Research Spotlight: The Impact of Solar Energy on Indiana Farmland Prices

August 9, 2024

PAER-2024-25

Binayak Kunwar, Graduate Research Assistant

According to the U.S. Energy Information Administration, solar generation accounted for about 3% of U.S. energy generation, but it is expected to increase to about 20% by 2050. Recent surveys conducted by the Purdue Center for Commercial Agriculture suggest that farmers’ interest in leasing farmland for solar energy generation has increased substantially over the last year. Solar energy leases typically offer rates well above rental rates for agricultural production. Farmers who lease land for solar generation may decide to reinvest in additional farmland or consider the solar option value when purchasing farmland. As a result, the impact of solar energy generation on farmland prices is an emerging issue for farmland owners, farmers, and policymakers across Indiana. Little is known, however, about the degree to which solar energy facilities influence farmland prices. My thesis research aims to provide some initial understanding of the influence of solar on farmland prices. The complete thesis is available here, but this article provides a brief summary.

Research Approach

In my research, I estimate the correlation between solar energy generation facilities and farmland prices in Indiana using a hedonic price model. The hedonic price model uses multiple regression analysis to decompose farmland transaction prices into the contribution of various attributes associated with the sales price, including acreage, soil quality, distance to the nearest town or city, the presence of power transmission lines, population density, and the distance to neighboring utility-scale solar generation facilities. Multiple regression analysis provides an approximate measure of the “dollar value” of each characteristic while controlling for all the other variables in the model. Hedonic price models are often referred to as “constant quality” price indexes.

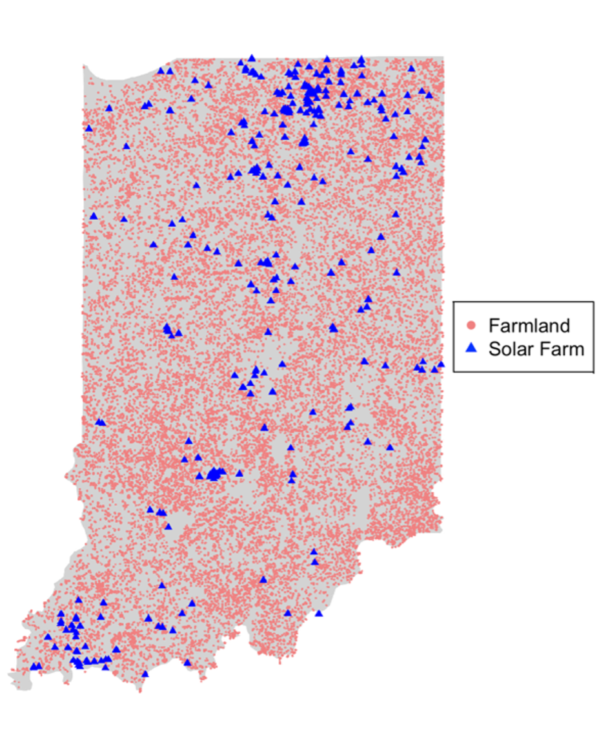

My hedonic price model examines the transaction prices for bare farmland across all 92 Indiana counties from January 2015 to December 2020. The data, obtained from Indiana Land Sales Bulletin, includes the acreage, soil productivity, sales price, and location for each parcel sold. Using geographic information systems (GIS), the location information was used to include additional variables, such as population density and distance to the nearest town or city. Most importantly, we also calculate the distance from each parcel to the nearest utility or commercial-scale solar generation facility, obtained from the Southern Indiana Renewable Energy Network (SIREN). Figure 1 plots the location of each transacted farmland parcel (red dot) and commercial or utility-scale solar generation facility (blue triangle).

Figure 1: Study Area

Findings

The hedonic price model estimates suggest that farmland near utility or commercial-scale solar generation facilities sells at a premium of 1.4% per mile on average. As previously stated, the hedonic price model estimates the impact of solar generation facilities on farmland transaction prices while controlling for all other characteristics included in the model. Thus, if two parcels are sold in the same year, in the same county, with the same acreage, soil productivity, distance to towns and cities, both with or without power transmission lines, and the same population density, the parcel closer to solar generation is expected to sell, on average, at a 1.4% premium for every mile closer to the solar generation facility.

In addition to these baseline results, the hedonic price model was also estimated across the farmland price distribution. The estimation results suggest that, for the highest-valued farmland (the top 10% of farmland prices), the estimated premium rises to 1.8%. Thus, for very high-value farmland, the transaction price is expected to increase by 1.8% per mile closer to the solar generation facility. The price premium, however, is less than 1% for the bottom 10% of farmland transacted. Our results, therefore, provide a preliminary indication that commercial or utility-scale solar facilities place a stronger price pressure on more valuable land.

Takeaways

My thesis research provides preliminary evidence that solar generation facilities place a positive price premium on nearby farmland. Further, the price premium increases for higher-valued farmland. These findings may be important to farmers, landowners, and policymakers. As solar energy continues to expand across Indiana, understanding its impact on land prices is key to making informed decisions. Rising farmland values near solar farms can affect farming costs and practices, potentially influencing agricultural production. The potential for increasing solar energy production offers both opportunities and challenges. On one hand, it potentially increases farmland values, which benefits current landowners. On the other hand, the increased values may represent an additional challenge for prospective farmland buyers. Decision makers will likely consider these dynamics to seek a balance between fostering sustainable energy production and maintaining the viability of the agricultural sector.

Again, for the interested reader, the full thesis is available here.