Manufacturing Investment: How is Indiana Doing?

March 16, 1991

PAER-1991-3

Author: Kevin T. McNamara, Assistant Professor and Rural Development Economist

Attracting new manufacturing investment has been a key component of local and state economic development efforts in Indiana. Metropolitan and rural communities alike have seen manufacturing recruitment as a means to increase manufacturing employment to replace lost jobs and/or to provide increased income and employment opportunity for area residents. New manufacturing investment also expands the tax base, providing additional funds for local government services.

However, changes in the U.S. economy raise questions about how successful this strategy will be in the future for communities wanting to expand income and employment opportunities. An increased dependence of domestic manufacturing on technology, combined with the migration of low-wage, low-skill jobs to foreign locations, suggests managers now look at site selection for manufacturing facilities differently. Now, access to skilled labor and technical services will become more important to firms seeking sites for new manufacturing facilities. Rural communities, especially those farthest from urban areas and not located near a major highway, may lack the resources to attract new manufacturing investment in the 1990s. State and local government officials and economic development leaders need to be aware of the changing needs of manufacturing facilities to ensure that Indiana communities continue to attract manufacturing investment Also, this awareness will enable them to advise specific communities on the appropriateness of manufacturing recruitment as a local development strategy.

Manufacturing investment can be either investment in a new manufacturing facility or increased investment in an existing manufacturing facility. Investment in new manufacturing facilities is referred to as a new investment, while investment in an existing facility is referred to as expansions.

New Manufacturing Investment in Indiana

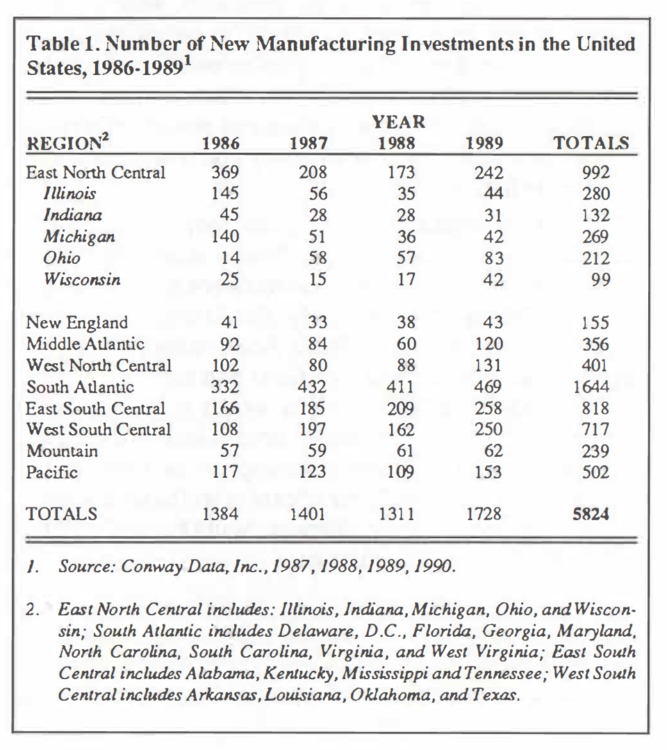

In general, Indiana has successfully attracted new manufacturing investment. Table 1 shows the distribution of new manufacturing investment across the 48 contiguous states for the 1986-1989 period as reported by Conway Industries, Inc. New investments are defined as new manufacturing facilities that exceeded a value of one million dollars, creating more than 50 jobs, or having a minimum of 20,000 square feet of floor space. While the data do not include all new manufacturing investments, they do include the major investments over the period.

The five states in the East North Central region attracted 992 new manufacturing investments over the 1986-1989 period. These investments represent 17 percent of the total reported investments in the United States over the period. As the data in Table 1 indicate, Indiana had 132 new manufacturing investments. While this is fewer than Illinois, Michigan, and Ohio, Indiana’s share compares favorably to the state’s regional population share. Indiana’s population is 13 percent of the region’s population. Indiana’s 132 new manufacturing investments represent 13 percent of the region’s investments.

