Estate and Gift Tax Changes in the Taxpayer relief Act of 1997

January 12, 1998

PAER-1998-01

Gerald A. Harrison, Extension Economist

The Taxpayer Relief Act of 1997(TRA ‘97) includes hundreds of changes to the Internal Revenue Code (IRC). This discussion deals only with federal estate and gift tax provisions with backgrounding and a discussion of selected 1997 changes.

The family-owned business interest exclusion (FOBE), IRC Section 2033A, was added. FOBE piggybacks on the newly expressed “applicable exemption amount (AEA).” Starting in 1998, a total exclusion (AEA + FOBE) of $1.3 million is possible if there is an FOBE election of at least$675,000.

Table 1. Unified Federal Gift and Estate Tentative Tax Schedule

Special use valuation (SUV) (IRC Section 2032A) for farm and ranch land is an important estate tax feature with amendments in the TRA ‘97. The SUV law permits tax avoidance by a reduction in the estate value of up to $750,000. Note that while Indiana Inheritance tax law increased the exemption to $100,000 for each “Class A” beneficiary on July 1, 1997, neither SUV nor FOBE reduces the Indiana inheritance tax value.

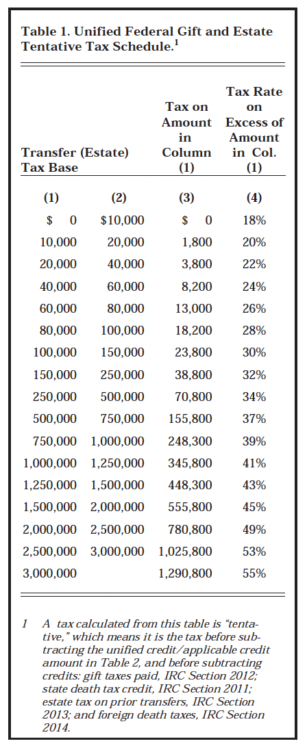

Knowing how federal estate tax is calculated is important. First, allow-able deductions (debt on assets in the gross estate, fees to settle the estate, last illness and burial expenses) reduce the gross estate. Next taxable lifetime gifts are added to get an “estate tax base.” A tentative estate tax is calculated from the estate tax base. The unified credit, $192,800 in 1997, is subtracted —which effectively shields$600,000 of estate tax base from the federal estate tax (Table 1). For decedents’ estates in 1998, the “applicable credit amount” of $202,050 will shield $625,000 of estate tax base (Table 2).

In 1997, before the new provisions, an “estate tax avoidance window” for an individual farmer was$1,350,000 (the $600,000 equivalent exemption, and up to $750,000 under SUV). In 1998, with the new family-owned business interest exclusion, there may be an “estate tax avoidance window” for the individual farm business owner of $2,050,000 ($625,000 + $675,000 + $750,000).

However, these provisions, along with market and minority interest discounts (attained from conventional and sophisticated business and estate planning), may shield an individual’s estate of more than $2 million from the estate tax. Sophisticated planning generally involves the control of: resources, management, and the transfer of interests.

Unified Credit/Applicable Exclusion Amount

In 1977, Congress replaced the estate and gift tax exemptions with a unified credit. This was done with a unification of the federal estate and gift tax rates into one schedule

(Table 1).

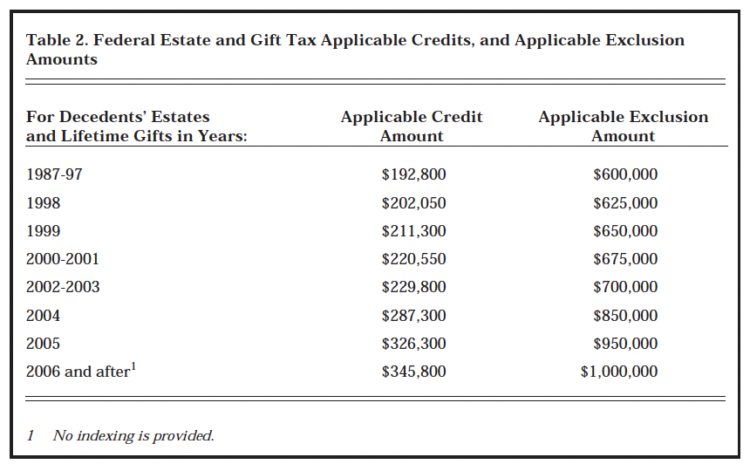

The estate value that may escape federal estate tax (or gift tax on adjusted taxable gifts) increased from $600,000 to $625,000 for 1998. TRA ‘97 added increases in the unified credit in increments. In 1999 the “equivalent exemption” is $650,000, with additional increases until the year 2006, when the equivalent exemption (renamed the “applicable exclusion amount”) is $1 million (Table 2). Perhaps, in respect for the popular use of the term “equivalent exemption” to define the estate tax-free amount, Congress specified the “applicable exclusion amounts

