2016 Indiana Farmland Values and Cash Rents Continue Downward Adjustments

August 6, 2016

PAER-2016-10

Craig L. Dobbins, Professor

The agricultural press is devoting a significant amount of time to the low commodity prices and the corresponding decline in net farm income. The major decline in margins associated with Midwest crop production continues to ripple through the broader agriculture production sector. The effect of these low margins continue to show up in lower farmland values and cash rents. The Iowa farmland value survey reported an 8.9% decline in 2014. A second decline of 3.9% was reported in 2015. The Ag Letter published by the Chicago Federal Reserve Bank reported district declines of 3% in farmland values in both 2014 and 2015. The 2014 Purdue Farmland Value survey indicated Indiana’s farmland values were at a peak. In 2015, there was a statewide decline of farmland values of about 5%. The 2016 Purdue Farmland Value Survey indicates a statewide decline of 8.2% to 8.7% (Table1). Declines of this size have not been seen since the mid- 80s [1].

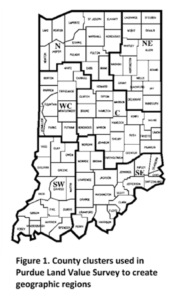

The downward change in farmland values was consistent across land quality and regions of the state. On a statewide basis, farmland values declined for all three qualities of land. Top and average quality farmland declined 8.2%and poor farmland declined 8.7%. The only region of the state to report an increase was the Southeast region. In the Southeast, both top and average quality land increased year-to-year. However, when one looks at the period of December 2015 to June 2016, the values in all regions declined between 3.4% and 6.7%.

The region with the largest year-to-year decline was the North region with declines of 14.2%, 10.7%, and 10.2% for top, average, and poor farmland, respectively. Historically declines of 10% or more are rare. In addition, the farmland value change in this region did not support the conventional wisdom of top quality land maintaining its value better than lower quality farmland in a down turn. The Southwest reported declines between 4.8% and 10.9%. The 6.1% difference between the minimum and maximum decline in this region was only exceeded by the difference of 13.2% in the Southeast. The West Central, Central, and Northeast regions had declines between 4.2% to 9.5%.

Farmland values per bushel of corn follow much the same pattern across regions of the state as changes in farmland values. Survey respondents were also asked to project the value of farmland for December 2016. On average, respondents expect farmland values to continue their decline. The only positive changes expected were top quality farmland in the Southwest region (0.1%) and poor land in the Southeast region (0.4%). Southeast region respondents seem to be anticipating stable farmland values for the remainder of 2016. In all other regions, respondents anticipate further declines in farmland values. This result is not surprising given the outlook for continued low grain prices. State wide, respondents anticipate a decline of 1.9% to 2.2% during the last half of 2016. Projecting this trend through the first half of 2017 will result in an annual decline next year of about 4% statewide.

Information was also gathered about the value of farmland moving out of production agriculture into commercial and residential uses (transition land). The June state wide average value of transition land declined to $10,506 per acre. From the previous June, this was a decline of 11.2%. The state-wide average value of recreational land had a steep decline, dropping from $4,523 in 2015 to $3,433 in 2016, a decline of 24.1%. Transition and recreational land values are quite volatile and have a wide range of values. In these situations, the median value (the value dividing a series of ordered numbers in half) and mode (most frequently reported response) can provide additional information about values. The statewide median and mode for transition land values was $10,000. The statewide median and mode for recreational land values was $3,000.

Table 1. Average estimated Indiana land value per acre (tillable, bare land), per bushel of corn yield, and percentage change by geographical area and land class, selected time periods, Purdue Land Value Survey, June 2016

Respondents were asked to estimate the value of rural home sites located on a blacktop or well-maintained gravel road with no accessible gas line or city utilities. Like transitional farmland and recreational farmland these properties have a very wide range in value. Because of this wide range, median values are reported. The median value for five-acre home sites ranged from $7,750 per acre in the Southeast region to $10,000 per acre in the Central and Southwest region (Table 2). Reported per acre median values of the larger tracts (10 acres) ranged from $7,000 per acre in the Southeast region to $10,000 per acre in the Southwest, Central, and Northeast region.

