Soybean Production: Competitive Positions of the United States, Brazil, and Argentina

November 13, 2002

PAER-2002-12

Alexandria I. Huerta, Graduate Research Assistant and Marshall A. Martin, Associate Director of Agricultural Research Programs, Purdue University

Soybean production in Argentina and Brazil combined is expected for the first time, this year, to surpass that of the United States (USDA, 2002). Furthermore, the U.S. share of world soybean exports has declined. In recent years, U.S. farmers have been facing some of the lowest soybean prices in decades, due in part to bumper crops, coupled with a weaker world demand. Also, the loan deficiency payments (LDP) incentives associated with the 1996 Farm Bill encouraged American farmers to increase soybean acreage.

Both Brazil and Argentina have not yet fully developed their agricultural resources. Infrastructure improvements, particularly transportation, combined with a more stable political and economic environment, could lead to further gains in South American soybean production and market share.

Can U.S. soybean producers remain competitive?

Geographical Comparisons

Three countries (United States, Brazil, and Argentina) produce 80%of the world’s soybeans. The United States and Argentina share a temperate climate, while the climate in Brazil is more tropical. Because of their location in the Southern Hemisphere, Brazil and Argentina have a crop production season opposite to that of the U.S. with approximately a six-month difference in the time of harvest. This provides some market advantages to Brazilian and Argentine farmers since they harvest their soybeans between February and April when historically soybean prices have been higher. Growing seasons for these three countries also vary in their length. The United States has a shorter growing season (May through October) than its competitors. Argentina’s growing season may extend from November through May. In Brazil’s frost-free tropics, three crops might be produced each year.

In the United States, the deep rich soils of the Corn Belt have made that region the world’s most productive soybean-growing area. Argentina’s soybean production region, known as the “Pampas”, has soils that are equally fertile (See figure 1).

In Brazil, soybean production historically was concentrated in the south, but in recent years has expanded into the “Cerrado”, which is a savannah-like flatland in the central west. The Cerrado soils, which are high in aluminum, highly acidic, and deficient in phosphorus and nitrogen, are naturally less fertile. But, public and private researchers in Brazil have adapted soybean varieties to these soil conditions. The addition of lime and phosphorus minimizes aluminum toxicity. Brazil has large supplies of lime. The soils in the Cerrado are very fragile, and high rainfall levels create significant soil erosion problems. Producers in Brazil have adopted no-till production practices and terracing to minimize erosion.

Figure 1. Soybean Production Regions for Latin America

Between 1991 and 2001, U.S. soybean production increased about 50% from 52.9 to 79.1 million metric tons (million ts). In 1991, the United States exported 23.6 million ts, 39%world market share. In 2001, U.S. exports had increased to 35.1 million ts, but the export share had fallen to 32% (Schnepf, et. al, 2001).

Brazilian soybean production more than doubled over the past decade, from 18.5 million ts in 1991 to 41.5 million ts in 2001 (Schnepf, et. al, 2001). Brazilian production has expanded faster than domestic consumption, resulting in increased exports. Argentina too has experienced an increase in soybean production. In 1991, Argentine soybean production was 11.1 million ts, and by 2001 had also more than doubled to 27 million ts (Schnepf, et. al, 2001).

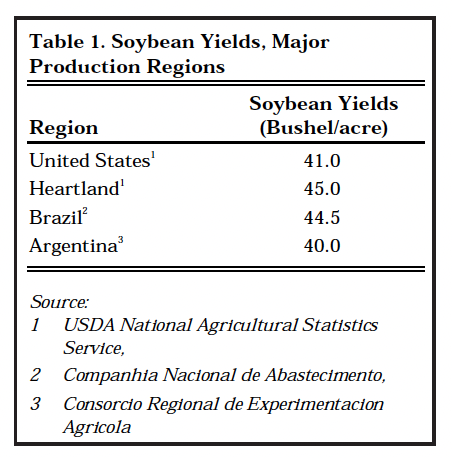

Soybean yields are comparable among the three producers; in the U.S. Heartland Region soybeans average 45.0 bushels per acre compared to U.S. average yields of 41.0 bushels per acre (Table 1). Soybean yields in Brazil and Argentina are 44.5 and 40.0 bushels per acre, respectively.

