Retirement in the Family Business: Farm and Non-Farm Differences

April 15, 2018

PAER-2018-02

Authors: Renee Wiatt, Family Business Management Specialist, Purdue Initiative for Family Firms and Maria I. Marshall, Professor of Agricultural Economics

Retirement planning is always challenging but can be especially complicated if you own your business, work for a family business, or are self-employed. Copreneurs (those who own a business with their spouse) have especially complicated situations since the financial wellbeing of both individuals is linked to the business.

Family businesses have many retirement considerations including:

- Who will take over the management of the business

- Whether or not ownership will be relinquished upon retirement

- Trust in a successor

- Whether a retirement plan has already been funded or retirement funds have to be withdrawn from the ongoing family business

- Selling the business in order to fund retirement

- Whether retirement will take place in phases or all at once

- Will retirement be partial or full

Sherwood (2007) urges business owners to consider partial retirement, with the owner retaining management decisions and delegating other tasks to the next generation. This would allow the owner to maintain control, while freeing up time to travel and enjoy hobbies. Kim and DeVaney (2003) found that partial retirement is in the forefront of family business owners’ minds, with 40% of their sample confirming that they expect to partially retire (instead of fully retiring). While partial retirement may not be ideal for all, it could be a great compromise for some family business owners.

Retirement decisions in the family business can be more emotionally trying than retirement decisions for wage-based employees. The integration of the family and the business into one’s everyday life makes exit emotional for many owners. Otherwise straightforward business decision can become more difficult for a family business.

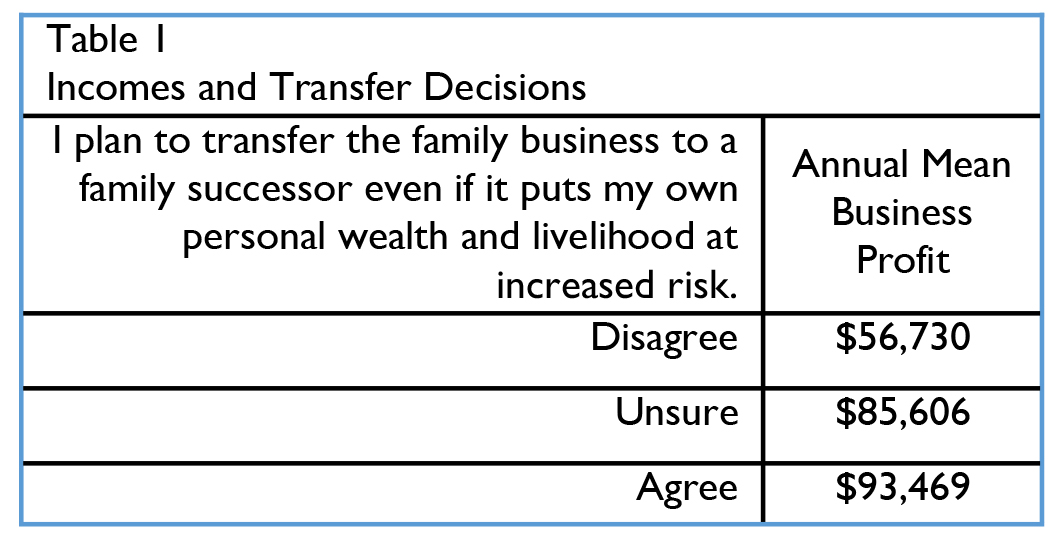

The Family Business Succession Survey (2012) found that 55% of owners had thought about succession planning because of their desire to retire. Further, 37% of owners responded favorably to, “I plan to transfer the family business to a family successor even if it puts my own personal wealth and livelihood at increased risk”. We measured annual mean business profit related to each response and found that when owners responded “disagree” to the afore- mentioned question, they had roughly $36,000 lower mean annual business profit than owners who re- sponded “agree”. Mean annual business profit for owners who disagreed was roughly $57,000, it was $86,000 for those who were unsure, and it was $93,000 for those owners who agreed, Table 1.

When the family business is a farm business, the retirement decisions can become even more complicated. The farming industry is notorious for owners who “never really retire” or whose retirement plan is to “die on the tractor.” According to the 2012 U.S. Census Data (2014), 33% percent of farmers are 65 years of age or older. Within 30 years, the average age of the American farmer has increased by roughly 8 years, moving from 50.5 years of age in 1982 to 58.3 years in 2012.

