2025 Agricultural Credit Outlook

January 31, 2025

PAER-2025-06

Authors: Joshua Strine, PhD Student; Todd Kuethe, Professor of Agricultural Economics and Schrader Chair in Farmland Economics

Despite lower interest rates, agricultural credit market conditions weakened in 2024, suggesting a pessimistic outlook for 2025. The Federal Reserve’s Federal Open Market Committee (FOMC), comprised of members of the Board of Governors and Federal Reserve Bank presidents, lowered the target range of the federal funds rate[1] three times in 2024, following 11 increases over the two prior years.

As shown in Figure 1, 68 counties in northern and central Indiana are part of the Federal Reserve Bank of Chicago region, and the remaining 24 counties in southern Indiana are part of the Federal Reserve Bank of St. Louis. It is important to note that both Federal Reserve regions cover large areas with diverse agricultural sectors. Thus, local conditions may deviate from broad, regional trends. At the time of writing, agricultural credit market information for the St. Louis Federal Reserve district was available through the third quarter of 2024 through the Federal Reserve Bank of Kansas City’s Agricultural Finance Updates and for the Chicago Federal Reserve district through the third quarter of 2024 through the bank’s AgLetter publication.

Figure 1. Chicago and St. Louis Federal Reserve Districts

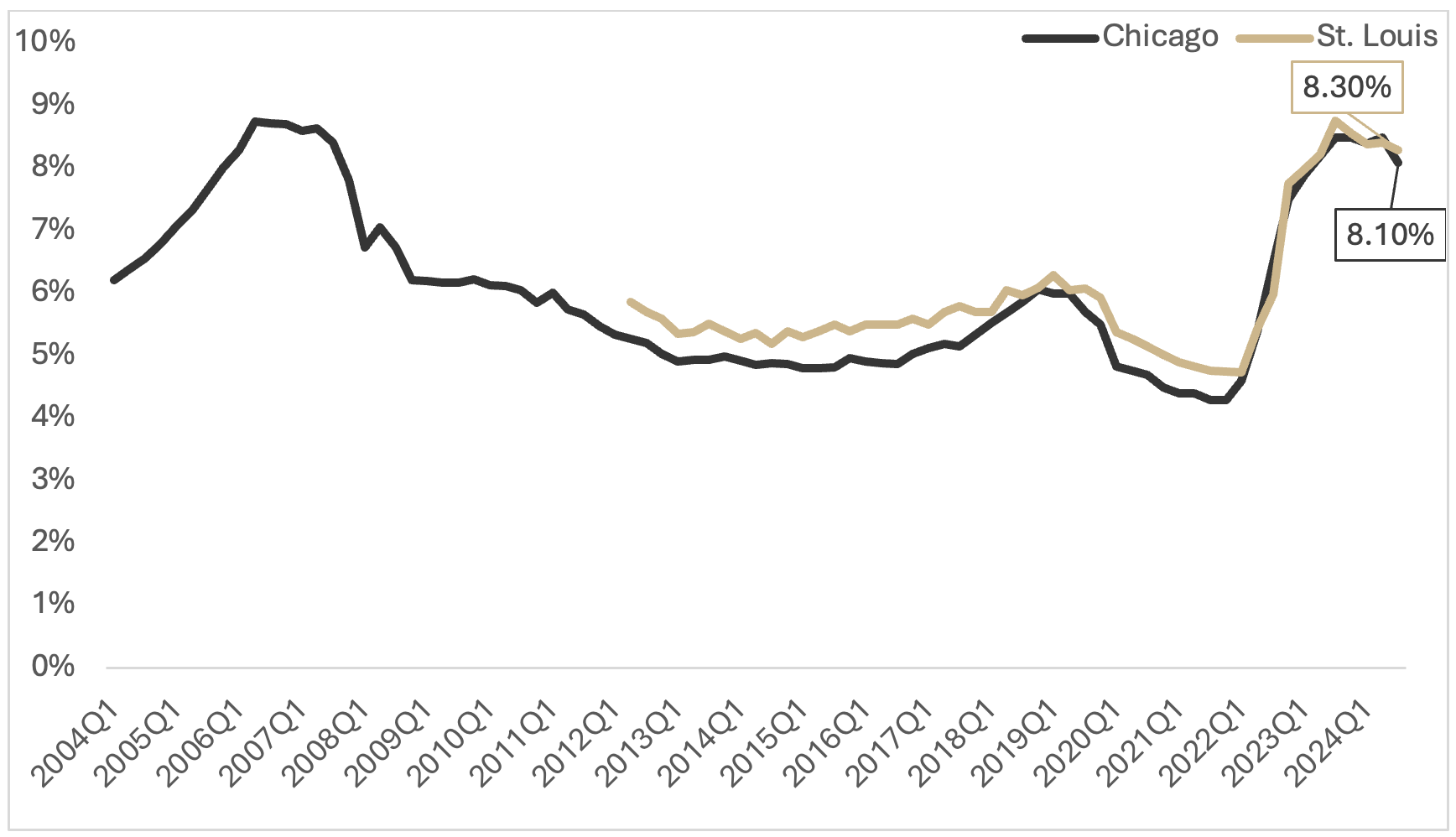

Figure 2 plots the average interest rate on farm operating loans, those primarily used to finance current crop production expenses and the care and feeding of livestock (including poultry). From the fourth quarter of 2023 to the third quarter of 2024, operating loan rates fell from 8.5% to 8.1% in the Chicago Fed District and from 8.56% to 8.3% in the St. Louis District. These decreases end a trend of increasing operating loan interest rates that had persisted since 2021 when interest rates were as low as 4.30% in the Chicago Fed district and 4.75% in the St. Louis Fed district. While the decreasing rate is a welcome sight for borrowers, operating loan interest rates have remained at levels unseen since 2007.

