The Economics of Harvesting Corn Cobs for Energy

December 19, 2010

PAER-2010-10

Matthew J. Erickson, Economist, American Farm Bureau Federation ®; Wallace E. Tyner, Professor and Chris Hurt, Professor

Biomass energy has received much attention in recent years. We now use about one third of the U.S. corn crop for biofuels. More recently, attention has focused on cellulosic resources – energy crops like switchgrass or miscanthus, and corn stover. But the question we explore is the economics of collecting just the corn cobs for energy instead of the stover. What are the costs of harvesting cobs? Will harvesting cobs generate extra returns for farming operations? To help answer the last question, we estimate the per ton payment farmers need to receive for harvesting cobs during the corn harvest.

Corn stover, the non-grain residue left on the field after harvest, has been shown to have significant potential in Indiana as a biofuels feedstock. However, collecting the corn stover and removing the residue from the field may have implications for soil erosion and soil quality. One possible feedstock that would not overly affect organic and nutrient content in the soil is the corn cobs. Little or no work has been done on the economics of harvesting and collecting just the cobs.

The Analysis

Data on cob harvest was obtained from farmers who supplied cobs for Chippewa Valley Ethanol Company in Minnesota during the 2009 corn harvest. Chippewa is one of the few firms collecting and using cobs. We collected the data through two focus group sessions with farmers harvesting cobs and a mailed questionnaire. Based on information on costs and extra time required provided by these farmers, we created a cob harvesting activity that could be added to the Purdue B-21 PC-LP Farm Plan model which is used to select the best crop rotations on each farm. The standard crop choices (corn-corn, corn-soybean, corn-soybean-wheat, etc.) were retained, but new activities were added that included cob harvest. In other words, in the model there was a choice between the normal corn rotations and corn rotations including cob harvest. In that way, we could estimate the relative attractiveness of the added cob harvest over a range of cob prices. The PC-LP model was simulated to reflect the optimum crop rotations for a group of farms. Data for this group came from 55 farms that participated in the 2009 Top Farmer Crop Workshop. These farms together represent about 100,000 acres of corn without any cob harvesting and also have other soybean and wheat acres. The individual farm data was used on a confidential basis.

The cob harvesting activity is a one-pass harvest of corn and cobs and involves pulling a dedicated cob collection wagon behind the combine. At this time, there is only one manufacturer of the wagon, and that company only leases the wagons. That lease rate of $28,000 per year represents a large, fixed cost. Cob harvesting involves additional costs beyond the cob wagon. Pulling the wagon requires added fuel and maintenance on the combine. The cobs must be offloaded from the wagon into a truck with a hoist and hauled to the field edge. This will require additional labor and some added costs for fuel and maintenance on the cob truck. These costs were estimated by our Minnesota farmer survey and are included in the analysis. Clearly, the cob harvest takes more time, and most farmers agree that slowing the corn harvest can be costly. For this reason, we included a cost for the decreased harvest working rate.

Nutrients that are in the cobs were another important cost that was included in the study. During normal corn harvests the phosphorus and potassium in the corn cob would be returned to the soil. When the cobs are harvested for ethanol, farmers face the additional costs for these nutrients that are destined for the ethanol plant and thus not returned to the soil.

Base Case & Interpretation at $100 per Ton

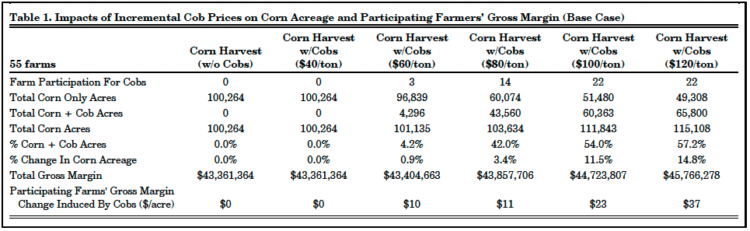

In the preliminary analysis, we found that the results were particularly sensitive to the amount of cobs in the stover, the cost of the cob wagon, and the decreased harvest working rate due to the added cob harvest activity. Thus, sensitivity was done on those variables. The amount of cobs in the overall stover has not been well studied, but the limited literature suggests a range. As a result, we used 20% in the base case. The lease rate for each cob wagon is $28,000 for the entire harvest season. The base case assumes a 10% decrease in the harvest working rate due to the added cob harvest activity. In general, the data came either from the Minnesota farmers or from earlier studies. Table 1 shows the base case of the 55 farms from PC-LP.

From Table 1, the first data column is the standard PC-LP solution without the cob harvest. The acres row is the sum of corn acres for the 55 farms, which is 100,264 acres. This can be thought of as the optimum number of acres these 55 farms would plant to corn if they were maximizing their returns. The columns to the right add cob harvest at different cob prices.

