Local Cooperative Restructuring

May 13, 2001

PAER-2001-7

Jennifer Vandeburg, Research Associate; Joan Fulton, Associate Professor; Susan Hine, Assistant Professor, Department of Agricultural and Resource Economics, Colorado State University; and Kevin McNamara, Professor

Consolidation in all areas of agribusiness is creating an increasingly challenging business environment for local cooperatives. “Fewer” and “bigger” are key words in describing why a cooperative’s customers, suppliers, and competitors all possess greater market power than in past years. This article is the second in a series reporting results of recent and ongoing research at Purdue University’s Department of Agricultural Economics examining how local cooperatives are responding to these challenges. In particular, local cooperatives are engaging in a variety of business arrangements— mergers, acquisitions, joint ventures, and strategic alliances— in order to remain competitive.

Data for this study were collected through in-person interviews with managers of 35 locally owned Indiana farm supply and grain marketing cooperatives in May and June of last year. These managers were asked about the restructuring activities in which their cooperatives had engaged during recent years, the factors that motivated the restructuring, and what contributed to the success of these arrangements.

In the following sections we report on the extent and types of restructuring by local cooperatives in Indiana. Then, we describe the driving forces behind these arrangements as well as the factors that contribute to success.

Use of New Business Strategies/Business Structures

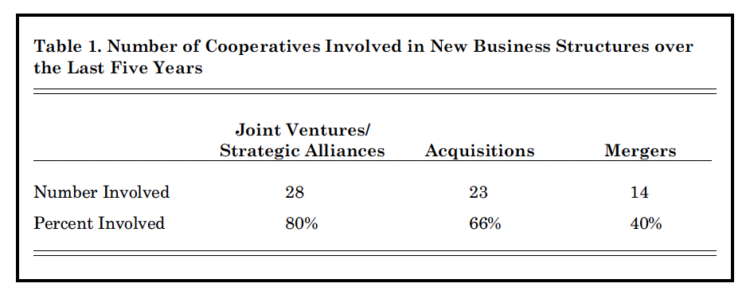

The most common business arrangements identified by study participants are joint ventures and strategic alliances, as shown in Table 1. A joint venture is formed when two firms choose to contribute assets or other resources to a jointly owned project, often involving the establishment of a new business entity, such as a limited liability corporation (LLC). A strategic alliance is a much less formal agreement between two firms, such as a preferred supplier agreement. Eighty percent of the managers mentioned involvement in one of these relationships.

Table 1. Number of Cooperatives Involved in New Business Structures over the Last Five Years

Acquisition of other cooperative and non-cooperative businesses generally smaller, competing firms, is a strategy often used by local cooperatives to increase market share. Two-thirds of the cooperatives have acquired at least one other firm in the last five years.

Starting in the early 1900s, local cooperatives were established across the state, many between 1925 and 1930, as part of the Indiana Farm Bureau Cooperative system. At one point, there was a local cooperative in every county in Indiana (Boring). As the agribusiness sector restructured through time, waves of mergers— the joining of two or more firms into a single business

entity—between and among local cooperatives swept the state. The last five years have been no exception. In the spring of 2000, there were 38 local farm supply and grain marketing cooperatives in Indiana, 35 of which participated in the survey. Fourteen of the 35 cooperatives surveyed were either currently involved in a merger or had been involved in a merger in the last five years. In one case, both partners in an ongoing merger negotiation were interviewed.

Mergers are often used as a tool for cooperative growth. Some managers indicate they perceived that cooperatives needed to increase in size to remain competitive. A minimum size is required for firm efficiency, because many cooperative operations benefit from economies of scale. Managers also suggested that greater firm size allows the cooperatives to offer their members a broader range of products and services, and in this way remain competitive.

