Indiana Farmland Values and Cash Rent Trends and Market Comments

August 5, 2019

PAER-2019-10

Author: Craig Dobbins, Professor of Agricultural Economics

Selected comments from 2019 respondents:

Seems like there is still a lot of outside money wanting to buy farm ground.

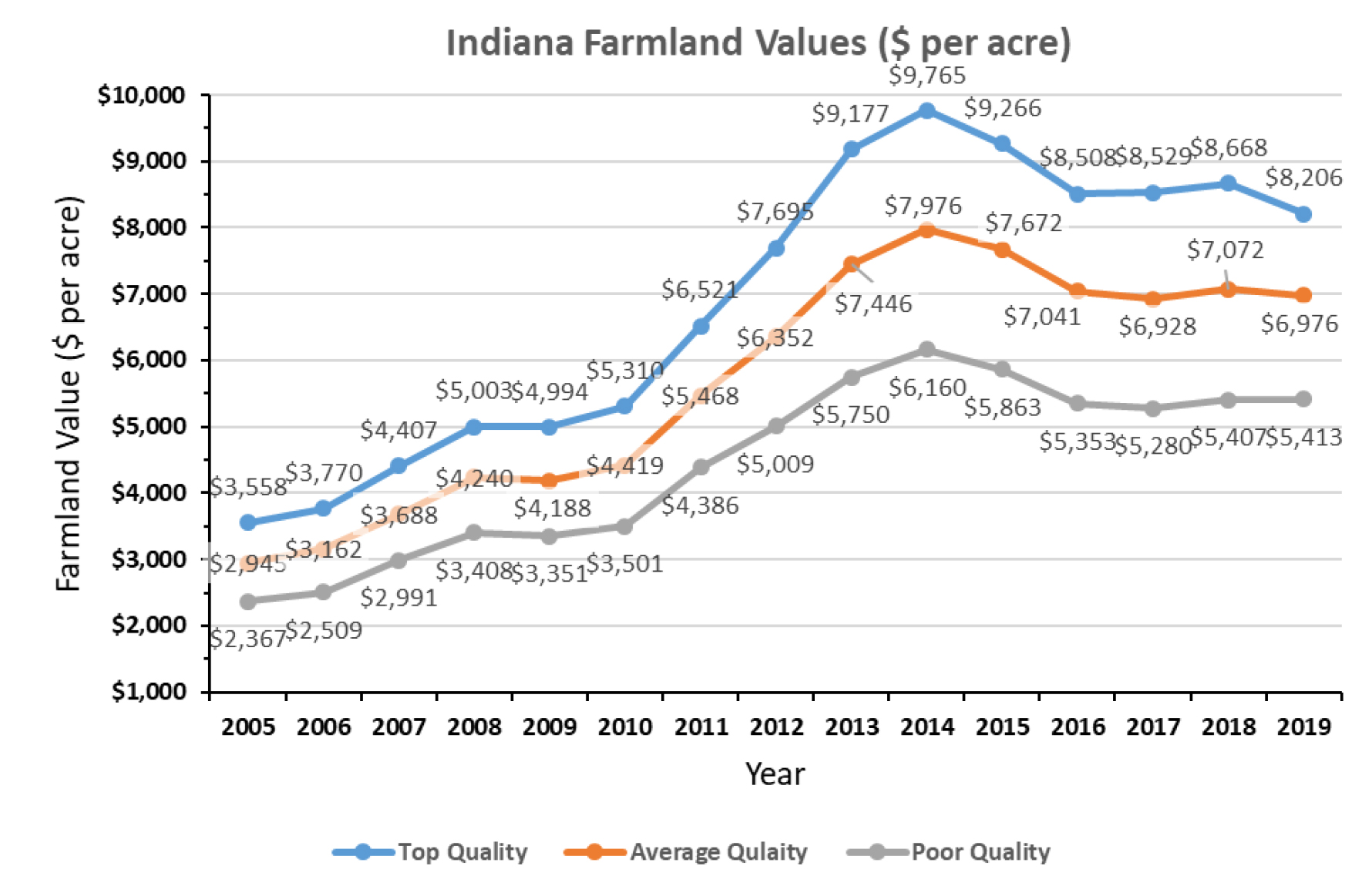

Markets remain subdued with fewer farms on the market and farm customers with strong balance sheets looking for opportunity. Fewer non-operator buyers in the market as appreciation expectations are not positive with current markets and trade issues.

