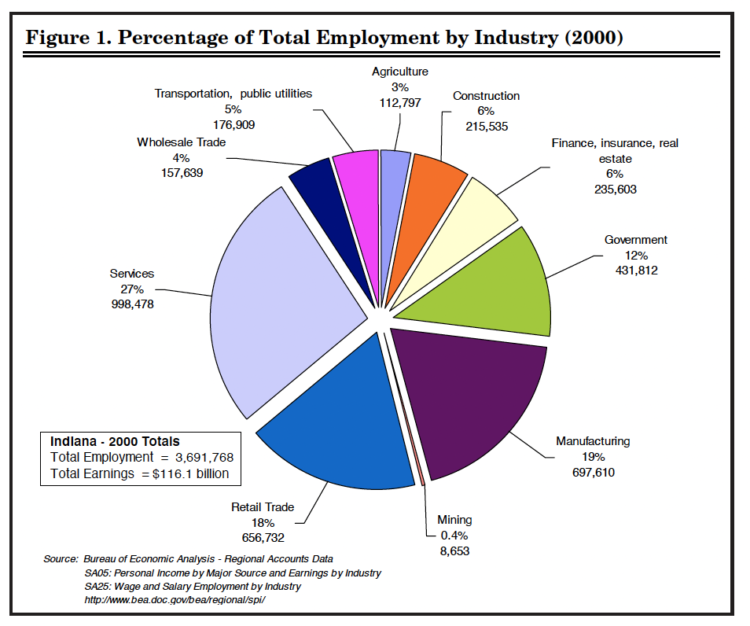

Indiana manufacturing accounted for $56.3 billion, or 31%, of Indiana’s $182 billion gross state product in 1999 (Bureau of Economic Analysis, 2000). Manufacturing wage and salary payments were $33.2 billion in 2000, 35% of Indiana’s $116 billion earnings by place of work (Table 1). The sector’s $47,559 average annual wage was second to that of mining. Manufacturing’s 697,610 jobs (Figure 1) were 19% of the 3.9 million jobs in Indiana (Bureau of Economic Analysis, 2000).

Table 1. Total Earnings, Percent of Total, and Average Earnings per Employee by Industry in Indiana, 2000

While Indiana manufacturing employment has suffered with the current economic downturn, intensified by the terrorism against the United States, it remains a driving force in the Indiana economy. Sustaining manufacturing competitiveness is seen as critical for continued economic prosperity (Indiana Economic Development Council, Indiana Technology Partnership). As part of an effort to understand Indiana’s manufacturing sector, Purdue University’s Department of Agricultural Economics, in cooperation with the Indiana Manufacturers Association and the Indiana Economic Development Council, conducted a survey of a random sample of Indiana’s 8,500 manufacturing establishments with more than 5 employees in the fall of 2001 to assess competitiveness and operational issues of Indiana manufacturing. This article reports information from the study.

Figure 1. Percentage of Total Employment by Industry (2000)

Participating Firms

Forty percent of manufacturers surveyed described themselves as single establishment corporations based in Indiana. Eighteen percent were branch plants of U.S., outside of Indiana, corporations. Sole proprietorships and Indiana corporate headquarters each comprised 10% of the sample. Partnerships (7%) and branch plants of larger corporations (5%) based in Indiana accounted for 12% of all firms. Foreign-based branch plants (4%) accounted for most of the remaining sample. Sixty-seven percent of the firms surveyed were located in urban areas.

Survey respondents represented the diversity of Indiana manufacturing. Firms in the food, chemicals, transportation equipment, and rubber/plastic sectors each accounted for 8% of total respondents. Wood/paper industries represented 11%, metal product manufacturers 17%, and electronics/machinery 19%. The remaining respondents (22%) were from stone, clay, glass, and concrete products; apparel and textile mill products; petroleum refining, leather products; non-wood furniture products; printing/publishing; and miscellaneous manufacturing.

The average number of employees per surveyed firm was 87. Seventy percent of the firms had 80 or fewer employees. Fifty-six percent had fewer than 40 employees. This compares to 75% employing 49 workers or fewer for all Indiana manufacturing firms in 1997 (U.S. Census Bureau, 1997). Firms were grouped by employment size to compare sales, market, and employment issues.

Sales and Employment Performance Firm financial performance was assessed by sales and employment in year 2000 and by average change since 1997. The average sales level per respondents was $25.7 million. A majority of firms (65%) had sales less than $10.5 million.

