Electricity Deregulation in Indiana

September 13, 2000

PAER-2000-17

Adair Morse, Ph.D. Candidate and Zuwei Yu, Ph.D., State Utility Forecast Group*

Regulation of electricity in the United States has ensured that service remains reliable and that sufficient quantities of electricity are provided to every industry and household at a price deemed reasonable by the regulating agency. In 1996, the Federal Energy Regulatory Commission (FERC) issued Order 888, which requires states to open electricity transmission lines to wholesale competition. In other words, all electricity generators should have equal access to transmission services. By forcing states to implement whole-sale competition, the FERC hoped that utilities would be able to lower costs to consumers while yet ensuring reliable service.

A natural step from wholesale competition in electricity is to deregulation in the power generation industry. Since open access to trans-mission lines will bring about generator competition, there may be no need for electricity generators to remain regulated. States have the authority to choose both whether electricity generation should be deregulated and how such deregulation should take place. The reality for most states is not whether deregulation should happen, but when and how it should take place. Some states, especially the high-cost states like California and New York, have not only implemented wholesale deregulation, but also have begun to promote retail competition in which there is competition among utilities for individual accounts. In Indiana, the proposed restructuring plan has failed twice in the General Assembly in the past few years because different interest groups have been unable to agree upon a path to deregulation.

This article briefly lays out the justification for the national deregulation of electricity generation, summarizes the current state of the Indiana electric power industry, explores the impact of deregulation on prices, and finally draws some implications for Indiana’s rural consumers.

National Deregulation of Electricity Generation

Generally, industries are regulated under one of two scenarios. In the first scenario, it is not considered efficient for more than one firm to provide a product or service. With electricity, it is awkward to think that two com-panies would build separate net-works of electricity wires in the same region. The other scenario for regula-tion occurs in industries for which a basic standard of service is mandated by the government. The electricity market fits under this description as well. Regulation ensures that elec-tricity service is reliably provided during the course of the day and that quality standards are met. These standards include voltage, frequency, stability, etc.

So why deregulate electricity? The answer is that it is the transmission and distribution of electricity that require regulation and not the generation itself. In the future, while a single transmission company within a region will deliver power and maintain electricity lines, electric power generation companies may compete either consumer-by-consumer to generate the electricity for each account or in a pooled marketing setting. In some states, this is already a reality, and pilot programs for retail choice are being tested. But why would consumers want this to happen?

Most economists argue that regulation raises prices to consumers. This occurs because the regulating agency fixes consumers™ prices based on the value of the assets of the regulated power company; this method allows for a fair rate of return on these assets. Thus, the firms have an incentive to buy expensive capital equipment and facilities that may be beyond a cost-effective level of investment.

In the U.S., regulated electricity provision is inefficient in its state-level orientation. Trade of electricity from states with low costs of generation (Indiana) to states with high costs of generation (Illinois) has been hindered by restrictions caused by individual state-level regulations. Thus, each state has continued to expand facilities to meet the demand for electricity within its own boundaries. In a fully competitive regional climate, consumers could buy cheaper power directly from a neighboring state.

Finally, regulation may not encourage innovation, particularly by smaller independent firms. Advances in new technologies, especially in natural gas turbine generation, offer relatively affordable and often environmentally friendly generation alternatives. These technologies may be fairly easily adapted by industries or communities as an alternative to purchasing electricity from larger generations when the market price rises at peak supply periods.

However, there are no certainties that deregulation and the ensuing competition will bring lower prices that typically accompany greater efficiency. The following example may illustrate this idea.

In electricity generation, nuclear and coal-fueled power plants can economically generate a steady stream of electricity. However, these facilities cannot easily increase or decrease output. Thus, electricity generation companies also build natural gas-fueled power plants that can be cheaply turned on or off to meet peak periods of demand Πthe hottest hours in the summer and the coldest hours in the winter. At peak periods, most power plants are generating electricity at maximum capacity. The few remaining gas plants can be in a position to charge high rates for the extra production.

