Beef Cattle: A Tumultuous Year

December 13, 2015

PAER-2015-17

James Mintert, Professor and Director of the Center for Commercial Agriculture

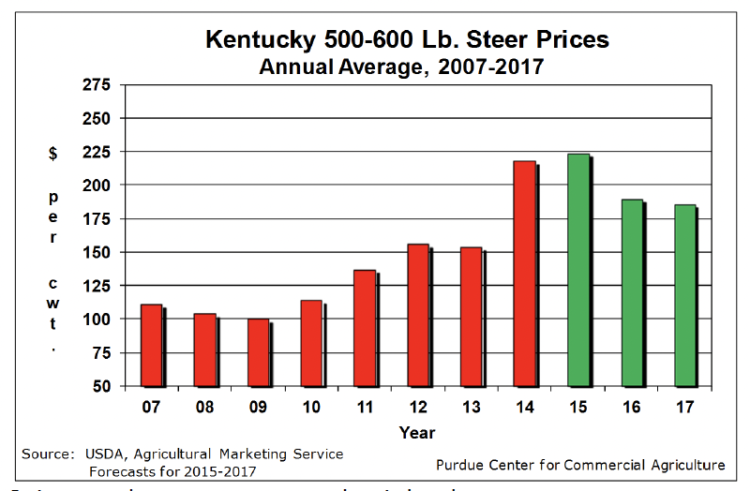

It is an understatement to say that it has been a tumultuous year in the cattle markets. Weekly average slaughter steer prices in the Southern Plains started 2015 at $170 per cwt. (live weight), but dipped into the low $120’s in late summer and early fall. The nearly $50 per cwt. price decline was the largest within-year price decline on record. Steer calf prices also declined precipitously during the course of the year. Kentucky prices reported by USDA for 500-600 pound steers averaged $251 per cwt. during 2015’s first quarter, but the 2015 fourth quarter average (through the end of November) was just $186 per cwt., a decline of $65 per cwt.

The slaughter cattle price decline led to a bloodbath for cattle feeders. Iowa State Extension’s estimates of Corn Belt cattle feeding returns indicate that a program of routinely placing a 750 pound steer on feed each month and then marketing it approximately 150 days later yielded an average loss during 2015 of over $200 per head. A cattle feeder following this simulated feeding regime would have absorbed losses during the fourth quarter of the year that were much worse than the annual average, approaching $500 per head.

Kentucky 500-600 Lb. Steer Prices Annual Average, 2007-2017

What led to the across the board decline in prices and, what are the implications for 2016?

Not surprisingly, more than one factor was behind the change in the cattle market during 2015, but the fact that meat supplies in the U.S. turned out to be larger than expected at the start of the year was key. Meat supplies in the U.S. have been declining for most of the last decade as animal agriculture responded to the loss of profitability arising from sharply higher feed costs by reducing inventories and production. During 2014, domestic per capita meat supplies dropped to about 202 pounds (retail weight), down from over 220 pounds as recently as 2007. A modest uptick in meat supplies was expected during 2015 as producers started increasing production in response to 2014 profits and to declining feed costs, but surprisingly meat supplies actually increased sharply. Total domestic retail weight meat supplies now look likely to exceed 210 pounds per capita during 2015, a year-to-year increase of nearly 5%. Part of the increase in meat supplies was attributable to larger domestic production, especially of chicken, but that did not explain all of the change.

How did domestic meat supplies turn around so quickly? Meat supplies available to U.S. consumers consist of meat produced in the U.S., plus imports, minus exports. A change in the foreign trade balance had an unusually large impact on domestic meat supplies during 2015. A strengthening U.S. dollar made exports of U.S. products, including meat, more expensive to consumers in importing nations, encouraging them to look elsewhere for meat imports. At the same time, relatively high prices in the U.S., combined with the strength of the U.S. dollar, made the U.S. an attractive market for meat exporters around the world. As a result, net imports (imports minus exports) of beef into the U.S. are now projected to increase by nearly 1 billion pounds during 2015 compared to 2014, thereby boosting supplies available to U.S. consumers.

Added imports and reduced exports increased domestic beef supplies and heavy weights added to the tonnage. Through early fall, dressed cattle carcass weights averaged 826 pounds, nearly 3% heavier than a year earlier. The widely anticipated reduction in the number of cattle slaughtered during 2015 was partially offset by unexpectedly heavy carcass weights. Through November, cattle slaughter was down more than 5% from 2014, but the increase in cattle weights meant that beef production declined by only 3%. When the impacts of increased imports and fewer exports are included, the amount of beef available per person was actually unchanged in 2015.

What is ahead in 2016? It seems clear now that the cyclical peak in both fed cattle and calf prices is behind us. Although the peak is behind us, odds favor prices remaining at historically high levels in 2016. Cattle slaughter is expected to start increasing cyclically during 2016 as producers have been holding back females to increase herd size, but cattle weights should stabilize, resulting in beef production that is 3% to 4% larger than in 2015.

Using USDA’s publicly reported prices for Kentucky as a basis for comparison, the annual average price for 500-600 pound steer calves in 2016 is expected to average between $170 and $190 per cwt., which would still be the third-highest price average on record. Although calf prices in this range will be profitable for most Corn Belt cow-calf operations, the fact that we are in the expansionary phase of the cattle cycle provides a cautionary signal that calf prices will likely move lower in each of the coming years (see chart). This means cow-calf managers need to budget closely as they evaluate expansion plans, and they will obviously need