Economic Impacts of Foreign Animal Disease

February 18, 2009

PAER-2009-4

Philip L. Paarlberg, Professor; Ann Hillberg Seitzinger, Agricultural Economist, U.S. Department of Agriculture’s Animal and Plant Health Inspection Service; John G. Lee, Professor and Kenneth H. Mathews, Jr., Agricultural Economist, U.S. Department of Agriculture’s Economic Research Service

Disease eradication from the U.S. livestock and poultry population has a long history. Research funded by the Program of Research on the Economics of Invasive Species Management (PREISM) uses a quarterly economic model of U.S. agriculture along with a disease spread model to examine hypothetical Foot-and- Mouth Disease (FMD) outbreaks. Economic impacts are determined by introducing animal de-population generated from epidemiological disease-spread modeling, NAADSM (Harvey et al.), and export restrictions. The complete analysis is available at www.ers.usda.gov/Publications/ers57/.

Initial cases are assumed to result from contaminated garbage fed on four small Midwestern swine operations. Few animals are infected initially. Off-farm movements are limited, so the most important vector for spreading FMD is local spread.

Three alternative control strategies are considered:

- direct-contact slaughter destroys only herds having direct contact with infected herds;

- direct- and indirect-contact slaughter destroys direct-contact herds plus those herds indirectly exposed to an infected herd; and

- destruction of all herds within a 1 km ring around infected herds.

The maximum number of animals killed is 77,582 head reflecting the assumption that the initial cases are in small swine operations with few off-farm animal movements. For the direct-contact slaughter control strategy, the shortest outbreak lasts 16 days, with the longest at 186 days. The average length is 56 days. Results for the direct- and indirect- slaughter strategy are similar. Ring-destruction scenario results differ. The mean length is 37 days and the longest outbreak is 64 days.

De-population shocks are inserted into the quarterly model of U.S. agriculture and the model is solved from the first quarter of 2001 through the fourth quarter of 2004. Several assumptions influence the results. One assumption is that U.S. exports of beef, pork, lamb meat, cattle, swine, and lambs and sheep are halted during the outbreak and for one quarter after the last case. Another assumption is that live‑ stock grower expectations of future returns are constant. Finally, U.S. consumers are assumed to know that transmission to humans is so rare that it is virtually nonexistent so there is no reduction in demand.

The results can be grouped into two sets:

- Standard outbreak scenario: Of the nine outcomes, seven are similar and are summarized using the results of the mean direct- and indirect-destruction.

- High outbreak scenario, consists of two outcomes that differ from the standard-outbreak scenario, but that are themselves similar. The high results are from the direct-contact destruction and indirect-contact destruction outcomes.

The primary factor separating the nine outcomes into the two groups is the duration. The out‑ comes of the standard outbreak scenario have durations shorter than one quarter. The high-outbreak scenario outcomes have outbreaks lasting into quarter 3.

Results

Because most of the animals destroyed are hogs, and exports of pork and hogs are restricted, those sectors show large impacts. The prices of pork and hogs fall because trade impacts are larger than depopulation shocks. First quarter pork prices fall from $63.33 to $53.26 per cwt, while prices of live hogs fall from $56.52 to $45.20 per cwt. Recovery to the baseline is completed by the sixth quarter.

Lower pork prices mean reduced return to capital and management in pork packing. By quarter 5 both scenarios converge on the baseline. Returns to capital and management for hog growers show large reductions in the first quarter. The second quarter decline is larger. By the seventh quarter returns to hog growers recover.

The beef and beef cattle sectors effects of the FMD outbreak are similar to those for pork and swine. The outbreak causes declines in the prices for beef and cattle. First- quarter cutout value for beef drops from $129.69 to $109.57 per cwt. The live-steer price falls from $79.17 to $64.69 per cwt. Ending export restrictions causes a price recovery.