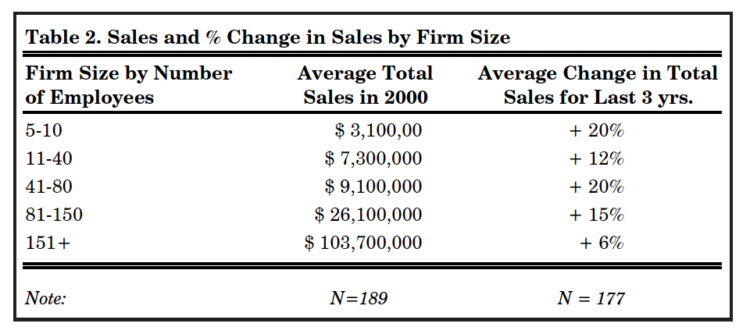

Firms were grouped by employment size to examine sales and employment performance. Firms with 80 employees or fewer had average sales of $6.3 million. Firms with more than 80 employees had average sales of $68 million. Average sales ranged from $3,100,000 for smaller firms to$103,700,000 for firms with more than 150 employees (Table 2).

On average, respondents experienced a 14% increase in sales from 1997 to 2000. Larger firms tended to have lower sales growth rates (Table 2). Average sales growth rates were higher for smaller employment groups, although rates varied widely. For example, sales growth for smaller firms ranged from a decrease of 75%to an increase of 300%.

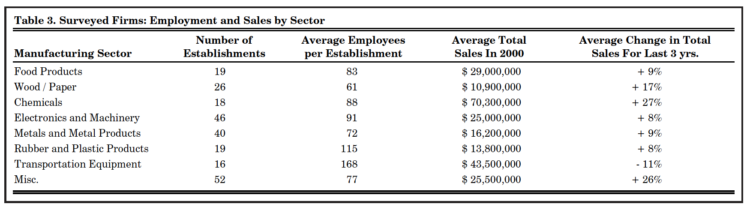

Grouping sample firms by industry, chemical firms had the highest average, with total sales of $70.3 million (Table 3). Wood/paper industry firms and rubber/plastic products firms had the lowest average sales, with $10.9 million and$13.8 million, respectively. Chemicals firms and firms in the miscellaneous group had the highest sales growth, with an average increase in sales of 27%. Transportation equipment, the group with the highest average employment, was the only group that reported negative average sales growth, an average decline of 11%, from 1997 to 2000.

Table 2. Sales and % Change in Sales by Firm Size

Table 3. Surveyed Firms: Employment and Sales by Sector

Where Do Indiana Manufacturers Do Business?

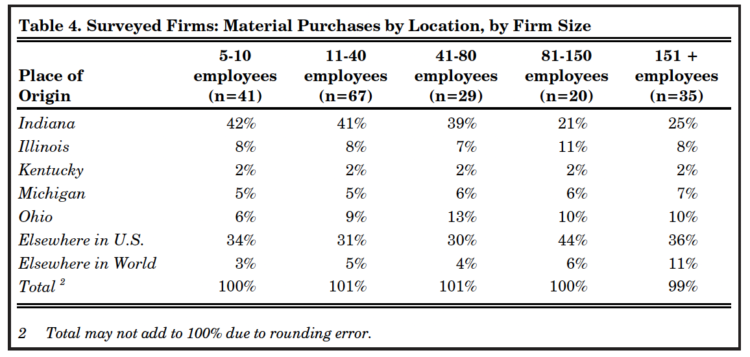

Survey participants identified where they purchase production inputs and where they sold their final outputs (Table 4). Indiana firms purchased inputs nationally and internationally, although suppliers in Indiana and adjacent states were the primary suppliers. Indiana manufacturers purchased about 60% of their supplies from suppliers in Indiana and bordering states. Indiana, Illinois, Michigan, and Ohio each have strong, diversified manufacturing sectors. Manufacturing firms’ ability to create strong backward linkages to this base is one of the strengths of the region as a location for manufacturing activity. Firms in these states are important suppliers to Indiana manufacturing. Manufacturers reported purchasing about one third of their supplies from other U.S. locations and 5% from outside the U.S.

While firms purchased more than half their inputs within the region, they also purchased elsewhere in the U.S. and internationally, especially larger firms. Globalization is increasing competition from developing countries like China as well as European countries. This restructuring will undoubtedly open international supply sources to Indiana manufacturers. Maintaining backward linkages to the region will be one of the keys to sustaining a strong regional economy.

