Does No-Till Spark Lease Changes

December 16, 1993

PAER-1993-19

- H. Atkinson, Professor

Increased No-Till Acreage

A 1993 Purdue/SCS survey revealed an increase in Indiana no-till crop acreage of nearly a half-million acres or 18% since 1990. The no-till system was used on 25% of Indiana’s crop-land in 1993. The Purdue land values survey respondents estimated that 72% of Indiana farmers were no-tilling at least some of their acreage, and that a third of farmers had half or more of their acreage in no-till.

The ASCS/SCS conservation compliance provisions have been a factor in the adoption of reduced tillage practices but economics also has played a role. Fewer trips over the ground and lower horsepower requirements have generally resulted in lower total machinery cost. In addition, lower labor requirements reduce labor costs, and allow more acres to be farmed with the same labor. Only a part of these savings have been off-set by higher herbicide costs and, in some situations, slightly lower yields.

The Landlordʼs Question

Some landlords are asking whether changes should be made in 50-50 share leases. The argument goes like this: “My tenant plans to go to no-till next year. He will save on machinery and labor costs but herbicide costs will be higher. Under our present lease, I would pay for half the higher herbicide cost and would not share in the cost savings. In addition, any yield reduction due to minimum tillage would put me even further behind. How can I change our lease agreement so that I will at least be as well off as under conventional tillage?”

Are Lease Terms Changing?

The answer to this question varies, depending upon who answers it. A sample of the participants in the 1993 Top Crop Workshop at Purdue were asked the following questions:

- Have you changed tillage in the past 5 years? Ninety-four percent replied that they had changed.

- How has tillage change affected your lease changes? Of those who had made a tillage change, 94%said that the tillage change had not affected lease changes.

- How have your tillage changes affected your farm size? A little over 50% replied that farm size had increased while the remain-der reported no change in size caused by changes in tillage.

Answers to the third question support the assumption that changes in tillage may result in increased farm size. The way the first question was asked limits the usefulness of replies to the second question. Any kind of tillage change was the basis for an affirmative answer to the first question, not just reduced tillage changes. In fact a change from no till or ridge till to a more conventional system might have been included. Furthermore, these farmers might have made a tillage change on owned land but not on rented ground. Nevertheless, the results are a reminder that tillage changes do not inevitably lead to lease changes.

Several hundred appraisers, farm managers, farm lenders, extension educators, farm land brokers, farm operators, ASCS county directors, and farm land owners were asked in 1993 whether they had noticed changes in leasing arrangements because of the shift to no-till. Eighty-three percent of those responding said no change had occurred. Changes reported by the remaining 17% are listed as follows with the percent reporting:

➤ More cash rent or higher cash rent, 35% of those reporting changes. Individual comments included:

“50/50 share is no longer as popular. No-till costs the owner more. Cash rent bids are a little higher. Custom work is less expensive and easier to find good operators.”

“Some criticism by older land-lords that the farmer is doing less, one farm shifted from

2/3rd’s share to $95/acre cash rent.”

“Some farmers who no-till are paying more for land rent and increasing the acres they farm by 25% or more.”

➤ Increase the share of herbicide cost the tenant pays, 31%. Typical comments included: “Tenant pays more than 50% of the herbicide costs. My landlord and I agreed for 93 to add $1 to the 92 soy herbicide costs, and landlord pays 1/2 of that and I will pay the remainder.”

“Most that no-till pay for any burn down chemicals that may be applied.”

“Some no-till operators are paying a higher portion of chemical costs.”

➤ More custom drilling of beans and equipment leasing, 13%. Comments:

“All grower co-op outlets have new no-till drills and are contracting to drill soybeans for

$12.50/acre. Owners are doing their own soybeans without an operator on some small farms.”

“Local equipment dealers leasing more no-till drills and planters.”

➤ Reduce the harvest costs paid by share landlords, 7%.

➤ Miscellaneous, 14%. Comments:

“Sometimes results in change of tenants.”

“Adjusting from 50/50 to 55/45 or similar terms to adjust to equal return relative to investment.”

“Some landlords are requiring conservation plans, due in part to CRP.”

