Beef Supply To Rise: Can Strong Demand Hold Cattle Prices

December 16, 2017

PAER-2017-19

Author: James Mintert, Professor and Director of the Center For Commercial Agriculture

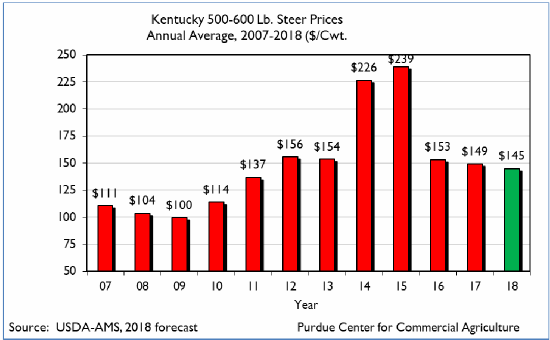

Prices for calves and feeder cattle started 2017 sharply lower than a year earlier but by year-end, prices were well above those of 12 months prior. Examining prices for steer calves and feeder steers in the eastern Corn Belt helps illustrate how large the price swings were over the last 12 months. During January prices for 500-600 pound Kentucky steers averaged just less than $130 per cwt., 27% below the January 2016 average. However, by late November and early December 2017, prices for the same weight steers had recovered to average in the low $150s per cwt., more than 20% above a year earlier. Despite the price recovery in late 2017, weakness early in the year led to an annual average price of $149 per cwt., which was about 3% lower than in 2016.

Prices for heavier weight feeder steers followed a pattern similar to that of steer calves in 2017 with prices for 700- 800 pound steers in Kentucky during January averaging near $121 per cwt., more than 20% below January 2016. But by late November and early December, feeder steer prices recovered to the mid-$140s, yielding a fourth quarter average nearly 27% higher than a year earlier. For the year, prices for 700-800 pound steers in Kentucky averaged about $136, just a couple of percent lower than a year earlier.

Prices for slaughter cattle during 2017 were not as volatile as calf and feeder prices, although they did fluctuate during the course of the year. During January, Southern Plains slaughter steer prices averaged just over 10% below a year earlier, but by late November and early December slaughter steer prices averaged about 12% higher than 12 months prior. The result was an annual average slaughter steer price of about $122 per cwt., virtually unchanged from 2016’s annual average.

The weakness in feeder and calf prices in late 2016 and early 2017 helped cattle feeders return to profit- ability during 2017, a welcome respite from the large losses many feeders experienced during the prior two years. In fact, Iowa State Extension’s estimate of cattle feeding returns rebounded dramatically during the year. Iowa State simulates returns from a stylized feeding pro- gram where cattle are placed on feed every month and feed is purchased, and cattle sold, in the cash market with- out any risk management.

Yearling based and calf based feeding programs were very profitable in 2017 as returns averaged over $170 per head above estimated costs for both feeding programs. This was a dramatic turnaround from 2016 when estimated losses averaged $111 per head for yearlings and $220 per head for calf-based programs. Feeding was especially profitable during the spring and early summer of 2017 when cattle feeders benefitted from marketing cattle that were placed on feed when calf and feeder cattle prices were near their lows and slaughter cattle prices were strengthening. By this fall, however, cattle feeders were struggling to breakeven again. Stronger feeder prices pushed cattle feeders’ breakevens up and, although slaughter cattle prices did strengthen seasonally from late summer lows into fall, they did not improve enough to offset the rise in feeder cattle placement costs.

A key driver of beef and cattle prices is the supply of meat, especially beef, available to consumers. Both beef and total meat supplies were larger in 2017 than in 2016, putting some downward pressure on prices. Cattle slaughter during 2017 rose nearly 6% above the prior year, but dressed carcass weights averaged 1.4% below 2016s. The year-to-year reduction in cattle weights held the 2017 U.S. beef production increase to approximately 4% compared to 2016. Beef supplies available for U.S. consumers, how- ever, did not increase as much as beef production because U.S. beef exports increased 10%, and beef imports actually declined about 2%. The result was only a 2% increase in per capita beef supplies for U.S. consumers at retail.

Likewise, total meat supplies at retail in the U.S. increased less than total meat production because imports declined by 1% and total meat exports increased by over 4%, both compared to the prior year. The result was an increase in total meat (red meat plus poultry) supplies of about 1%. So, international trade in meat clearly benefit- ted U.S. livestock and poultry producers.

What’s Ahead in 2018?

Annual cattle slaughter volume bottomed out in 2015 at 29.2 million head and has been increasing since, reaching 32.7 million head in 2017. Another increase in slaughter numbers seems likely in 2018 as the industry is still in the expansion phase of the cattle cycle. Earlier this year, USDA estimated that the January 1, 2017 cattle inventory increased by nearly 2% during 2016, driven in part by a 2016 calf crop that was almost 3% larger than in 2015. What will the upcoming inventory report, scheduled for release by USDA in late January 2018 reveal? One significant clue with respect to what might be revealed on the upcoming inventory report can be found by examining female cattle slaughter relative to steer slaughter during 2017 and prior years.

In years when producers are reducing the size of the U.S. cattle herd, female slaughter relative to steer slaughter rises and, conversely, when herd expansion is underway female slaughter declines relative to steer slaughter. During both 2015 and 2016 female slaughter averaged near 80% of steer slaughter, indicating expansion was under- way. Female slaughter did accelerate this year in response to lower calf prices and reduced returns to cow-calf operations. However, the female to steer slaughter ratio only climbed to 86%, suggesting expansion slowed, but did not stop. So, odds are good that we will see another increase in the size of the U.S. herd when USDA releases its next inventory estimate in late January 2018 and that suggests cattle slaughter and beef production in 2018 will both in- crease compared to 2017.

The year-to-year increase in cattle slaughter in 2018 is likely to be smaller than in 2017, perhaps falling in a range of 3% to 5%. Unlike 2017, dressed cattle weights are likely to equal or exceed the year ago level leading to a larger increase in beef production than cattle slaughter. However, an improvement in the beef trade balance could help hold back domestic beef supplies somewhat, leading to an increase in per capita retail beef supplies that’s actually smaller than the expected increase in cattle slaughter. Total meat supplies facing consumers at the retail case are expected to rise between 1% and 2%, compared to 2017. If incomes continue to grow, demand strength could compensate for most of the expected meat supply increase, however, alleviating downward pressure on retail meat prices.

What’s ahead in 2018? Modest increases in both beef and total meat supplies mean prices for slaughter steers in the Southern Plains during 2018 are likely to average near or perhaps a bit lower than 2017s average of $122 per cwt. If slaughter cattle prices soften modestly as seems likely, it will put some downward pressure on calf and feeder prices, but the decline in the 2018 annual averages could be small. Look for the annual average for 500-600 pound steers in Kentucky to average in the mid-$140’s in 2018 with prices for 700-800 pound feeder steers in Kentucky expected to average in the low to mid-$130s. Herd expansion showed signs of slowing down during 2017. The big question is whether U.S. cow-calf operations choose to remain on their expansion path in 2018. Conditions in 2018, including weather, grain prices and forage availability, could provide the keys to future herd growth.