Hay Ground, and On-Farm Grain Storage Rent

August 16, 2017

PAER-2017-13

Authors: Craig Dobbins, Professor of Agricultural Economics and Kim Cook, Research Associate in Agricultural Economics

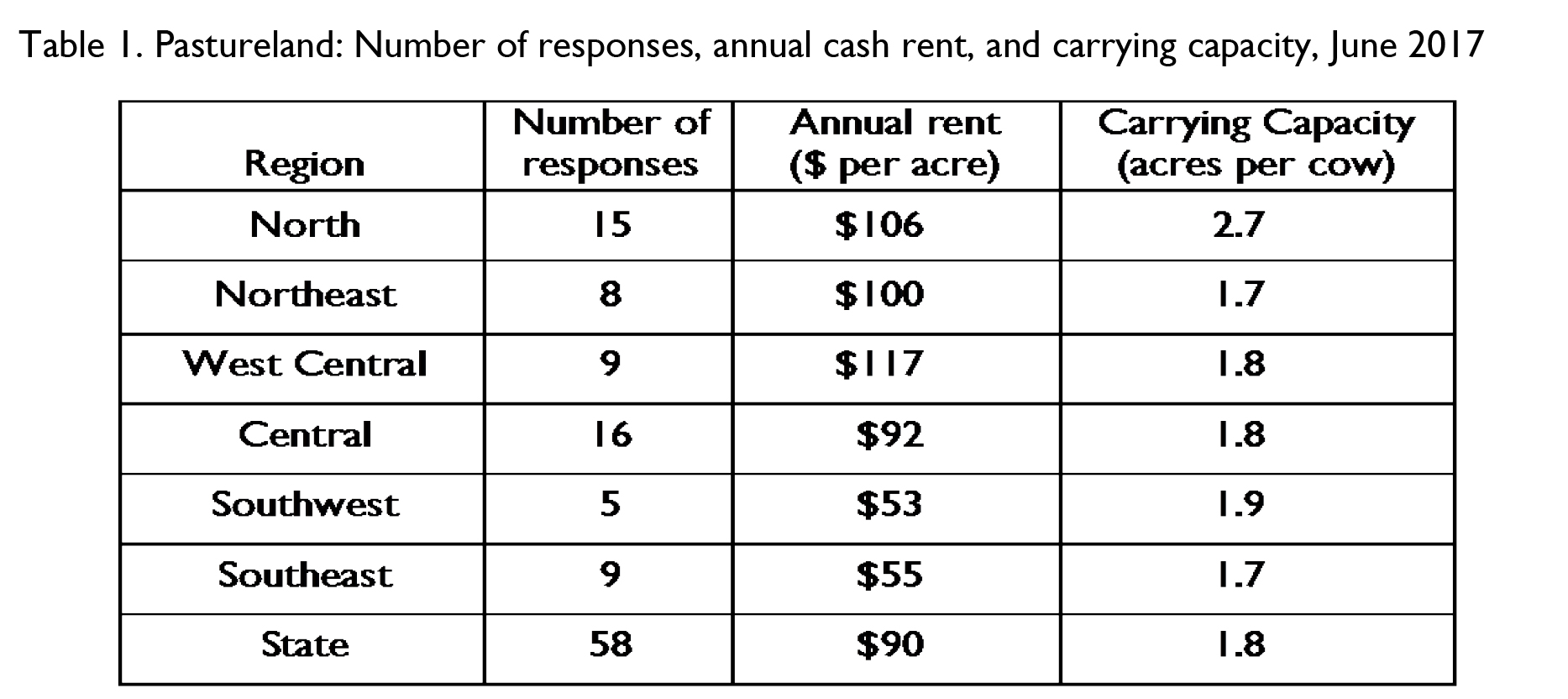

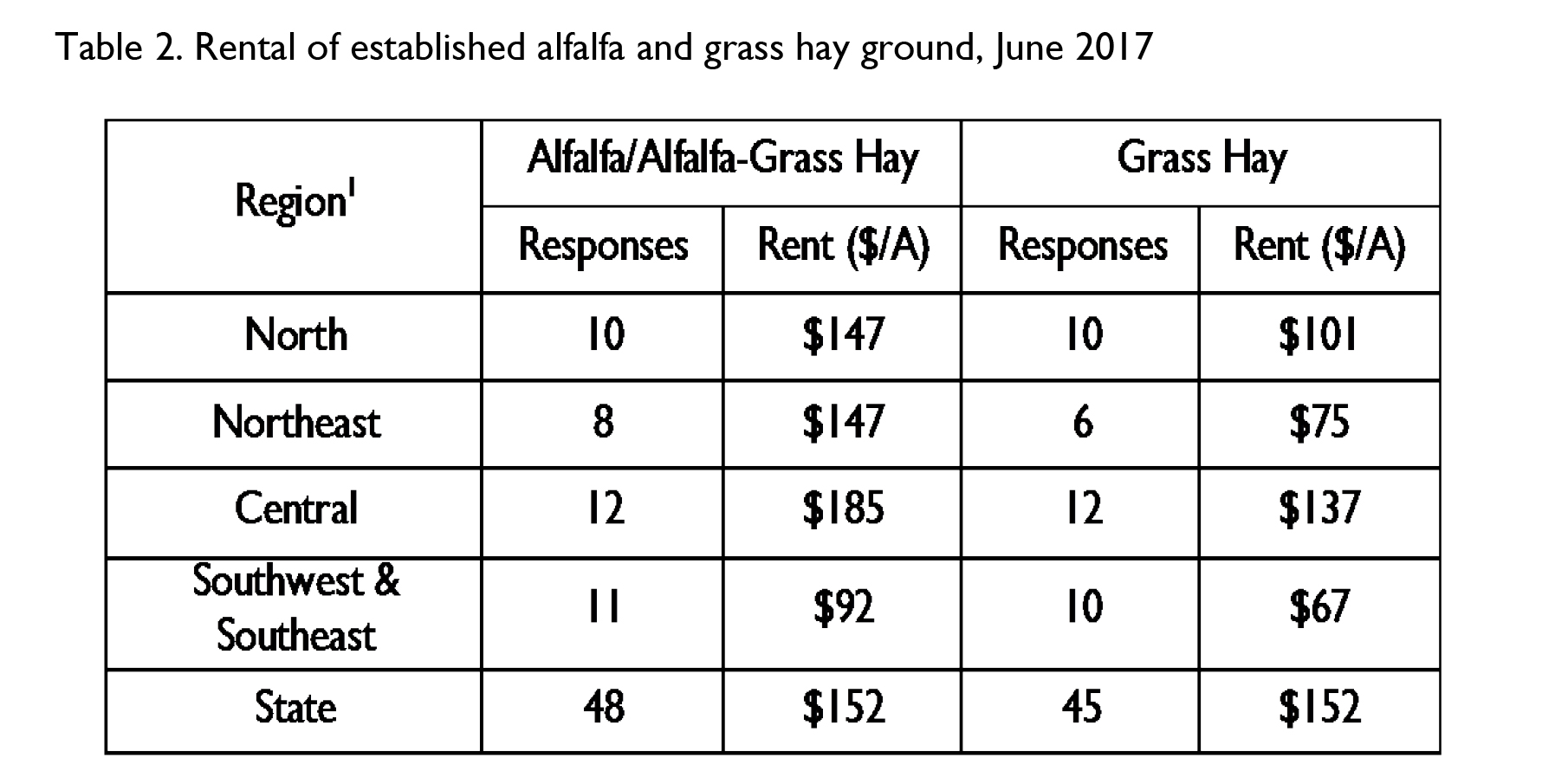

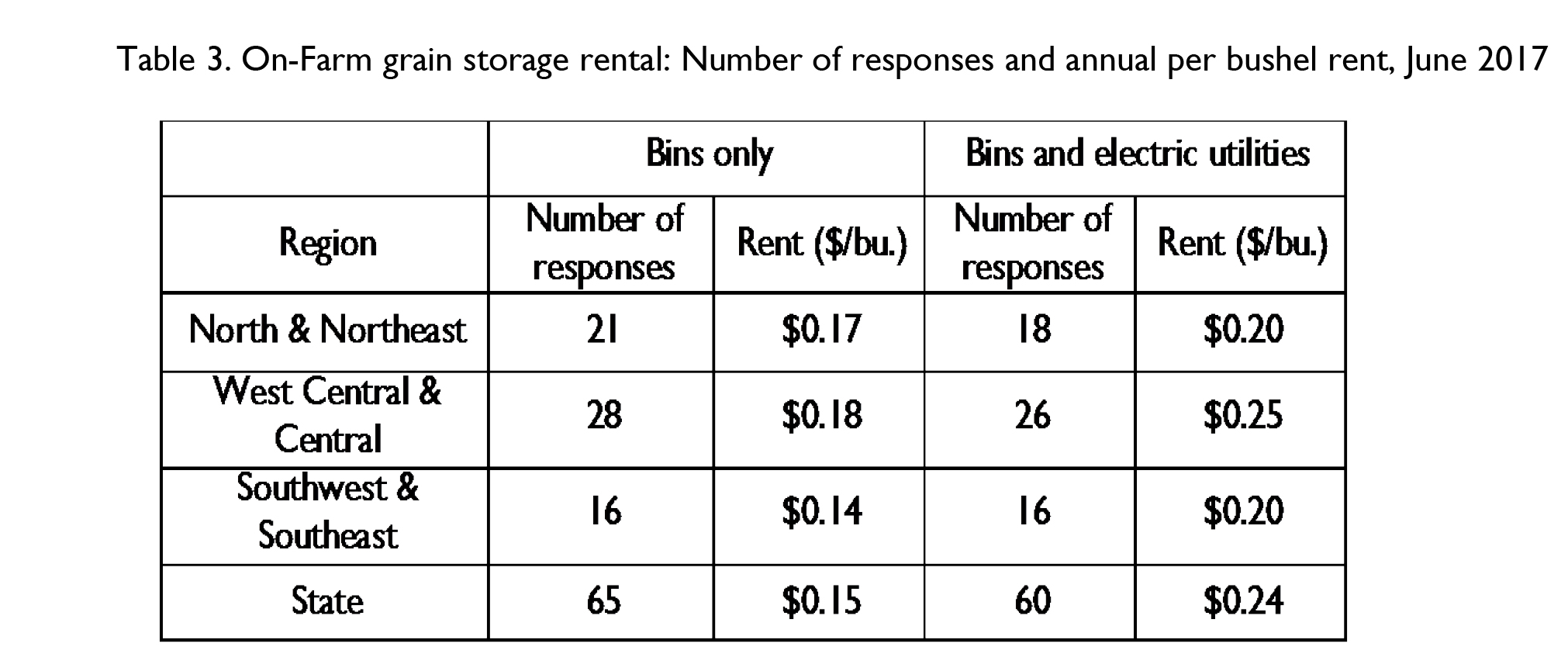

Estimates for the current rental value of pasture land, hay ground, and on-farm grain storage in Indiana are often difficult to locate. For the past several years, questions about these items have been included in the Purdue Farmland Value Survey. The values from the June 2017 survey are reported here. Because the number of responses for some items is small, the number of responses is reported.

Averages for pasture rent, hay ground, and the rental of on-farm grain storage are presented in Tables 1, 2, and 3, respectively. The rental rate for grain bins includes the situation where there is just a bin and the situation where there is a bin and utilities.

Information from prior years’ surveys can be found in the Purdue Agricultural Economics Report archive, http://www.agecon.purdue.edu/extension/pubs/paer/archive.asp. This information can be found in the August issue beginning in 2006. This information for 2016 is in the February 2017 issue.

1This information is a summary of data collected June 2017 as part of the Purdue Farmland Value Survey.