The Use of New Generation Grain Marketing Contracts

August 13, 2004

PAER-2004-8

Corinne Alexander, Chris Hurt and George Patrick

New generation grain marketing contracts (NGC), which automatically execute a pre-harvest marketing plan that the producer has established, were introduced in 2000 and are used at elevators throughout the Midwest (Smith). NGC are specifically designed to address some of the problems that producers face in executing their marketing plans. Some of these marketing challenges include: 1). Trouble “pulling the trigger” which means the reluctance or inability to establish both upside price objectives, as well as downside pricing exit points; 2). Letting emotion guide pricing decisions where up trending prices may cause excessive optimism and thus tendencies to buy near the high, while down trending prices breeds pessimism and willingness to sell nearer the lows; 3). The complexities and wide variety of pricing alternatives may add confusion and indecision; and 4). Lack of discipline as producers may change their minds frequently and not stick to their marketing plans.

NGC which have become widely offered, especially by larger elevators, help producers avoid some of these challenges by establishing prescribed rules for pricing grain that will be automatically executed. The producer establishes the number of bushels to price in these programs and the particular pricing program to use. Then the actual pricing is executed by the elevator’s program. Once producers have established the bushels to be marketed and the specific program, they generally become a passive participant in the pricing decisions.

NGC have been classified into three categories. First, there are automated pricing contracts that follow predetermined and nondiscretionary pricing rules over a specific time window. These are also called average pricing contracts because they are designed to give the producer an average price. For example, a producer might have chosen to price 10,000 bushels of corn based on the average price of December 2004 corn futures over the March 1, 2004 to May 7, 2004 time window. On each of the 50 business days between March 1 and May 7, the elevator’s program would price an equal amount of corn (200 bushels per day) at the closing price of the December corn futures. For 2004, these December futures prices averaged $3.09 per bushel. After taking into account the $0.05 per bushel service fee and the basis of say -$0.25, the producer will receive a final price of $2.79 per bushel on the 10,000 bushels sold when delivery occurs during the 2004 harvest.

A more complex set of automated pricing contracts are also being utilized that allow the producer to establish more parameters in the pricing criteria. One type uses technical price indicators to determine on which days pricing will occur. Common technical systems that can be selected include: moving averages, the relative strength index, and stochastics. Producers also have the opportunity to determine other parameters such as the minimum price and the number of days to be used in a moving average system. Some of these contracts allow the producer to change these parameters during the pricing window. Thus the producer can decide to forego passive management of the pricing criteria and return to more active management.

The second category of contracts is called managed hedging contracts where pricing decisions are made by an individual analyst chosen by the producer. Again the producer pre-determines the number of bushels to be priced and chooses the specific analyst. Analysts include nationally known marketing services as well as experts within the grain company itself. Once these decisions are made, the producer takes a passive role in pricing the designated bushels.

The third type of NGC are called combination contracts where the producer still utilizes automated pricing rules but is allowed to share in gains (if any) from pricing decisions made by the pricing analyst. The AgMAS report by Hagedorn et. al. (2003) provides a detailed description of some of these contracts.

Learning More About NGC

To better understand the potential reasons NGC are or are not being used, Midwest producers and Indiana elevator managers were surveyed in July 2003. The first group included producers who attended the Purdue Top Farmer Crop Workshop and the second group was composed of Indiana elevator managers.

The Purdue Top Farmer Crop Workshop participants tend to operate very large farms; the average farm size of the 46 respondents is 2,888 acres. In addition, these producers are technological innovators. Thus, they are ideal group to survey about their use of NGC.

About 30 percent of the 49 elevator managers who responded offer NGC. Notably, larger elevators are much more likely to offer these contracts. All of the elevators that handle 20 million bushels or more annually offer NGC. Over half (54%) of the midsized elevators, those that handle between 5 and 20 million bushels, offer NGC. Of the smallest elevators, those that handle 5 million bushels or less, only 13 percent offer NGC.