Table 1. Soybean Yields, Major Production Regions

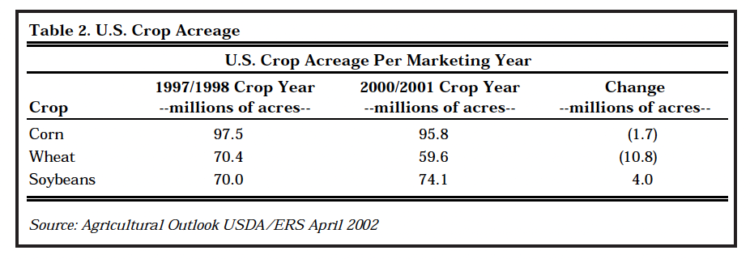

Table 2. U.S. Crop Acreage

Total U.S. agricultural land area is 418.3 million hectares (one hectare equals 2.47 acres), with 239.3 million hectares in permanent pasture, 177 million hectares in cropland, and 2.1 million hectares in permanent crops. Soybean expansion in the United States primarily must come from a reduction in the area planted to another crop (Table 2). Brazil and Argentina combined have approximately the same amount of agricultural land as the United States: 419.4 million hectares. The difference lies in the potential for expansion. For example, Brazil currently has 50% as much land under cultivation as the United States, but it has the potential to increase crop area by 56% more than the United States has under production (Leibold, et al.). Both Argentina and Brazil have vast expanses of land in permanent pasture which could be converted to soybean production with appropriate market incentives and technologies.

Infrastructure

The United States possesses a well-developed marketing structure. U.S. soybean producers are able to move their product to international markets more efficiently and at a cheaper cost. Paved highways are more prevalent in the United States than in Argentina and Brazil, where only 10 percent and 30 percent, respectively, of the highways are paved. The availability of rail lines and a common single gauge allows for larger load densities in the United States that further reduce transportation costs for commodities.

In contrast, Argentina’s and Brazil’s waterways and overland transportation infrastructure are underdeveloped and generally sub-standard. The governments in these countries have not invested much capital or implemented policies to modernize and improve existing transportation infrastructure. Inefficient barge and railroad transportation systems have led to

a dependence on slower, and more expensive, overland trucking. However, recent initiatives to deregulate and privatize railways and ports in both countries could lead to infrastructure improvements.

Another major problem in Argentina and Brazil is the underdeveloped on- and off-farm storage. Increasing storage capacity would reduce the need for harvest-time sales, and shipment, which tends to depress harvest-time prices and create congestion at terminal elevators and port facilities.

Competitive Positions Competitiveness in international commodity markets reflects the ability to deliver a product at the lowest cost. Competitiveness is influenced by many factors: relative resource endowments, agro-climate conditions, macroeconomic policies*, agricultural policies**, infrastructure and supporting institutions*** (Schnepf et. al, 2001). The combination of farm-level production, transportation, and marketing costs will determine a farmer’s competitiveness on the international stage.

As noted previously, there are clear differences in agro-climate conditions among the three soybean production regions. Soil types and climate conditions dictate yields and when the product reaches the market. However, there are other equally important differences: types and availability of technology, land costs, labor costs, access to capital (cost of capital), transportation costs and marketing costs.

A major production cost difference is the cost of land. The relatively high soybean production costs in the United States are partially attributed to higher fixed costs, especially land. A recent study by the USDA’s Economic Research Service (ERS) shows estimated land rental rates for Brazil at $6 per acre (in Mato Grosso) to $14 per acre (in Parana). Average per acre rental rates in the United States and Argentina were much higher: $88 and $63, respectively. U.S. data represent the Heartland region in the Midwestern United States, while those for Argentina represent prime land in northern Buenos Aires Province. The lower land rental rates in Brazil are a reflection of the abundance of land available in the Cerrado for agricultural development. High yielding land in Mato Grosso can be purchased for as low as $200**** per acre compared to the $2000 or more per acre costs in the U.S. Corn Belt (Schnepf et. al, 2001).

__________

* Macroeconomic policies affect exchange rates, investment incentives, energy costs, etc.

