Crop Input Prices Surge

October 23, 2011

PAER-2011-16

Bruce Erickson and Alan Miller

Growing an acre of corn, soybeans, or wheat in 2012 will likely cost much more than in 2011. Fertilizer prices have been a large part of recent input price swings and continue to be the largest variable cost–second only to land payments or cash rents. Prices for seeds are predicted to be up decidedly, and pesticide costs will be a mixed bag varying by product. Preliminary 2012 budgets show variable costs for rotation corn increasing by 16%, soybeans by 15%, and wheat up by 12% compared to our January 2011 revised budgets.

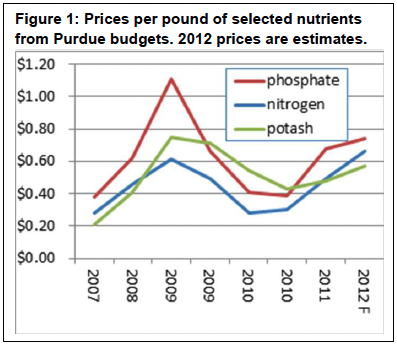

Fertilizers: September 2011 survey information from Illinois fertilizer retailers shows anhydrous ammonia for fall application selling for $790-890/ton, diammonium phosphate (DAP) at $680-725, and potassium at $580-665. All of these are more than $100/ton higher than in September 2010, which means their price per pound of nutrient is significantly higher as indicated in Figure 1. Our budget projections for 2012 put corn fertilizer expenses in the $165-211 per acre range, depending on previous crop, soils, and other factors (includes N as well as P, K, and lime replacement).

Figure 1: Prices per pound of selected nutrients from Purdue budgets. 2012 prices are estimates.

The U.S. fertilizer market is strongly tied to the worldwide situation since more than 55% of nitrogen and 81% of potash used in the U.S. is imported (USDA-ERS, 2009), and the U.S. exports 44% of its phosphorus production. The costs to produce and transport fertilizers are highly energy dependent and thus tied to energy costs. Current energy costs for fertilizer producers are mixed, with energy costs overall remaining high but the cost of natural gas, used extensively for N production, declining in recent years.

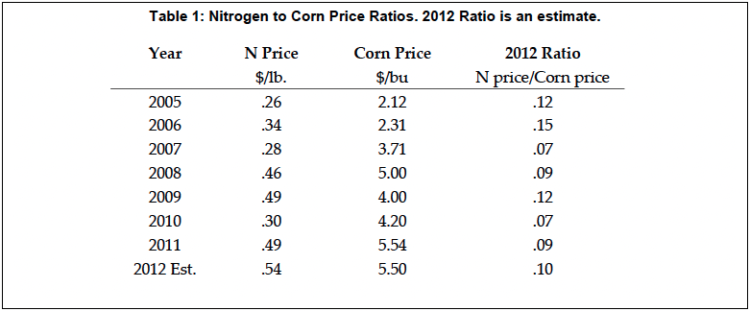

The optimal rate of a fertilizer to apply is influenced by: cost of the fertilizer, the value of the crop, and other factors. For nitrogen fertilizer on corn, a higher ratio of N price to corn price shifts the economically optimum N rate lower as suggested for 2012 relative to 2011 in Table (1).

Table 1: Nitrogen to Corn Price Ratios. 2012 Ratio is an estimate.

Seed/Genetics: Per-acre seed prices after quantity, early-pay, and other incentives are projected to be up for 2012 to $87-107 per acre for hybrid corn in our budgets and $62 per acre for GMO soybeans. The percentage of genetically modified corn acres in Indiana is increasing. According to USDA, 78% of the 2011 corn in Indiana was herbicide tolerant, compared to 15% in 2005, and 63% of Indiana corn acres this year were insect resistant. Ninety six (96) % of 2011 Indiana soybean acres were herbicide tolerant.

Pesticides: Prices for herbicides, insecticides, and fungicides to protect crops have been relatively flat in recent years. Prices for glyphosate-based herbicides fell in 2010 and again lower in 2011, and that isn’t expected to change substantially for 2012. It will be a mixed bag for other pesticides, depending on each particular market, but the overall trend appears relatively flat.

Energy: The Energy Information Administration predicts gasoline and diesel fuel prices to remain relatively flat going into 2012, following the steep uptick that occurred from 2010 to 2011.

Machinery: Farm machinery expenses have been increasing in recent years. Sales of smaller tractors across the industry continue to be affected by lingering housing and construction woes, but larger horsepower tractor and combine sales remain strong. Purchases remain strong for precision farming devices for efficiency with high-priced crop inputs, such as planter unit controls and sprayer boom section and nozzle controls that minimize overlaps in planting/spraying/fertilizing in turn rows, point rows, and along waterways and field borders.