Figure 2. Average Fixed Interest Rate on Operating Loans, 2004Q1-2024Q3

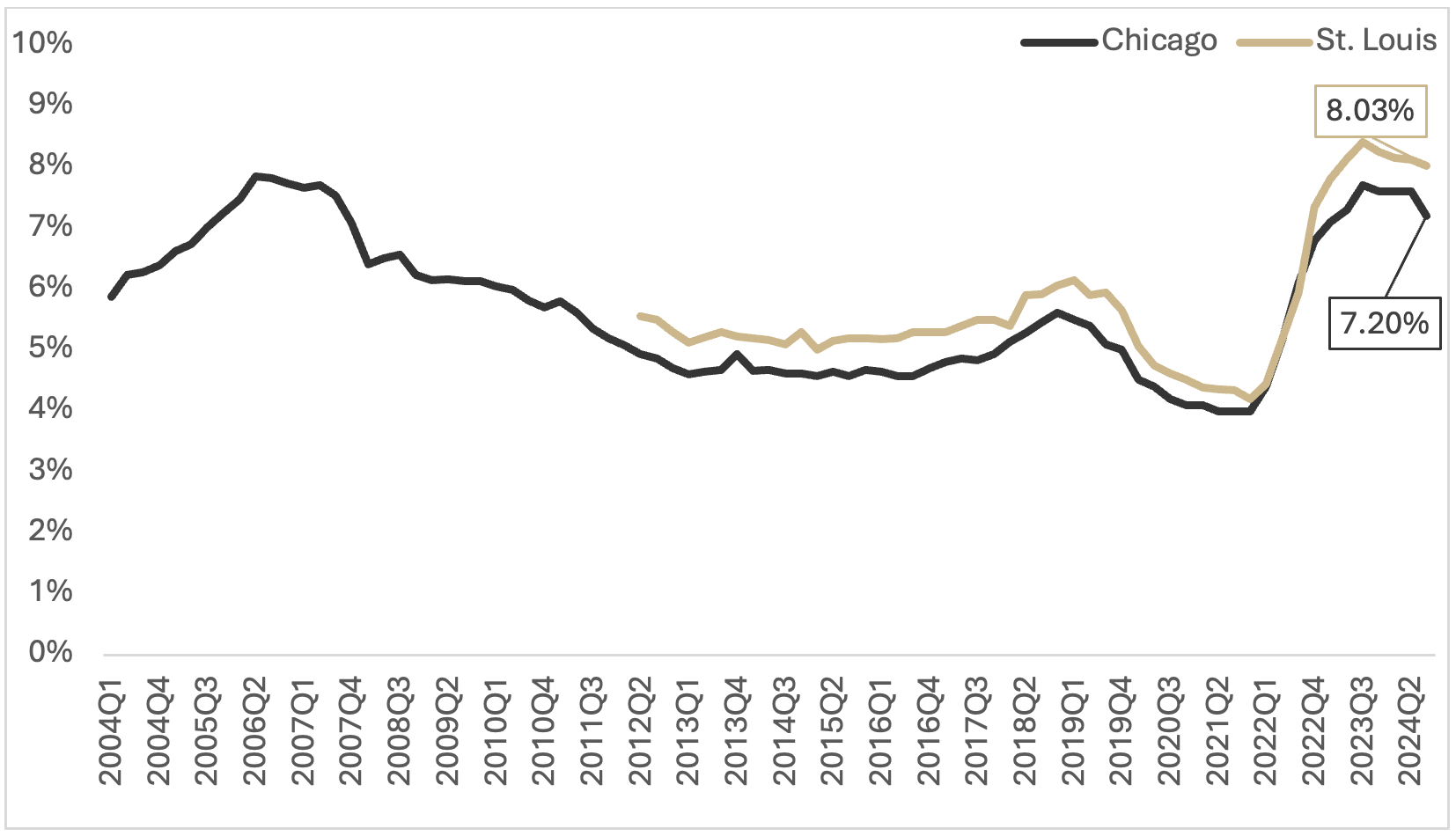

The interest rates on long-term farm real estate loans also decreased in 2024, but the changes were less pronounced. As shown in Figure 3, farm real estate loan rates fell from 7.6% to 7.2% in the Chicago Fed District and from 8.25% to 8.03% in the St. Louis Fed District. Similar to operating loan rates, the decreases in farm real estate loan rates end a trend of increasing real-estate interest rates that have persisted since 2020 in both Federal Reserve districts, and interest rates remain at the highest levels observed since 2007.

Figure 3. Average Fixed Interest Rate on Long Term Farm Real Estate Loans, 2004Q1-2024Q3