Lower prices for beef and cattle lowers beef industry returns to capital and management. Returns to capital and management for beef cattle producers fall. With the end of U.S. export restrictions, returns begin to climb back to the baseline. By quarter 10, little difference remains. The number of lambs and sheep destroyed is negligible and the United States exports little meat or live animals. Thus, the impact on these sectors is not large.

The FMD outbreak has little impact on the price of milk because few dairy animals are destroyed relative to the size of the national herd, and no exports of dairy products are assumed banned. Net returns to capital and management in the dairy sector are largely unaffected.

Spillover effects on other commodities are not large because most of the effects are caused by export disruptions. Poultry meat and eggs are not directly affected. Prices weaken some in sympathy with beef and pork. Corn, wheat, and soybean prices decline slightly.

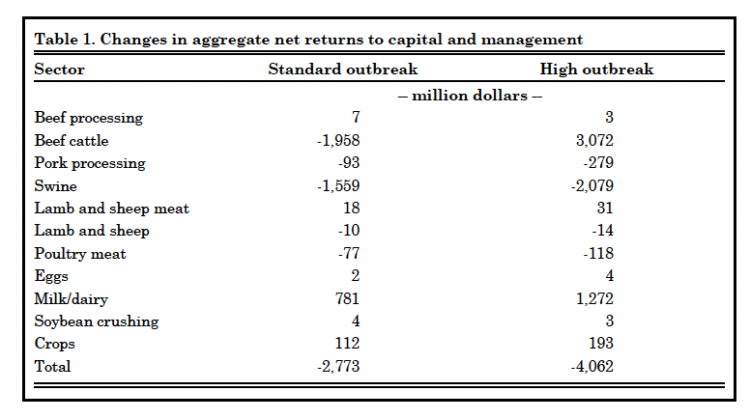

The changes in net returns to capital and management, summed over 16 quarters, give the cost to agriculture and (Table 1). Most effects occur in the first four quarters. The beef packing/processing and beef cattle sectors show the largest losses, with the combined losses ranging from $1,951 million to $3,075 million. Pork and swine sectors experience losses in returns of between $1,652 million and $2,358 million. Total losses to capital and

management amount to between $2,773 million and $4,062 million.

Table 1. Changes in aggregate net returns to capital and management

Conclusions

This article reports estimates of the economic impacts of hypothetical FMD outbreaks. The initial outbreaks arise from using garbage as feed in four small swine operations in the Midwest. Three alternative control strategies and three levels of disease-outbreak intensity are examined. Exports of beef, pork, lamb meat, cattle, hogs, lambs, and sheep are halted during the outbreaks, and for one quarter beyond the last case.

Epidemiological model results show small numbers of animals are destroyed. Nevertheless, the economic model results show large losses to capital and management resulting from the increased domestic supplies that occur with the loss of trade.

Because the loss of U.S. exports is linked to the length of an outbreak, control strategies reducing the duration of the outbreak dominate. Ring destruction reduces the length of an outbreak to less than one quarter. The mean- and low-outbreak cases for direct-contact slaughter and direct- and indirect-contact slaughter also reduce the outbreak to one quarter. But these control strategies exhibit situations where outbreaks last beyond two quarters. Total U.S. loss of net returns to capital and management ranges from $2,773 million to $4,062 million.

Variations could alter the results. Animal losses and length of outbreak are sensitive to assumptions about the type of outbreak. Under different assumptions, other control strategies could yield different results.

References

Harvey, N, A., Reeves, M.A. Schoenbaum, F.J. Zagmutt-Vergara, C. Dubé, A.E. Hill, B.A.

Corso, W.B. McNab, C.I. Cartwright, and M.D. Salman. The North American Animal Disease Spread Model: A simulation model to assist decision making in evaluating animal disease incursions, Preventive Veterinary Medicine (2007), doi:10.1016/j.prevetmed.2007.05.019, in press.

Paarlberg, P.L., A. Hillberg Seitzinger, J. G. Lee, and K.H Mathews Jr. Economic Impacts of

Foreign Animal Disease. Economic Research Service ERR-57. Economic Research Service, U.S. Department of Agriculture. Washington, DC. May 2008.