Indiana Land Values and Ag Enrollment

November 16, 1991

PAER-1991-15

Author: Unattributed

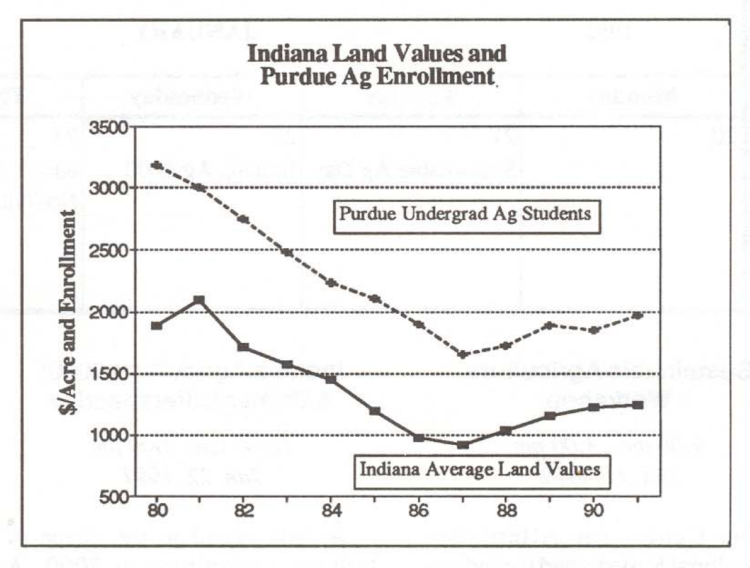

The Indiana agricultural economy experienced massive economic adjustments during the 1980s. These dramatic transitions were reflected in Indiana land values, which declined from 1981 to 1987 after the steep rise from the early 1970s. From their low value of $913 per acre in 1987, land values have risen 36% to $1,245 per acre in Purdue’s 1991 survey.

In a similar manner, the Purdue School of Agriculture was not spared the heartbreak of the 1980s. Undergraduate enrollment dropped throughout the decade to a low of 1,655 students. The lowest enrollment was in 1987, the same year land values hit bottom. Since that time, Purdue ag enrollment has recovered 19%.

Currently, there are good employment opportunities for ag graduates, and projected needs through 1995 look favorable. With these encouraging prospects, continued recruiting efforts by Purdue staff, alumni, and friends will be needed to keep young people aware of the opportunities.

The interesting parallel of these two items shows the impact of the broader macroeconomic condition of agriculture, a condition which has stabilized greatly from the trauma experienced in the 1980s.