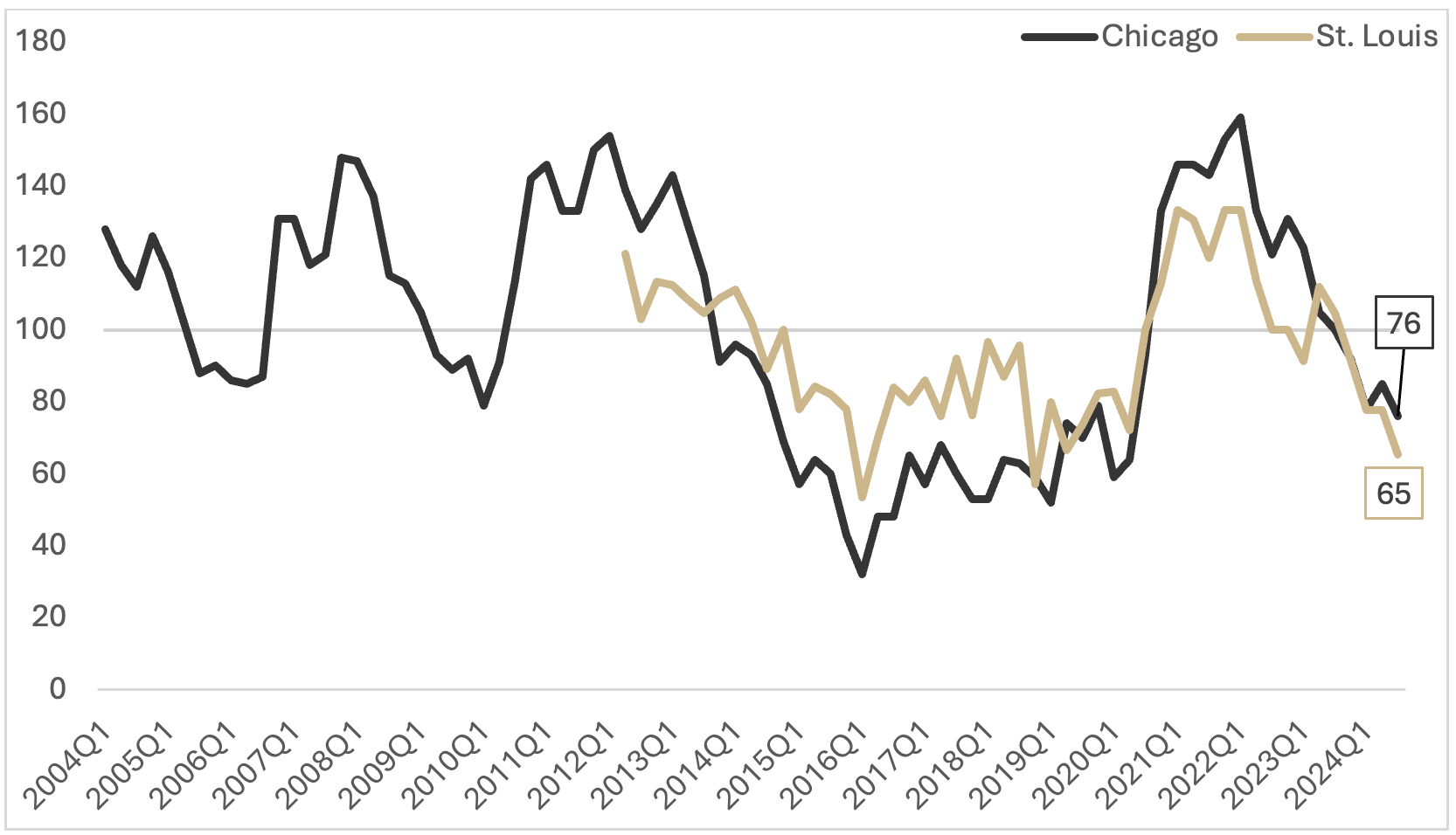

The Federal Reserve surveys also collect a number of subjective agricultural credit market conditions from agricultural bankers across their region. Respondents report whether various conditions – including loan demand, the availability of funds, and repayment rates – were “higher,” “lower,” or the “same” in each quarter relative to the same quarter a year ago. The responses are summarized by indexes, calculated as the share of lenders reporting “higher” minus those reporting “lower” plus 100. Thus, when the index is below 100, market conditions are worse than a year before.

Figure 4 shows that the demand for agricultural loans increased in 2024 relative to 2023, ending a trend of decreasing demand. Bankers have indicated a year-over-year increase in demand for agricultural loans through the first three quarters of 2024. The increased demand for agricultural credit reflects the tighter operating margins in 2024. While both crop prices and input costs have decreased, the drop was more pronounced for crop prices.