Table 1. Impacts of Incremental Cob Prices on Corn Acreage and Participating Farmers’ Gross Margin (Base Case)

At $40 per ton, no farms participated in the corn plus cob harvest because it was not profitable to do so. As the price for cobs increased, a higher percentage of the corn acres were used for harvesting corn plus cobs. At $100 per ton, 40%

of the farms (22 out of 55) and 54% of the corn acres were used for the corn plus cob harvest. At $100 per ton, “Corn plus cob acres” increased to 60,363 acres, which resulted in an overall increase in “Total Corn Acres” to 111,843 acres. Because total corn plus cob acres increased, cobs harvested during the corn har-vest also increased. The $100 per ton price increased corn acres by approximately 12%. The net change in the margin induced by cobs at $100 per ton was approximately $23 per acre of corn plus cobs.

With higher cob prices, some soybean and wheat acreage shifted to corn. This was due to the farms receiving a higher payment for their overall corn enterprise while holding soybeans and wheat constant at their original prices. Finally, the higher payment for cobs caused gross margins to increase. At $60 per ton, the gross margin change induced by cobs was estimated at $10 per acre of corn. At $120 per ton, the participating farms’ gross margin change induced by cobs was approximately $37 per acre of corn plus cobs. To calculate this number, we subtract the base case gross revenue of $43,361,364 from the gross revenue at $120 of $45,766,278 to get $2,404,914. We then divide this change by the cob acres (65,800) to get $37.

Having examined the impact of cob price on farm participation and acres harvested for cobs, we are going to assess three factors critical to the economics of cob harvesting:

1) The decreased harvest working rate;

2) A less expensive cob wagon rental at $14,000; and

3) Smaller fraction of cobs in residue.

Decreasing Harvest Working Rate Harvesting cobs along with the corn slows down the corn harvest. Our base case assumption from the Minnesota farmers was that there was a 10% reduction in the harvest working rate. However, the bottom line for this sensitivity analysis is that the change in the harvest working rate was not a major driver of whether farms harvested cobs during the corn harvest. However, while this result holds for a normal year, it could be very different for years with a very late harvest when slowing harvest by 10% could result in larger field losses due to lodging and non-optimum harvest dates.

Less Expensive Cob Wagon Lease at $14,000

Reducing the lease rate of the cob wagon to $14,000 increased the percentage of corn plus cob acres in the corn enterprise to 38% at $60/ton cobs. At $80 per ton, the $14,000 lease rate resulted in over 50% of total corn acres for the corn plus cob harvest activity. By comparison, in the base case with a $28,000 lease rate, corn plus cob acres did not reach the 50% benchmark until $100 per ton. Clearly, the cob wagon lease rate is a major determinant to the economics of cob harvest.

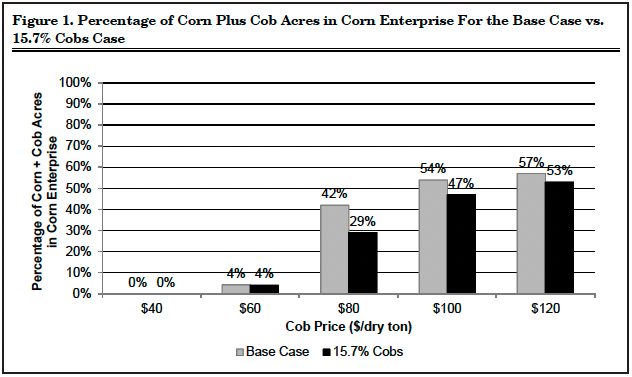

Different Percentages of Cobs in Residue

Since there is little research on what is the percentages of cobs in corn stover, we examined the impacts if the cob percentage was only 15.7% instead of the 20% in the base case. All other costs associated with the base case did not change. These results are shown in Figure 1. At 15.7% cobs, farms harvested fewer cobs per acre, which made it harder to offset the costs associated with cob harvest. At $100 per ton, the base case reached the 50% benchmark. Meanwhile, the 15.7% case did not reach the 50% benchmark until $120 per ton. This indicated that farms need to receive a higher cob price when the fraction of cobs in stover is lower in order to cover all the added costs for cob harvest.

Figure 1. Percentage of Corn Plus Cob Acres in Corn Enterprise For the Base Case vs. 15.7% Cobs Case

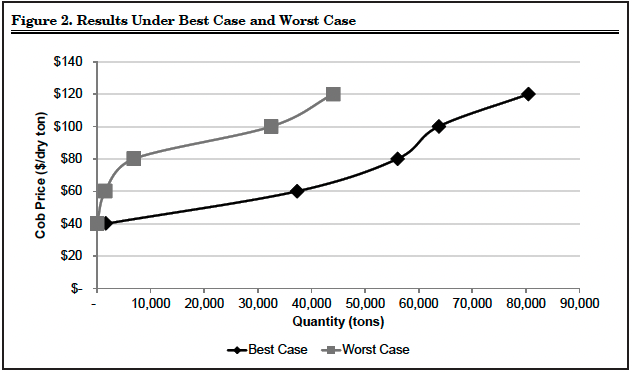

Best Case vs. Worst Case

Since this is largely a first attempt at evaluating the economics of cob harvest, we have examined a “best case” if all the critical parameters are better than expected, and a “worst case” if all parameters are worse than expected. The best case was based on 20% cobs, a $14,000 lease rate, and a 5% decreasing harvest working rate. The worst case used 15.7% cobs, a $28,000 lease rate, and a 15% decreasing harvest working rate. Figure 2 shows the price-quantity relationships of the total tons of cobs har-vested between the best case and worst case at various cob prices.

