Farmland Taxes: The Coming Dilemma of Higher Taxes and Lower Crop Incomes!

August 7, 2014

PAER-2014-9

Larry DeBoer, Professor

Property taxes for most Indiana residents have gone down, but not for farmland owners. Since 2007 Indiana property taxes have dropped by 15%. Why? The sales tax increase in 2008 provided about a billion dollars to help fund the elimination of school general fund property taxes reducing property tax rates. The tax caps voted into the Constitution in 2010 have reduced tax bills by another $780 million. Thus, homeowner property taxes have fallen 39% since 2007 primarily due to big homestead deductions. Tax caps and lower rates kept property taxes on rental housing and businesses almost unchanged during that time.

However, property taxes on agriculture have risen 33% since 2007.

The Rising Base Rate per Acre

The reason for this big tax hike has been the rise in the assessed value of farmland. The base rate is the starting point for farmland assessment. It’s a statewide dollar amount per acre calculated each year by the state’s Department of Local Government Finance. The base rate is then adjusted for each acre by its soil productivity index and influence factors, if any.

The base rate was $880 per acre for taxes in 2007. For taxes payable in 2014, its $1,760, exactly double. For taxes payable in 2015, the base rate per acre will be higher still, at $2,050.

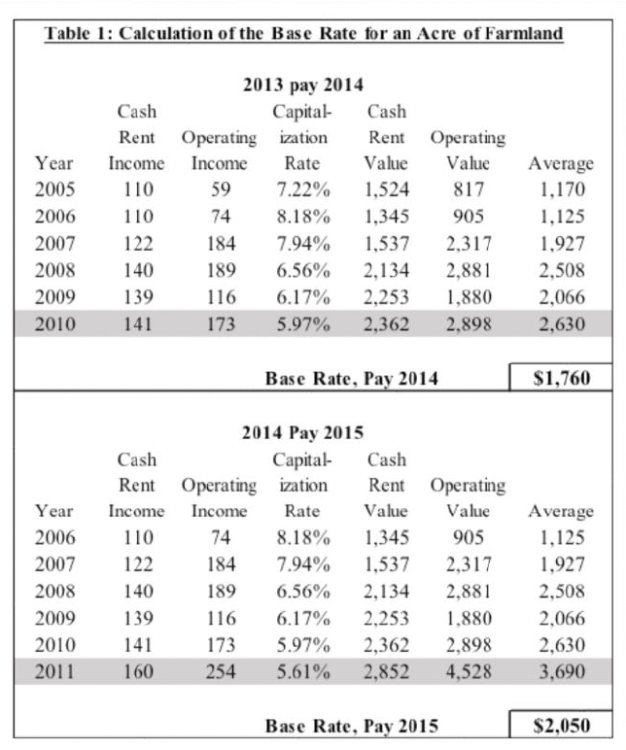

Table 1 shows details of the base rate calculations for taxes in 2014 and 2015. The calculation is a capitalization formula, which divides two different measures of income per acre by a rate of return to estimate how much an investor would pay for an asset yielding that income. The calculations sound complex so it really helps to look at Table 1.

Table 1. Calculation of the Base Rate for an Acre of Farmland

Cash rent income per acre is the first income measure and comes from the Purdue Department of Agricultural Economics land value survey completed each June. Operating income is the second and is a calculation of corn and soybean bean prices times yield per acre, less costs. The capitalization rate is the average of the interest rates for farm operating loans and for real estate loans, as reported by the Chicago Federal Reserve. The calculations use data from six years, which enter with a four-year lag (that is, the latest data used for 2014 taxes is from 2010). For each year, the two income figures are divided by the capitalization rate, and the resulting values are averaged. The highest value for the six years is dropped, and the average of the remaining five is rounded to the nearest ten dollars to determine the base rate.

The base rate is recalculated each year. For 2015 taxes, for example, the Department of Local Government Finance rolled the years forward, dropping the data from 2005 and adding the data from 2011, see Table 1. The average capitalized value for 2011 was $3,690, by far the highest of the six, so it was dropped from the base rate calculation. The remaining five years were averaged to get $2,050, a 16.5% increase from the previous year. The increase occurred because the calculation dropped the 2005 average of $1,170 and added the 2010 average of $2,630.

The base rate is rising because the recent income figures are higher, and recent capitalization rates are lower, than the earlier figures. Rents and commodity prices were higher in 2010 and 2011 than they were in 2005 and 2006. More recent interest rates are lower as well.

Problems Coming for Land Owners

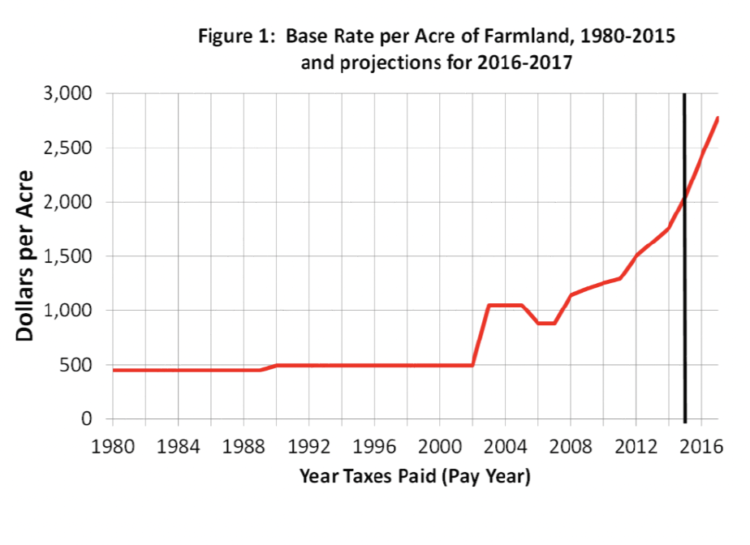

The four-year lag of data entering the formula means that Indiana agriculture may be entering a multiyear period of rising base rates and higher real estate taxes at a time when actual crop returns are sharply reduced starting with the 2014 crops. We can estimate changes in the base rate through pay-2017 with data already in the books. Assuming no change in the calculation formula, the base rate for taxes in 2016 will be about $2,420, an 18.0% rise from 2015. The base rate for 2017 will be about $2,770, another 14.5% increase. The increases occur because the very low 2005 and 2006 values are dropped from the calculation, while newer much higher values are added in. Figure 1 shows the base rate from 1980 through the 2017 estimates.