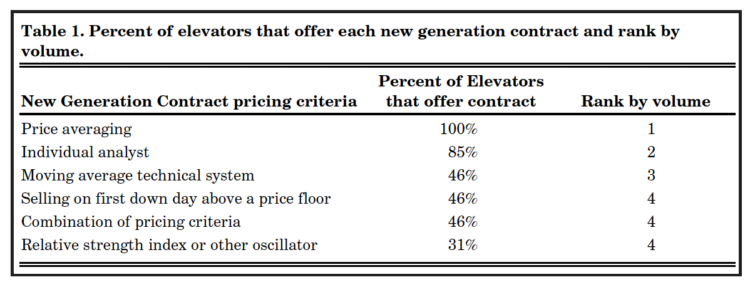

The elevator managers who offered NGC were asked to list the contracts they offer and to rank the types by volume of grain marketed (Table 1). The price averaging contracts are the most widely used; they are offered by all the elevators and account for the largest volume of grain. The next most popular NGC is use of an analyst, which is offered by 85 percent of the elevators and ranked second by volume. The NGC ranked third by volume is the moving average technical system, which is offered by 46 percent of the elevators. The rest of the pricing criteria are tied for fourth based on grain volume and these were: 1). Selling on the first down day above a price floor; 2). Combinations of all the pricing criteria; and 3). The relative strength index or another oscillator system such as stochastics.

Over two-thirds of the producers (68%) said that the grain handlers to whom they deliver offer NGC, but only a little over a third of these producers (37%) said they have used NGC. Of those who have used NGC, 60 percent plan to increase their use, 20 percent plan to remain at their current level of use, and 20 percent plan to decrease their use. Of the producers who have not used NGC, 60 percent plan to start using them, while the other 40 percent do not plan to use them.

Table 1. Percent of elevators that offer each new generation contract and rank by volume.

Why Producers Use NGC

In both surveys, producers and elevator mangers were asked their opinion regarding the advantages and disadvantages of NGC for producers. They were asked to agree or disagree with a series of statements based on a 5-point scale where 1 is strongly disagree, 3 is neutral, and 5 is strongly agree. An average response of greater than 3 means that the respondents on average agree with the statement and an average response of less than 3 means that the respondents on average disagree with the statement. Responses are reported separately in Table 2 for those who use NGC and those who don’t use them because an individual’s experience with NGC would be expected to affect their opinions. Each group’s responses were tested for statistical differences.

Table 2. Producers’ advantages and disadvantages of using new generation contracts.

All producers and managers at elevators who offer NGC believe that their biggest advantage is to provide producers with discipline in their pricing strategy. All producers and elevator managers agree that NGC provide the producer with pricing diversification, and help the producer get emotion out of pricing. Those who have experience with NGC agree more strongly with these statements. However, the only statistically significant difference is that managers at elevators who offer NGC are significantly more likely to agree that NGC provide discipline for the producer than managers at elevators who don’t offer NGC.

All producers and elevator managers agree that not having margin calls is an advantage to producers. Producers who use NGC are significantly more likely to agree that no margin calls is an advantage than producers who don’t use NGC. This is the only statistically significant difference of opinion between the two groups of producers and may indicate that producers who dislike margin calls are more likely to use NGC.

Producers agree that an advantage of NGC is to provide more pricing alternatives and disagree that a disadvantage of NGC is that they offer too many pricing alternatives, thus indicating they appreciate the expanded marketing alternatives. Elevator managers who offer NGC are significantly more likely to strongly agree that an advantage is to increase pricing alternatives and significantly more likely to disagree that a disadvantage is they offer too many pricing alternatives, compared to elevator managers who don’t offer NGC’s. This may indicate that one reason elevator managers offer NGC is to increase the pricing alternatives available to their customers, while the elevator managers that do not offer NGC are concerned about overwhelming their customers with excessive choices.

Producers who use NGC and all elevator managers weakly agree that NGC may increase net price. However, they also weakly agree that NGC may lower net price. This inconsistency may imply they don’t believe NGC will have a major impact on net price in either direction.

Elevator managers who offer NGC disagree that service fees are a disadvantage to their customers, while elevator mangers who don’t offer them think service fees are a disadvantage. This statistically significant divergent opinion about service fees may indicate that some elevators have decided not to offer NGC because they believe their customers will not be willing to pay the service fees. Producers who use NGC agree the service fees are a disadvantage, while producers who don’t use NGC tend to disagree but the difference is not statistically significant.

