Responding to Financial Stress What are the Options?

December 12, 1999

PAER-1999-16

Michael Boehlje, Professor; Craig Dobbins, Professor; Ken Foster, Associate Professor; and Alan Miller, Farm Business Management Specialist

Farmers are currently facing significant financial and economic stress. Many are calling the situation a crisis. Others cite relatively high net farm income for all the nation’s farmers as evidence that the severity is being overstated. There is some truth in both.

National net farm income is expected to be in the high $40 billion to lower $50 billion range in 1999. The exact level will depend on the extent of emergency appropriations from the government. If all of the approximately $8.7 billion approved is paid to farmers by the end of the year, farm income could exceed $50 billion and be the second highest on record after the nearly $55 billion of 1996. However, government payments could represent as much as 47% of the total income of farmers, indicating that farmers are nearly as dependent upon government as they are on the market.

Lower market prices for farm products and, thus, lower incomes are generally blamed on reduced farm exports because of the Asian crisis. U.S. exports have declined 17% since they peaked in 1996, but only part of that decline is due to the financial and economic problems in Asia. Other contributors to the reduction in U.S. farm exports have been a strengthening value of the dollar and increased (in fact, record) world production of farm products. Looking to the future, Asian economies appear to be recovering, but future economic growth is likely to be much more modest than the approximate 10% annual growth in gross domestic product during the decade prior to 1996. The value of the dollar with respect to other currencies is not expected to strengthen during the next year or two, which is neutral or possibly even positive for future export growth. But world pro-duction of agricultural products continues to expand, indicating that U.S. producers will continue to face intense competition in export markets. So the recovery in prices and incomes may be slow in coming (without a drought or other weather event) and the financial problems of the industry are likely to continue for the next couple of years.

Types of Managerial Responses

Farm business managers can employ a number of specific strategies if their business is under financial stress. The strategies can be categorized into one of the three following basic types of managerial responses: 1) managing cash flow, 2) managing liabilities, and 3) managing assets.

Farm business managers can use the following strategies to increase net income and manage cash flow in financially stressful times.

- Control cost: This is a time to be even more vigilant in determining which inputs produce sufficient revenue to cover their cost. Any strategy to reduce costs in plant and animal production should be considered again – and with a sharper pencil.

- Renegotiate cash rents: Rents are one of the largest cost items in crop farming and have some flexibility because they are often negotiated on an annual basis.

- Reduce capital spending: It makes sense to be much more cautious in machinery and equipment purchases during periods of financial stress. This may be the time to repair rather than replace, and even if you replace, it may not be the time to buy excess capacity or up-grade.

- Reduce family withdrawals: Many family expenses are difficult to cut back. Maybe you will have to postpone spending for big ticket items such as family vacations and car purchases. But be careful – come families cut too deep, particularly in the areas of health and medical insurance.

- Increase revenues/thruput: do you have some assets that are not generating as much revenue as they might? Can you rent out your storage facilities or your hog buildings to generate revenue? Can you use underutilized machinery to do custom work? Underutilized assets are particularly costly in times of financial stress.

- Increase non-farm income: One way to bridge the gap in financially stressful times is to obtain income from non-farm sources. An off-farm job may not be what you want, but you should certainly investigate the option to supplement farm income from off-farm employment.

Farm business managers can use the following strategies to manage debt during financially stressful times.

- Extend loan terms: A typical adjustment to reduce cash flow pressures is to negotiate longer repayment terms. Longer terms to repay will often reduce cash flow pressures, but remember that the debt must still be ser-viced and that this strategy does nothing to reduce cost or increase income. Extending debt servicing terms in many cases is a mechanism for “buying time” to make more fundamental changes in the farm business.

- Re-amortize carry-over: One way to manage this carryover is to covert it into a longer term loan –say five years – and set up a payment schedule to systematically reduce it over a period of time.

- Interest-only payments: In situations where a loan is well secured and the cash flow shortage is assumed to be temporary, your lender may accept an interest-only payment as an alternative to the full principal and interest payment required by the amortization schedule.

- Increase collateral: This strategy again does little to relieve the root causes of financial stress. It does give your lender a stronger financial position and raises your lender’s comfort level in case of default down the road, so it may relieve current intense financial pressure. But be careful to avoid assigning any more collateral than is absolutely necessary.

- Acquire guarantees or contracts: Like increasing collateral, this strategy in essence increases the comfort level of your lender and consequently should increase his or her willingness to extend repayment terms or re-amortize collateral.

- Reduce debt: Certainly one way to reduce financial stress is to pay off some of the debt and reduce the debt servicing require-ments. The funds might come from non-farm earnings, other family members in the form of a gift or personal loan with attrac-tive terms, or the sale of farm business assets.

- Refinance: Have interest rates declined? If so, it might be possi-ble to refinance some loans and reduce interest expenses. You need to compare the cost of refi-nancing with the savings in inter-est. This might be a good time to move variable rate loans to fixed rate loans in order to reduce the risk of any future interest rate increase.

Farm business managers can use the following strategies to manage assets during financially stressful times.