Joint Ventures and Strategic Alliances

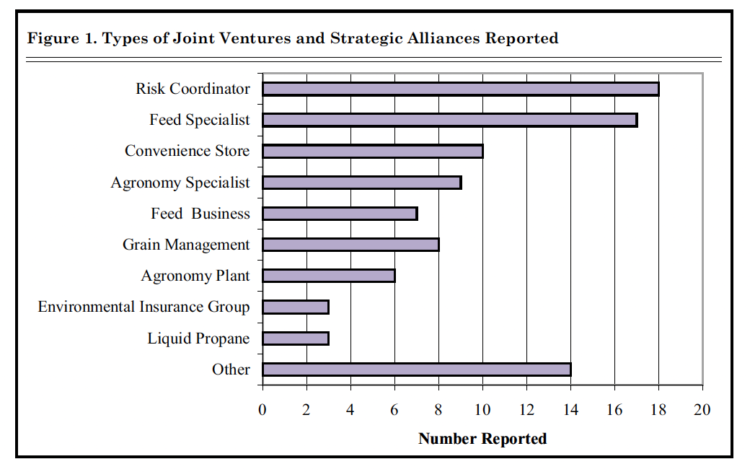

Managers described a variety of business activities as the focus for a joint venture, in response to an open-ended question. As a result of their responses, categories for types of joint ventures and strategic alliances became evident. The total number of all joint ventures and strategic alliances for each type is shown in Figure 1. If a manager described two projects that fall into the same category, then both are included in the totals in Figure 1.

Just over half of the cooperatives reported sharing an employee (or team of employees) who served as a risk coordinator. The risk coordinator monitors and ensures environmental and workplace regulation compliance. For most Indiana cooperatives, risk coordination is not a fulltime job and has economies of scale, so a shared business arrangement has proven effective.

Figure 1. Types of Joint Ventures and Strategic Alliances Reported

Seventeen managers throughout the state also reported sharing a feed specialist. Sharing a feed specialist allows cooperatives to hire an individual with greater expertise, in this case, in livestock nutrition, than it would be able to afford on its own. Other joint ventures included ten cooperatives sharing in convenience store investments and management projects, nine cooperatives sharing agronomy specialists, and seven cooperatives pooling assets for a more efficient feed manufacturing and distribution business. Eight cooperatives partnered with

noncooperative firms for management of cooperativeowned grain facilities. The grain firm partner brings merchandising and facility management expertise to the project. Cooperatives have also shared the investment and staffing for agronomy plants with neighboring cooperatives, have formed an environmental insurance group and are forming liquid propane marketing and distribution ventures with local rural electrification cooperatives. There were also a variety of other ventures and alliances, such as preferred supplier or distributor agreements, shared administrative employees, and non-traditional business projects, such as lawn and turf businesses.

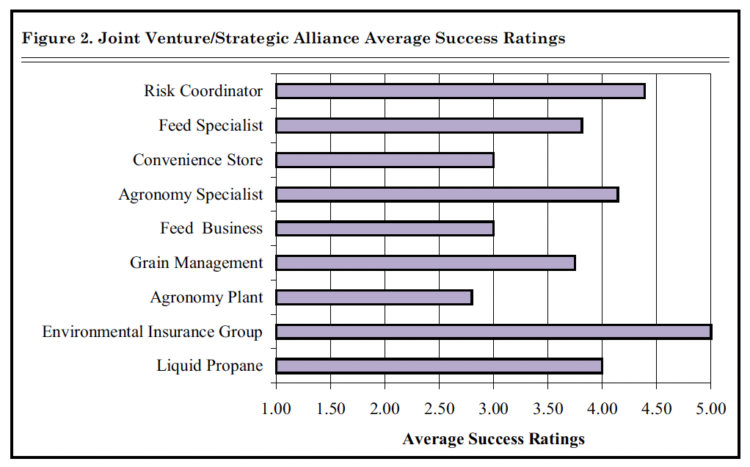

Managers were asked to rate the level of success for each venture on a five-point scale, with 1 being least successful and 5 most successful. These ratings were then averaged for each type of venture or alliance activity. The environmental insurance group has an average success rating of 5.0, indicating that all the managers reporting involvement in the group gave this alliance the highest possible success rating (Figure 2). The projects with the next highest success ratings, the shared risk coordinator, rated 4.4, the shared agronomy specialist, at 4.1, and the shared feed specialist, at 3.8, were those that involved shared personnel. In the case of the grain management ventures, rated 3.7, the goal of the agreement was to bring in greater expertise to more fully utilize existing capital investment. Projects that required new capital investment by the cooperative—C-stores, feed businesses, and agronomy plants—were rated as less successful, at 3.0, 3.0, and 2.8, respectively.