(AEAs)” listed in Table 2. An AEA amount corresponds to an “applicable credit amount (ACA).” An ACA is the estate tax on a given AEA (Tables 1 and 2).

Congress has increased the unified credit in increments, but they did this in terms of targeted AEAs shown in Table 2. The tax on $625,000, is $202,050, and that is the ACA in 1998. The ACA is subtracted from a decedent’s tentative estate tax. In 2006, the applicable credit amount is $345,800— a 79 percent increase over $192,800, the unified credit for 1987-97. There is no provision for adjusting the AEA for inflation (indexing).

Basic estate planning suggests that for an individual decedent’s estate at least the AEA should be subjected to estate tax, knowing that the ACA will cancel the tax on the AEA. In marital estate planning, a “credit trust” accepts at least the AEA rather than let that additional value go to a “marital trust.” Those assets qualify for the marital deduction and avoid estate tax in the estate of the first spouse to die, but they may remain in that spouse’s estate and are later subject to the estate tax.

Estate planners may add to the credit trust exempt or excluded amounts. This might be land that qualifies for special use valuation rather than let those assets go to a surviving spouse. Otherwise a surviving spouse’s estate may attain a high value and may be exposed to estate tax.

Other estate tax law provisions, besides the credit, allow additional sums of “net wealth” to pass to heirs without an estate tax. One such pro-vision is the new “family-owned business interest exclusion” for such interests that pass to qualified heirs. Also, special use valuation reduces the value of land in the decedent’s estate tax estate.

Special Use Valuation Background:

The special use valuation (SUV) law is an important estate tax avoidance feature for individuals and families with land in farming or ranching. SUV law was amended in many ways in 1981. Changes took effect in 1982 or were retroactive to the beginning of SUV in 1977. Regulations, court cases, IRS rulings, and TRA ‘97 changes make SUV very workable. SUV takes on extra significance because many definitions and requirements for SUV apply for the new FOBE presented below.

Table 2. Federal Estate and Gift Tax Applicable Credits, and Applicable Exclusion Amounts

If there is an election to use the SUV formula for farmland, the land in a decedent’s estate is valued using a formula rather than the fair market value(FMV). The valuation formula is a five-year average of actual cash rents minus the land taxes for comparable soils in the community. That numerator is divided by a five-year average of the “federal land bank” interest rate. The cash rent information (numerator) is usually assembled by a professional appraiser, and the interest rate is calculated by the Internal Revenue Service each year for estates in that year. For example, a decedent’s farmland yields a numerator of $130. The denominator for decedents’ estates in 1997 in Indiana is 8.39%. This SUV example gives nearly $1,550/acre ($130/.0839) for farm-land that may have an FMV of $3,000/acre. The alternate value is 52 percent of the fair market value.

It takes less than 520 acres with this amount of value reduction to exhaust the $750,000 SUV “reduction limit” for a decedent’s estate. Land in a prime location for homes, shopping centers, and industry may have an FMV of $5,000/acre or more.

Adding the SUV reduction limit of$750,000 to the individual’s equivalent exemption amount of $600,000 for 1997 equals $1.350 million. A couple that equally divided their property interest could shield $2.7 million (2 x’s [$750,000 + $600,000]) from the federal estate tax. They could achieve this result with mini-mum planning and with modest requirements for the qualified heirs. The qualified heirs must use the land in an agricultural business for at least ten years beyond the death of the individual whose estate contained the land. Note that the SUV value on land is the income tax basis of the land. Thus, if the qualified heirs sell the land that is subject to SUV, there is more capital gain income than if the income tax basis is stepped-up to the fair market value on the date of the decedent’s death. Capital assets that are part of the gross estate will generally have a new income tax basis set at the date of death fair market value.