Table 4. Surveyed Firms: Material Purchases by Location, by Firm Size

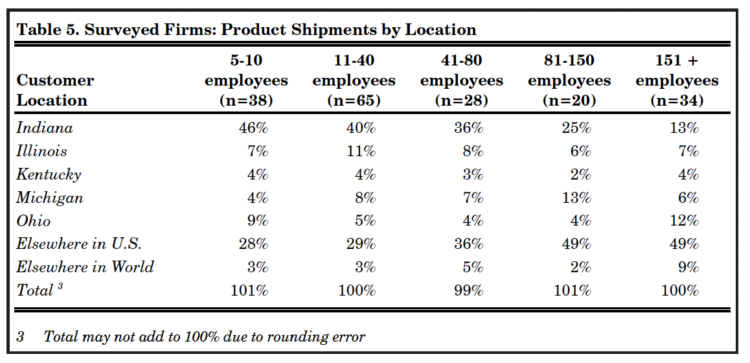

Table 5. Surveyed Firms: Product Shipments by Location

Customers in Indiana and adjacent states are the primary market for Indiana manufacturers (Table 5). More than half of all surveyed firms’ manufacturing output went to customers in Indiana and adjacent states. On average, larger firms sold more products out of the region. The largest firms appear to have a stronger hold in international markets, although firms of all sizes appear to ship internationally.

Shipments by Indiana manufacturers to customers in Indiana and adjacent states reflect the industry’s strong forward linkages. Much of what is produced by Indiana manufacturers is used in the production processes of other regional manufacturers. These linkages within the region sustain its manufacturing base.

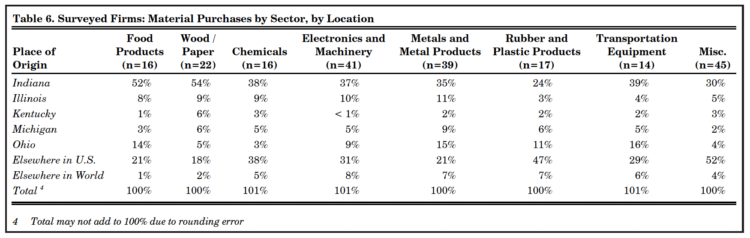

Table 6. Surveyed Firms: Material Purchases by Sector, by Location

On average, firms in sector groups purchase the largest share of their inputs from suppliers in Indiana and adjacent states (Table 6). Food products and wood/paper industry firms have the strongest links to in-state suppliers, a reflection of the availability of agricultural and forestry commodities in the state and the perishable nature of those commodities.

While the region is the largest source of supplies for firms in all sectors, national and international markets also are important input sources, especially for chemical and rubber/plastics firms. International markets supply firms in all industry sectors to some degree. Globalization may increase international supply levels as differential wage rates and other costs make foreign suppliers more competitive and quality concerns lessen.

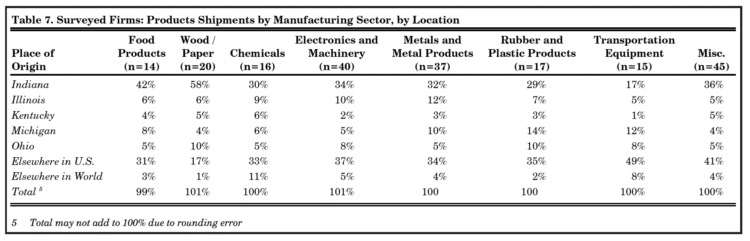

Table 7. Surveyed Firms: Products Shipments by Manufacturing Sector, by Location

On average, the primary product market for Indiana firms is in Indiana and adjacent states, except transportation equipment firms (Table 7). Food and wood/paper product firms have the closest ties to the region. Chemical firms and transportation equipment firms have the largest presence in international markets, with about 10% of shipments. Most production, however, is for the domestic market.

Indiana manufacturers have strong backward and forward linkages to the Midwest region. Firms in Illinois, Michigan, and Ohio, neighboring states with large populations and strong manufacturing economies, are important sourcing and marketing locations for Indiana manufacturers. Kentucky, the neighboring state with the smallest manufacturing base, had the lowest level of factor and product market links to Indiana firms. While international markets have become increasingly important in the globalized economy, the firms surveyed, in general, have the closest links to the regional economy. However, increasing competitiveness from offshore manufacturers is pressuring manufacturers throughout the state to consider low-cost, foreign-produced inputs as quality differences between domestic and foreign produced inputs disappear. Process improvement, service, and timeliness are important keys to maintaining the competitiveness Indiana firms.