** Sector specific policies include credit subsidies and import and export taxes.

*** Supporting institutions include regulatory agencies, credit, and news and information services.

**** This reflects land that has not yet been cleared or prepared for planting.

In terms of competitive advantages from infrastructure, the United States still holds the advantage. U.S. transportation systems are superior to those in South America. The U.S. infrastructure is better for moving soybeans from the field to a domestic port, and on to a foreign port. Since the mid-1980’s, the average U.S. producer to free-on-board (f.o.b.) port price spread has shown little variability at about $16 to $18 per ton. Lower transportation and marketing costs for U.S. soybean producers reflect in part the efficient barge transportation system. With the barge system, soybeans can travel long distances at relatively low costs. However, on the Mississippi River, barges loaded with Heartland grown soybeans often wait in line for hours to pass through a series of 80-year-old locks that lower the barges down to sea level at New Orleans. From there the soybeans are loaded onto freighters. Farmers have been lobbying for upgrades in the lock system, a project that will cost more than $1 billion (Rich, 2001). This long-awaited upgrade has been slowed by doubts raised about cost-benefit analysis and environmental impact studies by the Army Corps of Engineers. Such transportation improvements will be essential if U.S. soybean producers are to remain competitive in the international market.

This transportation advantage is under constant threat from U.S. competitors. There have been some reductions in internal transportation costs in Argentina and Brazil, which has boosted their soybean export competitiveness. However, despite construction of some new rail lines and ports, roadways are still the primary means of moving commodities throughout Brazil. In the last few years, the Brazilian government has leased roads for private maintenance. To fund road maintenance, private companies charge high tolls, thereby increasing the transportation costs for Brazilian soybean producers.

The trucking distance in Brazil is greater than that faced by U.S. farmers. Approximately 80% of Brazil’s soybeans are trucked to market (McVey, et. al, 2000). Unlike U.S. production regions, soybean production in Brazil is not conveniently located near a main source of water navigation, thus its reliance on overland travel. The quality of these roads is poor and a substantial portion of Brazil’s main highways that serve much of the soybean producing regions are dirt surfaced. On average, Brazilian soybeans travel 900 miles by truck before being transferred to railroad cars or waterways (Spangler and Wilson, 2002). These soybeans must then travel approximately an additional 900 miles to reach an east coast seaport, as is the case for soybeans produced in Mato Grosso. The producer f.o.b. price spread is estimated at $47 per ton.

The Brazilian government has been promising upgrades in paved roads and navigable waterways, but chronic economic instability and large budget deficits have held up this work. Private companies are stepping in and partially filling the gap. Using loans from a government development bank, private companies are building new railroads. One example of private initiative is Blairo Maggi, one of Brazil’s largest soybean producers. When promises of infra-structure improvements from the government went unfulfilled, Maggi provided $20 million plus $40 million from the state of Amazonas to build a port on the Amazon-feeding Madeira River. Once the port was opened, soy shipments on the Madeira River quadrupled, and Maggi’s shipping costs fell 20 percent (Rich, 2001).

Another competitive advantage for Brazilian soybean producers comes from the government breaking up the long-standing petroleum monopoly. New laws have allowed new petroleum companies access to the country, resulting in increased imports. In January 2002, Brazilians saw a 20% drop in fuel prices, which translates into decreased fuel costs for soybean producers.

One area that has concerned government and soybean producers alike is the state of navigation on Brazilian rivers. Producers want the government to invest in the development of a system of locks and dams to raise water levels on the rivers, especially the Parana-Paraguay River system. These projects would keep the waters deep enough to float barges capable of carrying larger soybean loads to ports. Such a project would require huge investments and has significant environmental implications. Draining this watershed could have an adverse impact on wildlife.

Argentina’s soybean producers also face the problem of shallow rivers. The Parana River which connects the Port of Rosario, one of the largest in Argentina, to the Atlantic Ocean requires dredging to maintain a deeper channel. Without dredging, barges cannot carry big shipments. This results in higher transportation costs for Argentine soybean producers.

The United States has a fairly efficient water-based system of transportation using barges. Trucking distances in the United States are shorter, especially since the majority of soybean production occurs in the regions surrounding the Ohio, Illinois, Mississippi, and Missouri Rivers. U.S. soybeans are hauled to the nearest river, and loaded onto barges. The majority of the soybeans exported flow down the Mississippi River.

There is the potential for substantial gains in South America, but these gains will require overcoming economic, political, and environmental hurdles and issues. The current gap in production costs will narrow with improvements in South America, but the United States can maintain a comparative advantage in transportation costs, with improvements in the existing U.S. locks and dams.