Table 2. Median value of five-acre and ten-acre unimproved home sites

Farmland Market Forces

Respondents were asked to evaluate the importance of eleven market forces having the potential to influence the farmland market. These items included: 1) current net farm income, 2) expected growth in returns to land, 3) crop price level and outlook, 4) livestock price level and outlook, 5) current and expected interest rates, 6) returns on competing investments, 7) outlook for U.S. agricultural export sales, 8) U.S. inflation rate, 9) current inventory of land for sale, 10) cash liquidity of buyers, and 11) current U.S. agricultural policy.

Respondents used a scale from -5 to +5 to indicate the effect of each item on farmland values. A negative influence is given a value from -1 to -5, with a -5 representing the strongest negative influence. A positive influence was indicated by assigning a value between 1 and 5 to the item, with 5 representing the strongest. An average for each item was calculated.

In order to provide a perspective on changes in these influences across time, data from 2014, 2015, and 2016 are presented in Figure 2. The horizontal axis indicates the item from the list above. Given the large declines in grain prices and net farm income over the past two years, it is not surprising that respondents placed negative influences on net farm income, expected growth in returns, and crop prices. Even the cash position of buyers has turned slightly negative. Given that cash position was the strongest positive force in 2014, this has been a substantial change in just two years.

Figure 2. Influence of eleven market forces in 2014, 2015, and 2016

Interest rates were the strongest positive influence in 2016. This was followed by alternative investments and the supply of land on the market. Long-term interest rates have been expected to increase for a number of years, but there has been very little upward movement in interest rates. The weak economic growth of the world and U.S. economy have caused the Federal Reserve Bank to postpone further increases in short-term interest rates. The supply of farmland also continues to have a positive influence on the market. One characteristic of the farmland market in decline is a reduction in the quantity of farmland for sale. Rather than sell in a down market, farmland holders tend to postpone.

To obtain more information on how selling. the supply of farmland may have changed, respondents were asked to compare the amount of farmland on the market in June 2016 to a year earlier and indicate if it was more, the same, or less. Figure 3 reports the results for 1999, 2012, and 2016. There is nothing special about 1999, other than it was the first year the question was asked. In that year, the majority of the respondents reported the same supply when compared to the previous year. The largest number of respondents reporting an increase in the supply of farmland on the market was in 2011 at 22.6%. In 2016, only a small percentage of respondents indicated more farmland was on the market than a year earlier. For the 2016 respondents, 56% indicated there was less land on the market than in 2015.

Figure 3. Percentage of respondents indicating there was less, the same, or more land on the market than the previous June

Another noticeable change in market drivers is agricultural policy. For the last three years, respondents have indicated agricultural policy no longer has much influence on farmland values. In the past, agricultural policy has been an important influence in the farmland market. Numerous research studies have investigated the link between agricultural policy and distortions in the value of farmland. While the influence of agricultural policy may have declined, other U.S. government policies have had major influences on agriculture. One strong government policy influence has been the low interest rate monetary policy. A second was an energy policy that gave rise to a large increase in corn demand for ethanol. The U.S. farmland market has also been strongly influenced by the decision of Chinese policy makers to import large quantities of U.S. soybeans.

Five-Year Forecasts

Table 3. Projected five-year average corn and soybean prices, mortgage interest, and inflation

Respondents were asked to forecast the five-year average for corn price, soybean price, mortgage interest rate, inflation rate, and finally the change in farmland value. The price and rate estimates for the past five years are presented in Table 3. The five-year average price of corn has been the most volatile. In 2012, respondents estimated the corn price would average $5.56 per bushel. This year the five-year average estimate is $4.03, a $1.53 lower. The five-year estimates for soybeans have fared better. For 2012, ‘13, and ‘14 respondents expected a five-year average just over $12.00 per bushel. Lower soybean prices led to a downward revision to the five-year estimate in 2015. The increase in soybean prices this summer, when the survey was taken, no doubt helped lift the 2016 price estimate.

