Mood Shift for Farmland and Cash Rents

December 23, 2013

PAER-2013-18

Craig Dobbins, Professor

After an impressive 10-year run that catapulted Indiana farmland values to unbelievable levels, the current economic situation indicates that the land market is likely to be in for a change. Based on the Purdue Farmland Value Survey, average Indiana farmland has nearly tripled in 10 years, increasing from $2,509 to $7,446 per acre.

This increase was fueled by a growth in demand for corn and soybeans associated with government policy, both domestic and foreign. In the corn market the big driver of demand growth was U.S. energy policy and the renewable fuels mandate. In the soybean market, the big driver of demand growth was the Chinese government’s decision to import soybeans from the U.S. and other producers. These changes in demand combined with weather events that reduced supply lifted corn and soybean prices to an unimagined level. While input prices were also increasing, crop production margins were at record highs and interest rates were at record lows. It would have been difficult to prescribe a more perfect environment for increasing farmland values.

With a large crop of U.S. corn and soybeans in 2013, supply appears to be catching up with the new demand quantities. In addition, the growth in demand for corn and soybeans has slowed. As a result, corn and soybean prices have declined and the record positive economic margins have disappeared. While the net return to a farmland investment is less supportive than in recent years, many of the other factors still remain strong. Long term interest rates continue to be low in relation to historic levels although there has been some increase in those rates already and markets continue to watch the Federal Reserve Bank closely for signs that quantitative easing will end with rates rising more. The supply of farmland relative to the demand remains tight. When a farm comes up for sale, there continues to be several interested buyers. Farmers continue to make purchases of farmland to expand the size of their business, and nonfarm investors continue to have interest in making farmland purchases when their desired rate of return can be achieved. Also, buyers continue to make farmland purchases with large down payments of their own equity. So far, farmland continues to provide a competitive return when compared to some alternative investments. While the profit picture for crop producers is not encouraging, the profit prospects of livestock producers has begun to brighten.

In addition to uncertainty about future crop production margins, there are important uncertainties about foreign and domestic government policy. The U.S. Congress has yet to settle on a new farm bill. The existing farm bill that is due to expire on December 31, 2013 provides little income support in the current environment. Creating a new farm bill that relies more heavily on crop insurance to provide a safety net will have limited income support when grain prices fall rapidly because the income floor is set using corn and soybean prices established each February. While there is a great deal of discussion about lower price levels for corn and soybeans, it is difficult to know where that might be without government income support to help establish it. A second uncertainty is China. While it is expected that imports of soybeans will continue to grow, there is growing evidence that these increases will come from countries other than the U.S. There is also increased uncertainty about U.S. renewable fuels policy.

Because of tighter margins and the above uncertainties, the 2014 the farmland market is likely to take on a more cautious mood. Highly productive farms will continue to attract strong buyer interest. Less productive farms will attract less interest. There are likely to be more “no sales” at auctions as reservation prices are not achieved. Prices are expected to remain steady during 2014, but the possibility for a 10% decline in farmland values seems much more likely than the possibility of another double digit increase.

Longer term the change in farmland values is much less certain. If large economic profits were an important driver lifting farmland values to their current levels, then significant economic losses should require downward adjustments. The most recent time period of declining margins was 2008-9. At that time, corn and soybean prices were declining and input costs were rising. Positive economic profits quickly flipped to economic losses and Indiana farmland values declined in 2009. Then in 2010 with strong demand growth, corn and soybean prices quickly recovered putting farmland values on an upward path again.

The evidence today points toward a much slower demand growth for grains and oilseeds. In addition, a farm bill built around crop insurance ill not establish a downside price safety net. This is an environment in which crop prices could be very low if supply exceeds demand and crop returns would be weak. Low crop returns, during a period of rising interest rates would be negative to land values.

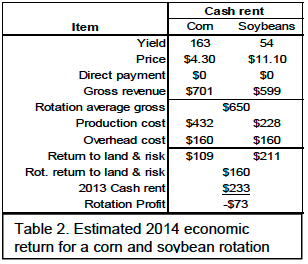

Tightening crop margins may have a more immediate impact in the cash rent market. With the economic breakeven price of corn close to $5.00 per bushel, $4.00 per bushel corn will result in significant per acre losses at current input costs. Using the futures market as an indicator of expected corn and soybean prices for fall 2014 and costs from the 2014 Purdue Crop Cost and Return Guide, the economic return for a corn and soybean rotation is projected to be minus $73 per acre (Table 2). This is a sharp change from $284 and $77 per acre estimated in 2011 & 2012, respectively.

For those using flexible cash leases or crop-share leases, an automatic downward adjustment in 2014 rent will likely occur if current 2014 crop prices persist. For those with a multi-year lease established under the assumption that corn and soybean prices would remain high, there may be a need to visit with the landowner regarding a potential downward cash rent adjustment. For tenants and landlords with up-to-date negotiated cash rents, there will likely be little change in those rents for 2014. In the longer-run, downward adjustments could be expected in negotiated cash rents in 2015 and 2016 if crop production margins continue to be weak.

Table 2. Estimated 2014 economic return for a corn and soybean rotation