Food Prices

January 31, 2025

PAER-2025-04

Authors: Caitlinn Hubbell, Market Research Analyst; Joe Balagtas, Professor of Agricultural Economics

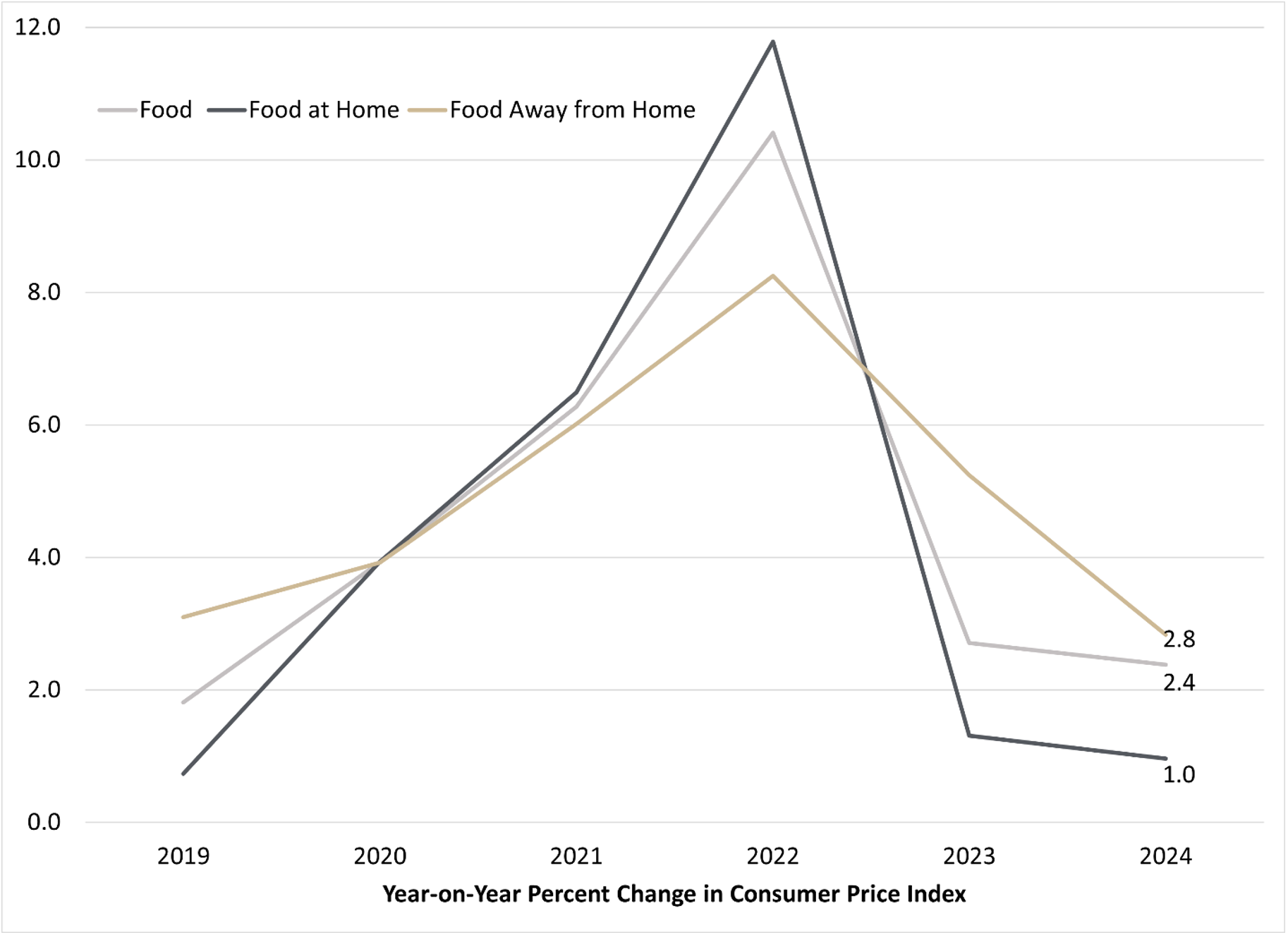

Food price inflation continued to cool in 2024, with food prices rising by 1.8% over the course of the year (see Figure 1), down from 11.8% in 2022 and 2.3% in 2023, and consistent with pre-pandemic norms. Prices of Food at Home (FAH, or groceries) rose by 1% in 2024, while prices for Food Away from Home (FAFH, or food service, including restaurant meals, rose by 2.8%.