Cost of Production: Analysis

Different countries and institutions within a country use different concepts, definitions, terminologies, and measurement methods to estimate production costs. This study summarizes production cost data from several sources. Data for U.S. soybean production costs are from USDA-ERS. Data for Argentina and Brazil were gathered from various government agency websites, e-mail contacts with key industry personnel in South America, individual company websites, and the USDA-ERS.

Methods used to calculate costs vary from country to country, with certain variables included in the costs by one country, but omitted by another. Another difficulty lies in the adoption of different production practices. These would include single versus double cropping, conventional till versus no-till, transgenic versus conventional varieties, etc.

Exchange rates further complicate cost estimates. Fluctuations in the Brazilian currency make accurate dollar-valued cost estimates some-what difficult. Between 1995 and 1999, apparent declines in Brazilian soybean production costs were largely a reflection of a weakening Brazilian currency (the Real). After the Real was allowed to free float in international exchange markets, Brazilian total production costs actually increased in local currency terms (ERS, 2001). If exchange rates adjustments are ignored and nothing changed in terms of the Real, devaluation alone makes it appear as if Brazilian producers possess a cost advantage in soybean production. However, the devaluation increased the cost of imported goods—machinery, petroleum, and agro-chemicals. Non-tradable goods, which are minimally impacted by currency devaluation, include land and labor, two key production costs. Currency devaluation drives up the cost of imported inputs, while making soybean exports more competitive in international markets.

Comparisons of costs of production are complicated by interest rates and inflation. For example, in the recent past, Brazilian inflation has exceeded 30% per month (AAEA, 1998), and from 1997 to 2002 the Real depreciated by 132%. In 1997, the Real was 1.0 to $1.00, and by 2002 it had devalued to 2.32 to $1.00. Increased government spending, due to domestic support programs such as subsidies, increases inflation. This increase in inflation normally leads to currency devaluation.

In the last 6 years, soybean producers in Argentina have adopted Round-Up Ready soybeans in about 95% of the area. This has resulted in higher yields and lower overall production costs allowing Argentine producers to be more competitive in international markets. Weak patent protection resulted in Argentine farmers not paying a technology fee for soybean seed. Cheaper glyphosate became available when Monsanto’s Round-Up product patent expired in Argentina.

In the 1990s, the Argentine government privatized the economy to drive out excess labor and increase labor productivity. The result was an increase in unemployment to almost 20%. Such structural readjustment takes a long time to take effect, so social unrest can develop, and investors can lose confidence in the economy. After nearly a decade of parity of the Argentine Peso to the U.S. dollar, the exchange rate fell from 1 to 1 to 3.22 to 1 in a period of three months (January to March 2002). While this made Argentine exports more competitive, import prices increased dramatically. The cost of most inputs, including capital and imported inputs, increased by as much as 100% (USDA/ERS, 2002). That has resulted in higher production costs for soybean farmers who use imported inputs such as agro-chemicals and machinery. Agricultural credit is essentially non-existent. Argentina currently finds itself in the midst of a serious economic crisis.

“Underlying the current economic crisis in Argentina are three interrelated factors: the policy of pegging the domestic currency to the U.S. dollar throughout most of the 1990s, the Argentine government’s failure to reduce budget and trade deficits, and the default on government debt” (USDA/ERS, 2002). In the short-run, supply-side effects of capital controls have made it difficult to obtain dollars to buy imports. In April 2002, the Argentine government imposed even more export taxes on many agricultural products and other primary products, with soybeans experiencing an export tax of 23.5%. Nitrogen-based fertilizer and fuel, which are produced domestically, are expected to at least double in cost. Also, percentage markups for transportation and export marketing expenses will likely rise due to increased market and policy uncertainty.

One way for Argentine farmers to off-set the higher costs of inputs is to change cropping patterns. Should this happen, farmers are most likely to plant more soybeans and less corn, since corn requires greater amounts of fertilizer, diesel fuel, agro-chemicals, and high-cost seed than soybeans. Prospects for Argentine farm exports will depend on that sector’s ability to adopt innovative solutions to the higher production costs.

