The Rise of Meat Substitute Consumption and its Impact on the U.S. Soybean Industry

May 15, 2023

PAER-2023-25

Yanyu Ma, H. Holly Wang, professor of agricultural economics, Yizhou Hua, and Shihuan Kuang

Introduction: Consumption of Meat and Meat Substitutes

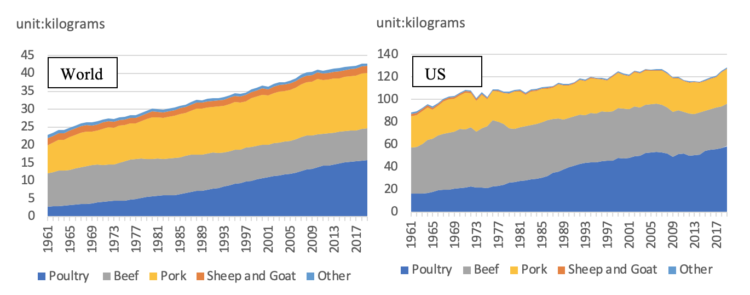

Meat is an important source of proteins and micronutrients in human diets. As a more expensive food source than grains, meat has experienced an increase in per capita consumption along with rising income in most countries. Figure 1 shows the global and U.S. consumption of both white and red meats in the past 50 years. Obviously, the world per capita meat consumption growth has been driven by pork and chicken; while that of the U.S. has stagnated with the growth of chicken consumption absorbed by the decline in beef consumption.

Figure 1: Global and US per capita meat consumption by type, 1961-2019.

(Source: Food and Agriculture Organization of the United Nations)

Traditionally, meat is only available through animal slaughter with conventional animal husbandry primarily and wild-caught as a small supplement. However, consumers led by those in developed economies have expressed concerns about conventional meat consumption citing reasons of food safety, animal welfare, and natural resource and environmental impacts from especially the low conversion rate turning feed grains to meat and high greenhouse gas emission in the livestock-producing industry. This is especially true for beef, as Figure 1 shows a stagnating or slightly decreasing beef consumption in the last three decades. With some consumers reducing or stopping their conventional meat consumption, there exists a concern about the conventional meat market in developed countries.

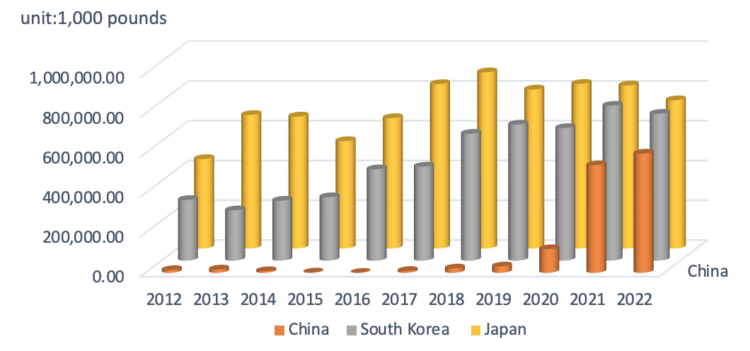

In 2020, the U.S. beef consumption was 27.6 billion pounds, ranking first in the world, accounting for 21.5% of the total global beef consumption. The U.S. is the world’s largest beef producer and third-largest exporter. Its exports accounted for 11 percent of U.S. domestic production. US’ major beef exporting countries are three Asia countries, Japan, Korea and China, in recent years. Japan has been the largest oversea beef buyer over the past decade, the annual export to Japan is around 713 million pounds. The U.S. exported a historically high value of $ 540 million of beef to China in 2021, and also $14 billion worth of soybeans to feed its livestock production. Beef is also the largest commodity that the U.S. exported to Korea, with about $1.8 billion value annually in recent years, with pork and soybeans making nearly another $1 billion. Beef exports to these three countries from 2012 to 2022 are shown in Figure 2.

Figure 2. U.S. Beef and Veal export to Japan, Korea and China 2012-2021.

Note: The data for 2022 include January to November only.

