Top Grain Farmers View Farming in 2000

June 17, 1993

PAER-1993-5

Michael Boehlje, Professor and Howard Doster, Associate Professor

Like all businessmen, farmers must think about the future of agriculture and how their business will change over time. As part of Purdue’s Agriculture 2000: A Strategic Perspective project, approximately 100 participants in the 25th annual Purdue Top Farmer Workshop were asked to project various characteristics of their farm businesses to the year 2000. These participants are certainly not typical of all midwestern producers, but they reflect the leading edge of the industry. Although no statistical data is available, it would appear that this group is typical of the more aggressive and progressive grain producers in the Mid-west, probably the top 20 to 25 percent of the industry, in terms of their farm management skills.

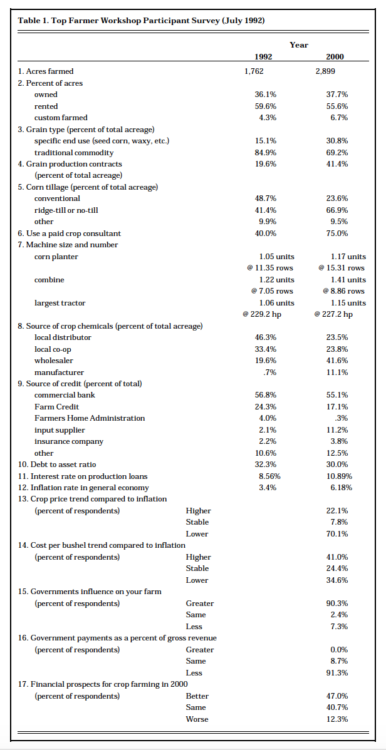

We list in summary format some of the observations provided by this group, with the data for their responses provided in Table 1.

- Rapid Growth

Acres farmed by this group in 1992 averaged 1,762, with a range from 200 to 4,500 acres. Farm size is projected to increase to almost 2,900 acres by the year 2000 — a 65 percent increase during this eight-year period.

Currently, 36 percent of the acreage farmed is owned, with the remainder rented or custom farmed. This group of producers expects to be farming significantly more acres by the year 2000, but their ownership percentage is projected to remain about the same, a little over one-third. Apparently, these producers feel that rental or custom farming is a permanent rather than a transitory part of their farming operation.

- More Contracts on Specific End Use Products

At the present time, 15 percent of the acres farmed by the Top Farmer Workshop participants is for a specific end use such as seed corn, waxy maize, white corn, popcorn, etc. By the year 2000, these producers expect the percentage farmed with a specific end use in mind to double to more than 30 percent. Almost 20 per-cent of the acreage operated by these producers in 1992 was produced with a production contract of some type; that percentage is also expected to double to more than 40 percent by the year 2000.

- Shift to Non-Conventional Tillage

Slightly more than 40 percent of the total corn acreage produced by this group was ridge or no-tilled in 1992; by the year 2000, more than two-thirds is expected to be ridge or no-tilled — a 62 percent increase from 1992. Forty percent of the producers responding to the Top Farmer Work-shop Survey currently use a paid crop consultant; this percentage is expected to increase to 75 percent by the year 2000 — almost double the percentage who use a paid consultant today.

- Bigger Implements, But Little Increase in Power

The producers were asked to project future size and number of corn plant-ers, combines, and tractors they expect to use in their farming operations. In essence, they expect to farm approximately 65 percent more acre-age in the year 2000 with only a slight (10 percent) increase in the number of large tractors. They see their largest tractors having the same horsepower in the year 2000 as in 1992. They expect an approximate 10 percent increase in the number of planters with a 35 percent increase in row size per planter and an approximate 15 percent increase in the number of combines with a 25 percent increase in row size of those combines.

Thus, these producers are expecting to farm significantly more acreage with larger planting and harvesting equipment, but only modest increases in the number of planters, combines, and large power units per farm. They will farm the larger acreage with about the same total labor but will increase labor productivity sharply with the larger sizes of planting and harvesting tools. They apparently also plan to work their machinery faster or more hours per day to get the job done in a timely fashion. The lack of increase in the expected number and size of tractors is likely related to their transition to non-conventional tillage.

Table 1. Top Farmer Workshop Participant Survey (July 1992)

- More Direct Purchase of Inputs

Currently, the Top Farmer Work-shop participants were sourcing approximately 20 percent of their crop chemicals from wholesalers and manufacturers, with the remaining 80 percent from a local distributor or cooperatives. By the year 2000 these producers expect to be sourcing over 50 percent of their chemicals from wholesalers and manufacturers —more than a 150 percent increase in direct purchase. This significant shift in sourcing chemicals more directly from the manufacturer or wholesaler has important implications for local dealers and distributors.

- Increased Debt Capital from Input Suppliers

Commercial banks provided almost 57 percent of the total credit used by these producers in 1992, and their market share is expected to be maintained to the year 2000. Almost one-fourth of the credit was provided by the Farm Credit System, and their market share is projected to decline to approximately 17 percent by the year 2000. Probably the most significant change in credit use is for input suppliers. In 1992 input suppliers provided only two percent of the total credit used by the Top Farmer Workshop participants, but they project to be obtaining more than 11 percent of their total credit needs from input suppliers by the year 2000.

- Stable Farm Financial Position

In spite of significant growth in farm size, the Top Farmer Workshop participants project their debt to asset ratio will remain substantially the same in the year 2000 as today, when a little less than one third of their assets are being supported by debt. (Recall that although these producers are planning to expand their operations significantly by the year 2000, almost two-thirds of that expansion is expected to be on rented acreage rather than purchased land that requires significant debt obligations).

- Higher Interest Rates and More Inflation

These producers expect interest rates to increase by the year 2000 by approximately 230 basis points com-pared to the rate they paid in 1992 of slightly higher than 8.5 percent. They expect inflation to almost double by the year 2000 from the cur-rent rate of just over 3 percent. It should be noted that the survey was taken in July of 1992, and the out-look for interest and inflation may have changed since that time.

- Costs to Rise Faster Than Product Prices

Seventy percent of the respondents indicated that they do not expect product prices to keep up with that rate of inflation during the eight-year period from 1992 to the year 2000. Approximately 40 percent of the producers expect that the cost of production per bushel will increase faster than the rate of inflation, with the remaining 60 percent indicating that costs will increase at the same or a lower rate than the rate of inflation.

- Less Government Financial Support of Farm Programs

Finally, 90 percent of the Top Farmer Workshop respondents expect that the government will have a greater influence on their farm in the year 2000 compared to today (apparently in the form of reg-ulations), but 90 percent also felt that government payments would account for a smaller percentage of their gross revenue in the year 2000.

11.These Farmers Remain Optimistic

In spite of projections of higher interest rates, higher inflation, and higher costs, almost 90 percent of the Top Farmer Workshop respondents indicated that they expect the financial prospects for crop farming to be the same or better in the year 2000 compared to 1992.