Figure 4. Demand for Agricultural Loans, 2004Q1-2024Q3

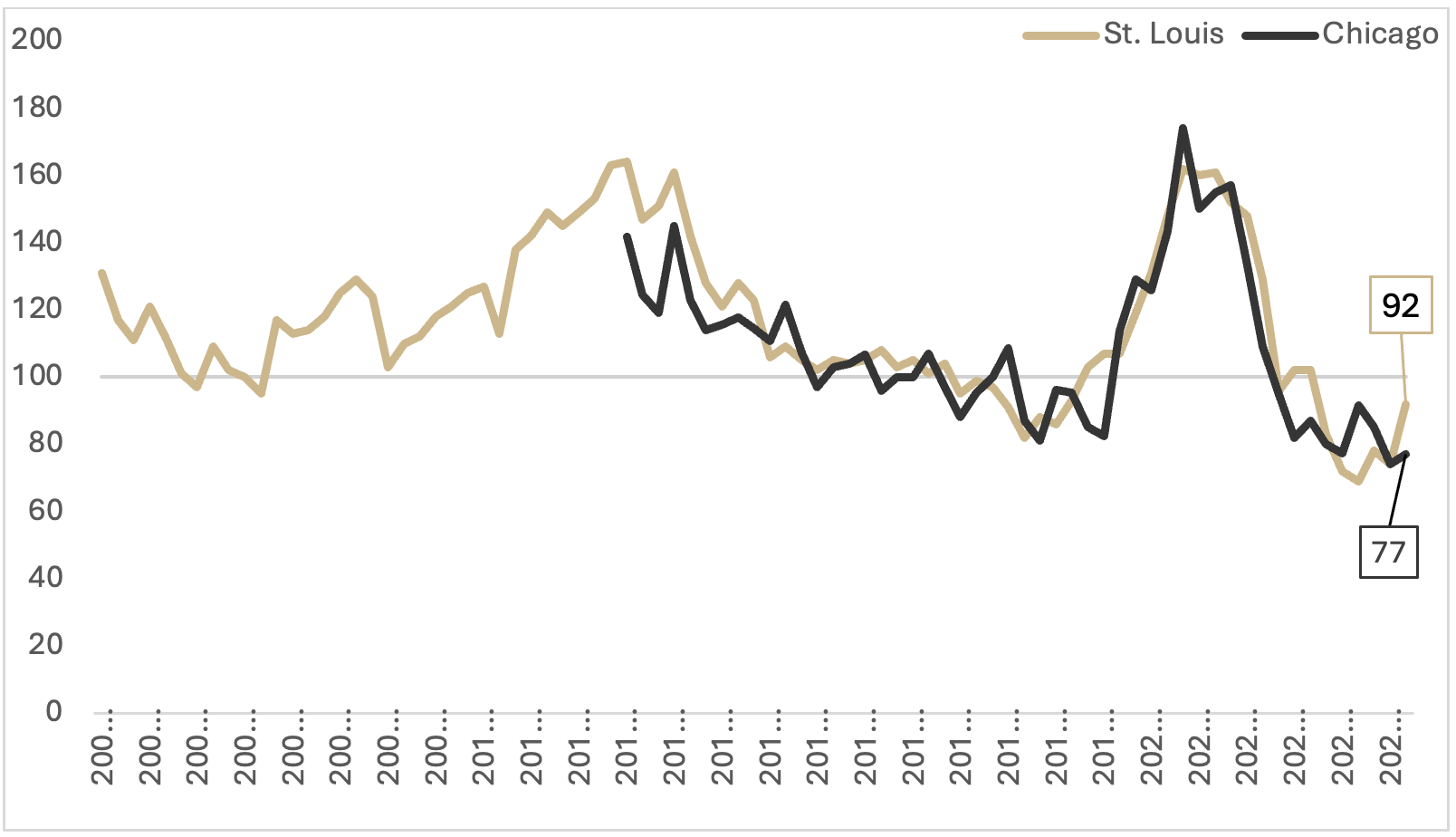

In addition, loan repayment rates decreased between 2023 and 2024. As shown in Figure 5, lenders’ reported repayment rates relative to the same quarter of the previous year have been below 100 since the fourth quarter of 2023. During the three years prior to the fourth quarter of 2023, the loan repayment index was positive since the onset of the COVID pandemic. The recent downturn in the index suggests that going into 2025, farmers are struggling to pay off their debts.

Figure 5. Loan Repayment Index, 2004Q1-2024Q3

Finally, the Federal Reserve surveys suggest that agricultural bankers have expressed a continued decrease in the availability of funds. As shown in Figure 6, agricultural bankers across the St. Louis Fed District have indicated decreasing availability of funds since quarter three of 2022, and agricultural bankers across the Chicago Fed District have expressed a similar reduction since the second quarter of 2023. Thus, agricultural credit markets in 2025 will likely be marked by both higher levels of demand and lower levels of supply.

Figure 6. Availability of Funds at Agricultural Banks, 2004Q1-2024Q3

