The Indiana Livestock Sector: Challenges and Opportunities

July 18, 2007

PAER-2008-6

Michael Boehlje, Distinguished Professor; Ken Foster, Professor and Brian Richert, Associate Professor, Department of Animal Science

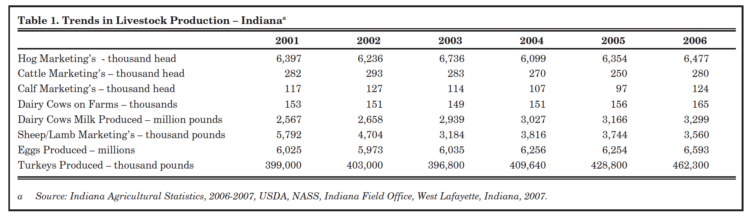

The livestock sector has been a critical component of the agricultural industry in the state of Indiana, and in recent years livestock production has reversed the decline of the 90’s and has generally been growing in numbers and value. Table 1 summarizes livestock production by species from 2001 through 2006; note the stabilization in hog production, which had been declining in numbers during the 1990’s, and the growth in diary, egg, and turkey production since 2001. Further growth of the livestock sector in Indiana will be facilitated or challenged by the following forces.

Demand for Niche Products

Organic, natural, and locally produced food products are all growing in popularity among consumers whose incomes have risen and who are willing to pay for unique attributes that cannot be delivered by conventional production systems and extensive marketing channels. The overall organic market has experienced rapid growth over the past couple of years, with annual growth rates of nearly 20 percent. The growth in the organic meat segment has been even stronger, however. In 2003, the latest year for which data is available, the market grew by nearly 78 percent for fish, poultry, and meat. Continued growth in demand is almost assured as the supply chain for such products is expanded.

In order to capitalize on these opportunities, producers will eventually be called upon by retailers or customers to verify production process claims. In the case of organic production, federal standards exist. In other categories, such as natural, environmentally friendly, animal humane, etc., producers and their partners may find opportunities to develop their own standards to be verified by independent third parties. In some cases, government may find a role in certifying the compliance, as is the case with the USDA Agricultural Marketing Service’s Process Verified Program.

Table 1. Trends in Livestock Production – Indiana

Food Safety and Traceability

Food safety is a key risk for all segments of the livestock industry. Food products that make people ill, or in a worst case scenario cause death, can quickly destroy brand value, the most valuable asset of a branded food product company. Supply chain management using a traceback system, combined with quality assurance procedures such as Hazard Analysis and Critical Control Point (HACCP), facilitates control of the system to minimize the chances of a food contaminant or to quickly and easily identify the sources of contamination. Traceability is increasingly a key motivation for controlled origination of raw materials from certified suppliers to implement a supply chain philosophy.

Animal identification and trace-ability systems have a key role to play in the future of the animal agriculture industry. Whether the underlying issue is animal health, food safety, animal welfare, process assurance, or quality attributes, animal identification and traceability are necessary. Identification and traceability systems should be evaluated and implemented to enhance the industry’s ability to respond to natural and intentional disease outbreaks, improve food safety, and provide assurances of food quality and wholesomeness. Some elements of these systems will be developed and managed by government; other parts may be purely private; and some elements may require public/private partnerships.

Crop-Livestock Synergies Increased synergy between animal and crop producers is anticipated in the future. In a long-term scenario of fertilizer costs increasing and fertilizer resources diminishing, the use of organic fertilizers will likely be much more valuable. When rations can be formulated to meet a specific animal’s requirements, the need to supplement diets will be reduced, reducing excess excretion of nutrients that need to be stored, treated, and used on cropland. Costs would also be reduced, as would the pressure on the environment. On farms or in regions that import grain to feed animals because not enough is produced locally, manure nutrient management is more challenging.

Technologies are available to enhance the efficiency of animal production and control the impact of animal production on the environment. Large operations can better afford and manage manure treatment technologies, particularly those with high fixed costs, such

as for biodigestors. They can spread the costs over a larger volume of product and have sufficient volume to potentially sell value-added products. Some technologies in nutrition or housing designs are size neutral and will not affect the structure of the industry as long as the technologies are cost effective.

Labor and Immigration

Most segments of animal agriculture in the United States and Indiana depend on a foreign-born labor force. Many of these workers are from rural Mexico or Central America, and some may be undocumented. The legal uncertainty associated with this undocumented work force has consequences for the workers and the companies for which they work. Workers may not receive full legal protections and may be reluctant to complain about working conditions. Employers are vulnerable to a variety of legal sanctions and risk the loss of a significant portion of their work force if immigration laws are strictly enforced. This legal uncertainty creates a cost that can be mitigated with revised immigration and guest worker government policies. A critical issue for both the livestock production and processing industries will be the resolution of the uncertainty surrounding immigration policy and guest worker programs so that the livestock sector can access a reliable and stable work force.

Environmental Regulations

Some of the most critical issues to shape the structure and location of the livestock industry in the future are storage and utilization of manure and other byproducts from production and processing, and mitigation of air and water pollution from the industry. Key environmental issues include: recycling of animal manure, processing manure into energy or other productive resources, and technological mitigation of nutrients and odors.

Recycling of animal manure as a crop nutrient would be facilitated by business models that efficiently aggregate, transport, and land-apply organic waste (maybe in combination with urban organic waste) combined with injection and other technology that reduces nutrient volatilization and odor problems. Biodigestor processing is increasingly techno-logically and economically feasible. For larger scale operations that can spread the fixed costs over more volume, the amount of energy produced will likely exceed that used in the livestock production unit, and access to the electrical transmission grid at competitive prices may be the key to the future of biodigestors.

Environmental regulations can be a significant cost factor for the industry and will likely be a major factor in future investment decisions by the industry. Differences in environmental regulation across locales are problematic for animal agriculture. Broader multijurisdictional regulatory approaches may represent an opportunity for more efficient environmental management and lower industry costs. Litigation or legislative outcomes must provide legal rights and responsibilities that balance business practices with environmental concerns to resolve the issues. In the environmental arena, uncertainty is often a greater problem than the level or type of environmental regulation.

Livestock Feed Costs and DDGS Use

The rapid growth in feed grains-based ethanol production has drastically affected the cost of feed for the state’s livestock and poultry producers. Both corn and soybean meal (traditionally the two largest ingredients in confined animal and poultry feed rations) have essentially doubled in price over the past two years; this has put significant economic and financial pressure on livestock producers. At the same time, the boom in biofuel production promises greater availability of by-products that, to some extent, can substitute for corn and soybean meal in feed rations.

Dried Distiller’s Grains with Solubles (DDGS) has the potential to be a valuable alternative feedstuff for the state’s livestock and poultry industries. However livestock and poultry producers are wary of utilizing DDGS because the nutritional quality of DDGS varies widely from one batch to another and across ethanol plants. Accurate nutritional and fat composition information is not possible to determine in a timely fashion that would allow accurate reformulation of diets as DDGS quality changes. Additionally, several biological phenomena related to the feeding of DDGS may deter-mine the upper limits of DDGS inclusion in livestock and poultry feed rations – generally 10 percent for poultry rations, 20 percent for pork rations, and 30 percent for beef and dairy rations.

Over time, efficiency in the markets for feedstuffs suggests that DDGS prices will be equivalent to their ability to substitute for the alternatives of corn and soybean meal. Thus, unless there is substantial expansion of ethanol production beyond the current ability of the livestock and poultry industries to utilize the byproducts, long-lived bargains associated with DDGS feeding should not be expected.