With an average mortgage interest rate of 4.8%, respondents expect interest rates to remain low for the next five years. Concern about monetary policy leading to high inflation rates has declined. Over the past five years, inflation rate expectations have drifted lower.

Given these estimates, where do respondents expect farmland values to be in five years? As expected, there is much less consensus about where farmland values will be in five years when compared to the estimates for the end of 2016. There were three closely balanced groups. One group expects farmland values will be higher in five years. This was 35% of the respondents. The average increase for this group was 7.6%. For this group, the minimum increase was 1% and the maximum was 15%. The second group expected farmland values to be close to their current value. This does not necessarily mean no change in farmland values. There could be ups and downs over five years, but in five years the value will be about where it is today. This was 29% of the respondents. The last group expects farmland values to be lower in five years. This group accounted for 36% of the respondents. The average decline was 9.5% but ranged from a decline of 1.5% to a decline of 35%. Regardless of which group might be the most accurate about the next five years, two thirds of the respondents are expecting the farmland market to be flat to down, a type of market we have not seen for the past 25-30 years.

Cash Rent

The survey in 2015 was the first survey since 1999 to report a state wide decline in cash rents across all land qualities. State wide cash rents in 2015 declined 1.3% to 2.4%. Again this year, the survey found another statewide decline in cash rents (Table 4). This year state-wide declines were more significant, ranging from 9.8% to 10.9%. The last time the cash rent market experienced a decline this large was 1987 when state-wide cash rent declined 8.8% to 10.8%. For 2016, top land had a cash rent of $257 per acre, average land had a cash rent of $204 per acre, and poor land had a cash rent of $157 per acre.

Table 4. Average estimated Indiana cash rent per acre, (tillable, bare land) 2015 and 2016, Purdue Land Value Survey, June 2016

Comparing regional cash rent changes, the Southwest region reported the smallest declines in cash rents ranging from 0% to 2.8%. The largest declines in cash rent were in the West Central region. Here cash rents declined by 11.4% to 14.2%. Changes in cash rents for the North, Northeast, Central, and Southeast regions declined by 1.5% to 11.4%.

The West Central region consistently has the highest cash rents. This is still the case with top quality land having a cash rent of $296 per acre, average quality land had a cash rent of $241 per acre, and poor quality land had a cash rent of $193 per acre. This is followed by the Central, Southwest, North, Northeast, and Southeast regions. As with past surveys, rents in the Southeast region are the lowest.

Cash rent per bushel declined state wide and for each region and land class except the Southwest region where there was no change. State-wide top quality farmland cash rent per bushel of corn was $1.30, while cash rent per bushel for average land was $1.23, and cash rent per bushel for poor land was $1.17 per bushel. As in the past, the difference in cash rent per bushel across land quality is small. For the state as a whole, the difference is only 13¢ per bushel. The largest regional difference in cash rent per bushel across land quality was $0.16 in the Southwest region. The smallest was $0.08 in the Southeast region.

On a state-wide basis, rent as a percent of land value remains around 3%. This is the third year in a row this measure of annual gross return has been around 3%. For the last 25 to 30 years, this value has been steadily declining. Looking across regions, the largest return is in the Southeast region with annual gross returns of 3.3% to 3.5%. All other regions except the Northeast have a gross annual return between 2.9% and 3.2%. For the Northeast, this measure of annual return is 2.6% or 2.7%.

