Agricultural Trade Prospects Weaken

December 13, 2014

PAER-2014-12

Philip Abbott, Professor of Agricultural Economics

Overall U.S. agricultural exports set another record in fiscal year 2014 at $152.5 billion. According to USDA’s most recent trade outlook, exports in 2015 are expected to fall to $143.5 billion, due to lower prices and reduced export volumes for bulk commodities. Agricultural imports were at $109.2 billion in fiscal 2014, and will set a record at $116 billion in 2015. The agricultural trade balance will fall from $43.3 billion in 2014 to $27.5 billion in 2015, its lowest level since 2009.

Grains and feeds exports are expected to be $6.5 billon lower in 2015, with volumes traded declining as well. Coarse grains exports are projected to be 6.3 million metric tons lower, and feeds and fodder are expected to be 7.8 million metric tons lower. Soybeans, meal and oil exports are up slightly in volume, but the value of that trade should fall $4.5 billion as a result of the lower prices this year. For bulk commodities overall, value is down 6.3% while volume is down 4.5%.

The decline in overall U.S. agricultural exports is slightly less than the combined declines for grains, feeds and oilseeds, since the value and volume exported for most other commodity groups is flat. Pork exports as well as overall livestock, poultry and dairy exports are expected to fall by 0.3%, but horticultural product exports may increase by 7.7%.

Prices for corn and soybeans are up somewhat from the lows in early fall when the excellent harvest began, but remain lower than last year and well below prices for 2011 to 2013. Prices over this period have been strongly influenced by surprises in trade, so attention is warranted for USDA’s projections on exports of these crops for the 2014/15 crop year. That forecast has been for only modest growth in soybean exports and significant declines in grain exports. A question that needs to be addressed is why are the lower prices not bringing greater export volumes?

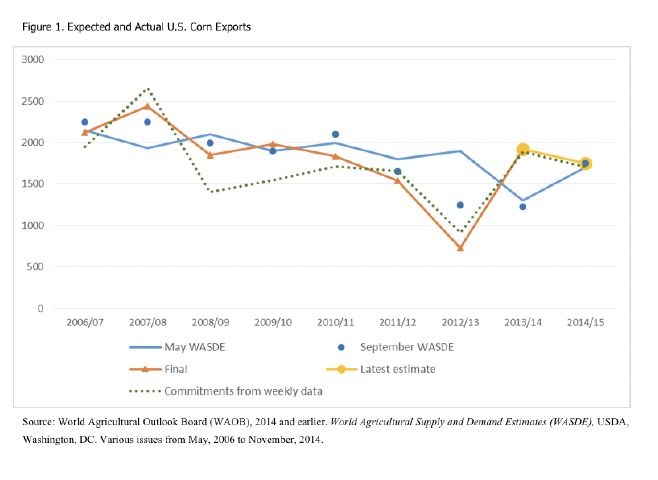

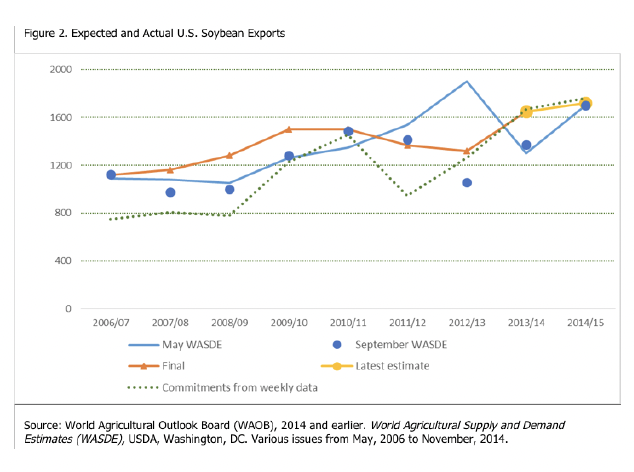

Figures 1 and 2 compare actual corn and soybean ex-ports to WADSE forecasts since 2006. While these show differences between actual and expected exports every year that persist beyond harvest, deviations were much larger for the 2012/13 drought year and for the next crop year when production improved. Exports of corn had been trending downward since the peak in 2008, while soybean exports had been growing until 2011, largely due to Chinese demand. In the recent past these exports had been price inelastic, as foreigners bought what they needed regardless of price or market conditions in the U.S. When the drought occurred in 2012, exports fell much more than expected, even after drought effects on production were known. Then in 2013, when production recovered and prices fell, exports also increased more than expected. Initial WASDE estimates presumed more of the decline in the 2012/13 crop year was due to the on-going trend, rather than a response to U.S. market conditions. The fall in exports in 2012/13 prevented prices from falling as much as they would have otherwise, and the surprisingly strong exports in 2012/13 kept prices higher than initially expected.

