Precision Agriculture Profitability: Implications for Land Values and Leasing

May 13, 2001

PAER-2001-8

Jess Lowenberg-DeBoer, Director, Site-Specific Management Center

Precision agriculture has proven its value for only a few uses. Yield monitors are used on roughly 20% of Corn Belt grain acres. Lightbars are used for guidance on sprayers and spreaders by about 30% of custom applicators in the Midwest and also by many producers. Variable rate application of lime has become common in the eastern Corn Belt. But many other aspects of the precision farming vision have not yet been realized or become common practice.

Precision farming technology has improved dramatically in the last 10 years, becoming easier to use, more reliable, and less expensive. But many questions remain about the profitability of the technology. This article summarizes the economic studies of precision agricultural technology, identifies key innovations needed to improve profitability, and outlines the implications for landowners.

Sometimes “precision agriculture” and “site-specific management” are used interchangeably, but there is an important distinction. Site-specific management is an idea as old as agriculture. Essentially it means doing the right thing, at the right time, in the right place. In the 20th century, agriculture became less site-specific. The economic pressure was to treat large areas with uniform crop recipes.

Precision farming is essentially information technology applied to agriculture. It uses global positioning systems (GPS), geographic information systems (GIS), sensors, and other electronics to help make site-specific crop management possible on a commercial scale.

Summary of Economic Studies

In their review of economic studies of precision agriculture, Lambert and Lowenberg-DeBoer (2000) found 108 articles that reported economic analyses. Of those 108 articles, 63%reported profits. Unfortunately, there was no standardization in the methods used, and some analyses omitted major costs or overestimated benefits. The costs of data gathering and data analysis were sometimes left out. Very few studies included the cost of developing the skill to use precision farming tools.

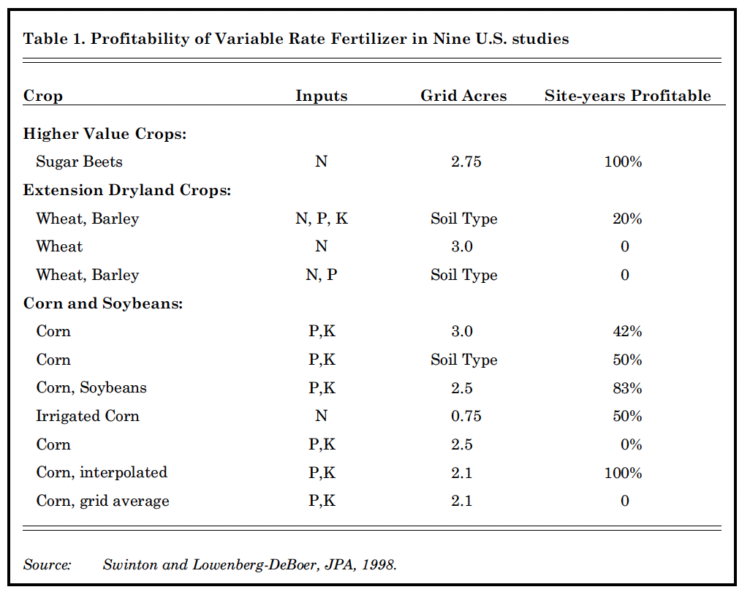

In an effort to overcome the lack of standardized methods, Swinton and Lowenberg-DeBoer (1998) reworked the budgets on nine studies of variable rate fertilizer (Table 1). Variable rate fertilizer is only one of many potential uses of precision agriculture technology, but it has been the subject of numerous economic studies because it was the first precision farming technology introduced commercially. The far-right column of Table 1 gives the percentage of “site-years” that the technology was profitable. For example, if a study had results from six farms over three years, that would make a total of 18 site-years. If the technology was profitable on nine of those farms over the three-year period, the percentage of “site-years profitable” would be 50%.

The main conclusions drawn from Table 1 are that: 1) variable rate fertilizer seems profitable for higher value crops, like sugar beets; 2) variable rate fertilizer is unprofitable for extensive dryland crops like wheat; and 3) for corn and soybeans profitability depends on where the trial was conducted and how the technology was implemented (e.g., grid vs. soil type, interpolated maps vs. management zones).

Key problems with the studies reported in Table 1 include the focus on “stand alone” technologies that manage only one or two inputs and the use of whole field fertilizer recommendations to create site-specific fertilizer application plans. It is argued that an integrated precision farming system which manages many inputs will be more profitable because costs can be spread and because the system can take advantage of synergy among inputs. For example, having both the corn plant population and nitrogen rate optimized together will have a bigger impact than the sum of each optimized separately.

Table 1. Profitability of Variable Rate Fertilizer in Nine U.S. studies

Whole field fertilizer recommendations, such as the Tri-State Recommendations used in Indiana, Ohio and Michigan, were designed as compromises that were acceptable over a broad range of conditions. They were never intended to optimize production on small areas within fields.

The trials on the Greg Sauder farm near Trimont, IL, (1995-97) overcame some of these problems. The trials were more integrated than previous efforts. Nitrogen, phosphate, potassium, and corn plant population were managed site-specifically. In addition, Sauder had done on-farm trials to determine optimal nitrogen rates and plant populations for the soils under his management. The Sauder trials showed a 15 bu./acre increase in corn yields with site-specific management and about $18/acre increase in net returns. This trial shows that precision ag technology can be profit-able for corn and soybeans, but it does not demonstrate how common profitability will be.