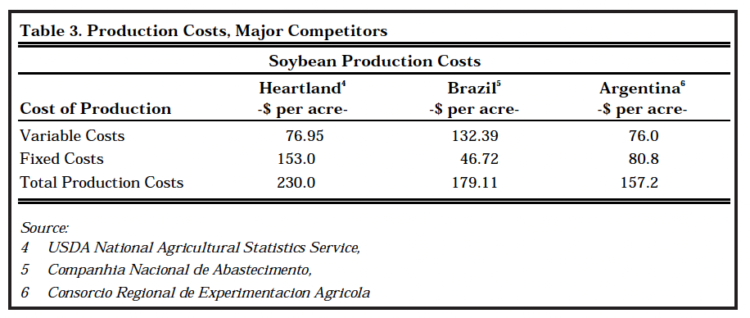

Table 3. Production Costs, Major Competitors

Cost of Production: Empirical Results

Total soybean production costs are higher for U.S. producers (Table 3). While per acre variable costs for soybean production are lower in the United States, fixed costs are higher, mainly due to the higher cost of land. Higher cost of land is due to limited availability of land, government payments, urban development demand, and stronger export demand in the early to mid 1990s.

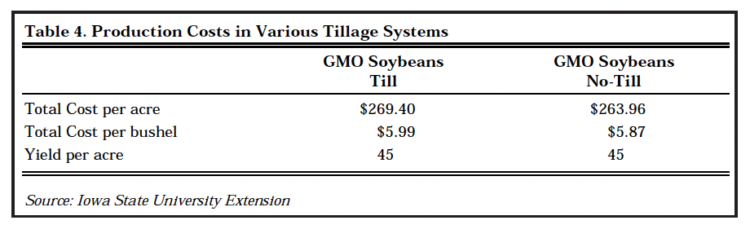

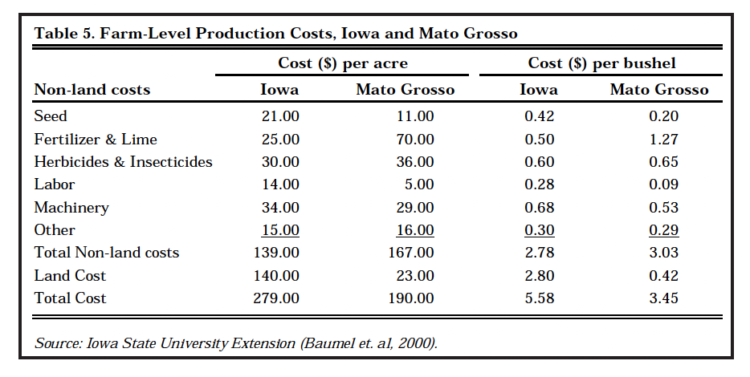

The Iowa State University Extension Service conducted a survey of soybean production costs for different tillage systems (Table 4 and Table 5). They found cost advantages for using GMO soybeans in a no-till system. The variable costs per acre in this Iowa study are $106.48, and fixed costs per acre were estimated at $157.48. Although the variable costs for Iowa soybean farmers are considerably higher than those for the Heartland Region, these variable costs are still lower than those of soybean farmers in Brazil. The Iowa State University Extension Service survey reported production costs for Iowa and Mato Grosso, a state in Brazil. Results of this survey indicate Mato Grosso’s competitive advantage lies in its lower land cost—estimated at $2.38 per bushel higher for Iowa farmers. Since farmland values are the major cause of Brazil’s cost advantage in soybean production, Iowa and other U.S. soybean producers must find a way to reduce or offset high land values (Baumel, et. al, 2000). This will not be easy for a number of reasons: it is politically difficult to reduce farm program payments which tenants use to maintain or bid up rents (land costs) and pressure from banks to maintain land values for mortgages.

For the U.S. Heartland Region, variable costs are comparable to those in Argentina, while Brazil’s variable costs are almost double that amount. In Brazil, it is illegal to plant Round-Up Ready soybeans, hence herbicide costs for non-GMO soybeans are higher. The majority of Brazilian soybean producers custom hire harvesting, further increasing their variable costs. Finally, production inputs (fuel, chemicals, lime, etc.) have to travel longer distances to the soybean production region in the interior of Brazil, which also results in higher variable costs.