Figure 1. Expected and Actual U.S. Corn Exports

Figure 2. Expected and Actual U.S. Soybean Exports

Figures 1 and 2 show the current USDA forecast: that soybean exports would increase only slightly and corn exports would fall for the current crop year. This was the case in the early May WASDE report, and the most recent (November) report is highly consistent with the May prediction. Weekly exports are reported to the USDA and published quickly. They provide some guidance as to how actual exports perform. Figures 1 and 2 also show weekly export data – accumulated export sales to date in late November plus outstanding export sales that have not yet shipped. While these export commitments at this time of year are an imperfect predictor of future trade, they have performed reasonably in recent years, and are highly consistent with the most recent WASDE forecast. Thus, it is reasonable to expect export levels near the WASDE forecasts, so weaker export demand is consistent in spite of the low market prices now occurring. As always caution is advised, as soybean exports (and increasingly corn exports) are dependent on harvests in South America which will not occur until the coming spring.

Trade with China is a critical factor determining these outcomes, especially for soybeans and more recently for corn. Chinese soybean imports are expected to increase only 3.6 million to 74 million tons, while corn exports fall 0.7 million tons to 2.5 million tons. Chinese imports of DDGs were 6 million tons for 2013/14, and may fall dramatically in the coming year. A dispute involving GMOs over a Syngenta strain not approved for importation into China has resulted in shipments being refused for both corn and DDGs. Chinese restrictions on corn and DDG trade, and more strict enforcement of GMO regulations, is probably the consequence of a large corn crop and excessive stocks in China. Low price imports would interfere with their producer support programs as well. Those expecting corn trade to China to expand like soybean trade has in the past will have to wait at least until those stocks are drawn down, and probably longer.

U.S. agricultural exports are weak because of a weak global economy as well. Europe and several emerging economies are in recession and key Asian economies are experiencing slower growth than has been the case in the past. The U.S. economy is the only one experiencing reasonable growth. That performance coupled with flight to safety of the dollar due to various geopolitical risks (Ukraine, Middle East …) means that the dollar is quite strong now. The strong dollar has affected crude oil and metals more so than agricultural commodities for now, but the expected continuing appreciation of the dollar could eventually lower agricultural commodity prices. Moderate improvement in global economic growth is behind the USDA trade forecasts for 2015, however. The strong dollar and relatively stronger U.S. economic growth will also fuel agricultural import expansion.

Progress on trade negotiations is unlikely to change the trade outlook in the near future. The Bali WTO Ministerial a year ago made only minimal progress toward a Doha round agreement. The “low hanging fruit” of adopting a Trade Facilitation Agreement is more likely now that the U.S. and India have resolved their dispute over WTO disciplines on India’s public grain stockholding to ensure food security. The U.S. and Brazil have also recently resolved their longstanding cotton dispute. While changes in the recent farm bill plus a $300 million payment to Brazil were sufficient to bring an end to that dispute, the move to crop insurance in that bill has considerably reduced the room for the U.S. to negotiate a future reduction in its coupled farm payments. Attention is now focused less on WTO and more on bilateral agreements – the Trans Pacific Partnership (TPP) and the US-EU trade and investment agreement (T-TIP). The recent Asian summit meeting has brought the TPP negotiations closer to conclusion, but the agricultural content of both those agreements remains highly uncertain.

Exports were key to limiting price declines last year, but global economic weakness and a strong dollar mean an-other favorable trade surprise is unlikely this year. In spite of lower prices and bumper crops this year, bulk commodity exports are likely to remain weak for the coming year.