To qualify for SUV, the requirements on the estate of the decedent who owned the farm land include:

(1) 50 percent of the adjusted value of the decedent’s estate must be farm business assets—personal or real property;

(2) 25 percent of the adjusted value of the decedent’s estate must be real estate;

(3) The decedent must have been a U.S. citizen or resident at the time of death and the land must be in the U.S.;

(4) The decedent or a member of the decedent’s family must have owned the qualifying real property, and have had the property in a “qualified use” for periods totaling at least five years out of the eight-year period ending on the date of the decedent’s death where:

- qualified use means the decedent must have been “at risk,” —a share lease and not a cash rental;

- a family member may satisfy the “at risk” requirement for the decedent (i.e., cash renting to his or her child or other family member is permissible); and

5) There must have been “material participation” (MP) in the operation (or leasing) of the farm for five of the last eight years the decedent lived or MP for the decedent by a family member of the decedent. Social Security dis-ability or retirement suspends the decedent’s MP requirement.

A family member for SUV includes: a spouse, ancestors, and lineal descendants of the individual (decedent whose estate is considering the SUV election) as well as the descendants of the individual’s spouse and the descendants of the individual’s parents and the spouse of any of those in the mentioned categories.

Material participation (MP) for these purposes is MP for self- employment tax (See Farmer’s Tax Guide, IRS Publication 225, for MP guidelines). Generally, an individual satisfies MP by having authority over the annual production process and exercising this authority while sharing in expenses in a crop-share lease. This conduct is in contrast to a typical cash-rent agreement.

A farm family, with the next generation continuing to operate the farm, may have little difficulty in qualifying a decedent parent’s or grandparent’s land for SUV. Due to a 1981 SUV amendment, a landowner may gain or maintain eligibility though cash renting to his or her family member—with the operating family member satisfying the “at risk” and MP requirements.

A retired farmer on Social Security (SS) may satisfy the at-risk requirement by maintaining a crop share lease with a tenant who is not his or her family member. There is no requirement for a landowner on SS retirement income (or on SS dis-ability) to materially participate.

However, qualified heirs—family members of the decedent who receive the interests in the SUV land from the decedent’s estate—also have at risk and MP requirements. It has been the law that a family member of a qualified heir may satisfy the MP requirement for a qualified heir, but not the at-risk requirement. This means that the lease on the land under an SUV election generally would have to be a crop-share lease. Qualified heirs of a decedent were required to share lease rather than cash rent to a family member. The share lease satisfies the at-risk requirement, but it does not require a qualified heir to MP if the tenant is a family member of the qualified heir.

The land must be kept in the special use (farming) for at least ten years following the death of a decedent to avoid recapture of the estate tax savings. Recapture may be pro-rata where part of the land under an SUV election is sold or transferred to someone other than one of the qualified heirs or a member of a qualified heir’s family. Generally, SUV requirements for the qualified heirs are flexible enough to allow continuation of a farm business without major problems.

The 1997 Amendments.

One requirement viewed as a problem was that qualified heirs had to be at risk—requiring a crop-share rather than a cash-rent lease. TRA ‘97 amended the SUV law to permit qualified heirs who are lineal descendants of the decedent to cash rent to a member of the lineal descendant’s family. The lineal descendant’s family members are the same categories of relatives of the qualified heir as the term is defined above for the decedent. This means, for example, that children of a decedent whose estate has elected SUV may cash-rent to their brother or to their brother’s child without being in violation of the at-risk requirement.

The cash-rent amendment is retroactive to the beginning of the SUV law, January 1, 1977. Estates that may have been declared in violation of the at-risk rule and experienced a recapture event may be entitled to a refund.

A second SUV amendment relaxes the burden on an executor to have “substantially complied with the applicable regulations” with the original election for SUV. Effective August 5, 1997, if the SUV election or recapture agreements do not contain all the required information or signatures, an executor may supply the missing information or signatures within ninety days of being notified by the IRS.

TRA ‘97 also makes it clear that granting a conservation easement will not cause recapture of the estate tax savings from an SUV election. Likewise, SUV may be elected though the land may be subject to a conservation easement.

Family-Owned Business Interest Exclusion

Introduction: The “Family-Owned Business Interest Exclusion”

(FOBE), IRC Section 2033A, is a potential estate-tax saver for decedents’ estates holding qualifying family business interests. FOBE is effective for qualified decedents who die after December 31, 1997. The FOBE is not preferential to agriculture, though many farmers’ and ranchers’ estates may benefit.