Figure 2. Joint Venture/Strategic Alliance Average Success Ratings

Figure 3. Types of Acquisitions Reported

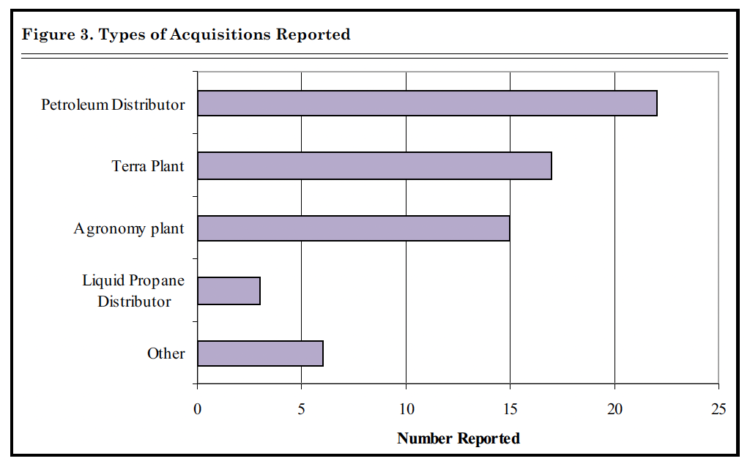

Acquisitions

Local cooperatives often used acquisitions to increase market share through the purchase of a local competitor. In response to an open-ended question, managers described the types of acquisitions. As a result, categories for types of acquisition became evident. The total number of all acquisition events for each type of acquisition is shown in Figure 3.

The most common acquisition reported was the purchase of a petroleum fuel distribution business. A large number of Terra dealerships became available for acquisition in 1998, 1999, and 2000, when Terra, Inc. first sold off plants as it experienced financial difficulties, and then Cenex/Land O’Lakes made plants available after buying out Terra. Therefore, it was not surprising that cooperatives in Indiana bought 17 Terra plants in the last five years. Fifteen independent agronomy plants were also acquired, usually being the purchase of a facility from a locally owned competitor who had decided to exit the business. Three liquid propane distribution firms were also purchased.

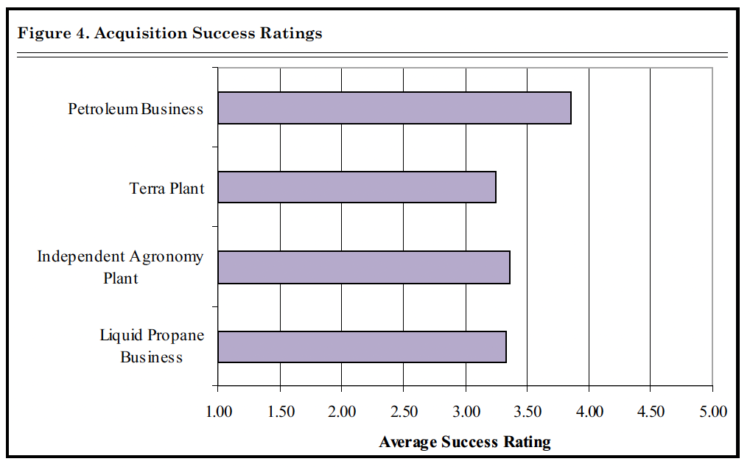

Figure 4. Acquisition Success Ratings

Cooperative managers rated the success of each acquisition, and the average rating for each type is reported in Figure 4. Acquisitions tended to receive lower average ratings than joint ventures and strategic alliances, with a range of 3.3 to 3.9, possibly due to the difference in objectives between the two types of arrangements. While joint ventures tended to be designed to expand a cooperative’s influence in a new market or business, acquisitions generally expanded market share in existing products and services. Opportunities for acquisition often occurred when a local business owner decided to retire or close the business, leaving the cooperative with a choice—buy the business or take the chance that someone else would buy it and continue to compete with the cooperative. Petroleum distribution business acquisitions received an average success rating of 3.9, on a five-point scale. Independent agronomy plant acquisitions were given an average success rating of 3.6, while liquid propane distribution businesses rated 3.3.

Many of the Terra plant acquisitions had occurred too recently for a success rating to be given, but the average rating for the four Terra plants purchased earlier was 3.3. This lower rating may be due, in part, to the financial difficulties that prompted Terra to sell their facilities in the first place. These plants may have already been experiencing challenges in the marketplace that affected their smooth transition to being a successful investment for the cooperative.

