Growing the Pork Industry: Exports to China

March 12, 2016

PAER-2016-3

John Lai, Graduate Research Assistant and H. Holly Wang, Professor

The U.S. pork industry has had to face numerous complex challenges over the past decade including an era of high feed prices and the porcine epidemic diarrhea virus (PED) in late 2013 and 2014. In 2015 and 2016 the industry has responded to lower feed prices by expanding production and has recovered from PED. As a result of these events, per capita pork consumption has recovered from a low of 46.4 pounds in 2014 to over 50 pounds for 2016. After two years of rapid recovery, long-term projections from the USDA (Westcott & Hansen, 2015) suggest more moderate, but continued gains over the next 10 years.

One likely avenue for that future growth can be found in exports. Given the importance of China as a buyer of food commodities in recent years there have been multiple studies examining their pork market and also studies to better understand their pork consumers.

There was much optimism in the U.S. a few years ago regarding the potential for greater pork exports to China and Hong Kong, but the actual results are more mixed. China primarily produces their own pork. In 2015, 98.5% of their pork supply was domestically produced and only 1.5% was imported. In addition, imports have stayed near 1.5% of supply since 2011, indicating only small import growth.

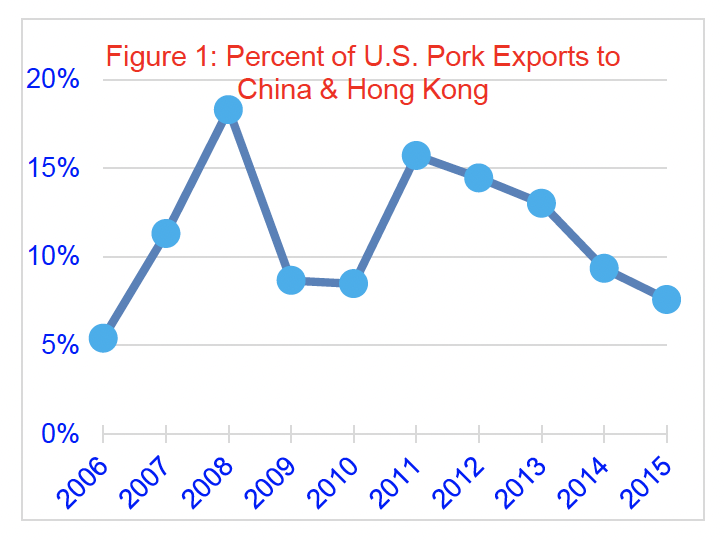

Figure 1 shows the percent of U.S. pork exports that moved to China and Hong Kong combined. In the two peak years, there was a lot of U.S. excitement as those two countries represented 18% and 16% of total U.S. pork exports. However by 2015, the importance of China and Hong Kong to the U.S. export program dropped to 8%. The volume of pork exports from the U.S. to Hong Kong peaked in 2008 and has fallen since while the volume of pork exports to China peaked in 2011 and has fallen since.

Figure 1: Percent of U.S. Pork Exports to China & Hong Kong

In recent years, China and Hong Kong combined are buying more total pounds of pork from the world, just not as much from the U.S. This means that other pork producing countries have been getting more of the Chinese/Hong Kong business. Two likely reasons are the PED virus that cut U.S. production in 2014 and resulted in record high U.S. pork prices in 2014 and 2015. In addition the U.S. dollar has been strong relative to other currencies since 2014 and this has tended to make U.S. pork less competitive relative to other pork exporting countries.

Get to Know Chinese Consumers

If the U.S. is going to grow the Chinese/Hong Kong markets then a better understanding of consumer taste and preferences will be helpful. The goal is to carefully match pork export products for each segmented market. Here I review some of those findings.

David Ortega and his colleagues at Michigan State University along with Holly Wang at Purdue University found that consumers in China differ from those in Hong Kong. In China, more attention is paid to the freshness and packaging of pork and therefore domestic produced pork is preferred. On the other hand, consumers in Hong Kong prefer pork from developed countries like the U.S. and consider the meat to be of higher quality than meat from mainland China. Regardless of whether the pork is domestic or foreign, food safety is considered the most important indicator of pork quality for both regions, a belief that has been strengthened in recent years due to numerous Chinese food related scandals.

Another study examined Chinese consumers’ preferences and willingness to pay for traceable food quality and safety attributes. Researchers at the Synergetic Innovation Center of Food Safety and Nutrition found that government certification was the most important quality indicator for consumers. Murphy et al (2015) explains that consumers also had strong preferences for very fresh-looking pork with traceability information which includes the farm source and slaughtering, processing and marketing information.

Finally, a study conducted by the Center for Meat Safety and Quality at Colorado State University showed that for 70% of Chinese importers, the price was considered as highly influential in where they buy pork, while only 20% of importers in China and Hong Kong considered the exchange rate as a deciding factor. Wu, et al. (2015) explains that the same group defined food safety as using government, or third party certifications.

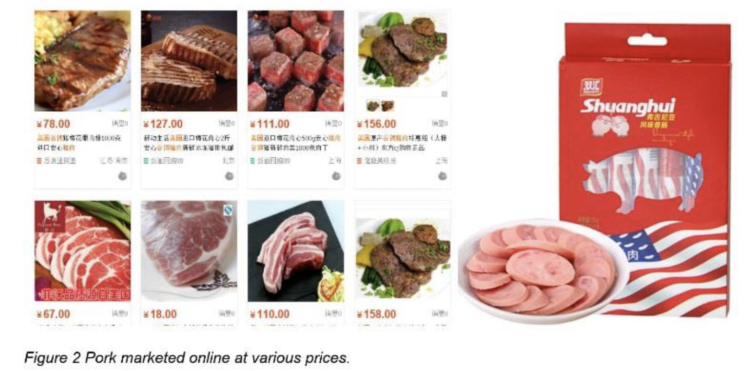

Although many pork products imported from developed countries are considered safer and of higher quality than domestically produced pork, Chinese consumers have misinformation about U.S. pork such as its dull taste, the use of growth hormones, and ractopamine. For these reason, Wang, argues that it is difficult for U.S. pork to compete with Chinese traditional pork in the retail market directly. Instead, it may be more beneficial to promote U.S. pork as a high-end, high-value product. Figure 2 provides two examples of U.S. pork products sold on-line in China. The cuts shown are from different vendors, they all are in western style instead of the traditional Chinese style, and each are priced quite high.

Shuanghui is the signature brand for WH Group that acquired U.S. based Smithfield Foods and specifically indicates the flavorful product is from Virginia. This promotes the image that U.S. pork is for Chinese consumers seeking an upscale western lifestyle.

There is an increasing need for U.S. pork exporters to connect with pork importers in the international arena. China and Hong Kong provide a market with a growing middle class who are seeking a higher quality and safer source of pork. However, there are other pork exporting countries seeking the same markets. For U.S. exporters to be successful they must understand the expectations of pork importers in China and Hong Kong and simultaneously fill the needs of those consumers.

Figure 2. Pork marketed online at various prices.

References

Westcott, P., & Hansen, J. (2015). USDA Agricultural Projections to 2024. United States Department of Agriculture.