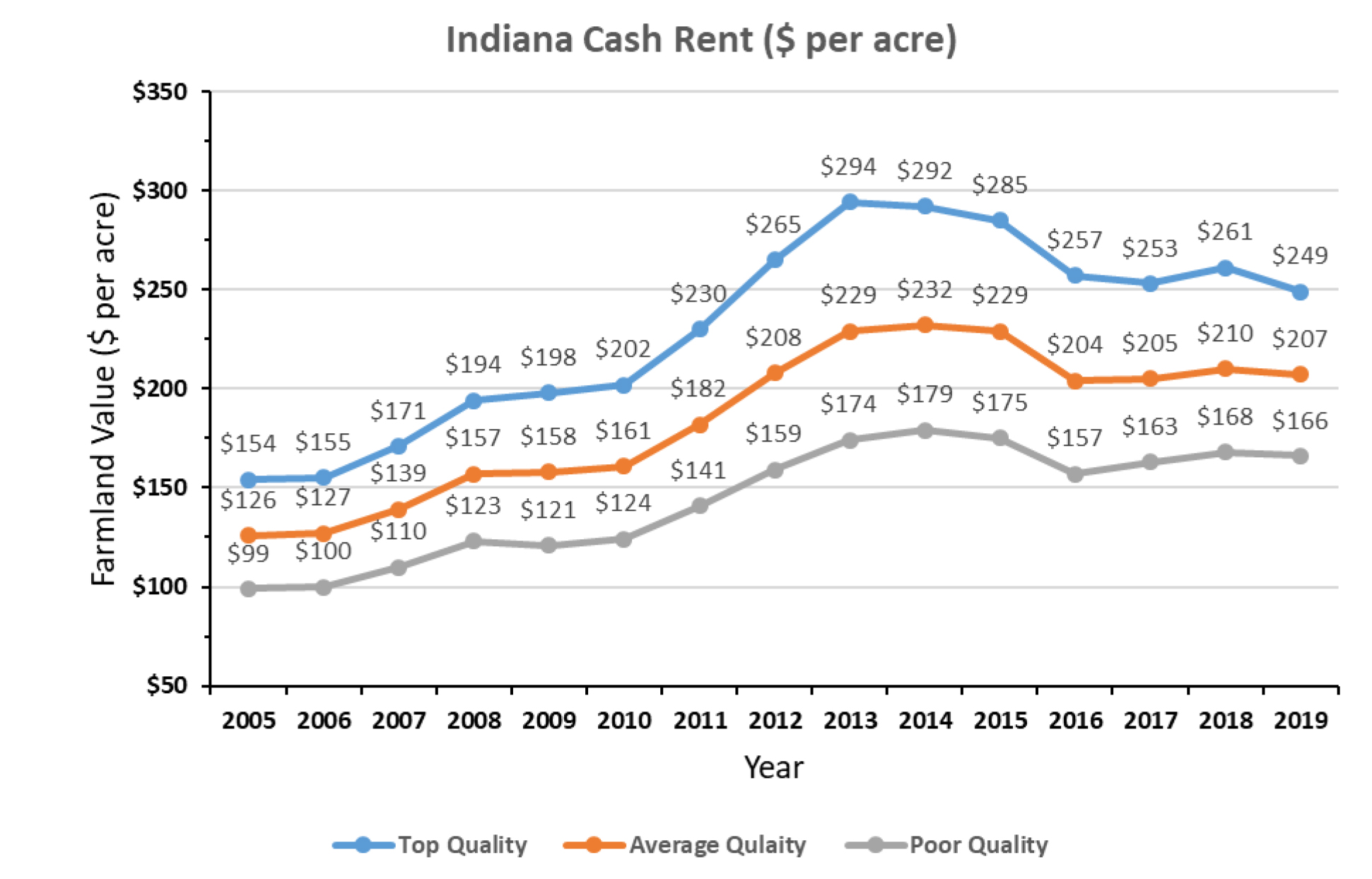

2018 was steady but in 2019 a significant drop with poor weather and tight income margins.

The farmland market has been surprisingly stable. Amish and non-farm investors have supported prices in NE IN. Still lots of people willing to pay very good prices for the right farmland. Strong farmland prices are encouraging older retirees to sell farmland.

Farmland sales are few in number with prices in a sideways direction.

Buying interest from generational farm families, particularly those diversified in livestock, and with strong net worth positions has continued over the past year, but at a slower pace than the 2006-2014 super-cycle. Liquidity has tightened in most operations, but solvency remains adequate due to stable land values.

Virtually nothing for sale in the counties I cover which include Randolph, Delaware, Jay, Henry, and Wayne Counties. There are farmers and outside investors interested in acquiring additional land. Will they remain as active heading into 2020 as they have been over that past couple of years? Also, farmland values from just west of Highway 27 and eastward to the Ohio state line are more competitive than land west of that area due to the strong livestock influence in Darke and Mercer Counties in Ohio. Am also seeing some positive effect on farmland values from wind energy in Jay and Randolph Counties.

Amish buyers, buying for hunting have been a positive influence of prices on marginal ground, by approx. $500/acre. Many local Amish buyers can now cash rent the land to a tenant if it is bare ground and not their home farm. The increase in value of multi-tract auctions seems to be about 30% (final successful bid vs. beginning bids). Many of my tenants will pay less cash rent at the end of their current leases.

Greene Co land values have increased tremendously due to land values to the south of us going in the $12,000 per acre range in Daviess Co. This has caused some Daviess Co. farmers to pursue land in Greene Co in the past year.

Good Ground still brings top dollar. Average and Marginal ground has declined around 5 – 8% due to shrinking margins and farmer confidence.