Recreation Demand at Indiana State Parks

December 12, 1999

PAER-1999-17

Jeremy Emmert, Undergraduate Student and Gerald Shively,* Assistant Professor

The use of public resources to expand state park systems is an important economic policy issue. Many U.S. states have extensive park systems designed to serve outdoor recreation needs. In recent years, however, public officials have begun to express concerns regarding growing populations of outdoor enthusiasts, high rates of visitation, and perceived crowding during peak periods of park use. This has led many states to con-sider adding new parks or expanding existing parks. Indiana is currently in the process of establishing a new 3,000-acre state park that will be located near Lafayette, in the north central part of the state. The Prophetstown state park will encompass approximately 2,770 acres of an early Native American Settlement and is designed to preserve the cultural and historic heritage of the area, as well as provide a site for recreation. The park will include a “Living History” farm, patterned on a typical Indiana farm from the 1920s.

In the early 1990s the Indiana Department of Commerce completed a fiscal impact study for Prophets-town. The study specifically examined impacts of park establishment on the state budget and projected a net gain in income for the state budget following park construction. However, the study examined neither the likely profile of visitors to the new park nor the potential impact of the new park on rates of use at existing parks. In response, we set out to measure patterns of demand at three popular state parks, and to provide analysis of the possible impacts of a new park on visitation rates at those parks.

We first constructed a demand curve for park visits using standard statistical techniques.** we then measured the relative importance of various factors on rates of park visitation, and investigated three specific questions. One, do parks serve primarily local needs? Two, are parks used equally among state residents, regardless of income level? And three, to what extent do visitors substitute among parks? This final question aimed to clarify whether visitors might reduce rates of visitation at existing parks in order to visit Prophetstown upon its completion.

Park Survey

Data used for our study came from surveys that we conducted in October 1998 and April 1999 at three state parks: Shades, Turkey Run, and McCormick’s Creek. All of these parks are popular destinations, and experience some degree of crowding during peak periods of use. Brief written surveys were completed by a random sample of adult park visi-tors. Information collected included town or city of origin, size of group, household income, reason for visiting the park, and frequency of visits to a list of Indiana state parks.

Findings

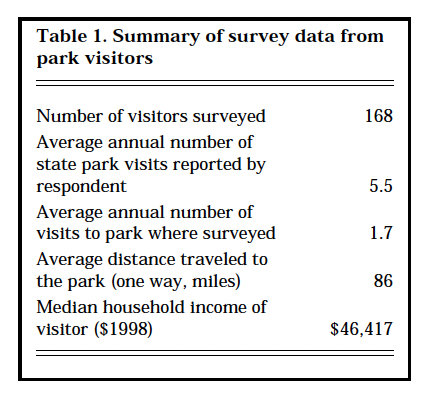

Table 1 summarizes some of the main data collected in the survey. A total of 168 individuals responded to the survey. Respondents reported an average of 5.5 annual visits to Indi-ana state parks, and an average of 1.7 annual visits to the park at which the survey was completed. In other words, repeat visits within the park system appear to be very com-mon. Although most park visitors were Indiana residents, the average distance traveled to reach the park was high. On average, visitors traveled 86 miles to visit a park. Approximately 30% of visitors came from within a 50-mile radius of the park at which a survey was completed. People who lived near a park had higher rates of park visitation that those who lived farther away. Median household income among respondents was $46,417.

Table 1. Summary of survey data from park visitors

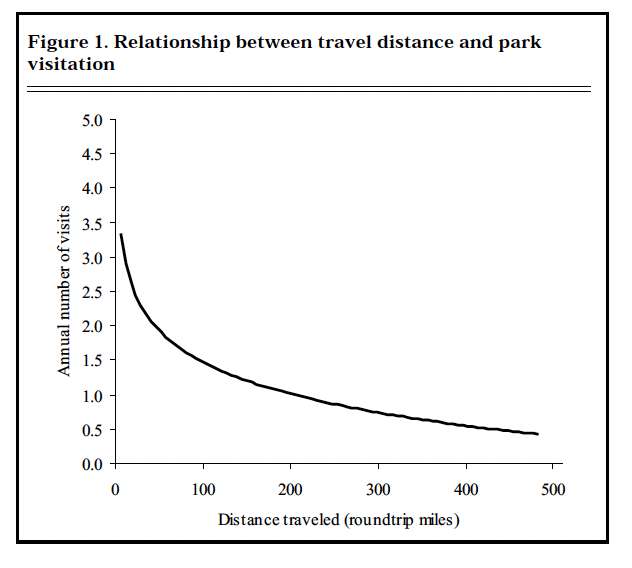

Figure 1. Relationship between travel distance and park visitation

Figure 1 shows the relationship between distance traveled and reported rates of visitation. The graph indicates that visitation rates fall off sharply as distance to the park increases. We found that this negative correlation between travel distance and number of park visits was both statistically significant and robust to inclusion of other variables in the analysis. The importance of distance was further confirmed by data showing that visits to parks tended to cluster in proximity to origin. This general pattern was represented at all sites studied and confirms that while it is by no means exclusively true, parks do tend to serve local recreation needs. Hiking, which was the most common reason noted for a park visit, was reported by 69% of respondents. Wildlife observation, the second most frequently cited activity, was reported by 27% of respondents. One-third of respondents reported overnight visits.

