The Family Business: Identifying A Successor

August 6, 2016

PAER-2016-12

Maria Marshall

There is a large gap between a business owner’s desire for their business to continue and actually taking concrete steps to establish a plan for continuity (De Massis et al. , 2008; V enter et al. , 2005). The Family Business Succession Survey (Marshall et al., 2012) indicated that more than 55% of family businesses plan to eventually transfer the business to a son, daughter, or other family member . However , 44% of family businesses had not yet started a management transfer plan and 54% had not yet started an ownership transfer plan. Moreover, less than 20% of family businesses had a written management or ownership transfer plan in place.

Without plans, disruptions such as sickness of an owner, death of a family business member, a large loss of sales, or loss of key employees can cause businesses to crumble. Choosing a successor is a pivotal step in the succession planning process. When a business chooses a successor, they are concretely saying that they want the business to continue into the next generation.

HAS THE FAMILY BUSINESS IDENTIFIED A SUCCESSOR?

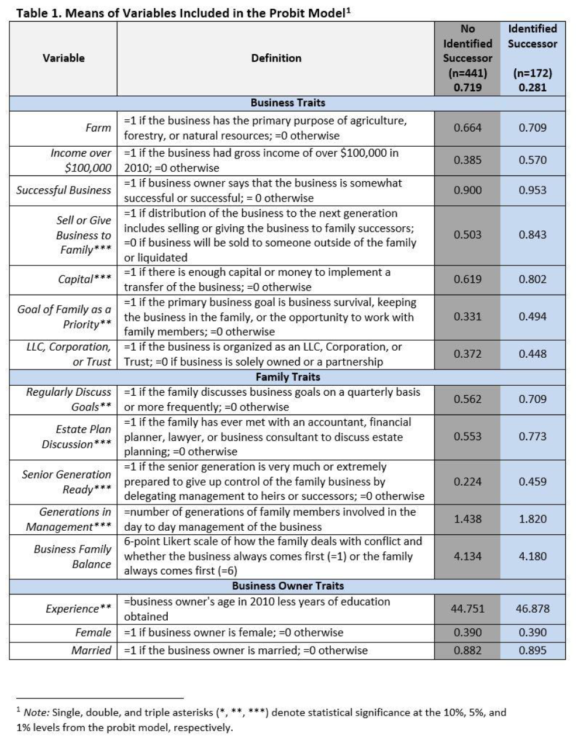

In this study, we used data from the 2012 Family Business Succession Survey to determine what factors lead a family business to choose a successor. There were 613 businesses in this analysis. The businesses were divided into subgroups of 441 (71.9%) family businesses that did not have an identified successor and 172 (28.1%) which had an identified successor. We wanted to identify variables that increased the odds that a family would have chosen a successor. Those variables that may influence choosing a successor were in three groups: business traits, family traits, and owner traits. The variables are defined in Table 1 with the averages shown in Figure 1.

As an example, the size of the business could be a variable that might influence the decision to choose a successor. The second variable in Table 1 is, “Income over $100,000.” The 613 business respondents answered 1 if the business’ gross income was over $100,000 and 0 if otherwise. The results are as follows: Of the 441 businesses that had not identified a successor, 38.5% had annual gross income above $100,000, and of the 172 businesses who had identified a successor, 57% had annual gross income above $100,000. This implies that larger size may be related to the decision to select a successor.

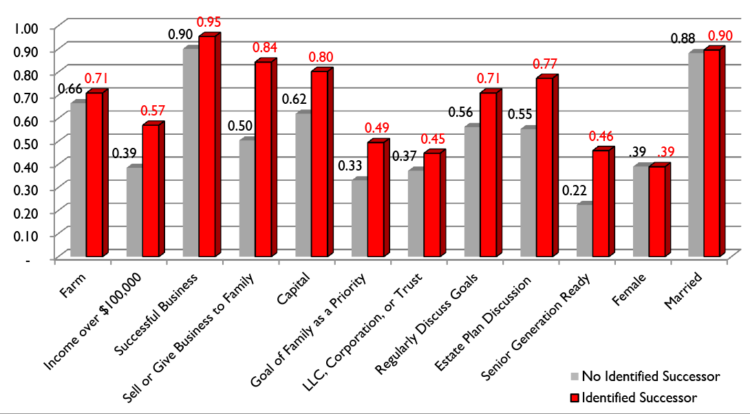

A comparison of the averages for the variables is shown in Figure 1. If the bars on the right (representing family businesses that have identified a successor) have higher averages than the bars on the left (representing family businesses without an identified successor) this may be a variable that is influencing the decision to select a successor. This was the case for most of the variables in this study. The one exception was owner’s gender where 39% of the owners were female in both groups.