If a decedent’s estate is qualified for the FOBE, the exclusion is a reduction in the estate tax gross estate. This is similar to the impact of the SUV provision. However, the SUV provision, in effect, provides for a reduction in value for a specific asset (land). The FOBE permits an exclusion of value associated with both real and personal property used in a qualified trade or business inter-est. In the farming context, besides land, FOBE includes: machinery, equipment, livestock, crop inventories, and cash needed in the business.

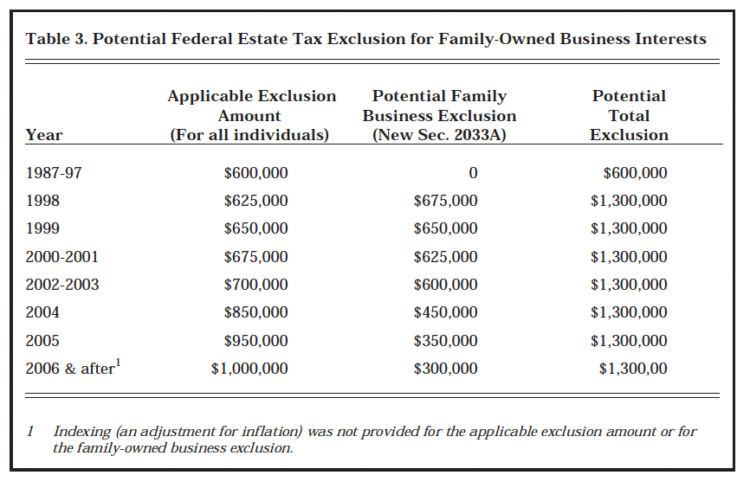

Exclusion Amount: The total possible FOBE for decedents in 1998 is $675,000. That amount, added to the $625,000 applicable exclusion amount, provides a potential total exclusion of $1.3 million (Table 3). The $1.3 million is a constant in the law—without indexing for inflation. By the year 2006 and after, the maximum FOBE is reduced to $300,000, when the applicable exclusion amount is $1 million.

Qualified Family Business Interests: FOBE is available to a decedent’s estate for any interest in a trade or business with a principal place of business in the United States, regardless of the form in which it is held. It also must be true that ownership of the trade or business is held at least 50 percent by one family, 70 percent by two families, or 90 percent by three families, as long as the decedent’s family owns at least 30 percent of the trade or business.

Members of an individual’s family are defined in the same way as for the SUV law discussed above.

For a trade or business that owns an interest in another trade or business, “look-through” rules apply. Each trade or business owned (directly or indirectly) by a decedent and members of the decedent’s family is separately tested to determine whether that trade or business meets the requirements of a qualified family-owned business interest.

A decedent’s corporate interest in a trade or business does not qualify if his or her stock or securities were publicly traded at any time within three years of the decedent’s death. An interest in a trade or business does not qualify if more than 35 per-cent of the adjusted ordinary gross income of the business for the year of the decedent’s death was “personal holding company” income (see IRC Section 543).

Table 3. Potential Federal Estate Tax Exclusions for Family-Owned Business Interests

Eligibility Requirements: Several conditions placed on the decedent’s family business interest to qualify for the FOBE are very simi-lar to or the same as those for the SUV law discussed above. FOBE law considers all family-owned trades and businesses, not just farms and ranches.

A personal representative must elect to use the FOBE and file an agreement of personal liability for repayment of the tax benefits. First, the decedent must have been a U.S. citizen or a resident at the time of death, with the principal place of business in the United States. Second, the aggregate value of the decedent’s qualified family-owned business interests passed to qualified heirs must exceed 50 percent of the decedent’s adjusted gross estate (the “50 percent” test). A “qualified heir” also may include any individual who has been actively employed by the trade or business for at least ten years before the date of the decedent’s death.

The 50 percent test is applied by adding all the transfers of qualified family-owned business interests made by the decedent to qualified heirs at the time of the decedent’s death, and certain lifetime gifts of qualified family-owned business interests made to members of the decedent’s family, and by comparing this total to the decedent’s adjusted gross estate. All the decedent’s qualified family-owned trade or business interests are aggregated for purposes of applying the 50 percent test. For this test, assets are valued at fair market value even though the estate may be electing SUV. To know whether the decedent’s “qualified family-owned business interests” are 50 percent of the decedent’s adjusted gross estate, a numerator and denominator must be established.