Expected Changes in Cash Rent

Information was presented previously about expected corn and soybean prices, mortgage interest rates and the rate of inflation. Those items also influence changes in cash rent. Respondents were asked to indicate if they expected 2017 cash rents to be higher, the same, or lower. If they expected an increase or decrease, they were asked to indicate the percentage change. Only 3% of the respondents thought 2017 cash rents would be higher. The average increase expected was 8.75%. Respondents expectations ranged from an increase of 2% to 15%. The group expecting no change in cash rent accounted for 40% of the respondents. The remaining 57% of the respondents expect cash rent to be lower in 2017. The average decline for the group was 8.3%. Respondents expectations ranged from a decrease of 1% to 35%. The average across all respondents was for a decline of 4.5%.

As with farmland, these expectations indicate a continued decline in the rental market. If cash rent declines in 2017, it will be the third decline in a row. There has not been a period of three consecutive declines in cash rents since the 1980s.

Combining Farmland Values and Cash Rent

One of the principles of economics and finance is that capital assets derive their value from the net cash return generated by the asset. The simplest form of this relationship can be expressed as V = E ÷ C, E represents the net annual earnings from the asset, C represents the capitalization rate. The capitalization rate is influenced by interest rates, risk premiums associated with being a landowner, expected rates of inflation, and expected growth rates in the net return. V is the expected value of the asset.

Doing a few algebraic manipulations, the expression above can be expressed as V ÷ E = 1 ÷ C. This expression indicates the value-earnings ratio (or the price-earnings ratio) is equal to one divided by the capitalization rate. This relation tells us how many times earnings buyers are willing to pay to be landowners. It also tells us the value-earnings ratio is determined by the capitalization ratio. As earnings rise and fall, the asset value will rise and fall, but if the capitalization rate remains constant, the ratio of value to earnings will remain the same. The value-earnings ratio for 1975 to 2016 is presented in Figure 4.

Figure 4. Value to Earnings Multiple for Average Indiana Farmland, 1975 to 2016

In 1975, people were willing to pay 13.7 times current cash rent to be landowners. This increased to 20.6 in 1978. With the sharp rise in long-term interest rates in the late 70s and early 80s the multiple dropped to 12.4 in 1986 (higher interest rates increased the capitalization rate). With the downward trend in interest rates (and lower capitalization rates) since 1986, the multiple rose to 34.4 in 2014. The values in 2014, 2015 and 2016 have been fairly constant.

Summary

The collapse in grain prices and the impact of tighter gross margins are working their way through the agricultural economy. While the underlying reasons for multiple years of tight gross margins now are not the same as in the 1980s, a series of years with downward adjustments in farmland values and cash rents like the 1980’s may still be the result.

Survey respondents are projecting a continuation of low grain prices, low and stable long-term interest rates, low inflation rates, and lower growth in farmland earnings. If they are correct, the per unit cost of production needs to be lowered further. Lowering per unit cost of production will take time and will likely be a combination of adjustments in lower input costs, higher yields, and lower cash rents and farmland values, each contributing a small change.

Many of this year’s respondents indicate they believe declining farmland values and cash rents are likely to continue being part of reducing per unit production costs. Over the last two years, Indiana farmland values have declined about 13%. While this is only about one-half of the adjustment amount for the first two years of decline in the 1980s, declines this large are rare in the farmland market and it appears the downward value adjustment process is not yet complete. The same is true for the cash rent market where a decline of approximately 12% has occurred over the past two years.

This implies important questions for individuals. How would a continuation of declining farmland values and rents alter your situation or impact your business? What has been your historic breakeven point? What is your current financial position and how would continue downward adjustments affect that position?

If the difference between where you are and where you want to be is small, then you can focus on alternatives for solving this problem. However, if the distance between where you are and where you want to be is large, then you may need to consider a set of more dramatic alternatives. Given the magnitude of the price and income changes that have occurred and the expectations of survey respondents, it seems more adjustments are called for.

1 The Purdue Farmland Value Survey was first published in August 1974. Individuals surveyed include rural appraisers, commercial bank and Farm Credit Mid-America agricultural loan officers, FSA personnel, farm managers, and farmers. Survey results provide information about the general level and trend in farmland values and cash rents. It does not indicate the specific values for an individual farm.