(Source:USDA-Economic Research Service, Cattle & Beef statistics)

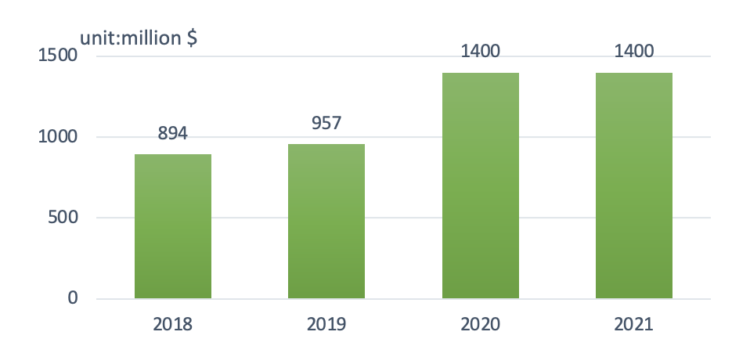

To supplement the protein in the diet and to satisfy the sensory need of people during the transition, two new “meat” substitutes, plant-based “meat” and cell-cultured meat (also known as lab-grown meat) have emerged in the market. In theory, they can be more efficient in production than the conventional method in terms of not only saving feed, land, water, and greenhouse gas emission to produce each unit of product but also speeding up the production cycle. Consumers have shown interest in these two alternatives. There are lots of plant-based meat brands in the U.S., such as Beyond Meat, Impossible Foods and Morning Star. Private labeled brands, such as Walmart’s Great Value, have also started to roll out plant-based meat products. In 2021, the total retail sale of plant-based meat in the U.S. is 1.4 billion dollars. Figure 3 shows that the sales of plant-based meat in the US increased by 56% over the recent four years from 2018 to 2021. Cell-cultured meat is not allowed in the US market yet.

Figure 3: Dollar of Sales of Plant-Based Meat, U.S. 2018-2021

Notes: Red meat, poultry and seafood are all included

(Source: Good Food Institute-U.S. retail market data)

Analysis: Soybean Used in Meat and Meat Substitute Production

Meat is typically accessible through traditional livestock husbandry. However, to supplement the protein in diet and to satisfy the sensory need during the transition for some consumers in their conventional meat reduction, two new meat substitutes, plant-based “meat” and cell-cultured meat (also known as lab-grown meat) have emerged in the market. We use beef as an example in this study for two reasons. First, beef is the most popular red meat in the U.S. and the most common type of plant-based meat in the market, accounting for 32% market share based on Good Food Institute Report (Ignaszewski, 2022). Second, cattle production is mostly criticized for its environmental and resource impact.

Soybeans are the most available high protein content crop and commonly used as feed for livestock production. Soybean is the major ingredient of plant-based meat, and an economical source to produce media used to feed the cells in lab-cultured meat as well. In the following, we will estimate the soybeans needed to produce one unit of beef and each type of beef substitute.

Conventional livestock production

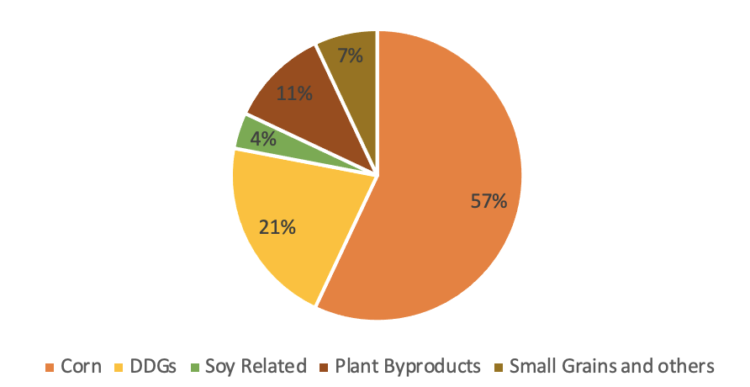

Livestock feed uses a significant amount of both corn and soybeans. The total amount of U.S. beef cattle consumption in 2019 was 27.3 billion pounds. The total amount of feed excluding harvested forages fed to beef cattle equals approximately 64.5 million tons in 2019 in the U.S. Roughly 57% of this amount came from corn and only roughly 4% was soy-related ingredients in recent years (Figure 4), as dried distiller grains with solubles (DDGS) has substituted a large volume of soybeans to provide a source of proteins. The total feed conversion of beef is around 6:1, that is six pounds of cattle feed were digested and converted to one pound of beef. The soybean to beef ratio from livestock production then is only 0.24:1.

Figure 4: Beef cattle diet percentage from conventional husbandry

(Data Source: Animal-Feed-Food-Consumption-COVID-19, IFEEDER)

Plant-based meat

Plant-based meat also known as “Vegan Meat” is made from soybean, pea or other high protein-content plants. One major kind of plant-based meat available almost in all grocery stores is burgers. These plant-based burgers look, cook, and taste similar to traditional beef burgers, but comes with the upsides of a plant-based meal. However, its nutritional contents are quite different from real beef burgers. The main source of protein in these plant-based burgers is soybean. We roughly estimate the volume of soybeans we need to produce one unit of plant-based burgers.

