Continued High Food Prices for 2013

December 23, 2012

PAER-2012-13

Corinne Alexander, Associate Professor

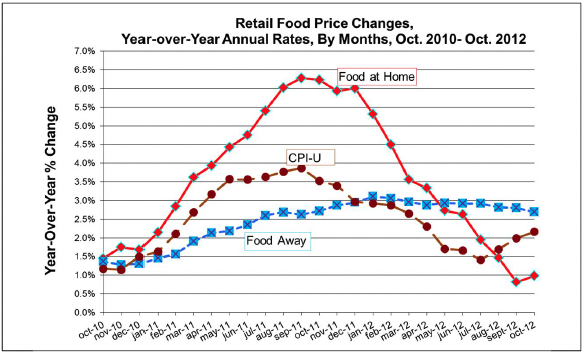

Food shoppers are struggling in a period of above normal food price inflation that is persisting for multiple years. Overall food price inflation was 3.7% in 2011, with 2012 expected to average between 2.5 to 3.5% and 2013 expected to average between 3 and 4%. So far, food price inflation in 2012 is building on the very high inflation in 2011 as manufacturers, retailers and restaurants are forced to pass on record high ingredient prices. The four primary drivers of food price inflation are: 1) strong global demand for commodities largely driven by a growing middle class in developing countries such as China; 2) major agricultural production problems due to extreme global weather events such as the record drought in the U.S. Midwest in 2012 which compounds the record drought in the Southern Plains which affected both crops and livestock in 2011, as well as production problems in Brazil, the Black Sea region, etc.; 3) continued high crude oil prices; and 4) Government mandates that use food products for ethanol and soy biodiesel production.

Food price inflation is composed of expenditures at the grocery store and restaurants. Grocery store prices are much more sensitive to commodity prices. As of October, grocery store price inflation was 1% which reflects deflation for products such as pork, and fresh fruits and vegetables. The primary impact of the drought is on the livestock industries which are being forced to liquidate animals and resulting in a glut of meat products that is driving down prices in the short term. Restaurants price inflation is 2.7% as restaurants struggle with higher ingredient costs and higher energy costs.

Over the last 12 months, the product categories with the largest food price increases have been peanut butter, beef, and chicken. The household staple with the largest price increase is peanut butter at 30%. Beef and chicken prices are up over 5% as these industries adjust to higher feed costs.

At present, there are very low U.S. and global inventories of food commodities such as food grains, feed grains, sugar, fats and oils. Given the adverse weather conditions in 2012 which are reducing supplies, U.S. inventories of these commodities will remain low until at least mid-to-late 2013. In order for basic commodity prices to fall, there needs to be large harvests where supply exceeds demand and thus inventories can be rebuilt to more comfortable levels. High commodity prices are likely to persist at least through the summer of 2013 and thus retail food prices will continue to be high through 2013. The food industry is in a classic costs-price squeeze. The food industry is learning to manage the financial risks due to a volatile ingredient price environment.

Figure 1. Retail Food Price Changes