The numerator includes the aggregate of all qualified family-owned business interests that are includable in the decedent’s gross estate and are passed from the decedent to a qualified heir, plus any life-time transfers of such interests by the decedent to members of the decedent’s family (other than to the decedent’s spouse). Such interests must have been held continuously by members of the decedent’s family and must not have been otherwise includable in the decedent’s gross estate.

For this purpose, transfers are valued as of the date of the transfer. All indebtedness of the estate reduces the above amount except debt on a qualified residence, debt incurred to pay educational or medical expenses of the decedent, of his or her spouse, or of his or her dependents, and any other indebtedness up to $10,000.

The denominator is the gross estate of the decedent reduced by estate indebtedness and increased by lifetime transfers of qualified business interests made by the decedent to members of the decedent’s family (other than to his or her spouse) if the interests were held continuously by members of the family, and transfers (other than de minimis transfers) from the decedent to his or her spouse within ten years of death, and any other transfers made by the decedent within three years of death except nontaxable transfers made to members of the decedent’s family. From a planning point of view, post death sales of trade or business assets must be monitored to prevent the failure of an FOBE election.

The value of a trade or business qualifying as a family-owned business interest is reduced to the extent the business holds passive assets or excess cash or marketable securities. A qualified family-owned business interest does not include any cash or marketable securities in excess of the reasonably expected day-to-day working capital needs. Day-to-day working capital needs are to be based on the average of the business’ needs in the past as set forth in prior Tax Court holdings. Certain other passive assets that will not be included as qualified trade or business interest are assets that:

(1) produce dividends, interest, rents, royalties, annuities, income equivalent to interest, and any other passive types of income (personal holding income);

(2) are interests in trusts or partner-ships;

(3) produce no income;

(4) give rise to income from commodities transactions or foreign currency gains; or

(5) produce income from notional principal contracts or payments in lieu of dividends.

The above exclusions lead to the conclusion that cash-rent lease activity by the decedent or by qualified heirs will not be considered a qualified trade or business, regardless who the lessee may be. That is, assets producing “rents” may be excluded from FOBE eligibility. Will a nonmaterial participation crop-share lease allow an otherwise eligible business interest to qualify?

Further, the decedent or a member of the decedent’s family must have owned and achieved material participation (MP) in the trade or business for at least five of the eight years preceding the decedent’s retirement, disability, or death. The MP requirement is similar to the SUV test. MP for this purpose is presumably the MP required to make net income from a trade or business subject to the self-employment (SE) tax. Further, MP cannot be achieved by an agent on behalf of a landowner or qualified heir for FOBE purposes just as it cannot for SUV or SE-tax purposes.

Recapture Rules: Once there is an election to benefit from FOBE, there are requirements to avoid having the resulting estate tax savings recaptured. There is a recapture tax, if within 10 years of the decedent’s death and before a qualified heir’s death, a recapture event occurs.

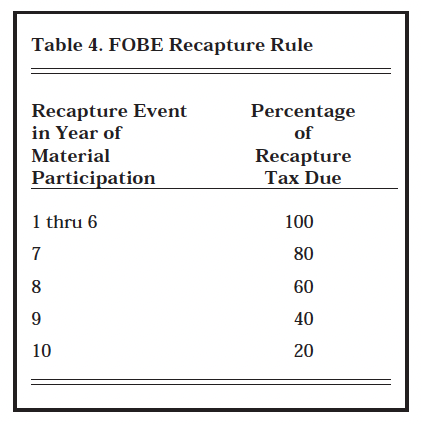

Table 4. FOBE Recapture Rule

An important requirement placed on the qualified heir(s) is that of MP. If the qualified heir or a member of the qualified heir’s family fails to materially participate for more than three (3) years in any eight (8) year period ending after the decedent’s death, that causes recapture.

Table 4 shows the percentage of the tax savings from FOBE that will be recaptured based on the number of years the qualified heir (or members of the qualified heir’s family) materially participated after the decedent’s death.

To illustrate, if the qualified heir has materially participated in the trade or business after the decedent’s death for less than six years, when the qualified business interest is transferred or another recapture event occurs, 100 percent of the qualified heir’s proportionate savings from the FOBE is subject to recap-ture. If the participation was for more than six years, but less than seven, 80 percent of the savings may be recaptured.