In sum, current credit market conditions generally provide a pessimistic outlook for 2025. With lower operating margins, farmers are expressing a greater demand for credit. Lenders must balance this demand with a decreased amount of funds available and lower loan repayment rates. If there is one bright spot for 2025, it is the potential for further reductions in short-term loan rates. The FOMC’s most recent “Summary of Economic Conditions” suggests that the committee expects to decrease the Federal Funds rate to a target range of 3.75 – 4.00% in 2025. The most recent Fed projections suggest stable unemployment rates and a decrease in inflation in 2025, prerequisites for future rate declines.

References

Cowley, C. and T. Kreitman. 2024a. Early Signs of Financial Pressure. Federal Reserve Bank of Kansas City, August. https://www.kansascityfed.org/agriculture/ag-credit-survey/early-signs-of-financial-pressure/

Cowley, C. and T. Kreitman. 2024b. Slowdown in Farm Economy Continues. Federal Reserve Bank of Kansas City, Ag Finance Update, November. https://www.kansascityfed.org/pdf/article/articlepage/15379/

Federal Open Market Committee 2024. Summary of Economic Projections. Federal Reserve, December. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20241218.pdf

Oppedahl, D. and E. Kepner. 2024. Farmland Values and Credit Conditions. Federal Reserve Bank of Chicago, AgLetter No. 2006, November. https://www.chicagofed.org/publications/agletter/2020-2024/november-2024

[1] The federal funds rate is the interest rate at which deposit-granting institutions (i.e. banks) trade federal funds with each other