The fixed costs for U.S. producers are nearly triple that of their Brazilian counterparts. Much of this is attributable to higher land costs in the United States. Fixed costs for Argentine producers falls between the U.S. and Brazil. Argentine land costs are higher than in Brazil.

Table 4. Production Costs in Various Tillage Systems

Table 5. Farm-Level Production Costs, Iowa and Mato Grosso

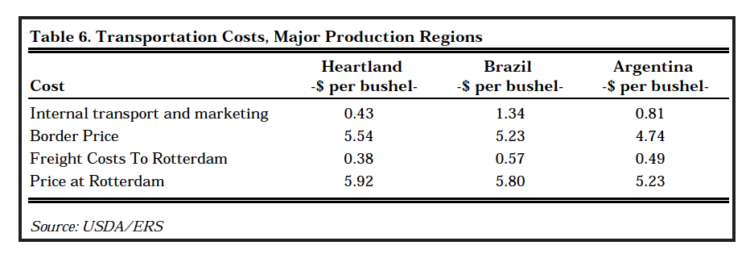

Table 6. Transportation Costs, Major Production Regions

Using data from a USDA-ERS study, costs for transportation and marketing indicate the United States holds the competitive edge in international freight costs (Table 6). Internal transport and marketing costs for Brazil are nearly three times more expensive, due in large part to the inefficient infrastructure and the longer distances the soybeans must travel before reaching a waterway. U.S. producers have a slight cost advantage when ship-ping to European markets. Internal transportation costs are much lower in the United States, affording U.S. producers a competitive advantage.

Recent U.S. government policy developments will impact future soybean production costs. On May 13th President Bush signed a new farm bill. Once variable production costs have been met, remaining market revenues received by farmers are used to pay the costs of land, and provide a return to labor and management. New payments to soybean producers will be used to offset input costs, and provide residual income that will be capitalized into land values, resulting in higher land costs and higher production costs for U.S. soybean producers.

Implications

How can U.S. producers become more competitive? If the United States wants to expand soybean exports, there are two methods to increase competitiveness: (1) reduce costs or increase yields, and/or (2) increase demand. Supply side changes can be affected by boosting production through improved genetics. Demand can be expanded by adding value to soybean products. However, increasing the demand for soybeans without concurrently increasing the supply side could alter the competitiveness of U.S. farmers.

While most soybeans in the United States are already produced under a no-till system, encouraging more U.S. farmers to switch to no-till practices, could further reduce labor, machinery, and fuel costs. More than half the farmers in Brazil and Argentina have adopted no-till practices. No-till practices are of vital importance in controlling soil erosion, and maintaining long-term production efficiency.

Another supply side change would be to improve soybean yields and/or quality. In the United States, a large percentage of soybean producers already use Round-Up Ready seed. This allows farmers to reduce herbicide costs, improve weed control, and make fewer trips across the field. Potential for further adoption of this technology in the United States and Argentina is limited. Currently, 74%of all soybean acres in the United States are planted to biotech varieties (NASS, 2002). In Argentina, about 95% of the soybeans are biotech varieties (Round-Up Ready). Even though it is illegal to grow biotech varieties in Brazil, approximately 10% – 20% of soybeans produced in Brazil are estimated to be Round-Up Ready. The potential growth in biotech soybeans in Brazil will be much greater if a court injunction against biotech varieties is rescinded.

Another way to reduce production costs is through varieties with enhanced traits. Currently, research is being conducted on ways to improve pest resistant soybean varieties. Several insects and diseases attack the soybean plant. Sudden death syndrome (SDS) and the soybean aphid can reduce yields by 20% or more. Also, nematodes that attack soybean roots can reduce yields. Purdue University scientists have developed CystX, a soybean variety that is resistant to nematodes. Efforts are underway to cross this variety with existing varieties.

U.S. producers can increase demand by enhancing the quality of their product and searching for alternative markets. For example, there is growing demand for soybean oil blended with diesel fuel (bio-diesel). Bio-diesel (ranging from 5% to 20% soy oil) can be used in diesel motors, for both on- or off-road vehicles (trucks, school buses, tractors, combines, etc.). This new fuel blend is environmentally friendly and reduces sulfur emissions. Research is underway to blend soybean oil with jet fuel. The goal is to find a cleaner, more efficient jet fuel. This would reduce dependence on foreign oil also.