Studies have demonstrated prof-its for some other precision technologies. A Purdue study showed a benefit of about $3/acre/year when lime is spatially managed in Indiana. For a producer who already owns a GPS with satellite differential correction, just reducing skips and over-laps in chemical and fertilizer application can be worth an average of $0.50/acre/year.

Widespread adoption of yield monitors suggests that producers find them valuable. Unfortunately, there is very little data to document that value, because yield monitor information is used mainly at the whole farm level. For instance, if a producer uses a yield monitor to do hybrid strip trials and identifies the best genetics for that operation, those hybrids will be planted every-where on the farm, not just in the field where the strip trial occurred.

To measure the benefits of yield monitoring, economists would need whole farm records, and those are much more difficult to obtain than the on-farm trial results often used for evaluation of variable rate fertilizer.

Examples are often used to justify yield monitor use. For example, if a producer has 2000 acres of corn and soybeans, purchases a yield monitor and GPS for about $7000, and uses that yield monitor information to choose hybrids and varieties, then a one bushel per acre increase will pay for the yield monitor and equipment in the first year.

Innovations Needed

In 2001, precision agriculture is in about the same position that mechanization was in the early 1920s. At that time tractors had proven their value for a few uses. Tractors were profitable for primary tillage on relatively large farms and belt driven stationary equipment, but the technology was not well developed for row crop cultivation or any machine that required power on-the-go. The complete phase-out of the horse for farm power required the development of tricycle-type tractors for row crop cultivation, power-take-off, rubber tires for farm equipment, and other innovations.

Predicting the future of technology with absolute accuracy is impossible, but the economic studies suggest that several innovations are needed before precision agricultural technology becomes standard practice:

- Integrated precision agricultural systems with standardized parts and information formats,

- Soil sensors to reduce the cost of soil testing,

- Low-cost high-resolution remote sensing to reduce pest scouting costs,

- Easy-to-use software for data analysis, and

- Ways for producers to pool data to make the most of their information.

Implications for Land Value and Leasing

In the past, a substantial part of the benefits of any new crop technology in agriculture was capitalized into land values. That may happen again with precision farming. Using the standard capitalization model, dis-counting land over an infinite life (Value of land = Annual income/dis-count rate), using a 10% discount rate, and assuming that all the extra income was attributed to land, the added value due to the $18/acre benefit found in the Sauder trials would be $180 per acre. Even though it is unlikely that all the benefits would be capitalized into land, it is likely that profitable precision ag technology will add upward pressure to land prices.

The typical land capitalization model assumes that the scarcest resource in the farm sector is land, and hence all income that does not go to pay for specific inputs (e.g., seed, fertilizer, labor) can be attributed to land. In the precision farming case that assumption may not hold, at least not in the initial stages of adoption of the technology. The scarcest resource for the precision farmer may be human capital, that is, the knowledge and skill required make the system work, especially the ability to analyze data and develop strategies that increase prof-its. If skill is the scarcest resource, more of the precision farming bene-fits will go to attract people with the necessary skills. This may mean higher salaries for the agronomist working for the local fertilizer dealer or higher incomes for those farmers who acquire the skills.

Precision agriculture technology will also increase the demand for rental land. Precision technology is essentially a way to automate management. It takes some of the functions that formerly occurred in the brain of the farmer and turns them over to a computer. This will allow one person to manage more land, more effectively. To acquire that land, many managers will bid more aggressively on rentals, just as they did when mechanization, chemical weed control, no-till, and other automation technologies were introduced.

The technology may also alter rental agreements. In recent years many farmland rentals have shifted from share agreements to cash rental, which is easier for tenants with multiple landlords to manage and requires less agricultural knowledge on the part of the landlord. Precision technology may slow that trend by making share rentals more profitable and easier to manage for landlords and professional land man-agers. In the recent past, most of the yield-increasing technology in agriculture has required higher expenditures (e.g., hybrid seed, fertilizer, pesticides). In most traditional share rental arrangements, this meant that the landlord shared in these costs. Most of the expenditures for precision agriculture technology

(e.g., sensors and other equipment, software, training) would be paid by the tenant in the traditional share arrangement. Many studies of variable rate inputs show that overall input use changes very little, though the distribution of those inputs in the field may be changed substantially. Thus, under many current share agreements, precision farming means higher revenue for the land-lord, with little additional expense.

One perennial problem in farm-land rental is finding a trustworthy tenant. Sensor technologies may make it easier for a share landlord to monitor production practices and yields. For example, “as-applied maps” can show sloppy fertilizer or herbicide application practices. Yield maps provide a means to verify yields. Remote sensing can provide landlords with yield maps and other information completely independent of the tenant.

Summary

A few uses for precision agriculture technology have proven to be profit-able, and more are likely to be developed. As precision agriculture becomes common practice, some of those benefits will probably be bid into higher farmland prices. But initially the scarcest resource in this system is likely to be human capital, and a substantial part of the benefit will go to those who have the skills. To the extent that adoption of precision agriculture is slow, there may be a larger window for earlier adopters to benefit.

Precision agriculture is also likely to increase demand for rental land and make share rental relatively more profitable for the landlord. Precision technology essentially auto-mates management and allows one person to manage more land, more effectively. Under traditional share rental agreements, most of the cost of precision farming is paid by the tenant, so landlords may receive yield increases with relatively little extra expense. Sensors and satellite imagery also can make it easier to supervise share rentals.