Crop Economies Favor Corn

December 23, 2012

PAER-2012-16

Alan Miller, Farm Business Management Specialist

Purdue’s returns and costs estimates for 2013 corn and soybeans are based on forecast crop prices that are 4% higher than they were last January. Crop prices at these levels are indicative of the strong demand for farm commodities on the heels of the drought-reduced crop in 2012. The total estimated variable costs of production per acre for 2013 are expected to be very similar to the costs expected last spring (see the section above titled “Total Input Costs to Level Off”). Purdue’s 2012 crop budgets are available here.

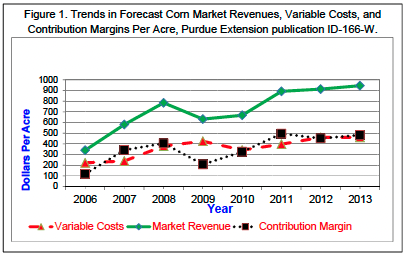

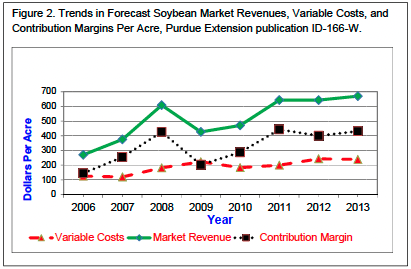

Figure 1 shows that corn market revenues per acre and contribution margin per acre (market revenue minus variable costs) are both expected to be higher for 2013 crops. The contribution margin per acre for rotation corn on average yield land in 2013 is expected to be $61 per acre more than for rotation soybeans, signaling that the market continues to encourage higher corn acreage for next year. Figure 2 shows a similar upward trend in both market revenue and contribution margin per acre for soybeans in 2013. Using 2013 expected harvest cash prices based on futures market prices from November 15, 2012, the forecast returns above variable costs from a corn-soybean rotation on average yield land in Indiana is $457 per acre. Purdue’s estimates for 2013 indicate that continuous corn has a contribution margin about $30 per acre less than rotation beans on average yield soils. This implies that corn returns on average quality land are not sufficient to bring corn into the crop mix if one has to move from a corn-bean rotation to corn-on-corn. However, on high yield Indiana soils, continuous corn may be more competitive versus rotation soybeans. Purdue’s estimates indicate a slight contribution margin advantage of $17 per acre for continuous corn as compared to rotation soybeans.

Figure 1. Trends in Forecast Corn Market Revenues, Variable Costs, and Contribution Margins Per Acre, Purdue Extension publication ID-166-W

Purdue’s forecast contribution margin per acre for single crop wheat on average yield ground in 2013 is $124 per acre higher than the year before due to a 28% higher expected wheat price. Wheat and double-crop soybeans are estimated to have the highest contribution margins per acre in 2013 of all the cropping alternatives considered in the Purdue budgets and should be very competitive with rotation corn and soybeans in those areas of the state suited for double-crop soybeans.

While contribution margins per acre are expected to increase in 2013, overhead costs are also expected to increase. As a result, the average returns above all costs per acre for the 3,000-acre corn-soybean rotation in Purdue’s budgets are estimated to decline by 5%, 8%, and 28% for the high, average, and low yield scenarios, respectively.

Figure 2. Trends in Forecast Soybean Market Revenues, Variable Cost, and Contribution Margins Per Acre, Purdue Extension publication ID-166-W

There is a lot of financial risk per acre if prices or yield outcomes drop. Crop profitability would change a much greater percentage than would the falling prices or yields. For example, the $457 per acre budgeted return above variable costs for a corn– soybean rotation on average yield land for 2013 minus $123 for machinery overhead and $214 an acre for cash rent leaves an economic profit margin potential of $120 per acre. A 10% drop in the price of corn and soybeans reduces economic profit for the average yield corn–soybean rotation from $100 per acre to just $39 per acre, a reduction of over 67% in profit margin.

Producers should regularly update their crop cost and return estimates. The bidding for acres is likely to be intense with crop prices, in particular, expected to vary sharply over time. Variable costs per acre can vary significantly from farm to farm and may increase substantially during the peak demand period for inputs next spring. Producers should take steps to manage the financial risks associated with revenue and cost variability which include effectively coordinating input purchasing plans and crop marketing plans with the use federal crop insurance coverage.