Increases in demand also can be achieved through value-added components in food. For example, work is underway to develop soy iso-flavons (a food additive). Soy derivatives can be used as a hormone replacement for women to help reduce the incidence of osteoporosis. Researchers are looking for ways to blend soybeans with petroleum for plastic polymers. This would make polymers more biodegradable, which could have significant impacts in food packaging and landfills.

Latin American producers also can consider various methods to increase their competitiveness. First, they can increase the adoption of no-till methods to reduce production costs. Second, they can seek higher yields through research and development. With the high costs of agro-chemicals for Latin American producers and the greater amount of applications required, new herbicide and insect resistant varieties could reduce production costs. For example, in Brazil the warm weather often makes insect problems more severe than in the United States (Leibold et. al.). Many producers spray several times during the growing season to control insects and diseases. Brazilian producers also are plagued by the nematode problem. If Brazilian producers were to adopt genetically enhanced pest resistant varieties, they would be able to improve yields as well as reduce production costs, and they could reduce their transportation and handling costs through improvements in infrastructure and port facilities all of which

would increasing their export competitiveness.

Conclusion

It is not likely that U.S. soybean producers will be able to regain the dominant export position they once enjoyed. To remain competitive U.S. producers will need to reduce costs, enhance quality, and increase yields. A growing concern among U.S. producers is that Latin American competitors will gain more market share due to lower production costs, mostly associated with lower land values in Brazil and Argentina, but these countries face other challenges that reduce their competitive edge. They include: economic instability, inadequate transportation infrastructure, and insect and disease pressures associated with warmer climates.

In summary, there is nothing in the foreseeable future that points to Brazil and Argentina leaping over their U.S. competitors in the export market. But there will be on-going competition among these three major soybean producing countries.

References

American Agricultural Economics Association. 1998. Commodity Costs and Returns

Estimation Handbook. Ames, IA.

AgBrazil, 2002. Brazil Production Inputs Markets. http://www.agbrazil.com

AgriAmerica. May 8, 2002., US AG Today. Wednesday, http://www.agriAmerica.com

Baumel, P., B. Wisner, M. Duffy, and D. Hofstrand. December 2000. “Brazilian Soybeans – Can Iowa Compete?” AgDM Newsletter Article.

CONAB, Companhia Nacional de Abastecimento (National Food Supply Company). March 2002. http://www.conab.gov.br/

CREA, Consorcio Regional de Experimentacion Agricola (Regional Consortium for Agricultural Research). March 1998. No. 209.

EMBRAPA, Empresa Brasileira de Pesquisas Agropecuarias (Brazilian Institute for Agricultural Research). March 2002. http://www.embrapa.br

Fee, R. October 2001. “U.S. Producers Say They Can Compete With Brazil.” Successful Farming.

Foreman, L. and J. Livezey. March 2002. “Characteristics and Production Costs of U.S. Soybean Farms.” ERS Statistical Bulletin. No. 974-4.

Leibold, K., P. Baumel, R. Wisner and M. McVey. January 14, 2002. “Brazil’s Crop Production System Holds Much Potential.” Feedstuffs. Vol. 74, No. 2.

McVey, M., P. Baumel, and B. Wisner. December 2000. “Brazilian Soybeans – Transportation Problems” AgDM Newsletter Article.

Rich, J. July 10, 2001. “Soy Growers in Brazil Shadow U.S. Farmers.” The New York Times.

Schnepf, R., E. Dohlman, and C. Bolling. November 2001. “Agriculture in Brazil and Argentina: Developments and Prospects for Major Field Crops.” ERS/USDA Agriculture and Trade Report. WRS-01-3.

Spangler, H. and M. Wilson. March 2002. “Beating Back Brazil.” Prairie Farmer.

U.S. Department of Agriculture. October 2002. “World Agricultural Supply and Demand Estimates,” WASDE – 391 www.usda.gov/oce/waob/wasde/latest.pdf

U.S. Department of Agriculture, Economic Research Service (ERS). March 2002. Published Database. http://www.ers.usda.gov/

U.S. Department of Agriculture, Economic Research Service. May 2002. “Argentina’s Economic Crisis: Can the Ag Sector Help?” Agricultural Outlook.

U.S. Department of Agriculture, National Agricultural Statistics Service (NASS). March 2002. Published Estimates Database. http://www.nass.usda.gov