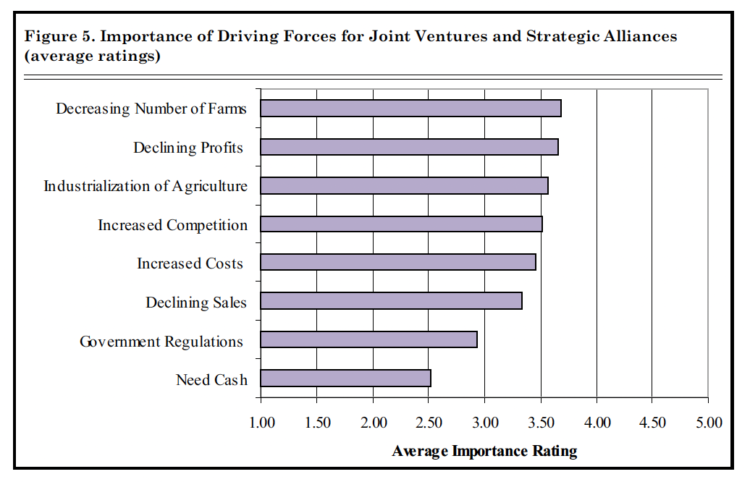

Figure 5. Importance of Driving Forces for Joint Ventures and Strategic Alliances (average ratings)

Mergers

While over half of the managers interviewed indicated that the merger had been completed too recently for a fair assessment of success to be made, managers generally held positive opinions about how the merger was progressing.

Motivation for Cooperative Restructuring

To identify motivating factors for restructuring, managers were asked to rate the importance of several factors, or driving forces, behind joint ventures and strategic alliances, on a scale of 1 (least important) to 5 (most important). The average (or mean) importance ratings for each of the driving forces for joint ventures and strategic alliances are reported in Figure 5. The driving forces specifically associated with consolidation in agribusiness—decreasing number of farms, declining profits, the industrialization of agriculture, and increased competition—received average importance ratings above 3.5. Increased cost and declining sales, factors that also tend to result from consolidation, scored above 3.0. The impact of government regulation and the need for cash were not viewed as nearly as important.

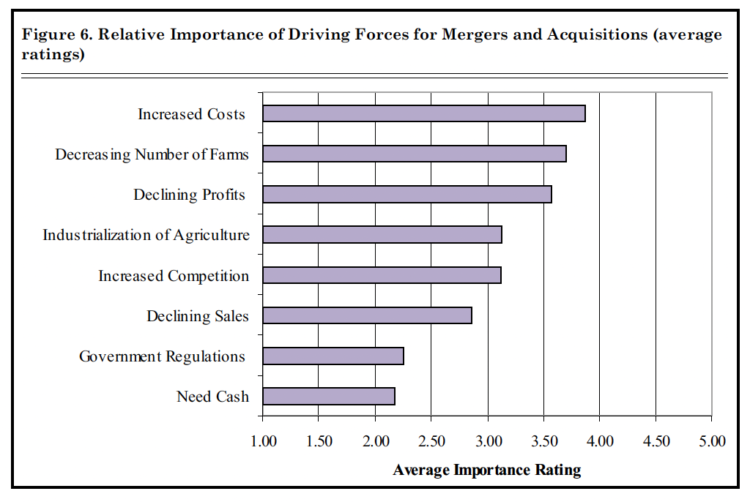

Managers also were asked to rate the importance of factors motivating mergers and acquisitions (Figure 6). While issues closely associated with agribusiness consolidation were again rated the highest, the relative importance of some factors differed. Most notably, increased costs, previously with the fifth highest rating for motivating joint ventures and strategic alliances, now had the highest average importance rating at 3.9.

Mergers address these driving forces through increased firm efficiency, because overhead was distributed over more sales. A larger, merged cooperative can justify investment in equipment and personnel needed to meet the greater technical needs of modern agricultural customers/members. The most common types of acquisitions addressed the issue of increased costs, since the businesses purchased were those that offer economies of scale, as with the petroleum distribution businesses.

Figure 6. Relative Importance of Driving Forces for Mergers and Acquisitions (average ratings)

