Changing Consumer Diets Alter Agriculture

June 16, 1992

PAER-1992-12

Chris Hurt

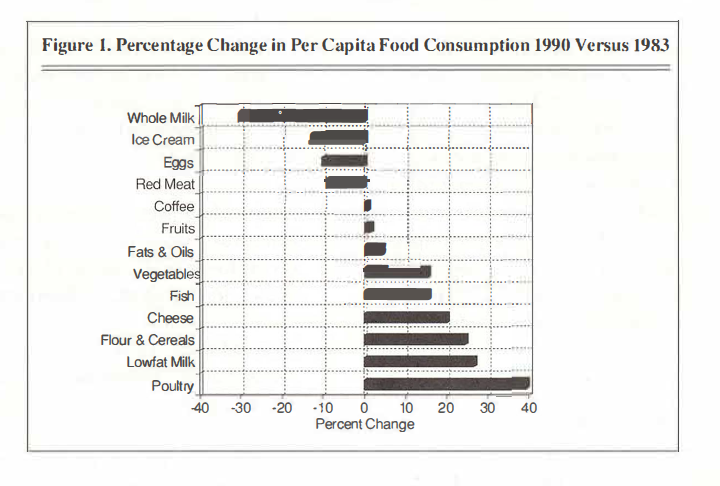

Consumers in the United States continue to alter their diets. As they change the types of food products they eat, the food system must adjust to meet these desires. The figure at right shows some of the basic changes which are taking place in per capita consumption of selected food products. The percentage changes shown in the figure are for 1990 compared to 1983.

Consumers have reduced consumption of products they consider to be high in saturated fats or cholesterol, such as whole milk, ice cream, eggs, and red meats. One exception to the reduction of saturated fats is cheese, where consumption has risen about 20%, presumably because of our increased taste for pizza. Alternatively, consumers have increased consumption of vegetables. fish and seafood products, grains, low-fat milk, and poultry. Increases are especially noted in consumption of fresh products such as fresh fruits and vegetables.

These changes have important implications for the entire food system, from farmers to grocery store managers/ Farmers must grow the type of raw food products which processors can convert to the final food products consumers desire. Participants in the food system who can meet these needs stand a greater chance of financial reward, while those who do not, stand a greater chance of receiving low economic returns over time.

Figure 1. Percentage Change in Per Captia Food Consumption 1990 Versus 1983