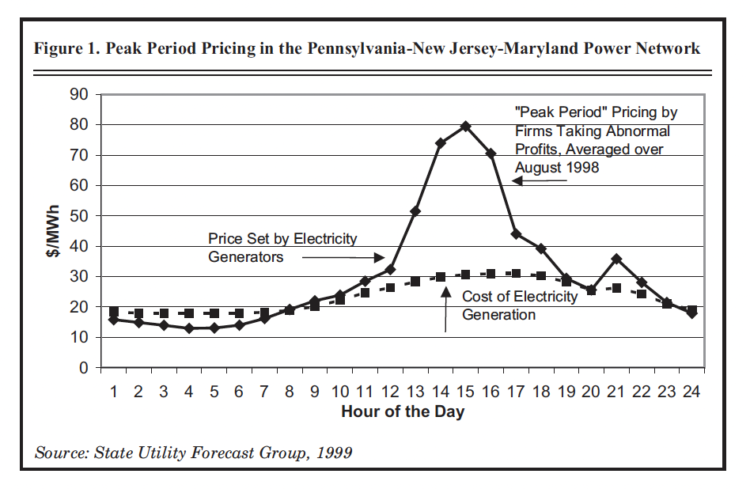

This peak pricing phenomena, shown in Figure 1 for summer peak demand in Pennsylvania, New Jersey, and Maryland (the PJM Power Pool), has occurred in most deregulated electricity environments. In such a situation, peak power generators may be able to take advantage of little competition and thus to take large profits at consumer expense. It would seem logical that new plants might be built if there were opportunities to profit from peak demand. This would in turn lower the ability of firms to implement peak pricing strategies. However, both the short duration of the peak periods and the uncertainty of the market may dis-courage new firms from entering the market, leaving existing peaking units unchecked as profit makers.

Indiana Electricity Generation

In 1997, Indiana was ranked as the 8th lowest cost generator of electricity among the fifty states. Neighboring Kentucky generates electricity even more cheaply than Indiana, and Illinois and Ohio run higher cost generators. Indiana’s low-cost position stems from the abundant availability of coal and from the early development of low-cost generating facilities to take advantage of the coal supplies.

In theory, Indiana™s low electricity prices should be significant in drawing high power-using industries into the state. Lawmakers would like to preserve this ability to attract businesses to build (and keep) facilities in Indiana. Forecasts for Indiana electricity prices by the State Utility Forecasting Group (SUFG) at Purdue University predict a slight decline in the real price of electricity over the next 7 years if the market were to stay regulated. Where Hoosiers may have a choice concerning regulation, interstate commerce laws will not allow states to insulate themselves from exports or imports from other States. Thus, depending on the speed of deregulation in other states, this forecast may be short-lived, and low prices in Indiana may be influenced by higher prices in other states.

At the same time, Indiana’s demand for electricity is supposed to continue to grow more than the projected expansion in electricity generation. Thus, the fear that the currently proposed generation additions largely may not be built on time heightens concerns over future supply shortages, particularly during peak periods.

Impact of Deregulation in Indiana

The SUFG has forecast that deregulation may initially lower consumer prices in Indiana as competition among producers ensues, if there is no artificial manipulation of electricity market prices. However, the long-run price level may in fact be higher than the current prices. As mentioned, power generation companies may be able to extract profits at high peak periods. They may also be able to raise prices at other times in the day if they can somehow coordinate their pricing schemes among firms without breaking antitrust (cartel) laws. Finally, prices may be higher in Indiana simply because other states will want to buy more of the less expensive electricity from Indiana and bid up the price.

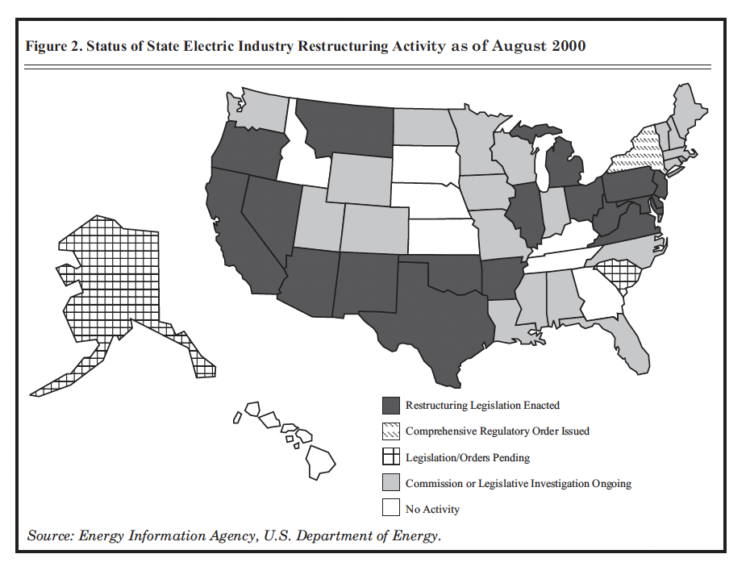

As shown in Figure 2, Kentucky and Indiana have not yet legislated electricity deregulation, but Illinois and Ohio are both quickly moving to deregulate. This is a logical progression. Consumers in Illinois and Ohio would face lower prices if electricity generators from Indiana and Kentucky were allowed to sell more electricity in neighboring states. The downside of this situation for Hoosiers might be that as local generators begin selling more electricity to other states, the supply of less expensive electricity left over for Indiana consumers would grow smaller and smaller, forcing prices to rise.

However, a trade-induced increase in price will likely occur even in a regulated environment! As demand in other states rises, local power companies will want to build more facilities. Indiana consumers may find themselves paying for these new projects via regulated prices.