FOBE rules follow SUV law in allowing “active management” in lieu of material participation for selected qualified heir(s) who may be: a surviving spouse, a full-time student, an heir under age 21, or a disabled per-son. Active management requires less involvement than material participation. Material participation for FOBE purposes is the same as for SUV purposes. This means the mate-rial participation set-out as a required involvement in a trade or business activity such that self-employment tax must be paid on the net returns from that activity. In farming, we know material participation as involvement in the production management with oversight authority along with a tenant and contribution to costs.

There is a two-year grace period after the qualifying decedent’s death that permits a non-business status. After the end of the grace period, the 10-year recapture period starts.

Recapture is triggered if a qualified heir transfers a portion of his or her FOBE interest to someone other than a member of the qualified heir’s family or through a qualified conservation contribution.

Planning for the FOBE

It is clear that Congress contemplates the conduct of a business, and there is a material participation requirement. However, unlike SUV rules, FOBE rules do not state an explicit qualified use or at risk requirement. FOBE rules do provide for a family member of the qualifying decedent and a family member of a qualified heir to fill the material participation requirement. Will FOBE have a higher standard of business involvement than for the SUV law, or the same requirement?

Until there is additional information from FOBE regulations or amendments to the law, the safe haven for the retired farmer is to have a share lease with their family member engaged in material participation for that activity, preferably, but not necessarily, as the operating tenant. Qualified heirs in the post-death period will likely be required to do at least as much, i.e., be involved in a crop-share lease rather than a cash-rent lease. If a qualified heir is not in MP activity, he or she will be required to have a family member material participating on his or her behalf. The rules could turn out to be more restrictive than this, and there is language in Congressional Reports that suggest less restrictive behavior could suffice, such as, a decedent qualifying for FOBE that was cash renting to a family member who was materially participating. The statement of the FOBE law is not consistent with statements in Congressional Reports that presumably reflect the intent of the law makers.

FOBE rules have features to deal with various family business and estate planning arrangements. Business interests may be in various forms and tiers of interests, though most farm businesses are not as com-plicated as the FOBE rules.

Gift transfers of family business interests may account for significant parts of what was a decedent’s business interest. These prior transfers in the hands of qualified heirs at the death of a family business owner may also be included to satisfy the 50 percent test to permit an estate to receive a FOBE. While FOBE rules anticipate estate planning and com-plex business arrangements, there is still a concern over an individual’s asset mix since certain non-business assets will not count in the numerator to establish the required 50 percent.

There is a requirement to be in a “trade or business,” without defining the term for FOBE purposes. There is also a trade or business requirement for the estate tax installment plan for a closely-held trade or business. In that context, cash rent arrangements will not suffice. In this case, trade or business requires continuity and regularity of activity, and the activity seeking to qualify must bear both production and price risk. Individuals, retired from farming or otherwise leasing their land, who wish to be eligible for FOBE, may be wise to shift from a cash rental to a crop-share lease.

FOBE rules make it clear that the material participation requirement for an otherwise qualified decedent or a qualified heir in a post-death period may be satisfied by a family member. In many cases, the family member, to satisfy the MP requirement, may be the same person for the qualified decedent and the qualified heir.

A farm business may involve a farmer’s child with a long-term lease and with the first right to buy under a “buy-sell” agreement. The family member(s) who is “heir(s) apparent” to the family business will typically have sisters and brothers “outside” the business. The same family member(s), may fill the MP requirement for both a qualified decedent and qualified heir(s).

If the potentially FOBE-qualified decedent may satisfy the trade or business requirement with a share lease that does not require material participation, he or she can avoid the SE tax on his or her net farm earnings. If the retired farmer is in the early years of retirement, before age 70 1/2, and the lease does not involve material participation, the income arising from the lease does not encumber his or her Social Security entitlement. The qualified heir may also be retired in the post-death period, and may have a family member satisfy his or her material participation requirement.

Material Participation: Another valid concern may be what and how much activity is required to satisfy the material participation for FOBE purposes. The FOBE law refers to the SUV law for the definition of material participation. SUV law refers to the SE tax concept of material participation. The Farmer’s Tax Guide, IRS, Publication 225, includes four alternative tests to establish when there is material participation for self-employment (SE) tax liability purposes.’

Test 1 of the four alternatives states, “You do any three of the following: (a) pay or stand good for at least half the direct costs of producing the crop; (b) furnish at least half the tools, equipment, and livestock used in producing the crop; (c) consult with your tenant; and (d) inspect the production activities periodically. The typical crop-share lease would have (a), (c), and (d) if the landowner wishes to materially participate for SE tax purposes. A crop-share lease that seeks not to have MP would not provide (c) and (d). It is apparent from examining all four of the tests that they provide considerable flexibility in achieving material participation.