Producers who use NGC strongly disagree that they are too complex to understand while those producers who aren’t using them weakly agree that they are too complex to under-stand. Elevator managers that offer NGC’s very weakly disagreed that they are too complex, while in contrast elevator managers that don’t offer NGC’s agree that they are too complex.

Reasons Grain Elevator Managers Offer NGC

Elevator managers who have experience with NGC tend to have stronger opinions regarding their advantages than managers who do not offer them (Table 3). In contrast, managers who do not offer NGC tend to view NGC as having many disadvantages for their business. Those managers not offering NCG tended to believe they introduced too many pricing alternatives that could create producer confusion, that the added costs of offering NGC could exceed potential fees, and that NGC would increase the elevator’s price risk exposure.

Table 3. Advantages and disadvantages for elevator managers who offer NGC.

From the perspective of managers who have experience with NGC, the largest advantages are that NGC could increase grain volumes and could create customer loyalty, both of which would help them originate grain. These managers also disagreed that NGC would cause producers to be concerned that the elevator could take advantage of them.

Overall, managers do not believe NCG will increase an elevator’s price risk exposure. All elevator managers were generally neutral on whether NGC could add income from service fees. While managers who have experience with NGC say that they do not increase merchandizing costs above the fees, managers who don’t have experience are concerned that the merchandizing costs would be above the fees.

Managers who offer NGC disagree that these contracts will decrease their time spent giving marketing advice, and disagree that they will increase their time spent merchandising. This suggests that NGC will not substantially change the amount of time managers spend on merchandising and giving marketing advice. In contrast, managers who do not offer NGC are neutral as to whether they can decrease their time giving marketing advice and agree that it could increase their time spent merchandising.

Summary and Further Research New generation marketing contracts (NGC) offer producers new tools for pricing grain that can help reduce problems associated with inability to “pull the pricing trigger,” excessive emotion in pricing decisions, and lack of discipline in following a marketing plan. Of elevators responding, all large-volume elevators in Indiana offer NGC, while 54 percent of midsized elevators and 13 percent of smaller sized elevators offer them. The most popular NGC were a simple pricing average, use of an individual analyst to do the pricing and moving average technical pricing systems. Sixty percent of surveyed producers who have used NGC plan to increase their use. Of those who have not used them, 60 percent also plan to initiate their use.

Survey respondents felt that the biggest advantages for producers to use NGC included increased discipline in marketing, greater diversification of pricing alternatives, reduction of the negative components of emotion in pricing decisions, and not having to worry about margin calls. Alternatively, the primary disadvantages for producers were felt to be the costs or service fees, the possibility their use could actually lower net prices received after the service fee, and elevators managers that were not currently using them felt the use of NGC would provide too many pricing alternatives.

The elevator managers’ opinions about the advantages of NGC use varied between those managers who currently use them and those who are not. Those who are currently using them felt they helped increase the elevator’s volume and helped increase customer loyalty to their facility. These managers also did not think the NGC would add income for the elevator, but tended to view them more as a service that could be helpful to some of their customers.

Those managers who did not currently use the contracts felt they could help increase volume, but had limited other advantages. They also expressed concerns that these contracts could create confusion for the producer with too many complex pricing alternatives, that they would increase the manager’s time explaining and merchandising grain, that they would result in added costs that would not be recovered in fees, and that producers might feel the elevator manager was using these contracts to make money or take advantage of them in some way.

This research has helped to develop a better understanding of the opinions of Midwestern producers and Indiana elevator managers regarding the use of NGC. Now there is a need to more closely examine their performance. Specifically, how does NGC use affect the net prices received by producers? How are the costs versus revenues for the elevator affected by NGC.? Research on their performance when utilized by producers is underway at Purdue and will be reported soon.

References

Hagedorn, Lewis A., Scott H. Irwin, Darrel L. Good, Joao Martines-Filho, Bruce J. Sherrick, and Gary D. Schnitkey, 2003, “New Generation Grain Marketing Contracts,” AgMAS Project Research Report 2003-01.

Smith, L.H. “Can Robots Replace a Marketing Mastermind?” Top Producer, November 2001, pp. 12-13.