Suggested Changes

This same group was asked if they thought any change should be made in a 50-50 lease with a tenant who plans to adopt no-till on all the acre-age. A little less than half (44%) of the respondents thought no change should be made. Some of these replies pointed out benefits to the landlord (higher yields, erosion control). Others advised trying no-till for a few years before making changes and a few suggested that the tenant try to reduce costs or do a better job or production.

Following are selected comments by respondents who suggested no change.

“No change if the tenant is a good operator, manager, successful, good character, etc. A good tenant is worth something and since the net income will be little if any less, I suggest not to change.”

“Keep records for a year and com-pare. Then make changes in lease arrangements.”

“Leave the lease the same. The landlord will reap many benefits of no-till that saves money for him in the long run. Examples, less erosion, reduced soil compaction, better drainage, more organic matter, more wildlife, etc.”

“If you are happy with your current tenant keep him with his new proposal. The farmer is only trying to become more efficient. It is only the most efficient farmers who will be in business this century. If you have decided that you must have a new lease arrangement, be fair about it. Assuming your tenant is a good operator and steward of the land, he will have a sharp pencil as well. You may be better off to take just a little less and retain a good tenant than to get more and lose your tenant.”

In my opinion, your tenant using no-till practices is actually doing you a favor in the long run by saving your top soil and increasing the land’s productivity. Besides that, I don’t think that what the farmer is saving in machinery cost is going to make him rich. I would give the no-till some time to see what kind of effect it is going to have on the land, the bills and the crop yields before renegotiating the lease, but it might be a good idea to keep your tenant clued into the fact that you may need to renegotiate in the future.”

“From my personal standpoint, I’m glad to pay additional herbicide costs to offset his taking better care of my land investment.”

“If you’re happy with the tenant, and satisfied he’s treating you fair, you’d better leave him alone and let him farm.”

Six in ten of the suggested changes shifted more expense to the tenant, most often involving herbicides. These included “tenant pay for the burn-down,” “tenant pay 60% of herbicide,” and “establish a maxi-mum for landlord to pay.” “Reduce harvesting charge to landlord” was mentioned several times.

The remaining 40% of the replies suggested changing the type of lease, most often to cash. The 2/3 -1/3 arrangement was mentioned several times.

Finding a Solution – If There Is a Problem!

A rapid shift to no-till is occurring in Indiana. Changes in share leasing arrangements related to this shift are progressing at a slower rate. Opinion is divided as to whether no-till should or will result in changes in share leasing arrangements. One survey respondent wrote “We’re seeing a few landlords who only want to rent to producers who will no-till their farm and some who are the exact opposite!”

A number of survey respondents suggested basing lease changes on analysis of costs and returns. In Purdue publication ID-191 on the tillage economics of one planter farms, estimates are given for various tillage systems on three different soil types. Based largely on these estimates, and assuming a 50-50 share lease, comparisons were made as follows:

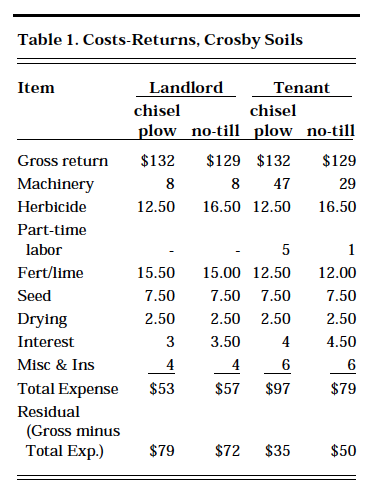

- Crosby and similar light, low organic matter, somewhat poorly drained silty clay loams, level to 6% slopes: fall chisel plow versus no-till, half corn/half soybean rotation; machinery overhead included in costs, real estate taxes and other land costs not included, no storage costs included; corn price, $2.40/bu, beans, $6.00/bu; corn and bean yields (bu/A) were, respectively, 122 and 39 with fall chisel and 120 and 38 with no-till. (Table 1)

Table 1. Costs-Returns, Crosby Soils

Based on these figures, the residual for the tenant would increase by$15.00 per acre and would decline by$7.00 per acre for the landlord. The tenant’s cost was $18.00 per acre less with no-till and gross return declined by $3 per acre. The landlord’s drop in returns resulted from an increase of $4.00 in costs and the $3.00 per acre decrease in gross receipts.