Lower actual incomes starting in 2014 will not help to potentially reduce the base rate until 2018 because of the four-year lag.

Figure 1. Base Rate per Acre of Farmland, 1980-2015 and projections for 2016-2017

Policy Alternatives and Consequences

What could be done to ease the coming tax burden on farmland? There are policymakers who would like to lessen further increases in farmland assessments and farmland property taxes, but, assessment policy is restricted by three

facts: (Note: the author is not an attorney, but is basing these comments on the State Constitution!)

1. Policy is restricted by the Indiana Constitution. Article 10 Section 1 of our Constitution requires “a uniform and equal rate of property assessment and taxation” and “a just valuation for taxation of all property, both real and personal.” This article has been amended to create exceptions for household property, intangible property, motor vehicles, homesteads, inventories, personal property—but not farmland. This restricts the exemptions, deductions or credits that might be used to reduce farmland property taxes. 2. Policy is restricted by the Supreme Court’s 1998 market value decision. In December 1998 the Indiana Supreme Court decided the “Town of St. John” case, which forced a change in the way Indiana assessed property. The court required that assessments be based on “objective measures of property wealth.” Every number in the current base rate formula is objective, in the sense that it comes from an authoritative source outside the assessment system. And capitalization is a recognized method of determining property wealth. While it has not been challenged in court, the current formula seems defensible under the Town of St. John criteria. This restricts changes that might be made in the base rate formula.

3. Policy is restricted by the nature of the property tax. The property tax is a tax on the value of property. The value of farmland has been increasing faster than the values of other property types. So property taxes on farmland will increase, because that’s how a property tax works.

Given these restrictions, what policy alternatives could be used to slow the growth in farmland property taxes? And, what would be the consequences for other taxpayers, and for local government revenues?

The tax caps voted into the Constitution in 2010 do not reduce the tax bills on farmland by very much. This is because taxes are capped at 2% of gross assessed value before deductions. Most rural tax rates are less than $2 per $100 assessed value, so the cap does not apply. Further, as the base rate rises, the cap rises too. The cap does not prevent tax bill increases when the cause of the increase is a rise in assessed value.

The Constitution does say that taxes on farmland may not exceed 2% of gross assessed value. The cap could be set lower. A cap of (say) 1.75% would cut property taxes for many farmland owners. It would also reduce the revenues received by a large number of rural local governments. Farmland owners would pay less, and rural governments would have less to spend on local services.

Gross and net assessed value are nearly equal for farmland, because there are no deductions. In contrast, homestead net assessed value is less than half of gross assessed value, because of the large deductions that homeowners receive on their houses. The Constitution allows homestead deductions, but might not allow deductions simply aimed at reducing farmland taxes. There is no farmland exception to the uniform, equal and just requirements in the Constitution.

Perhaps deductions for other public policy purposes could be devised for farmland, like the economic development deductions and abatements on business property. Such deductions would reduce taxable assessed value and raise tax rates. Farmland owners would pay less, but other taxpayers would pay more, and if they hit their tax caps, local governments would lose revenue. Another approach could be to attempt to reduce other taxpayer deductions. Most homeowners receive a $45,000 standard deduction, and a 35% supplemental deduction on the assessed value that remains. These are the deductions that reduce homestead taxable or net assessed value to less than half of gross assessed value.

If homeowner deductions were reduced, assessed value would increase and tax rates would fall. Homeowners would pay more, other property owners would pay less. Some local governments would receive more revenue, since lower rates would reduce the tax bills of non-homestead property below their caps. Other local governments would receive less revenue, because more homeowners would hit their caps. Of course, homeowners would object to higher taxes, and they make up a majority of voters in almost every legislative district.

The property tax is the problem for farmland owners. Property taxes could be reduced by shifting local revenues to other taxes. Since the early 1970’s Indiana has been shifting local taxation away from property taxes, towards state sales and local income taxes.

Higher local income tax rates to reduce property tax rates would decrease the property tax bills of all property owners, but increase the tax payments of all taxable income earners. Most farmland owners would pay less in combined property and income taxes, but most renters and employed homeowners would pay more. Lower property tax rates would mean less revenue lost to tax cap credits for local governments.

Some policymakers recognize the difficulties that ever-higher property taxes could cause farmland owners. The next few years could be a period of falling farm incomes while taxes continued to rise, because of the lags in the base rate calculation. The high capitalized value of 2013 will first enter the base rate calculation in 2017, and will still be influencing the base rate in 2022.

The Indiana farmland tax dilemma may prove hard to avoid. All policymakers recognize the multiple difficulties of solving this problem: There are Constitutional difficulties; Farmland does not appear to be eligible for special treatment under our Constitution; There are revenue difficulties; Under the tax caps, any policy that raises property tax rates will reduce local government revenues; and there are distributional difficulties because if farmland owners pay less tax, somebody else will generally pay more.