Figure 2. Results Under Best Case and Worst Case

As cob prices increased, the 55 farms supplied more cobs to the market. The best case resulted in considerably more cobs harvested than the worst case at all cob prices. At a $100 per ton cob price, cobs harvested in the best case were about double the worst case. At $120 per ton for the best case, 33 farms harvested approximately 80,000 tons of cobs. This is equivalent to approximately 5.6 million gallons of ethanol production. For the worst case, 21 farms harvested approximately 44,000 tons of cobs. This is equivalent to approximately 3.1 million gallons of ethanol production.

Size of Farms for Which Cob Harvesting is Feasible

Are smaller or larger farms more likely to harvest cobs? For this analysis, the 55 farms from the base cases were split into three corn acreage categories. There were 14 farms with fewer than or equal to 1000 corn acres, 28 farms between 1000 and 1999 corn acres, and 13 farms with 2000 or more corn acres. Figure 3 shows the cob harvest acres as a percent of total corn acres for the three corn acreage categories by cob price.

Farms that contained 2000 or more corn acres generally had much higher cob harvest as a percent of total corn acres. The 13 farms that contained 2000 corn acres or more were better able to cover the additional costs associated with cob harvest than smaller farms. In fact, all 13 farms with 2000 corn acres or more added a second cob wagon at a total lease rate of $56,000. At $80 per ton received for cobs, the farms with 2000 or more corn acres harvested cobs on 71% of their total corn acres. For the 14 small farms with 1000 corn acres or fewer, only three farms harvested cobs. The three farms that harvested cobs had high expected corn yields of 210 bushels per acre, which resulted in higher cob yields. Smaller farms might still harvest cobs if their yields were quite high.

The cost of harvesting cobs has high fixed cost components, especially for the seasonal lease rate of the cob wagon. With high fixed costs, the costs per unit are lowered by spreading these costs over harvesting large quantities of cobs. The large quantities of cobs can come from either large acreage (large farms) or for some smaller farms with high corn yields per acre.

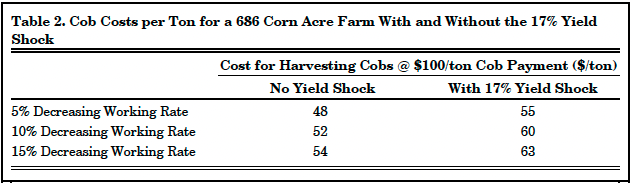

Impacts of a Corn Yield Shock

How would a surprisingly small yield due to a poor growing year impact cob harvesting costs per ton? A 17% yield shock would increase the costs to harvest cobs by $6 to $9 a ton for a sample farm with cobs at $100 per ton. Table 2 indicates the total per ton cost for cobs for the three decreasing harvest working rates for a sample 686 corn acre farm. The higher costs per ton results because most of the costs are fixed and the 17% yield shock reduces total cob tonnage by roughly the same percentage.

Table 2. Cob Costs per Ton for a 686 Corn Acre Farm With and Without the 17% Yield Shock

Summary and Conclusions

This study reports on the economic costs and returns for harvesting corn cobs used as a feedstock for cellulosic ethanol production. As such, it is one of the first studies to shed light on important questions such as how cobs can be harvested, what are the costs of doing so, what will the price of cobs need to be in order to encourage cob harvest, and what types of farms will be most likely to harvest cobs.

Perhaps the most important conclusion is that cobs are more expensive to harvest for energy than many had originally thought. Our results suggest that harvesting of cobs in the Midwest would not become attractive unless cob prices approach $100 per ton. In addition, there are costs to store and transport cobs to ethanol plants. Some people viewed cellulosic material as a by-product that had little cost. That clearly is not the case, including the costs of corn cobs examined in this study.

If ethanol plants are unable to pay $100 per dry ton for cobs at the field in the near future, additional incentives would be required to cover the differential payment and make cobs “economic.”

It was evident that the cob operation is more attractive for larger farms. Farms containing 2000 or more corn acres were better

able to offset the large, fixed costs of harvesting cobs, thus reducing per unit costs. For smaller farms, the fixed lease rate of the cob wagon at $28,000 per year was a barrier to entry. The inability to offset the wagon lease rate and the other associated cob costs appears to be challenging for small farms. However, decreasing the rental cost of the wagon to $14,000 allowed for higher participation of small to moderate farms in cob harvest.

Every farm is unique. The results of this analysis demonstrate that the breakeven prices for cobs can differ substantially among farms depending on corn yield, farm size, and other factors. Results are quite sensitive to the cob wagon cost and the fraction of cobs in the stover. However, the major conclusion is that cobs will be more expensive than previously believed – maybe too expensive to be used for energy production unless the public is willing to further subsidize such activities. Another important possibility is that cob harvest technology could evolve into different systems that might lower cob harvest costs.

Acknowledgements

We would like to thank the Indiana Corn Marketing Council for providing partial funding for this research. We would also like to thank Chippewa Valley Ethanol Company in Benson, Minnesota, for their support and hospitality during the research process.