It also should be noted that an agent, such as a professional manager, who is involved in the decision-making process on behalf of a landowner cannot have his or her activities go to the credit of the land-owner for material participation purposes. Yet it is true, as stated above, that family members (where anyone else could not) may meet the MP requirements for both qualified decedents and heirs under both SUV and FOBE rules. However, an individual who may be required or desires to materially participate may engage an agent (such as a farm manager) to assist in his or her decision-making responsibilities.

In 1980, final Treasury Regulations were adopted under IRC Section 2032A. Regulations regarding material participation for Section 2032A are summarized with the following points: there must be an oral or written arrangement, to “advise and consult” with the farm operator.(No specific number of days or hours of such activity was imposed.); regular inspection of production activities; operating funds must be “advanced;” financial responsibility assumed for a substantial portion of the operating expense; and providing a substantial portion of the machinery, implements and livestock used in production activities is considered important, but not mandatory.

Regulations for SUV narrow the choices compared to what is provided in The Farmer’s Tax Guide. How-ever, Kelley, et. al., point out in Estate Planning for Farmers … that the Section 2032A Regulations “appear to go beyond the statutory authority to implement the material participation requirement.”

A material participant must actually perform the necessary tasks. Documentation of a landowner’s MP might be made part of the tenant’s responsibilities in the lease.

It is understood that the FOBE will be available in conjunction with estate value determinations that arise from minority interest and marketability discounts and estate value reduction due to electing SUV on farm or ranch land.

The FOBE is not a change in the valuation of property involved (as is the case with SUV of land): it operates independently of the valuation of the business itself. Kelley (cited above) concludes, based on case law and the language of the FOBE law, that the fact that the business interest being valued under FOBE law is adjusted for marketability and lack of control, should have no effect on the application of the FOBE in electing estates. It appears that the reduction in gross estate value due to FOBE is in addition to the value reduction from SUV. This conclusion is based on a Committee Report that says the new FOBE is in addition to the unified credit, the SUV value reduction, and the provision for installment payment of estate taxes attributable to a closely held business interest.

Until we learn more from new regulations or amendments and IRS interpretations from actual FOBE situations, family businesses and their counsel should plan based on what we understand.

Interest on Installment Payments

The IRC Section 6166 provides a low interest installment plan for paying the estate tax associated with a closely held business interest of up to$1 million. Only the interest on the tax due must be paid for four years after death with 10 years of install-ment payments to follow. Previously, the interest rate was four percent. Under the prior law, the tax on the$1 million at the four percent rate was reduced by the unified credit.

TRA ‘97 sets the interest rate at two percent for the unpaid balance of estate tax on the first $1 million of closely held business assets. Further, the two-percent rate is available on the tax associated with up to $1 million in assets above the applicable exemption amount (less the applicable credit amount). In 1998, the two-percent portion is the estate tax attributable to the value of the closely-held business between $625,000 and $1,625,000.

However, interest at this lower rate is no longer an estate or income tax deduction. Also, the $1 million for which tax installments apply at the two-percent interest rate is indexed under the new law. The two percent rate is effective December 31, 1997.

A higher interest rate that applies for underpayment of federal taxes was available on installments for the estate tax associated with closely held assets in an estate above $1 million. The underpayment rate is the federal short-term rate plus three percentage points. TRA ‘97 sets this higher rate at 45 percent of the rate applicable to under payments of tax.

Under the TRA ‘97 amendments, those who have installment payments under IRC Section 6166 prior to 1998 have a one-time election before January 1, 1999 to switch to the two-percent rate. This may be done only for the installment amount under the prior election and not for the expanded amount of tax possible under the revised law. Further, if there is an election at the lower rate, the interest is no longer deductible.

Conservation Easement Estate Tax Exclusion

A conservation easement given to a charity or qualified organization

(such as a land trust) is excluded from inclusion in the federal estate tax gross estate. However, this exclusion from the estate tax gross estate does not relate to the remaining value of the land that gives rise to a conservation easement. TRA ’97 adds a limited estate tax exclusion for the value of land subject to a conservation easement—but only for selected qualified conservation easements.

