Key Estate Gift Tax Law Amendments

November 18, 1997

PAER-1997-11

Gerald A. Harrison, Professor, Extension Farm Management

- What is now the unified credit with an equivalent exemption amount of $600,000 has increased to$625,000 [renamed as the “applicable exclusion amount” (AEA)] in 1998 with more increases in most years until the AEA reaches $1 million in 2006. There is no indexing of AEA for inflation. The $10,000 gift tax exclusion will be indexed.

- There is a new “family-owned business interests exclusion (FOBE)” permitting up to $675,000 of FOB to avoid inclusion in the gross estate tax estate in 1998. The FOBE amount is reduced as the AEA in (1) above increases. The two together may reach a maximum of $1.3 million. In the year 2006, the FOBE amount is a maximum of $300,000. There is no indexing for the FOBE.

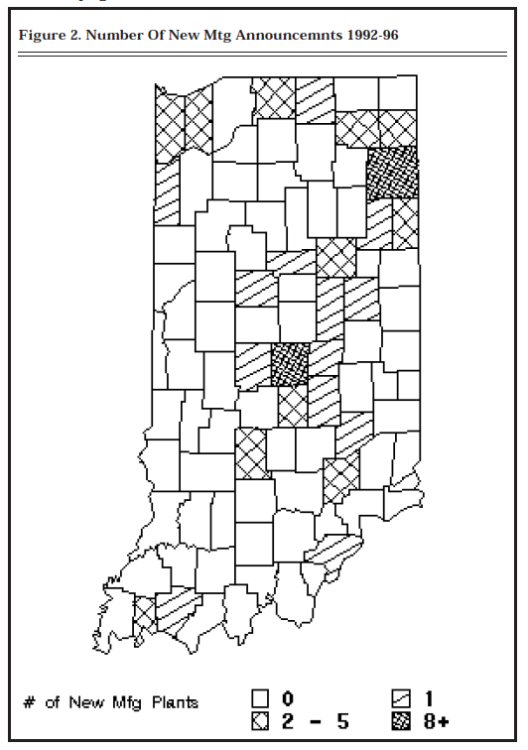

Figure 2. Number Of New Mtg Announcements, 1992-96

Many requirements and definitions for FOBE eligibility draw directly from the special use valuation (SUV) law. SUV allows for a reduced valuation of farm and ranch land for estate tax purposes. How-ever, the FOBE requirements go beyond the those for SUV. Qualifying decedent’s estate and qualified heirs will, generally, have to engage in “material participation” — direct involvement in a trade or business. This new law emphasizes that “rent” arrangements will not satisfy the “business involvement” test for the owner of the business interest. How-ever, for the decedent who was actually engaged in a business with a family member ready to get involved or who is already in the business there should be little problem in qualifying — if the “percentage tests” are satisfied.

For example, the FOB interests must make up more than 50% of the decedent’s estate and the total value of qualified FOB interests that passes to qualified heirs must be over 50% of the decedent’s adjusted gross estate.

- An amendment to the special use valuation law permits a qualified heir to cash rent to family members without causing recapture of the SUV estate tax savings. This is a change in the “at risk” rule that required the qualified heir to share lease to a family member. This change is consistent with earlier amendments providing that the

“qualified use” or “at risk” requirement was lifted from the decedent (1981) whose land was rented to a family member and otherwise qualified for SUV and likewise for a surviving spouse (as a qualified heir) (1988) — meaning a cash-rent lease was permitted. Also, the $750,000 limit on reduction in land value under SUV is indexed after 1998.

- For those estates with a “closely-held business interest” that have an estate tax liability, installment payment of estate tax remains available at a reduced interest rate of 2%

(down from 4%) for up to $1 million in closely held business assets. The law no longer allows, that reduced interest to be deductible, but the $1 million limit is indexed.

The Taxpayer Relief Act of 1997 includes several amendments to the federal estate and gift tax laws. Ger-ald A. Harrison has a paper “Estate and Gift Tax Changes in The Taxpayer Relief Act of 1997” that may be obtained by calling Gerry Harrison at 765-494-4216; or E-mail: harrison@agecon.purdue.edu or a toll-free call: 1-888-398-4636. Additional discussion of these changes is planned for the January 1998, “Purdue Ag Econ Report.”