2021 Indiana Pastureland, Hay Ground, and On-Farm Grain Storage Rent

July 26, 2021

PAER-2021-10

Author: Todd H. Kuethe, Associate Professor and Schrader Endowed Chair in Farmland Economics

Estimates for the current rental value of pastureland, hay ground, irrigated land, and on-farm grain storage in Indiana are often difficult to locate. For the past several years, questions about these items have been included in the Purdue Land Values and Cash Rent Survey. These tables report the values from the June 2021 survey.

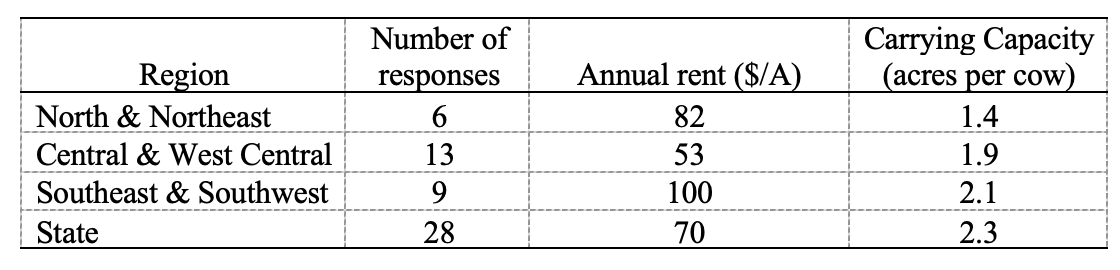

Table 1 reports averages and the number of responses for pasture rent. The number of acres required to support a cow, animal unit, is also presented.

Table 1: Pastureland: Number of responses, annual cash rent, and carrying capacity, June 2021

Table 1: Pastureland: Number of responses, annual cash rent, and carrying capacity, June 2021

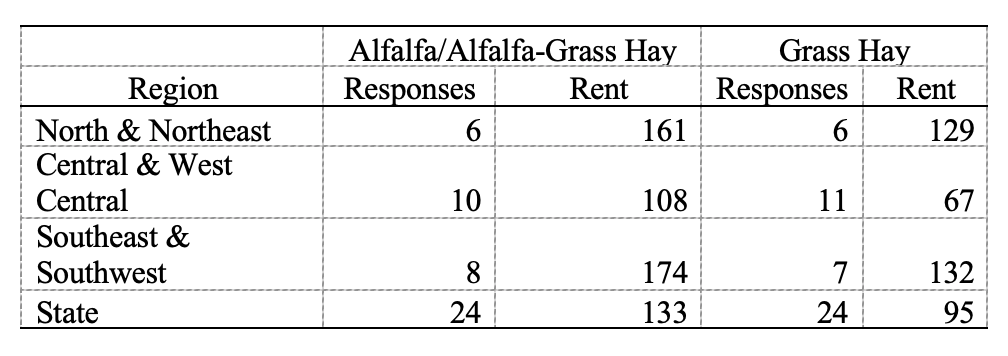

Table 2 reports the average per acre rental rates and the number of responses for established alfalfa/grass hay and grass hay.

Table 2: Rental of established alfalfa hay and grass hay ground, June 2021

Table 2: Rental of established alfalfa hay and grass hay ground, June 2021

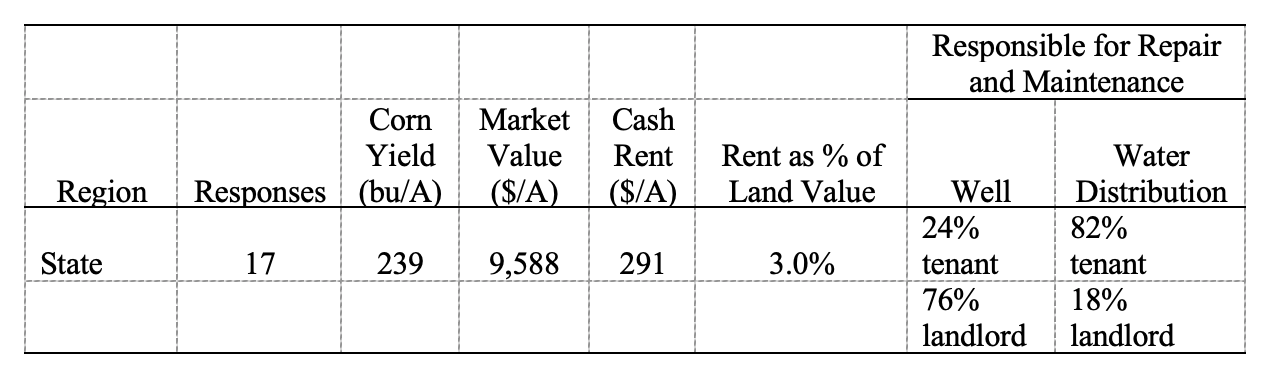

Table 3 provides information about the value and rental rate for irrigated farmland. These rates are associated with the production of corn and soybeans. When producing specialty crops, such as see corn or tomatoes, rent is frequently higher.

Table 3: Irrigated Indiana farmland: Number of responses, long-term corn yields, estimated market value, annual cash rent, and rent as a percent of farmland value, June 2021

Table 3: Irrigated Indiana farmland: Number of responses, long-term corn yields, estimated market value, annual cash rent, and rent as a percent of farmland value, June 2021

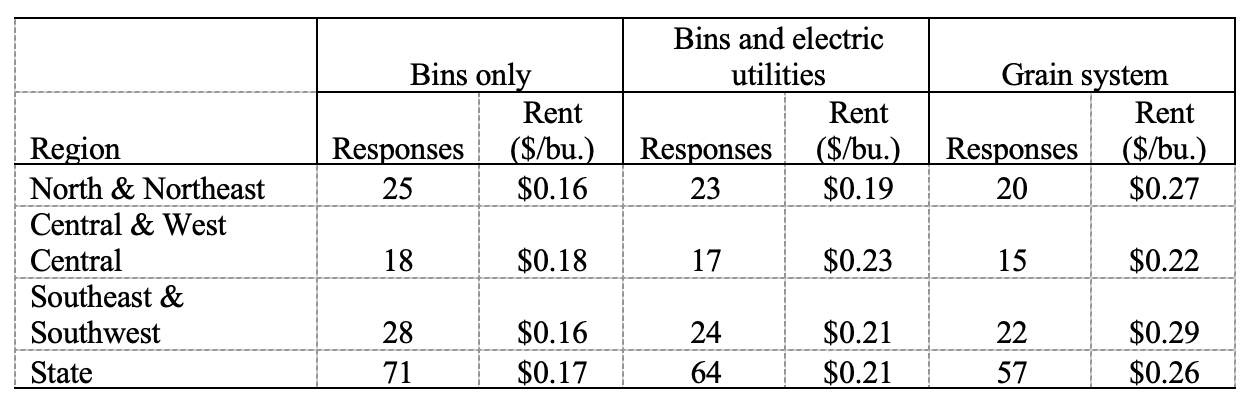

Table 4 provides information about on-farm grain storage rental rates. The rental rate for grain bins includes the situation where the bin is rented and the person renting the bin pays utility expenses, where the bin is rented and the bin owner pays the utility bills, and where the producer rents a system that includes dryer, legs, and bins. These rates are annual rates.

Table 4: On-Farm grain storage rental: Number of responses and annual per bushel rent, June 2021

Table 4: On-Farm grain storage rental: Number of responses and annual per bushel rent, June 2021

The first year for reporting this information was 2006. Past reports are in the Purdue Agricultural Economics Report archive: https://purdue.ag/paer_archive.