Factors Contributing to Successful Restructuring

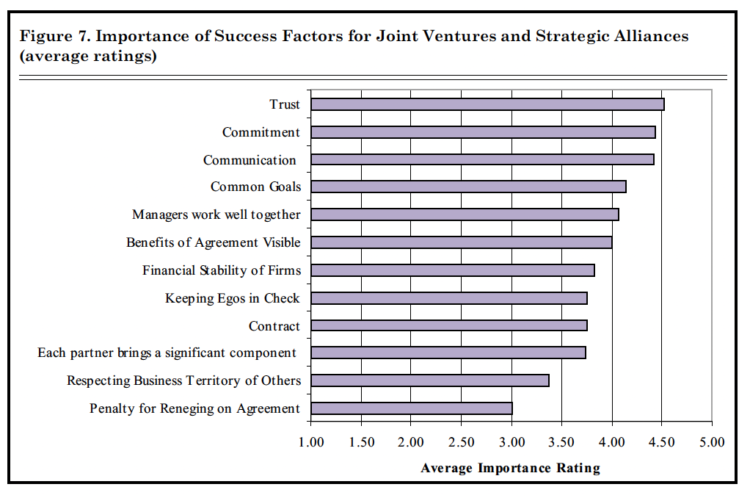

To identify key success factors for restructuring arrangements, managers were asked to rate the importance of factors that might contribute to the success or failure of a joint venture or strategic alliance (Figure 7). All of the success factors received importance ratings of 3.0 or higher, again on a five-point scale with 1 being least important and 5 most important. Intangible factors related to interpersonal dynamics received the highest ratings—trust had a score of 4.5, commitment to the project, 4.4, and communication, 4.4. Teamwork-oriented factors, having common goals for the project, managers that worked well together, and being clear about each firm’s benefits from the project, were rated 4.1, 4.1, and 4.0, respectively. Tangible factors, like the financial stability of the firms, with a rating of 3.9, having a written contract, at 3.8, and a penalty for reneging on an agreement, at 3.0, were rated lower in importance. These importance ratings suggest that interpersonal communication skills are vital to the success of a restructuring arrangement.

Figure 7. Importance of Success Factors for Joint Ventures and Strategic Alliances (average ratings)

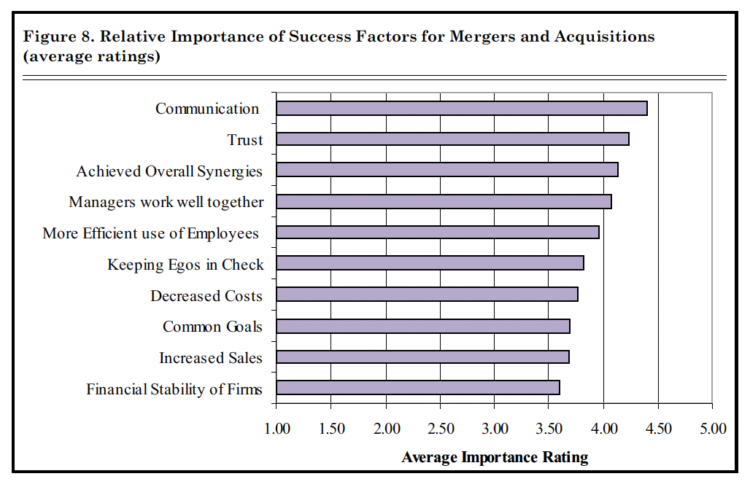

Figure 8. Relative Importance of Success Factors for Mergers and Acquisitions (average ratings)

The success of mergers and acquisitions may be even more critical to the performance of the cooperative, because these restructuring arrangements are more permanent than joint ventures and strategic alliances. All of the success factors for mergers and acquisition were rated as important, with the average ratings ranging from 3.6 to 4.4. Managers again placed interpersonal dynamics factors—communication, rated 4.4, trust, at 4.2, and managers that work well together, at 4.1—as important for contributing to success (Figure 8). More tangible factors, like decreased costs, rated 3.8, more efficient use of employees, at 4.0, and increased sales, at 3.7, also received strong, but lower, average ratings. Smooth transition, as the cooperatives meld into a new firm, or the acquisition becomes part of the cooperative, needs an environment that fosters trust and clear communication.

Conclusion

Cooperatives struggle to remain competitive as consolidation in agribusiness continues. Many cooperatives are engaging in joint ventures, strategic alliances, mergers, and acquisitions as strategic actions. Joint ventures allow cooperatives to acquire resources and offer services that would otherwise be financially prohibitive. Cooperatives are using acquisitions to increase market share within their market territories by reducing the number of local competitors and achieving economies of scale. Mergers are allowing cooperatives to quickly grow to a size that improves firm efficiency and makes a more competitive product and service offering feasible.

All new business arrangements involving restructuring should be evaluated in a business context and be pursued only if deemed economically profitable, financially feasible, and a good strategic business decision. The results presented here indicate that the interpersonal dynamics of trust, communication, commitment, and having managers that work well together are also critical to the success of restructuring. This suggests that training for cooperative managers, employees, and board members needs to include communication skills, and trust building and team building exercises.

Reference:

Boring, Gary, President and CEO, Countrymark Co-op, Inc. Personal Communication. April 16, 2001.