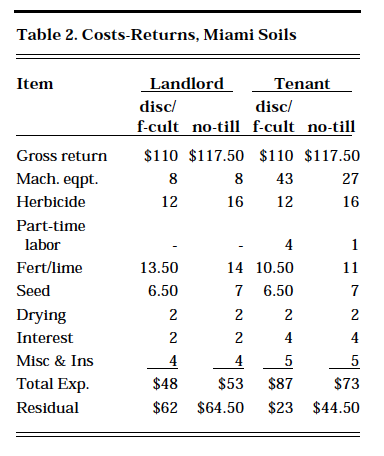

- By way of contrast, both the tenant and landlord gain (as was suggested by a number of survey respondents) from the shift from disc and field cultivator to no-till on highly erodible land (HEL) as follows: Miami and similar light (color and texture), sloping, eroded soils: disc/field cultivate versus no-till; corn and bean yields (bu/A) were, respectively, 101 and 33 with disc/field cultivate and 108 and 35 with no-till; other assumptions same as #1 above. (Table 2)

Table 2. Costs-Returns, Miami Soil

On this sloping, eroded land, yields increase about 10% (probably over a period of years), expenses drop by 7% and residual increases about 28%. Both tenant and landlord show an increase in their residuals; however most of the total increase in residual goes to the tenant ($21.50 of $24 total).

The two cases presented above illustrate the wide differences caused by soils in the results of changing to no-till. There also are wide differences in results obtained by different operators. (Some no-till operators claim their herbicide costs are no more than with conventional tillage; others experience weed and insect problems even with higher pesticide costs). Operator experience, know-how and equipment no doubt affect results. Finally, climatic conditions, either year to year or by location in the same year, affect results. All this causes uncertainty about no-till results and suggests that a true picture of an individual farmer’s operating results must be based on several years’ experience.

Conclusions and Suggestions

There is no easy answer, no “pat” answer to the question of whether or not changes should be made in 50-50 lease arrangements when no-till is adopted. Over a period of a few years, the land rental market will answer the question. In the meantime, tenants and landlords need to examine their own situation and try to arrive at a mutually agreeable arrangement. Listed below are suggestions which might be helpful in lease negotiations:

- Remember that one year’s results of no-till may not give a true picture and that the full effects may come over several years; however, operators need to know their costs and returns.

- Don’t over-estimate machinery cost savings. These savings may require several years to be realized, especially if conventional back-up machinery is retained until the new system is operating smoothly.

- Remember that machinery and labor cost savings which tend to allow an increase in acreage will be divided between the land-owner and the operator. Tenants will offer more cash rent or make concessions in share lease arrangements but they will not bid away all of the expected savings. They must be rewarded for the risks of making changes and the management needed to make them successful.

- On level to slightly sloping heavy soils, consider a change in the 50-50 agreement which would leave the landlord at least as well off after the shift to no-till as before.

- Tenant pays for burn-down or,

- Tenant pays the landlord a set amount based on

cost/return analysis. (This would allow the supplier to continue to bill on a 50-50 basis) or,

- Reduce the harvesting or trucking charges paid by the landlord to the tenant.

- On farms which consist of a mixture of some level, heavy soils and some HEL soils, review the lease with a view toward making changes which should be made regardless of tillage system. Plan to review the arrangement annually after beginning no-till and make appropriate changes.

- On farms with mostly HEL, landlords would be well advised to encourage tenants to change to no-till and consider changes in leases later. Both are likely to have higher returns and meet SCS conservation compliance requirements.

- If a satisfactory 50-50 agreement cannot be reached, consider cash rent. This may have special appeal to older landlords who are ready to give up some of the risk and responsibility of a share lease. A percentage lease might also be considered, 1/3-2/3, for example. Tenants should recognize that a cash or percentage lease involves more risk while, at the same time, providing the opportunity to retain the gains of superior management and innovation.

- Watch for new research results which will help determine the impact of no-till on yields, variability of yields and production costs.