2020 Indiana Pastureland, Hay Ground, and On-Farm Grain Storage Rent

July 23, 2020

PAER-2020-09

Author: Craig Dobbins, Professor

Estimates for the current rental value of pastureland, hay ground, irrigated land, and on-farm grain storage in Indiana are often difficult to locate. For the past several years, questions about these items have been included in the Purdue Farmland Value Survey. These tables report the values from the June 2020 survey.

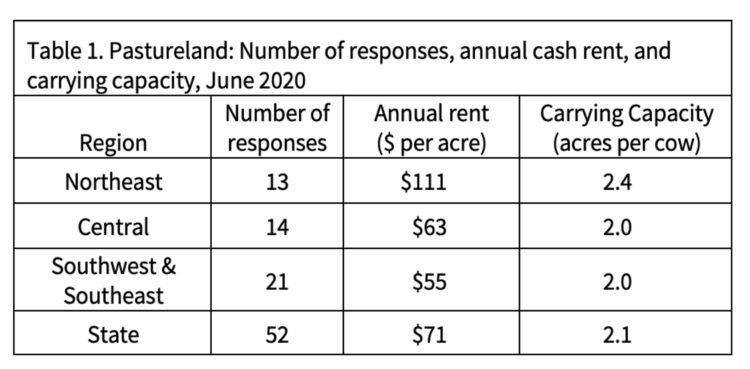

Table 1 reports averages and the number of responses for pasture rent. The number of acres required to support a cow, animal unit, is also presented.

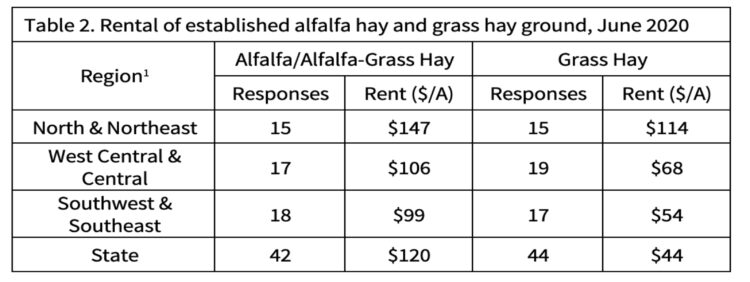

Table 2 reports the average per acre rental rates and the number of responses for established alfalfa/grass hay and grass hay.

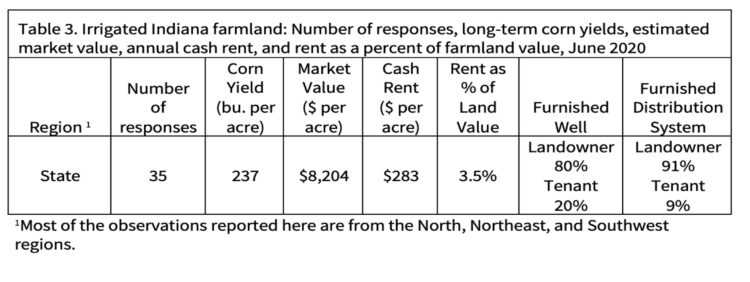

Table 3 provides information about the value and rental rate for irrigated farmland. These rates are for the associated with the production of corn and soy- beans. When producing specialty crops such as seed corn or tomatoes, rent is frequently higher.

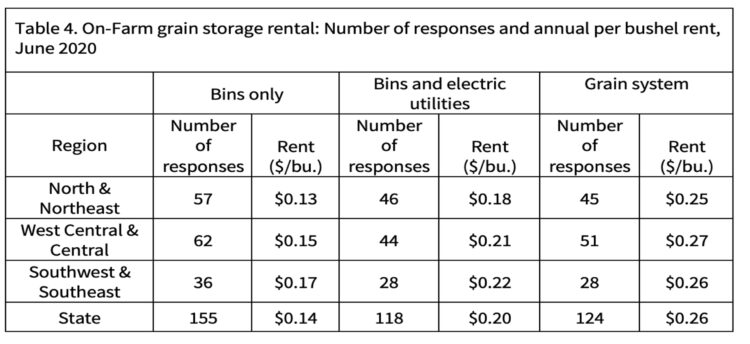

Table 4 provides information about on-farm grain storage rental rates. The rental rate for grain bins includes the situation where there the bin is rented and the person renting the bin pays utility expense, where the bin is rented and the bin owner pays the utility bills, where the producer rents a system that includes dryer, leg, and bins. These rates are annual rates.

The first year for reporting this information was 2006. Past reports are in the Purdue Agricultural Economics Report Archive, https://purdue.ag/paer. This information Is typically found in the August issue of the specified year. However, 2016 results for are in the February 2017 issue and the 2017 results are in the April 2018 issue.