- Liquidate cash/investments, and reduce debt: In essence, this strategy involves the use of cash and financial reserves that have been maintained in the farm business to reduce the debt load. But most farm businesses do not maintain substantial cash or liquid asset positions, so this strategy is typically not a realistic option.

- Sell inventories, and pay down debt: Some farms have accumulated substantial inventories. Although selling inventories at depressed prices may not seem to be an attractive alternative, it may be a reasonable option, particularly if the stress is severe and if there are substantial storage and other carrying costs associated with carrying inventories. However, the entire proceeds received from liquidating raised products will often be taxed at ordinary income tax rates unless expenses or deductions are avail-able elsewhere to offset this tax-able income.

- Sell capital assets, and reduce debt: As with selling inventories, the liquidation losses that might be incurred if capital assets such as land, machinery, and equipment are sold may be high, and this strategy also will likely reduce the long-term income-generating capacity of your farm business. Again, you must consider the tax consequences of such a sale.

Selecting a Strategy

How do you choose among various strategies? Two possible scenarios are critical in choosing a strategy. The first is whether the source of the financial stress is external and of short-run duration. An example of this type of financial stress would be the unexpected reduction in income brought on by a decline in grain prices, because favorable growing conditions resulted in above average yields. While this change can have important implications for the cash flow of the farm business, continued strong demand, increased usage of commodities because of lower prices, and normal production levels the following year may allow grain prices to quickly recover.

This type of stress could also be brought on by a localized drought in which yields for the farm are depressed because of bad growing conditions for this year, but recover under normal weather the following year. In both cases, cutting the quantity of fertilizer applied, postponing capital purchases, or lengthening repayment periods will help the farm business through these short-run events. These techniques buy time until prices improve or the economic environment recovers.

The second scenario is when the problem is of longer duration or is caused by problems internal to the farm business. In this case, strategies to buy time will likely not be effective. While the actions used to buy time will appear to work initially, financial problems will reap-pear later, requiring additional changes. In many cases, the adjustments that the farm manager will need to make when the problem reappears will be much more difficult.

While the problem in this second scenario might be caused by an external event, it can create problems internal to the farm business. In a new lower price environment, the farm business may no longer be generating a sufficient amount of revenue from its fixed assets. While cost cutting or debt restructuring can buy time, financial stress will likely reappear. A better solution to this problem would be finding ways for enhancing the thruput of the farm business. Increased thruput will increase the efficiency of the fixed resources and lower per unit fixed cost.

Strategies to manage income or cash flow through increasing revenue, reducing cost, or increasing thruput will not only reduce current financial stress, but will have long run benefits in terms of increasing profitability or net margins in the farm business. But in many cases, these strategies are either not avail-able or do not provide sufficient benefits to relieve financial stress. This leaves a strategy of selling assets. Selling assets may be very painful, but at the same time may be necessary to solve a serious financial stress problem.

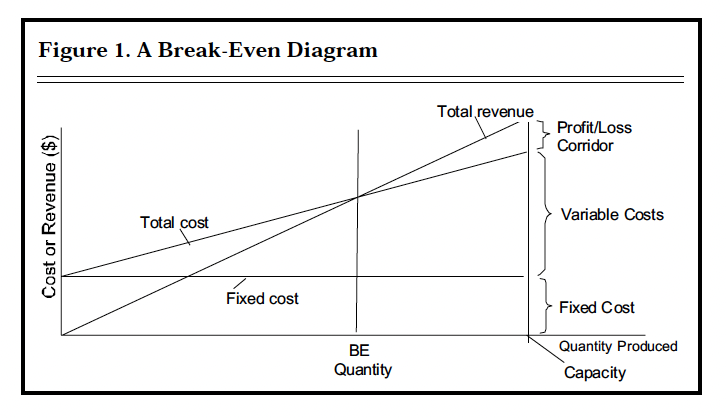

A break-even diagram may be helpful in choosing among various long-term strategies (Figure 1). The horizontal axis in Figure 1 represents the quantity of production or the size of the farm business. The vertical axis represents the cost of production and the revenue from sales of production. There are two types of costs represented in Figure 1 – fixed costs and variable costs. Total fixed costs are the same regardless of the quantity produced. This is represented by the horizontal line in Figure 1. While total fixed costs stay the same as quantity is increased, fixed costs per unit will decline as the quantity produced is increased.

Adding variable cost to fixed cost provides total cost. Because total variable cost increases as the quantity of production increases, more production results in more cost. This causes total costs to increase in response to increases in the quantity produced.

Figure 1. A Break-Even Diagram

As volume increases, total revenue will increase. Because per unit revenue must be more than per unit variable cost for the farm business to undertake production, total revenue will rise faster than total expenses.

At some point, total cost will inter-sect total revenue. This is the break-even point (BE) for the farm business. At quantities of production to the left of the break-even point, the farm business is losing money. However, even below this break-even level, if per unit variable cost is less than per unit revenue, production helps to reduce the losses, so it makes economic sense to continue to produce. All quantities of production to the right of the break-even point (BE in Figure 1) provide a profit.