After December 31, 1997, their may be an exclusion of up to 40 per-cent (the “applicable percentage”) of the value of the land after it has been reduced in value below the fair market value by the granting of the conservation easement. The maxi-mum amount that can be excluded is the lessor of the applicable percent-age or the “exclusion limitation.” Exclusion limits are: $100,000 in 1998; $200,000 in 1999; $300,000 in 2000; $400,000 in 2001; and

$500,000 in 2002 and thereafter.

The “applicable percentage” is a maximum of 40 percent. It is reduced by two percentage points for each percentage point (or fraction thereof) by which the value of the qualified conservation easement is less than 30 percent of the total value of the land.

To illustrate the above rule, con-sider a landowner who died with a conservation easement on his or her land. The fair market value of the land at death before considering the easement is $900,000, and with the easement it is $700,000. The $200,000 easement is 22.22 percent ($200,000/$900,000) of the total value. Since the rule requires a 16-percent reduction (twice the difference between 30 percent and 22 percent) in the applicable percentage, there is an applicable percent-age of 24 percent. Twenty-four percent of $700,000 gives an exclusion of $168,000.

For the land to qualify for this exclusion, the land must be located in or within 25 miles of a metropolitan area or a national park or wilderness area, or in or within 10 miles of an urban national forest.

A post-mortem conservation easement may be placed on the property, provided the easement has been granted no later than the date of the election for this new exclusion.

Further, a contribution of a permanent conservation easement on property qualifies for a charitable deduction for estate and income tax purposes despite the retention of a mineral interest. This is a change from prior law. Previously a charitable contribution was available if subject to a retained mineral interest only if the mineral interest was separated from the land prior to June 13, 1976.

Gifts from a Revocable Trust Within Three Years of a Grantorʼs Death Planning with living trusts entails moving many assets into the trust for lifetime asset management and death-cost minimization purposes. Many who follow this strategy want to continue to make gifts during their lifetime. Under the unified gift and estate tax rules, present interest gifts above

$10,000 per calendar year to an individual are added back into the gift-maker’s estate tax base valued at the time of the gift. The individual’s gifts within the $10,000 annual exclusion, however, avoid the estate tax calculation, including most gifts within three years of death.

Because of the intricacies of IRC Sections 2038 and 2035, the IRS maintained that gift transfers from a revocable living trust were not the same as if made personally by the trust grantor. The IRS position was that the grantor could only do what he could do personally if the assets to be gifted were first removed from the trust—otherwise, such gifts directly from the grantor’s trust assets would be included in his or her gross estate, even if they were within the annual$10,000 exclusion.

TRA ‘97 makes it clear that a grantor’s gift from his or her living trust is not included in the grantor’s gross estate, even though it was made within three years of the gran-tor’s death. Instead, transfers from a living trust are treated as made directly by the grantor.

Repeal of the Excess Distributions and Accumulations Excise Tax

While few individuals may have con-fronted the 15-percent excise tax, this tax was poised to levy on those who had qualified retirement plans, tax-sheltered annuities, and IRAs that totaled $160,000, or more, in 1997. This tax was not only to levy on “excess” annual distributions

(indexed for inflation) but also “excess accumulations” of retirement funds (in addition to the federal estate tax). TRA ‘97 repealed both of these 15-percent excise taxes in order to dismiss what was labeled a “success tax.”

Inflation Indexing of Certain Estate and Gift Tax Provisions

After 1998, selected limitation amounts in the estate and gift tax law may be adjusted upward for inflation. These items include:

(1) the $10,000 annual gift tax exclusion;

(2) the $750,000 “special use valuation limit” under IRC Section 2032A;

(3) the $1 million generation-skipping tax exemption; and

(4) the $1 million of assets which sets the reduced interest rate ceiling under IRC Section 6166, which provides for the closely-held business estate tax installments.

Adjustments for inflation are made by comparing the increase in the Consumer Price Index (CPI) in the preceding year with the CPI for 1997. The factor for the adjustment is the percentage increase deter-mined by this comparison. The gift tax annual exclusion must increase by the next lowest multiple of $1,000. The other three items can only increase by the next lowest multiple of $10,000.

To illustrate, if the CPI for 1998 is 200.4 and for 1997 is 195.2 the inflation factor is 1.026693 (1998 CPI divided by 1997 CPI). That multi-plier times the $750,000 value reduction limit in Section 2032A gives $769,979. After rounding to the next lowest $10,000, the new limit would be $760,000.