From the tables of chemical composition and nutritional value of soybeans in Feedipedia, we obtained the fact that per 100-gram soybean contains 88.7 grams of dry matter, which contains 35.13 grams of crude protein. We sampled burger patty from four plant-based meat brands: Impossible, Morning Star, Boca and Gardein. The average burger patty is 85 grams, and the average protein provided by burger is 16 grams, which needs 45.55 grams of soybeans as raw material to satisfy the protein. The soybean to veggie burger ratio is 0.54:1, if soybean is the only plant-based protein used to produce these products (Table 1).

Table 1: Soybeans demand for plant-based meat (unit: gram)

| Impossible | Morning Star | Boca | Gardein | Average | |

| Burger patty | 113 | 71 | 71 | 85 | 85 |

| Protein provided | 19 | 16 | 15 | 14 | 16 |

| Soybean needed | 54.09 | 45.55 | 42.70 | 39.86 | 45.55 |

(Data source: Plant-based meat nutrition fact labels from grocery stores)

Cell-cultured meat

Cell-cultured meat is a new product that may revolutionize the meat industry. Compared with conventional meat production, its potential benefits include avoiding animal suffering and death(Mancini and Antonioli 2019), reducing greenhouse gas emissions (Tuomisto and Teixeira de Mattos 2011), and decreasing the risks of emerging infectious disease or pathogens contamination(Espinosa, Tago, and Treich 2020).

There emerge some successful examples of cell-cultured meats in the U.S., Netherlands, Singapore and Israel. Meanwhile, its cost has experienced a precipitous drop from $1.2 million per pound in 2013 to around $50 per pound (Nittle, 2020), and may reach as low as $2.57 per pound by 2030 as expected (Swartz, 2021). By comparison, the global cultured meat market is expected to hit 94.54 billion by 2030 (BISResearch, 2021).

Products are already commercially produced and sold in Singapore by a U.S. company, Eat Just. In the U.S., companies are still upon impending approval from the government to bring cell-cultured meat to the market. Upside Food Company, one of the largest cultured meat producers, has just received FDA’s approval of its products, and is in the process of getting additional approvals from other regulatory bodies. The following analysis in this report is based on several assumptions.

To produce cell-cultured meat, animal cells need to grow in a growth medium from which they absorb nutrition, primarily amino acids to multiply. Currently, different kinds of growth media for cell-cultured meat are available. We take an average of ten kinds of different media based on data sample from a biotechnology company Kerry and list the averages in the first column of Table 2. Soybean is one of the great plant sources of protein to produce growth medium through soybean hydrolysate, which provides a wide variety of amino acids covering all that listed. Again, from the chemical composition and nutritional value of soybeans provided in Feedipecia, we know that each gram of dry soybean contains 351.3 milligrams of crude protein. With the detailed percentage of each kind of amino acid listed in the second column, we could calculate how many milligrams of amino acids contained in each gram of soybeans, as in the third column. Suppose all kinds of amino acids of growth medium come from soybeans alone, we calculate the ratio between growth medium and soybeans needed for each amino acid and list in the last column. These ratios show how many grams of soybeans we need to produce 1 gram of growth medium which contains enough of all specified amino acids. The highest ratio is for Valine at 3.45, which means that 3.45 grams of soybeans can provide sufficient amino acids for one gram of medium.