One of the largest differences between bars in the figure is for “sell or give business to family”. In this instance, 50% of businesses without an identified successor have the intention to sell or give the business to family members while 84% of family businesses with an identified successor have that same intention.

WHAT ARE THE MOST IMPORTANT FACTORS?

The variables that were statistically significant to naming a successor were: 1) the business having the intention to sell or give the business to a family member; 2) if the business has enough capital to implement the business transfer; 3) if the primary goal of the business is family- related; 4) if the business discusses goals at least quarterly; 5) if the family has discussed estate planning with a professional; 6) if the senior generation is ready to give up control of the business by delegating responsibility to successors or heirs; 7) the number of generations in the day to day management of the business; and 8) years of experience of the business owner.

In the study, family-related matters play heavily on whether a family business had identified a successor. If the business owner had the intention to sell or give the business to family heirs or successors, then that business was 23% more likely to have identified a successor. Having sufficient capital to transfer the business and the discussion of goals also play very large roles. If the family has met with a professional such as an accountant, business consultant, financial planner, or a lawyer to discuss an estate plan, then they were 14% more likely to have identified a successor than those who had not met with such professionals. If family business members met at least quarterly to discuss goals, then they had a 9% higher chance of having named a successor versus those businesses who meet yearly or less to discuss goals. The number of generations that are involved in the day-to-day management of the business had a positive influence on identifying a successor. For each generation that was added to the daily management of the business, there was a 7% greater chance that they had identified a successor. The senior generations’ wishes had a positive influence on naming a successor as well. Businesses had an 11% greater chance of having an identified successor if the senior generation was prepared to give up control of the family business by delegating management to heirs or successors.

SUMMARY: DOES YOUR BUSINESS HAVE A SUCCESSOR?

Many family business owners would like to see their business continue, but many fewer have actually put plans in place for that to happen. One of the important steps in the process of business continuity is identifying a successor. This article reports on some of the variables that influence family businesses to identify a successor.

The study involved survey results from 613 family businesses. They were divided into two groups: those who had identified a successor and those who had not identified a successor. A set of variables that might influence families to identify a successor was developed. Then these variables were compared between the group that had identified a successor and the group that had not. The average response for each group was compared, and tests for statistical significant differences were also evaluated.

Goals and family business expectations have a very distinct influence on family business continuity planning. Having the business thrive for the benefit of the family is an important orientation. There is a greater link to continuity when family business members work closely together. This includes discussing business goals on a regular basis, working on an estate plan, working with attorneys or similar professionals, and when the senior generation has the willingness to relinquish some of the control of the business.

Family businesses are strengthened by the presence of their families, and nothing makes this clearer than the overwhelming significance of family variables in our model. When the owner has the intent to sell or give the business to family heirs and successors, then they take distinct steps to make that plan a reality. When more generations of the family are involved in the daily management of the business, that business has a better chance of planning for an intergenerational transfer. Finally, as family members age and gain more experience, they have a greater interest in finding a successor and having sufficient capital in the business to implement the transfer is also important.

Family business continuity is a primary objective for many. The odds of reaching that goal can be enhanced by families working closely together and by elevating the goal of continuity within the family. Ultimately, developing a continuity plan and implementing that plan is critical.

REFERENCES

De Massis, A., J.H. Chua, and J.J. Crisman. 2008. “Factors preventing intra-family succession.” Family Business Review, 21(21), 183-199.

Marshall, M. I., C. Dobbins, W.A. Miller, R. Keeney, and J. Ayers. 2012. Family business succession survey.

Venter, E., C. Boshoff, and G. Maas. 2005. “The influence of successor-related factors on the succession process in small and medium-sized family businesses.” Family Business Review, 18(4), 283-303.