Figure 1. Year-on-Year Changes in the Consumer Price Indexes for Food, Food at Home, and Food Away from Home

(Note: 2024 data are through November. Source: authors’ calculations from Bureau of Labor Statistics data)

While official food inflation estimates have cooled substantially since 2022, consumer perception of food inflation has remained elevated (Figure 2). Consumers in the Consumer Food Insights survey reported food inflation of 5.3% for 2024, which is lower than inflation perceptions in the previous two years but almost triple official estimates of 1.8%. During the initial period of high inflation through 2022, consumers typically reported lower inflation rates than official estimates. But as food inflation measured by the CPI cooled dramatically through 2023 and 2024, consumers perceived only modest reductions in food inflation.

Figure 2. Consumer Food Inflation Estimates (Past 12 Months) versus CPI Annual Food Inflation Rate

Source: Consumer Food Insights Survey and Bureau of Labor Statistics

Despite the slowing of food inflation, food prices are nearly 25% higher than they were back in 2020 when food inflation first jumped before accelerating in 2021. This increase in the price level is likely contributing to the gap in experienced versus official food inflation estimates as consumers slowly adjust.

Looking ahead, consumers are more optimistic about the future of food prices, predicting lower levels of future food inflation than their estimates of past inflation. Figure 3 summarizes average food inflation expectations, as predicted by consumers, compared with the CPI food inflation rate. Looking twelve months ahead, consumers predict that food prices will be approximately 2.5% higher than in November 2024, matching the USDA Economic Research Service’s prediction for annual food price increases in 2025.

Figure 3. Consumer Food Inflation Expectations (Next 12 Months) versus CPI Annual Food Inflation Rate

Source: Consumer Food Insights Survey and Bureau of Labor Statistics

In addition to inflation, supply and demand factors continue to influence the relative prices of specific food products. Over the last year, eggs have seen the largest increase in price at 32.6% from last year. This is largely due to the resurgence of highly pathogenic avian influenza (HPAI) in the last several months. Other commodity markets have been affected by difficult growing conditions around the globe. Production challenges in West Africa have resulted in a 93% increase in global chocolate prices for 2024; however, recent unseasonal rains are anticipated to relieve some of the pressure and hopefully lower the price of cocoa. Drought in Brazil and disease pressure in Vietnam, two major coffee exporters, has driven higher coffee prices. Global coffee prices rose by 54%, yet retail coffee prices in the U.S. rose by 1.9% in 2024.

Beef prices rose by 4.3% in 2024, driven by low cattle numbers, difficult weather, high grain prices, and high interest rates. Meanwhile, prices of other protein staples, including pork, poultry, and dairy products, rose by less than 2% over the past year.

Figure 4. Price Changes in 2024 (through November)

Source: Authors’ calculations from Bureau of Labor Statistics data

So, what’s on the horizon for 2025?

As we look toward 2025, USDA predicts that inflation will continue to cool, forecasting inflation rates of 1.9% for all food, 0.8% for food at home, and 3.5% for food away from home. However, much uncertainty remains about how the economy will perform, including how/if the Federal Reserve will continue to cut the federal funds rates. The most recent rate cut of 0.25 percentage points occurred this past December, the third rate cut for 2024.

Further economic uncertainty exists in light of potential federal policy changes as Donald Trump returns to the White House. Statements from President-elect Trump that suggest increased tariffs on major trading partners could impact food prices through various channels. In general, tariffs raise the price of imported goods. Thus, tariffs on food imports or on inputs to food production would likely increase U.S. food prices. However, the specific implementation details of such trade policies and potential retaliatory measures from trading partners remain unclear, making it difficult to quantify the exact impact on consumer food prices.

President-elect Trump also campaigned on tighter immigration, which could have significant implications for the agricultural sector. The agricultural industry relies heavily on immigrant labor, particularly in labor-intensive crops and livestock operations. In recent years, 19% of U.S. farmworkers were immigrants with work authorization, and 42% were immigrants with no work authorization. Any substantial reduction in the agricultural workforce could potentially lead to increased labor costs and reduced agricultural production, which could translate to higher food prices for consumers. But, as with trade policy, the timing, scope, and implementation of any changes to immigration policies would ultimately determine their impact on food prices and agricultural production.

Finally, growing conditions in certain parts of the world will impact production and, thus, prices. Given these multiple sources of uncertainty, food price projections for 2025 should be viewed with caution. While baseline inflation forecasts suggest moderation, policy changes, weather patterns, and other supply chain events could create significant deviations from these expectations.