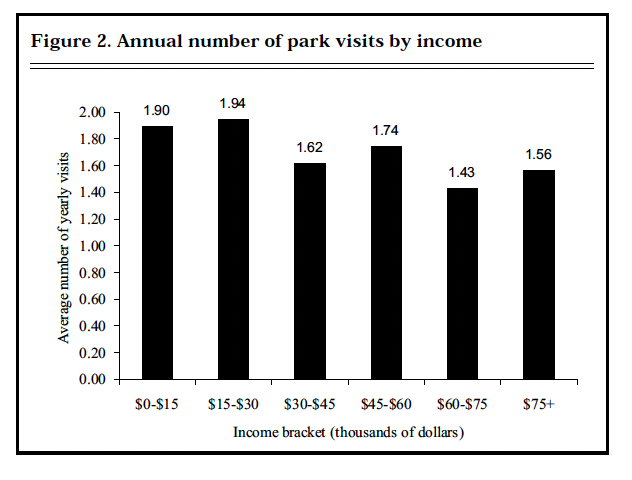

Our data show that the median household income in the sample ($ 46,417) exceeded median house-hold income in Indiana as a whole ($ 35,147 in 1996). While on the sur-face this suggests that parks may serve upper income groups more than lower income groups, we also discovered that overall rates of park use were higher in lower-income groups. For example, Figure 2 illustrates the relationship between annual household income in the sur-vey and the reported number of park visits. As the chart indicates, there was a tendency in the data for aver-age visitation to decline as incomes rose. In short, we found that while individuals and families from upper-income groups are more likely to visit parks, those from lower-income groups tend to visit more often. Although a visitor in our survey was about twice as likely to be from the top income bracket as from the bottom income bracket, con-trolling for distance traveled and number of annual visits, high- and low-income residents were roughly equally likely to make a park visit. Our conclusion is that the benefits of state parks appear to be distributed equitably among state residents.

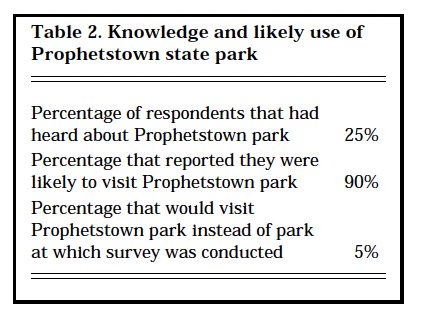

Our final investigation focused on the likely use of Prophetstown, and the potential impacts of Prophets-town on rates of use at existing parks. Unlike the results reported above, which are based on observed rates of visitation, our investigation at this stage relies on responses to hypothetical questions. Our survey gave a brief synopsis of Prophets-town park, and asked respondents whether they would be likely to visit the new park. Table 2 summarizes our findings. Although a relatively small proportion of visitors (25%) had heard of the planned park before taking the survey, 90% of respondents reported that they would be likely to visit it. Moreover, of those who said they would visit Prophets-town, 95% said they would visit the park in addition to the park where they were filling out their survey. Only 5% said they would use Prophetstown as a substitute for the park they were visiting. Based on the reported data, we found that if the 5% of respondents who said they would substitute Prophetstown for the park they were attending had actually made the substitution, their average travel distance to the park would have decreased by 43%. This supports the idea that a major factor conditioning park visitation is travel distance. In fact, we found that in terms of overall statistical and eco-nomic importance, distance was far more useful in explaining rates of park visitation than was income. These results suggest policy makers should always consider the importance of population centers and highway access when siting new parks, since lower distances and lower travel costs are correlated with higher rates of visitation.

Based on the results of our survey, it seems likely that Prophets-town could become a frequently visited park upon its completion. Furthermore, based on our findings from the survey, we believe the new park may help to reduce congestion at nearby state parks, albeit by a small amount. Finally, given current patterns of use, the establishment of Prophetstown state park is unlikely to reduce the overall importance of existing parks for residents of the state.

Figure 2. Annual number of park visits by income

Table 2. Knowledge and likely use of Prophetstown state park

Further reading

Emmert, Jeremy. 1999. “Income and Substitution Effects in the Travel Cost Model: An Application to Indiana State Parks.” Undergraduate Honors Thesis. Department of Agricultural Economics, Purdue University.

Indiana Department of Commerce (IN DOC). 1992. “An Assessment of the Potential Impacts from the Establishment of the Proposed Prophetstown State Park.” Research Office, Indiana Department of Commerce.

* This article summarizes research from Jeremy Emmert’s undergraduate honors thesis in the Department of Agricultural Economics. The thesis, entitled “Income and Substitution Effects in the Travel Cost Model: An Application to Indiana State Parks” was selected as the best undergraduate paper in the country at the annual meetings of the American Agricultural Economics Association, which were held in Nashville, TN, August 9-11, 1999. Dr. Gerald Shively, an assistant professor in the department of agricultural economics, was his thesis advisor.

** To conduct our analysis we developed a “travel cost model” of park demand. Travel cost models are widely used in recreation studies to relate visitation rates at existing parks to travel distance, household income, and park characteristics. The idea behind the travel cost model is that the distance a person travels to a recreation site is an indirect indicator of the value the visitor places on the recreation site. In the travel cost model, park visits are interpreted as commodities that a person “purchases” with his or her time. One advantage of using this method to measure economic benefits is that it is based on economic data derived from observed behavior rather than from responses to hypothetical questions, as are sometimes used.