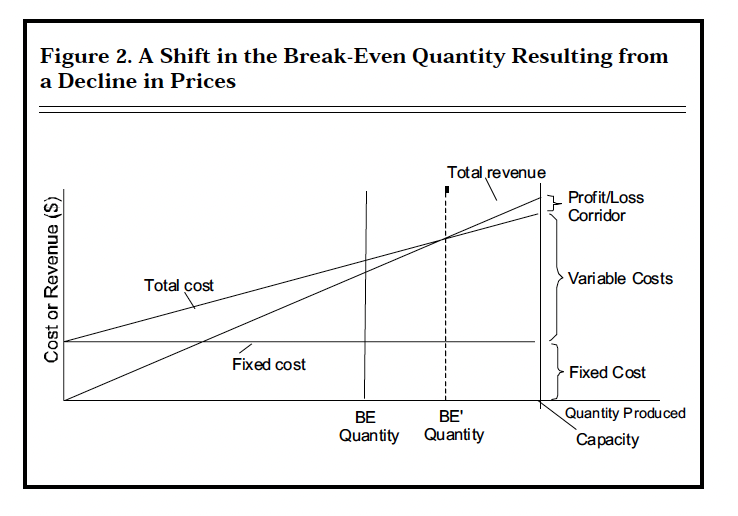

Figure 2. A Shift in the Break-Even Quantity Resulting from a Decline in Prices

Figure 2 illustrates what happens to the break-even point in Figure 1 if there is a general decline in per unit sales prices. The total revenue curve tilts down, and the break-even point shifts to the right (from BE to BE’). Farms that were just breaking even before the price decline no longer break even and will feel pressure to adjust. One possible adjustment would be to increase the quantity produced. For example, we might expect increased competition to rent ground as farmers’ profits are squeezed by the increase in the required break-even volume. But is this the best alternative? What about making adjustments that will reduce variable costs and shift the break-even back to the left? Or what about selling off unproductive assets in order to shift the break-even point back to the left by reducing fixed costs and shifting the total cost line downward? Any or all of these alter-natives may be preferable to bidding up rents for cropland.

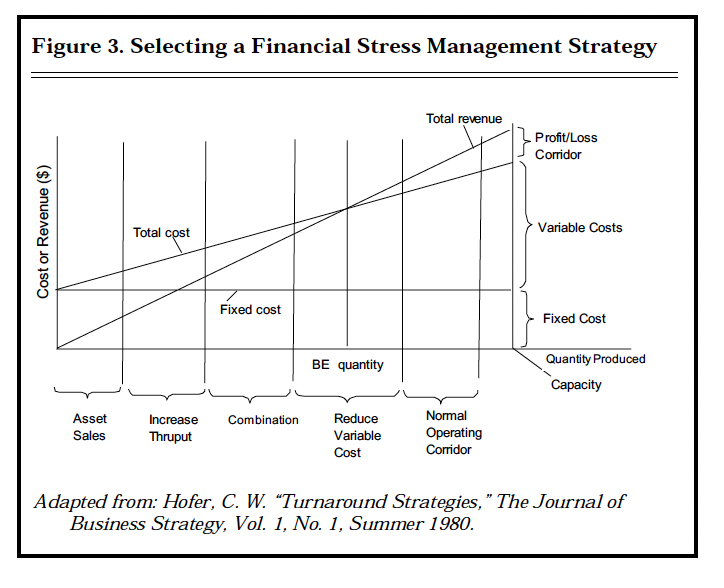

Now let’s use a break-even diagram to choose a strategy to manage financial stress (Figure 3). Near the break-even point, strategies for cut-ting variable cost to reduce financial stress are preferred. Relatively small changes in variable costs may allow the firm to return to the break-even point or better. But further to the left in Figure 3, fixed costs (depreciation, interest, taxes, insurance, and family living) are an increasingly important part of total cost, so

cost-reducing strategies become relatively less effective, and revenue-enhancing strategies – including increasing thruput – become increasingly more important. At some point (moving even further to the left in Figure 3), fixed costs, which cannot be reduced in the short term, become so dominant in the farm business that cost reduction and revenue enhancement are no longer effective and asset reduction or liquidation strategies are necessary. This appears to be when fixed costs are 40 percent or more of total cost. Clearly, resolving the problem before it becomes this severe is highly desirable. But if the fundamental financial stress is resulting from excessive depreciation, interest, and labor costs (i.e., fixed costs), there are only two ways to solve the problem: 1) spread those fixed costs over more revenue by increasing thruput, or 2) get rid of the fixed resources that are creating the high fixed costs.

Figure 3. Selecting a Financial Stress Management Strategy

It is possible to operate at less than break-even for some period of time. But in the long run, failure to achieve a cost-volume-profit relationship that allows the farm to break even on average catches up with the farm business. Then, the resources those farms controlled move into the hands of more profitable farms.

In many cases the root causes of financial stress are internal and have been long in the making before the symptoms become critical. The persistent inefficiency associated with too little volume or costs that are too high often goes unrecognized until it is too late. One of the most important rules of financial stress management can be summed up in the simple but powerful equation: early recognition = early resolution. Certainly, the resolution is generally much easier and less painful when financial problems of this type can be nipped in the bud.