Table 2: Soybean needed to produce cell-cultured meat growth medium

| Amino Acids | 1g Medium Average

(unit: mg) |

Soybean (unit: % protein) | 1g Soybean amino acids

(unit: mg) |

Ratio

(medium/soybean amino acids) |

| Alanine | 20.1 | 4.30% | 15.11 | 1.33 |

| Arginine | 33.5 | 7.20% | 25.29 | 1.32 |

| Aspartic Acid | 46.1 | 11.10% | 38.99 | 1.18 |

| Cystine/Cysteine | 1.3 | 1.50% | 5.27 | 0.25 |

| Glutamic Acid | 105.5 | 17.80% | 62.53 | 1.69 |

| Glycine | 16.6 | 4.20% | 14.75 | 1.13 |

| Histidine | 11.3 | 2.60% | 9.13 | 1.24 |

| Isoleucine | 15 | 4.50% | 15.81 | 0.95 |

| Leucine | 32.8 | 7.50% | 26.35 | 1.24 |

| Lysine | 26.5 | 6.20% | 21.78 | 1.22 |

| Methionine | 8.4 | 1.40% | 4.92 | 1.71 |

| Phenylalanine | 22.6 | 5% | 17.57 | 1.29 |

| Proline | 25.2 | 5% | 17.57 | 1.43 |

| Serine | 23.3 | 5% | 17.57 | 1.33 |

| Threonine | 17.4 | 3.90% | 13.7 | 1.27 |

| Tyrosine | 16.1 | 3.60% | 12.65 | 1.27 |

| Valine | 56.9 | 4.70% | 16.51 | 3.45 |

We assume there is no waste in the growth media hereafter, which means all amino acids in growth media could be converted into the meat we want. With a rough calculation of the demand for soybeans to produce the growth media of cell-cultured meat, we know that 3.45 grams of soybeans could be converted to one gram of medium with 478.63 total milligrams of amino acids. Suppose that these amino acids are converted to the same amount of protein and that meat often has 20% of its weight from protein while the rest water, carbohydrates, fat and other components (Beltrán & Bellés, 2019), this protein means 2.39 grams of meat. Therefore, the soybean to meat ratio is then around 1.44:1. In fact, not all medium can be absorbed by the cells and become the same amount of beef, because cells grow and release waste to pollute the medium. The medium needs to be replaced regularly. So, the actual soybean to cell cultured meat ratio is higher. While on the other hand, there are many amino acids left unused. As technology becomes more advanced, some amino acids, such as Valine, may be supplemented from other sources and thus the soybeans to meat ratio can be further improved.

Compared with the conventional beef cattle industry using a lot of DDGS instead of soybeans, cell-cultured meat and plant-based meat will have a much higher demand for soybeans. This conclusion is based on the assumption that cell growth media are made primarily from soybean protein hydrolysates.

Summary and Conclusion

Conventional red meat production and consumption are facing challenges by consumers in the developed world for health, environmental, and ethical concerns. Plant-based and cell-cultured meat substitutes emerge in the market. Using U.S. beef industry as a case, we present the perspective of our domestic and three major exporting markets for beef and its substitutes. We also analyze the soybean used to feed the production of these three types of “meats”.

Results shows that our three largest exporting markets, Japan, South Korea and China have stable and slightly increasing beef consumption, with China likely having the largest growth, while the domestic market is stagnating. The total beef demand may face increasing competition from its substitutes globally. The plant-based beef has experienced fast growth in the U.S. with a sign of slowdown, while the cell-cultured meat is ready to enter the domestic market.

Our major results show that one unit of conventional beef, plant-based beef and cell-cultured beef would require 0.24, 0.54 and 1.44 units of soybeans, respectively, to feed. Even though these numbers are very rough as they were estimated under many assumptions, they reflect the fact that due to the current beef cattle industry replacing soybean meals with corn and DDGS in its feed, the new meat substitute production utilizes more soybeans. The demand for soybeans can be expected to rise with the two changes: the increase in consumer demand for conventional beef in emerging economies and the increase in new meat substitutes even at the cost of cannibalizing the conventional one.

As the primary protein rich field crop in the world, soybeans shall be the ultimate source for protein hydrolysates, the main nutrient fed for cells to grow into cultured meat. Soybean farmers are expected to benefit from the meat demand growth and the new meat substitute production. The competition in the new market for soybeans comes from other protein-rich crops, such as peas. So, the industry is encouraged to engage with the meat substitute nutrition supply industry to capture this potential market.

References

Tuomisto, Hanna L., and M. Joost Teixeira de Mattos. 2011. “Environmental Impacts of Cultured Meat Production.” Environmental Science & Technology 45 (14): 6117–23. https://doi.org/10.1021/es200130u.

Espinosa, Romain, Damian Tago, and Nicolas Treich. 2020. “Infectious Diseases and Meat Production.” Environmental & Resource Economics 76 (4): 1019–44. https://doi.org/10.1007/s10640-020-00484-3.

Ignaszewski, Emma. “2021 U.S. Retail Market Insights: Plant-Based Foods.” Good Food Institute. 2022. https://gfi.org/marketresearch/?gclid=EAIaIQobChMIjf6gn-aD_gIVEvHjBx1tMgG4EAAYAiAAEgJlXPD_BwE. Retrieved on December 2022.

Mancini, Maria Cecilia, and Federico Antonioli. 2019. “Exploring Consumers’ Attitude towards Cultured Meat in Italy.” Meat Science 150 (April): 101–10. https://doi.org/10.1016/j.meatsci.2018.12.014.