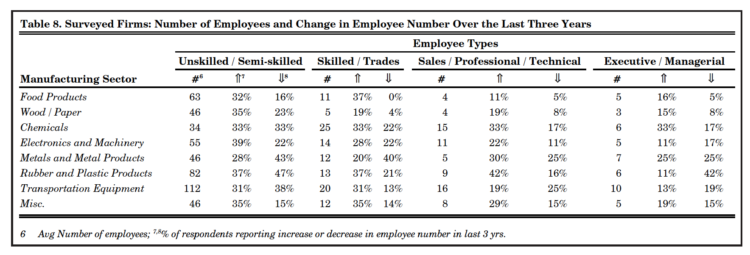

Indiana’s Manufacturing Workforce Survey respondents answered several questions relating to the number and types of their employees, changes in number of employees over the last three years, and difficulties related to hiring and human resources (Table 8).

Table 8. Surveyed Firms: Number of Employees and Change in Employee Number Over the Last Three Years

The Indiana manufacturing economy continued to grow through 2000. About 34% of survey participants reported increased unskilled and semi-skilled employment for 1997-2000. The share of firms reporting employment cuts for unskilled/semi-skilled workers ranged from 15% to 47% by industry group. In line with the economic slowdown in 2000-2001, metal/metal products, rubber/plastic, and transportation equipment groups had the largest share of firms reporting employment cuts. Data from the Indiana Department of Workforce Development indicate employment cuts have spread across all manufacturing sectors since September 11th.

The employment data reported by surveyed firms suggest that skilled/trades and sales/professional/technical employment growth tended to be strong across all industry sectors, even those where firms were decreasing unskilled/semi-skilled and executive/managerial employment. Food products firms and wood/paper firms, sectors with strong backward and forward linkages to the region, had growth in all employment types, as did the chemical sector.

Indiana employment markets throughout the 1990s favored job seekers as the reported employment growth bares this out. It appears, however, that there has been a hiring slowdown in unskilled/semi-skilled employment, especially in the metals/metal products, rubber/plastic products, and transportation equipment groups. Availability of people to hire for these jobs has been a problem across Indiana for much of the 1990s.

Hiring new employees for all types of jobs has been a chronic problem in the Indiana economy in recent years. About 68% of all firms surveyed experienced difficulty hiring new employees the past 3 years and/or in some aspect of human resource management. Hiring difficulties were reported by a majority of firms across all sectors in all regions of the state, especially for unskilled and semi-skilled workers. Firms also indicated that the sales/professional, and technical worker markets were tight. Other hiring problems included lack executive and managerial candidates in local labor markets, a low skill base, and difficulty attracting persons from outside of the local labor market.

Among human resource management issues, firms reported high unskilled and semi-skilled worker turnover, especially among metals and metal products firms. Firms also reported difficulties retaining skilled/trade employees. Absenteeism, especially among unskilled and semi-skilled workers, was a serious concern, and it appears to be increasing.

Summary and Concluding Comments

The Indiana manufacturing sector is a large, important component of the state economy, with strong backward and forward linkages to the region’s economy. Sales and employment growth among manufacturing firms in through the 1990s demonstrate the sector’s competitiveness. The data reported in this paper raise two issues about the sector’s future.

One, Indiana manufacturing has strong traditional links to industry in the Midwest. While Indiana firms need to participate and be competitive in the global economy, programs to maintain and promote backward and forward linkages to the Midwest economy should be considered as key to sustaining and expanding the state’s manufacturing sector.

Two, workforce development continues to be an issue that plagues the Indiana economy. The state needs to be proactive in all aspects of education, from primary and secondary schooling through vocational and university education, to assure a well-educated, skilled, flexible workforce to meet current and future needs of the Indiana economy. Firms also suggest that retraining and work place training programs are needed to help manufacturers maintain and improve the skill base of current employees. As information technology becomes more integrated into manufacturing, the educational and skill level of the workforce will become increasingly important. Increasing price pressure from manufacturers in China and other developing counties is forcing Indiana manufacturers to become more efficient, increasing the importance of a skilled, flexible workforce. Human capital development—the knowledge and skill base of the workforce—is critical to sustaining and growing Indiana manufacturing industries.