U.S. Economic Outlook: Slow but Steady Ahead!

December 13, 2015

PAER-2015-11

Larry DeBoer, Professor of Agricultural Economics

The expansion after the Great Recession is almost six and a half years old. That makes it the fourth-longest expansion since World War II. It has been slow going, though. Gross Domestic Product grew 2.0% above inflation during the past year. We have not seen annual growth above 3% or below 1.5% during the whole recovery. So, it has been one of the steadiest six-year periods in the past 70 years.

The economy might grow faster over the next year. Consumers have reason to spend more. Job prospects have improved, home prices have risen, gas prices have dropped and consumer confidence is up. Over the past year consumers stepped up their purchases, with consumption growing 3.2%.

Home construction has done better, too. The stock of homes for sale remains low, and home prices have been rising. That means there are incentives to build. Residential construction has been the fastest growing part of GDP over the past year. Building permits have leveled off since spring, though, which may indicate a pause in housing construction growth in the near future.

Now for economists’ favorite phrase: “on the other hand.” Business equipment investment has grown slowly. Declining capital goods orders this year mean growth is unlikely to increase. Business structure investment has dropped, which may be due to cutbacks in new oil drilling. Neither the federal nor state and local governments are buying much more either.

Overseas, China’s growth has slowed, Europe’s is slower, and Japan and Brazil are in recession. The worlds spending for our exports will not be rising very much. The value of the dollar is up against most currencies, and that makes our exports more expensive for the world to buy. That discourages exports and encourages U.S. consumers to buy more imported foreign goods (rather than buying products produced here).

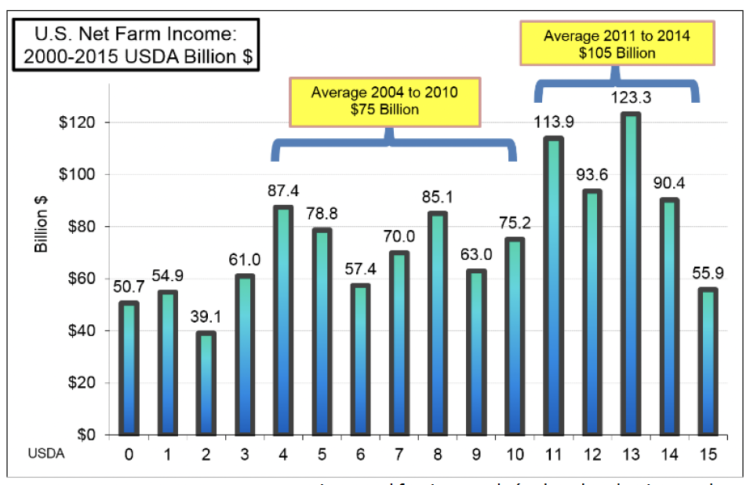

U.S. Net Farm Income 2000-2015 USDA Billion $

Add it all up and there’s not much reason to think that the economy will accelerate next year. Consumers are spending, though, and they make up the lion’s share of the economy. Expect real GDP to grow about 2.3% in 2016.

The unemployment rate was 5.0% in November, down from 10% in October 2009. In the past, slow GDP growth could not have brought the unemployment rate down so far. However, the labor force is growing more slowly now. Boomers are retiring, fewer millennials are entering, and a large number of potential workers are still feeling discouraged. With fewer job searchers entering the labor force, slower growth creates enough new jobs to bring the unemployment rate down. The unemployment rate has less room to fall now that there are fewer unemployed people, and better job prospects may draw more discouraged workers back in. That means a small drop in the unemployment rate by the end of next year, to around 4.8%.

The inflation rate over the past year was just 0.1%, measured by the Consumer Price Index. It was that low mostly because of the gasoline price drop. Not counting oil, the “core” inflation rate was 1.9%, which is near the rate of the past few years. There is less slack in the economy, so businesses may see some rising costs, maybe even rising wages. Expect the core inflation rate to rise to 2.2% for the next 12 months.

The Federal Reserve has held its federal funds interest rate near zero since the end of 2008. They have been hinting strongly that they will raise the rate soon. Still, with growth slow, inflation low and the dollar’s exchange value rising, they will probably be cautious. My outlook is for a three quarter-point increases over the next year, which would put the federal funds interest rate and the three-month Treasury bond rate at 0.75% by late 2016. Likewise, the 10-year Treasury interest rate should rise by about three-quarters of a point, to 2.8% to 3.0%.

But, what if the Greeks and Germans get at each other’s throats again? What if China implodes? What if Wall Street panics at the first sign of a Fed rate hike? Any of these “shocks” could cut growth and increase unemployment.

What’s the best guess, “slow but steady for another year.”