Indiana Distribution of New Investment

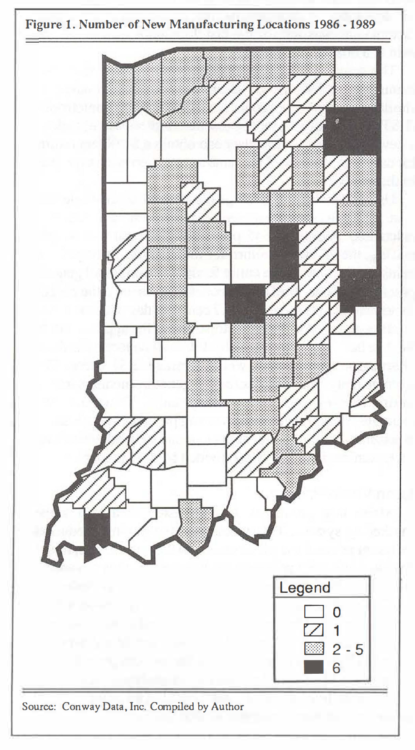

Regions of Indiana did not share equally in the state’s new manufacturing growth. Figure 1 shows the distribution of the 132 investments by county. New investments are clustered in and around Evansville, Fort Wayne, Indianapolis, Lafayette, and Richmond; and along interstates 65, 69 and 80. Wayne County had the most investments with 10. Allen and Madison counties both had eight new investments. Marion County had seven, and Vanderburgh six. These five counties accounted for about 30 percent of the new manufacturing investments made in Indiana over the 1986-1989 period. Forty Indiana counties, or 43 percent, did not attract any new manufacturing investment. Eighteen of the 24 counties west of Interstate 65 and south of Interstate 70 attracted no new investment. Counties to both the west and east of the northern half of Indiana’s Interstate 65 corridor also did not attract new manufacturing investment.

Manufacturing Expansions in Indiana, 1986-1989

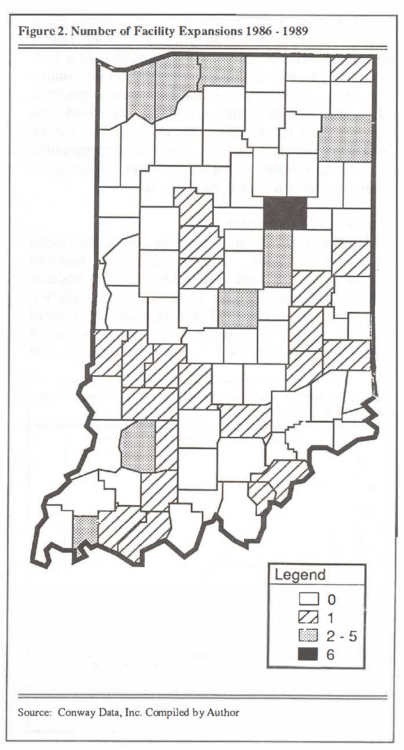

Indiana counties had 51 manufacturing expansions over the 1986-1989 period. Manufacturing expansions are defined as increased investments in existing manufacturing facilities that exceeded a value of one million dollars, created in excess of 50 jobs, or had a minimum of 20,000 square feet of floor space. Figure 2 shows the geographic distribution of these investments across Indiana counties. While much of the expansion occurred in metropolitan areas, investments in the expansion of existing manufacturing facilities also occurred in several of the counties located in the southwestern quarter of Indiana. Eleven of the 24 counties west of Interstate 65 and south of Interstate 70 grew through increased investment in existing manufacturing facilities. Counties to both the west and east of the northern half of Indiana’s Interstate 65 corridor, which did not attract new manufacturing investment, also failed to attract investment to expand existing manufacturing facilities.

Summary

Indiana, like neighboring states, was successful in attracting both new and expanded manufacturing investment in the 1986-1989 period. Both types of investment are heaviest in the metropolitan areas. New manufacturing investments occurred in communities along interstate highway corridors. The expansions that occurred in nonmetropolitan counties, on the other hand, were in counties that were not along corridors. This location pattern suggests that different types of Indiana communities might wish to consider different development strategies.

Examination of the location data suggest two questions: How does access to interstate highways impact firms’ location decision? and, How can community leaders identify local firms that have the potential to and are considering expansion of their manufacturing capacity? Research and Extension efforts to address both of these questions are currently underway in the Department of Agricultural Economics at Purdue to provide local leaders with information about the most effective strategies for expanding a local economy.