Optimum Hog Marketing Weights With Higher Feed Prices

April 17, 1994

PAER-1994-03

Michael A. Boland, Research Assistant and Paul V. Preckel, Associate Professor*

Feed prices, in particular corn, are predicted the higher in 1994 die to lower stock cause by the flood that occurred in much of the western Corn Belt in 1993.

As a result, pork producers can expect higher feed costs. Maintain-ing low feed costs per pound of gain is important for profitability because feed is the largest cost in producing pork. However, the weight at which a producer markets hogs is also critical to profitability.

Hence, a key question for pork producers is: “how will higher feed costs impact the optimal marketing weight and profit per hog?”

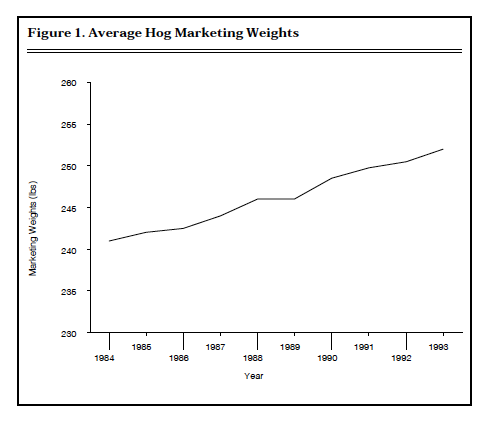

Economically optimal marketing weights differ across producers depending upon management, nutrition, type and size of pens and facility, genetics, markets, and other fac-tors. Average marketing weights have been increasing in recent years due, in part, to increased packer dis-counts for light weight hogs (generally under 235 pounds), processor demands for heavier primal cut weights, and substantial labor savings associated with trimming heavier primal cuts.

Over the past ten years, the aver-age marketing weight for U.S. hogs has increased from 241 pounds to 252 pounds (Figure 1).

Bioeconomic Model

Genetics based upon a typical Indi-ana hog genotype (Duroc x White Landrace) from the Purdue Cooperative Swine Lean Growth Trial was used in the economic model to deter-mine an optimal marketing weight for a feeder pig produced under different feed prices.

Feed costs were evaluated with four different corn prices ($2.25, $2.50, $2.75, and $3.00/bu) and a corresponding soybean meal price/ton ($185, $192.50, $200, and

$207.50/ton, respectively).

Other direct and indirect costs were obtained from the Purdue University Livestock Production Budgets (Foster et al.). All daily direct and indirect costs remained the same over time.

Three diets were fed to these animals. From 50 to 93 pounds, the barrows and gilts were fed a 19 percent protein ration with 1.2 percent lysine. A 16.8 percent protein ration with 1.0 percent lysine was fed from 93 to 177 pounds.

Figure 1. Average Hog Marketing Weights

Finally, the pigs were fed a 14.9 percent ration with .9 percent lysine above 177 pounds. The feed included corn, soybean meal, grain, premix, lysine, protein, and fat. The growth relationships between feed and live weight gain, and feed and lean weight gain were used to approximate the daily growth of the animal. An Indiana pork packer discount schedule was used to discount animals under 235 pounds or over 275 pounds.

The biological model maintained information on daily feed efficiency (pounds of feed/pound of live weight gain) and lean efficiency (pounds of feed/pound of lean gain). In addition, daily live weight gain was deter-mined using daily feed intake. Total costs and revenues were calculated each day. A more detailed description of the economic and biological model is presented in Boland, Preckel, and Schinckel.

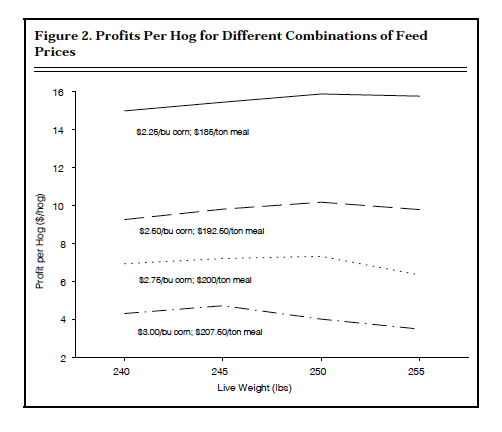

The model was used to determine an optimal marketing weight and the associated profit per hog assuming a $48.00/cwt live weight price. Profit is defined as a return to management and operator labor. With a corn price of $2.25/bu and a soybean meal price of $185/ton, the marketing weight was 253 pounds with a profit per hog of $16.12.

When the corn price was increased to $2.50/bu ($192.50/ton soybean meal price), the marketing weight dropped to 250 pounds and profit dropped to $10.16 per hog. A twenty percent increase in the price of corn per bushel ($2.75/bu with a corresponding $200/ton soybean meal price) yielded a marketing weight of 248 pounds and a profit of$7.47 per hog.

Finally, $3.00/bu corn and $207.50/ton soybean meal yielded a marketing weight of 244 pounds and a profit per hog of $4.77. Figure 2 contains the profits per hog associated with the different combinations of feed prices between 240 and 255 pounds. As the price of feed goes up, the cost of not marketing near the optimal weight increases as profits decline faster with the higher feed prices.

Summary and Conclusions

Higher feed costs mean lighter market weights. However, a producer’s marketing weight depends upon several factors and your marketing weights are probably different than these. For example, crowding is a critical factor that a producer considers when deciding when to market.

Figure 2. Profits Per Hog for Different Combinations of Feed Prices

Timing is another factor. You may have a group of pigs that you want to get out of the nursery, and hence you need to market the hogs in the finishing barn.

In addition, those producers growing their own corn may have a price/bushel different than ours. Finally, producers with improved genetics that are more feed efficient will use less feed per pound of gain. Hence, feed costs will be lower.

All of these factors help deter-mine a marketing weight. As feed costs get higher, it becomes more important for producers to deter-mine the optimal marketing weight.

References

Boland, M.A., P.V. Preckel, and A.P. Schinckel. Optimal Hog Slaughter Weights Under Alternative Pricing Systems.” Journal of Agricultural and Applied Economics, 25(1993): 148-163.

Foster, K.A., W. Dillon, K. Hendrix, V. May rose, and M. Neary. “Purdue University Livestock Production Budgets for 1993.” ID-200, Purdue University Cooperative Extension Service, West Lafayette, Indiana, 1993

* The comments and suggestions of Craig Dobbins, Chris Hurt, and John Kadlec are appreciated. The model used in this paper was funded, in part, by a grant from the Indiana Pork Producers Association.