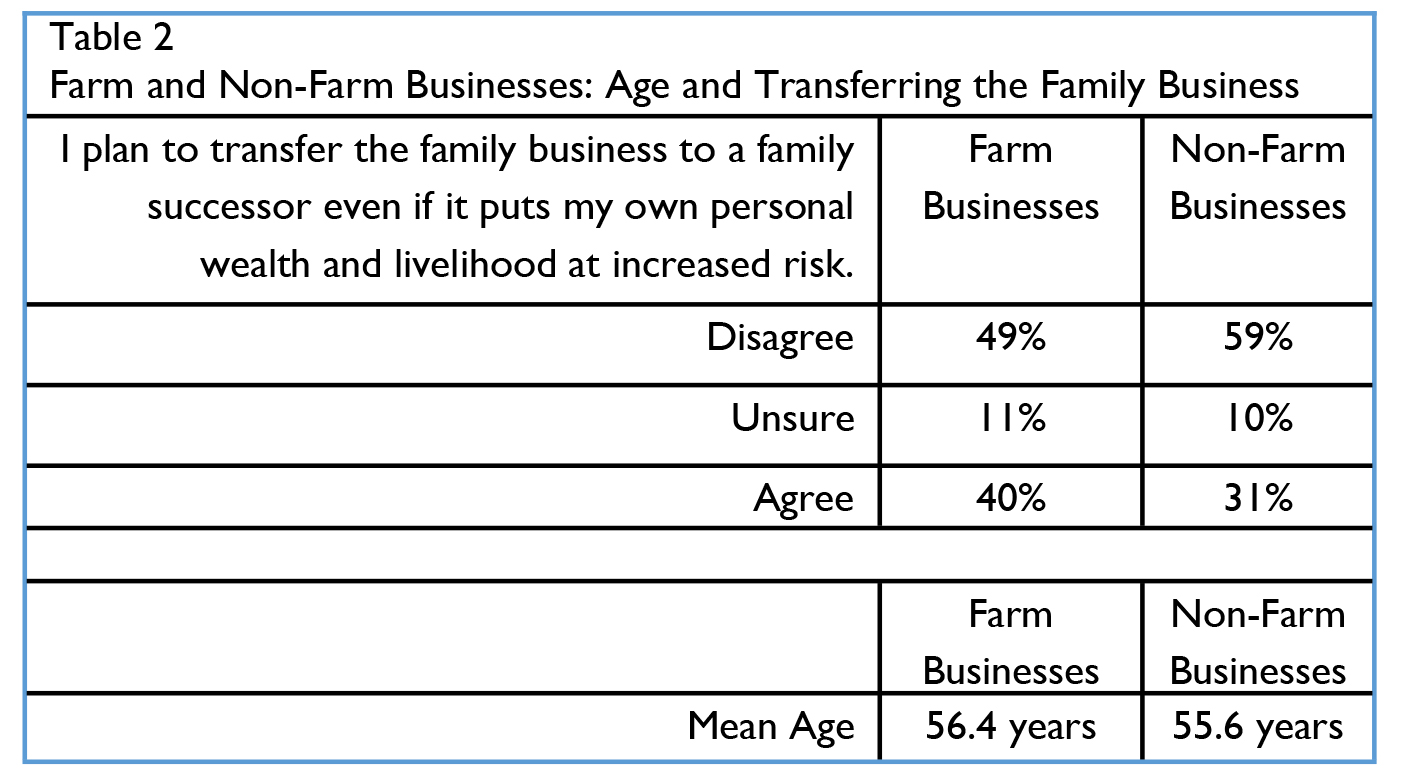

Table 2 shows the differences between farm and non- farm decisions to transfer the family business. The Family Business Succession Survey showed that the average age of farm business owners was 56.4 years and the average age of non-farm business owners was 55.6 years, only a slight difference. A larger difference between farm and non-farm businesses was in willingness to put themselves in financial risk. While only 31% of non-farm businesses planned to transfer the family business even if it put the owner’s wealth and livelihood at increased risk, 40% of farm business owners would agree to the increased risk.

Careful consideration of the owner’s involvement before, during, and after retirement is necessary for a smooth retirement process. Added benefits of careful succession planning include: minimizing emotional pain, minimizing the tax burden, maximizing the wellbeing of retiring owner(s), and adhering to the owner’s wishes when the business transfers from one generation to the next (Battersby, 2012). Clearly, the transition to retirement is not easy, especially in a family business, but retirement is possible with sound planning in place.

References

Battersby, M.E. (2012). “What Happens to Your Business When You Retire?” Metal Center News, September 2012.

Kim, H. & DeVaney, S.A. (2003). “The Expectation of Partial Retirement Among Family Business Own- ers.” Family Business Review, 16(3), 199-210.

Sherwood, B.J. (2007). “Why Family Business Own- ers Should Consider Alternatives to Full Retirement.” Metal Finishing, 105(2), 58-59.

USDA Census of Agriculture. (2014). “2012 Census Highlights, Farm Demographics – U.S. Farmers by Gender, Age, Race, Ethnicity, and More.” United States Department of Agriculture website: https://www.agcensus.usda.gov/Publications/2012/Online_Resources/Highlights/Farm_Demographics/