Figure 1. Peak Period in the Pennsylvania-New Jersey-Maryland Power Network

For example, Indiana electricity generators may expand capacity to meet not only the growing shortages in Indiana but also electricity demand from other states. New facilities, however, are built with newer, more expensive technologies than those in existing assets of generation firms. The total value of all facility and equipment investment would naturally rise, and more importantly, the average investment for each megawatt (MW) of electricity would also increase. Recalling that regulators set consumer prices based on the assets of firm, even with new revenues from other states, price increases would be warranted. The accuracy of this scenario regulators to decipher which assets are exclusively for export generation and the power of the regulators to balance this information against generators™ requests for rate increases. It may be that the Indiana Utility Regulatory Commission can exclude generation assets used for exports when calculating a fair price to charge Indiana consumers.

In these examples, the selling of less expensive Indiana electricity to other states may have the detriment of increasing local prices. However, there is a benefit for Hoosiers in trade scenarios as taxable revenues are brought home from sales in other states and as (a limited number of) new jobs are created in the expansion of generation.

Some Hoosier legislators are concerned that consumers may see higher prices in the near future due to the trade impact. But lawmakers have no intention of implementing deregulation until they can be sure that generators will act competitively. Collusion and peak pricing are the key concerns to be addressed before deregulation will occur.

Consumer Pooling

How does all of this affect the Indi-ana consumer? Consumers must be prepared for the reality of a deregulated environment. The large Indi-ana industries (automobiles/parts, steel, etc.) will be able to contract directly with generators and get the lowest prices possible. (This already is occurring.) However, the small users of electricity, particularly in rural areas, are potentially exposed to high prices because the quantities demanded are less, and the distances between consumers are greater. One option here involves the pooling of consumers.

The existence of rural electricity cooperatives in some areas may offer some relief to higher prices for widely dispersed consumers. Already such organizations have pools of clients/owners which may be able to negotiate with the deregulated electricity companies for more favorable pricing. Other types of pooling organizations may be yet to form. The State of Indiana believes that new breeds of utility marketing firms will develop that also serve this pooling function, contracting consumers and re-selling these accounts to generators while taking a margin of profit. This is much like the early years following the telephone deregulation.

Risk management will play an important role for buyers and resellers of electricity. Even large industries may have a future need for firms specializing in managing risk. Electricity cannot be stored; therefore, if peak pricing does occur, energy consumers usually can-not just altogether stop using electricity. Generators may offer incentives to consumers or resellers who use less electricity in peak periods. Yet this voluntary cutback in peak demand may not entirely solve the potential for severe price fluctuations. Thus, the role of electricity resellers may evolve to a role of risk management. If contracts with end-users of electricity bind resellers to sell at a particular price, these middlemen may bear the burden of price fluctuations. Option and insurance markets to smooth electricity prices are already in development and early use stages.

There are great difficulties involved in predicting the dynamics of competition in a consumer market for electricity that has never existed. In the coming months and years, Indiana cannot afford to miss the opportunity to learn from other states that are already encountering some of these transformations.

Summary

The lessons of the Indiana electricity situation might be the following:

- Hoosiers should encourage the state to ensure that deregulated utilities are not allowed to extract abnormal profits in periods of high demand before Indiana embraces deregulation. However, in doing so, Hoosiers should be sensitive to two dangers:

- Too much interference in producer profit potential may dis-courage investment in capacity planned for export. This in turn will lower possible bene-fits for the state such as additional tax revenues or creation of new job opportunities.

Figure 2. Status of State Electric Industry Restructuring Activity as of August 2000

- Hoosiers should be aware of the dangers of fighting possible higher prices associated with the trade of electricity across state lines. Continued regulation will not fully protect price levels from increasing as Indiana generators expand sales in other states. Instead, Indiana may hinder efficiencies that come from a competitive environment. This may be even more important as federal nitrogen oxide (NOx) emissions laws are implemented by 2003. The new environmental laws will increase the cost of running Indiana’s old line coal genera-tors and may force the remodeling or even the closure of some plants. Deregulation may encourage quicker adoption of new, environmentally improved technologies both by large generators and by individual industries or communities.

- In the coming environment of electricity competition, consumers should be proactive in thinking about how their business and personal electricity accounts can be pooled for price discounts in the age of competition. In doing so, however, both industrial consumers and pooled groups should understand the cost and role of risk management that this new environment demands.

More information on deregulation of electricity in the United States as a whole or in Indiana in particular can be found on the Internet at the following sites.

State Utility Forecast Group

http://www.ecn.purdue.edu/IIES/SUFG

Indiana Utility regulatory Commission

http://www.ai.org/iurc/

http://www.state.in.us.iurc/energy/

U.S. Department of Energy http://www.eia.doe.gov

* This article does not reflect the views of the State Utility Forecast Group or any other organization. The opinions represented are solely the judgments of the authors.